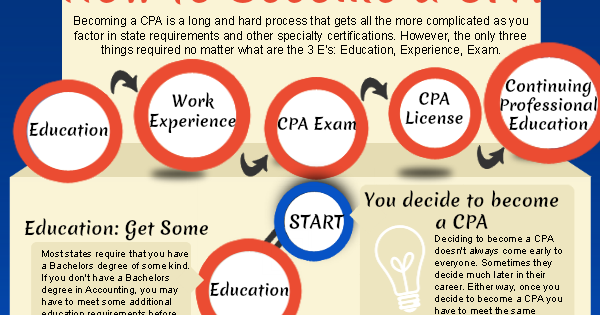

How To Become A Cpa

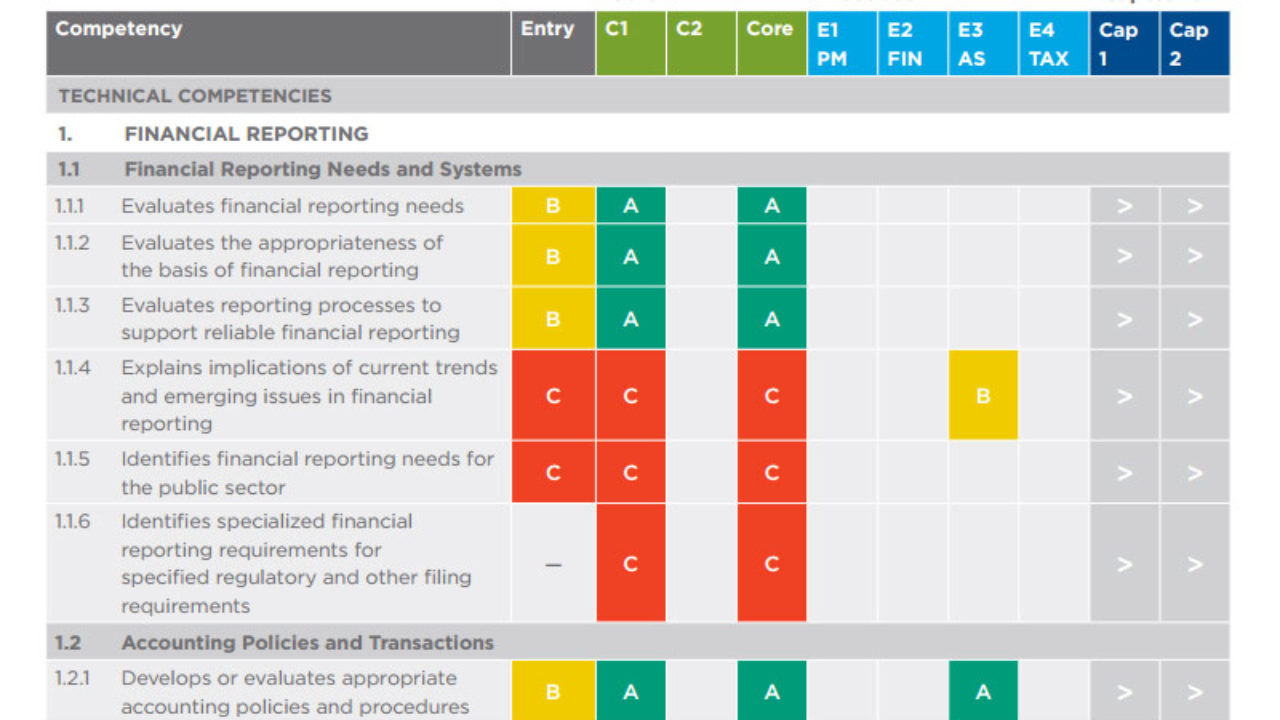

Auditing not including internal auditing.

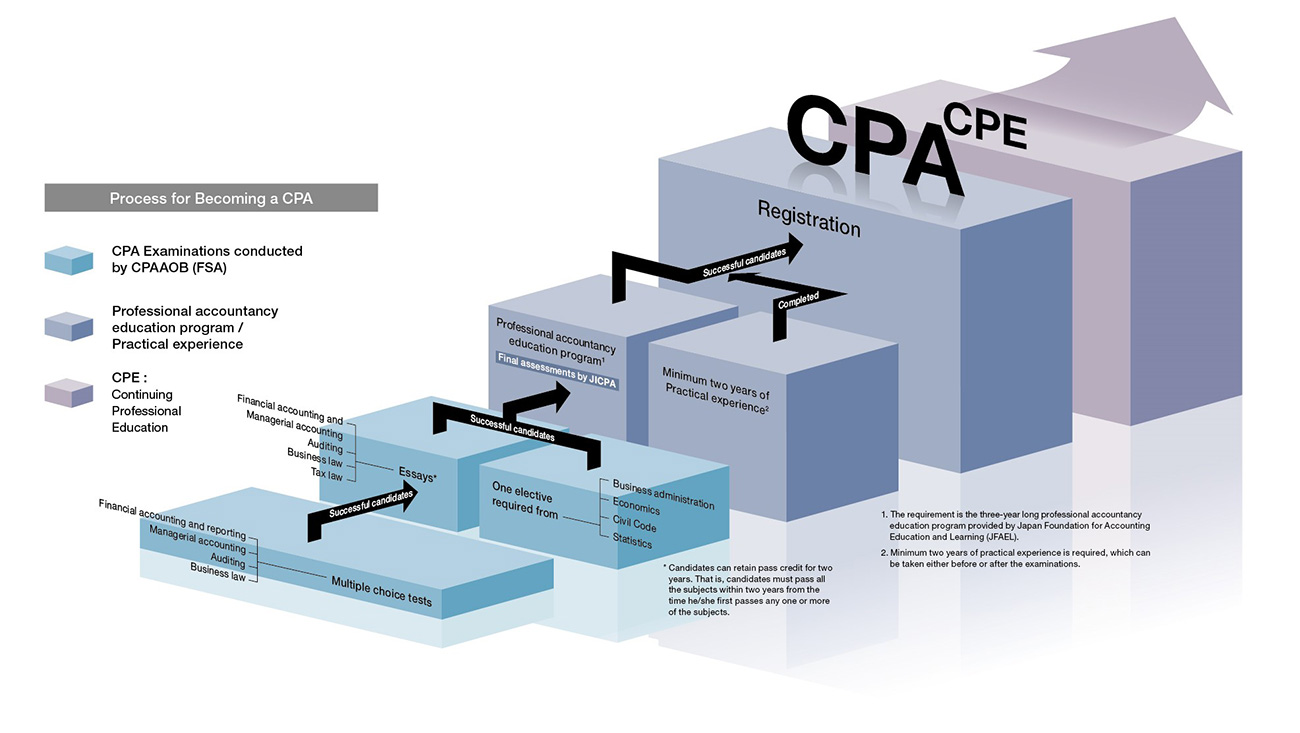

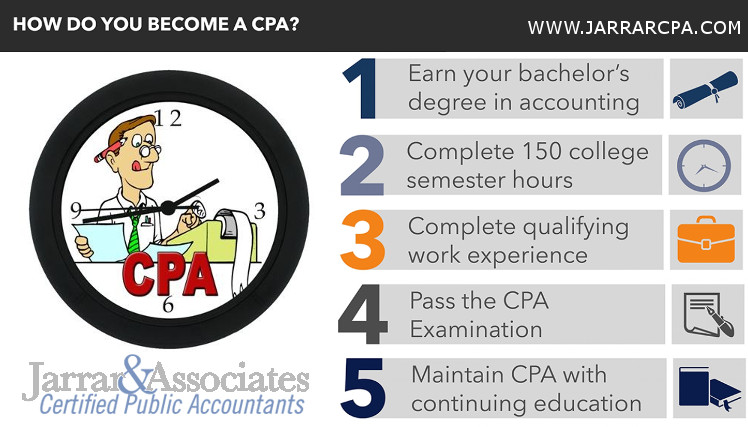

How to become a cpa. 4 pass the cpa exam. Courses within this concentration must include. Alternatively you can take the general education development ged examination.

How to become a cpa step 1. Steps 2 and 3 can really be interchanged. 3 get a review course and start studying.

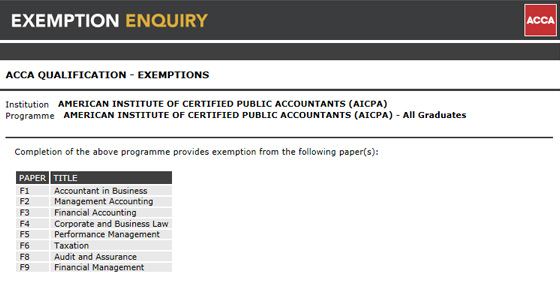

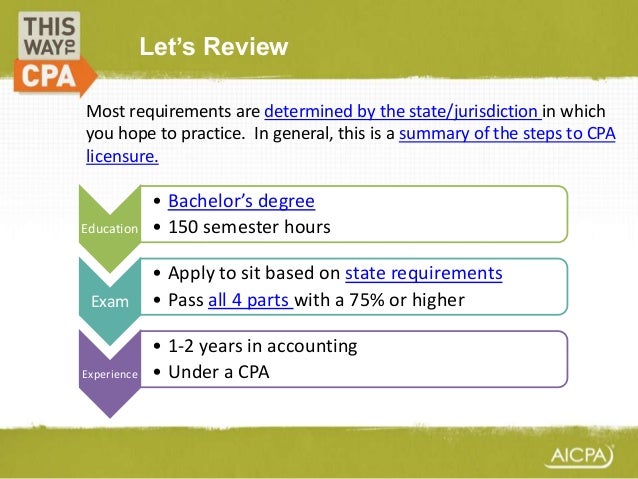

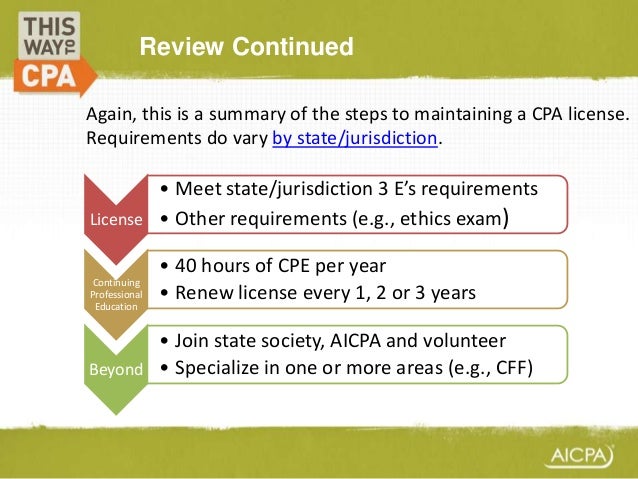

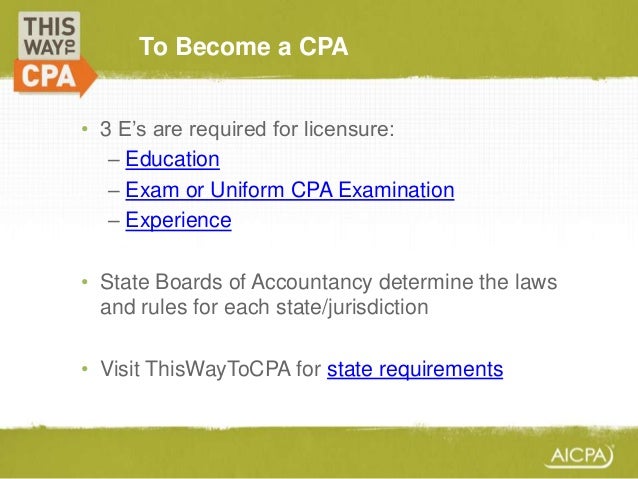

Each state lists the number of accounting courses you must take and the types of courses. Cpa candidates must hold a bachelors degree and additional educational qualifications. The aicpa is committed to providing students and cpa candidates with the information and tools to guide them to successful entry into the accounting profession.

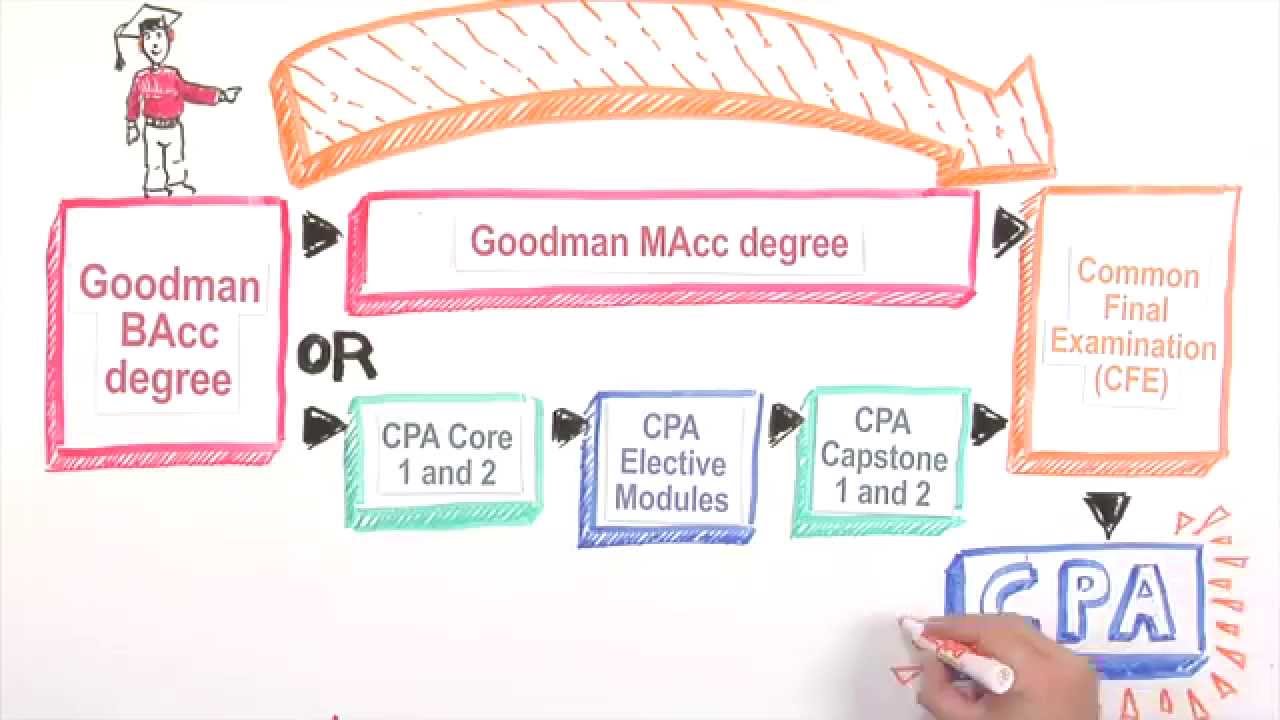

First students should earn a bachelors degree in accounting. 5 pass the aicpa. After you are all signed up to take the exam and have your review course ready to go its time to.

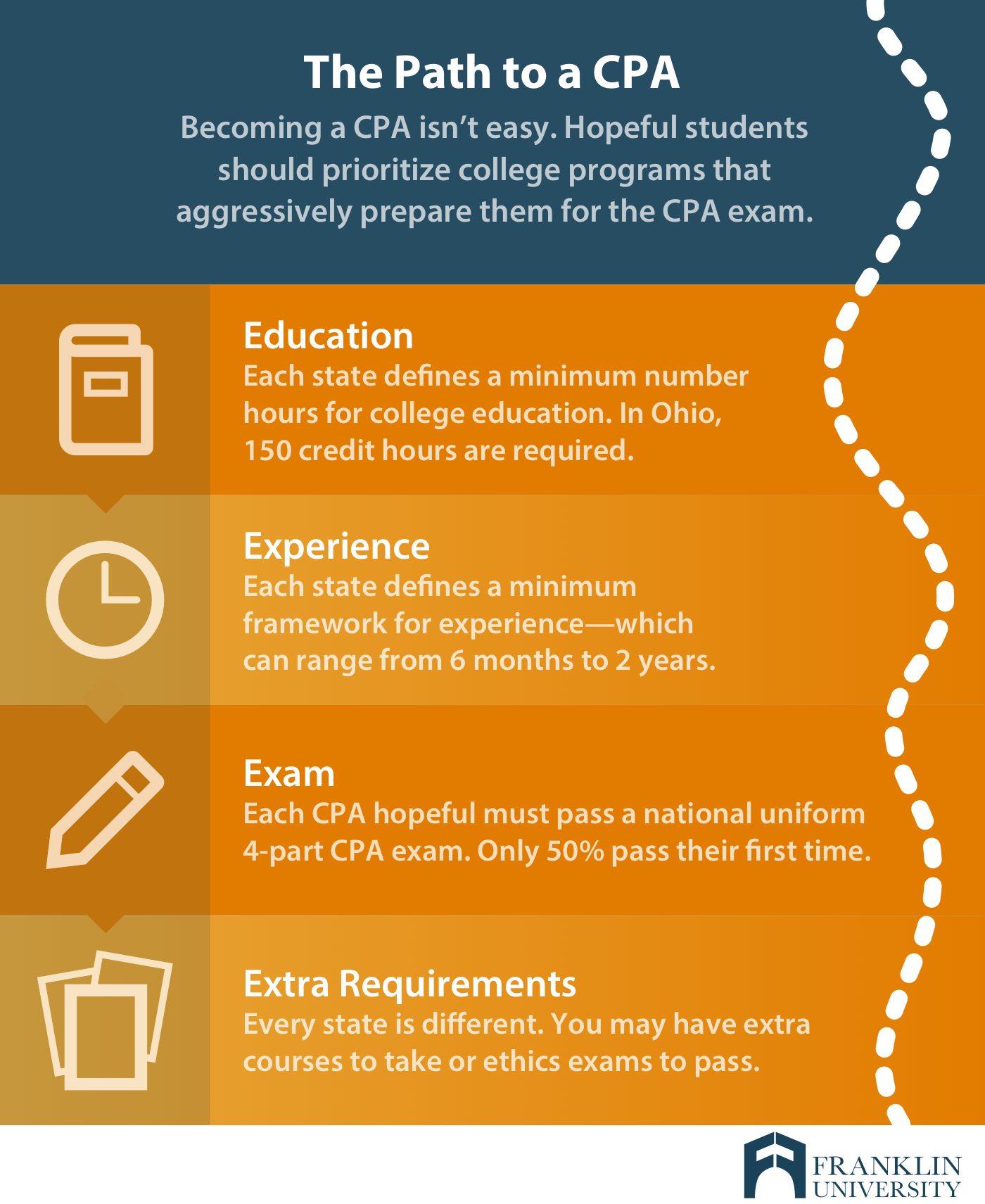

Each state sets its own educational criteria for the cpa credential but most states require aspiring cpas to earn 150 postsecondary credits or about 30 credits beyond a typical bachelors program. Get a bachelors degree. A masters degree is not required to become a cpa though some employers.

Get certified in your state. Degree completed high school diplomaged some college associate degree bachelors degree masters degree doctorate degree. You must complete 30 semester hours in accounting 24 semester hours of which must be above the introductory level.

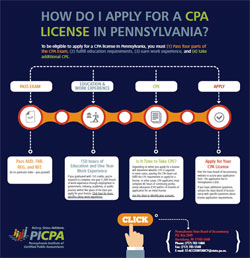

Its always a good idea to start. To become a cpa in ohio you must complete 150 semester hours of acceptable coursework. How to become a cpa becoming a cpa cpa 2020 requirements by state cpa exam and accountant education.

In this section you can learn more about getting started scholarships licensure frequently asked questions and the uniform cpa exam. To become a cpa a. Earn a bachelors degree.

Most states with a few exceptions require that cpas have at least a bachelors degree in. Cpa exam education experience requirements most states are moving toward a 150 hour masters degree in accounting requirement to become a cpa. Consider earning a masters degree.

Preparing to take the course 1.

-Step-4.jpg)

.png?width=600&name=Visual_1%20(1).png)

.png?width=1200&name=Visual_2%20(2).png)

.png?width=600&name=Visual_3%20(1).png)