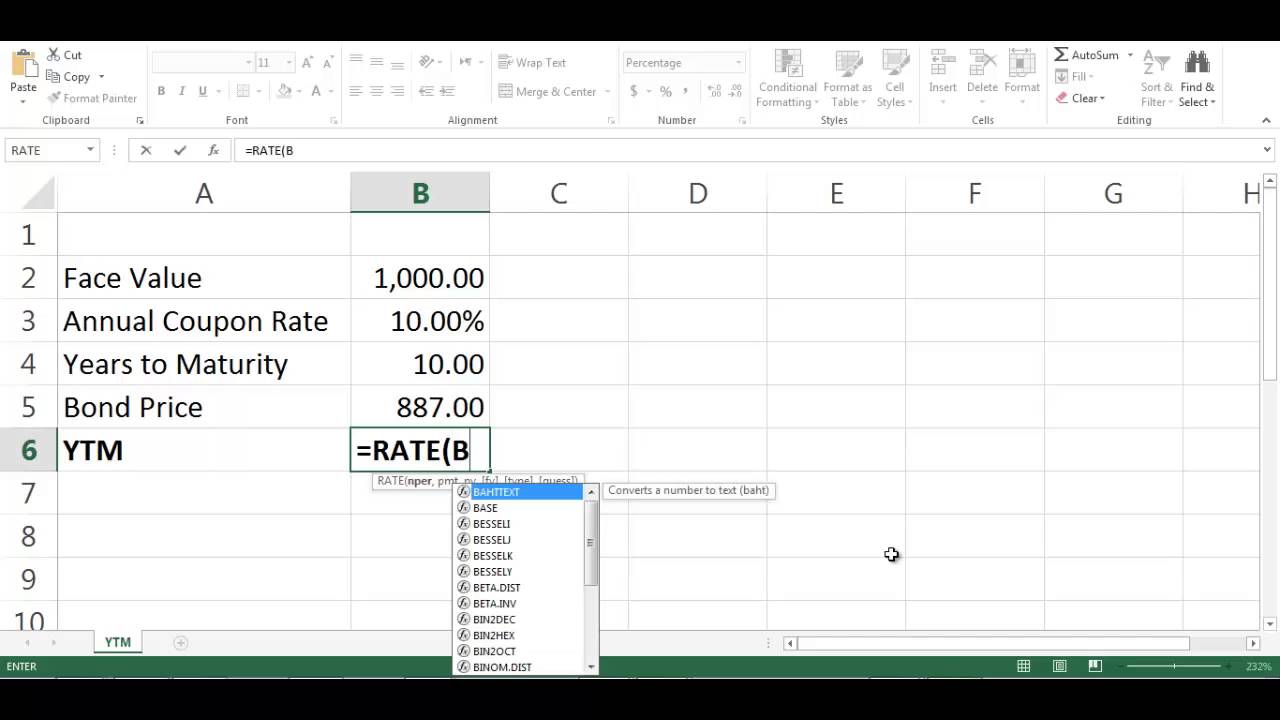

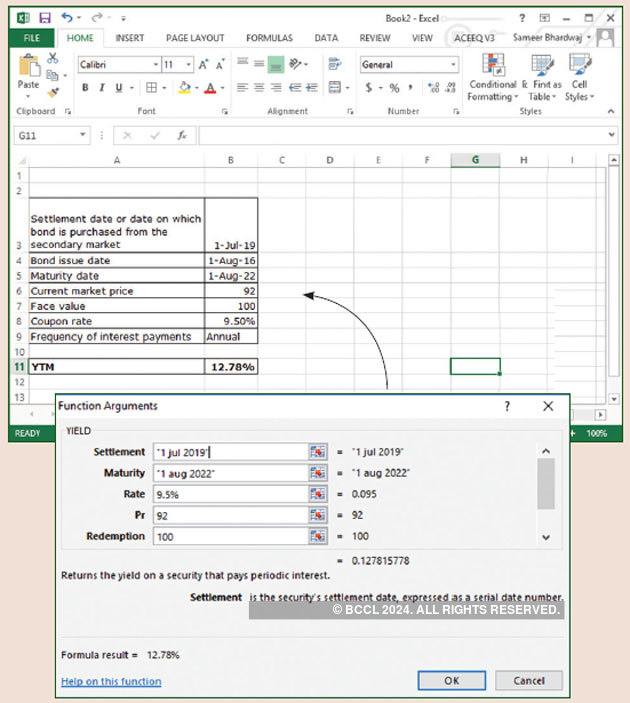

How To Calculate Yield To Maturity In Excel

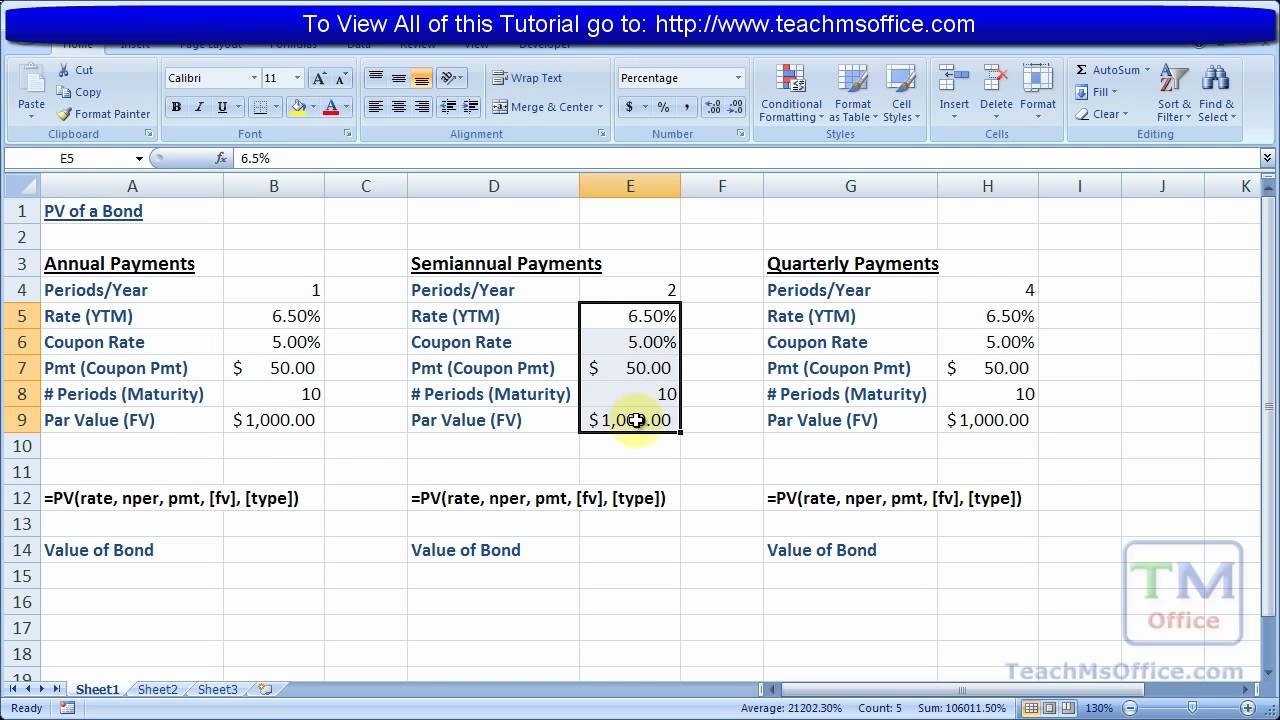

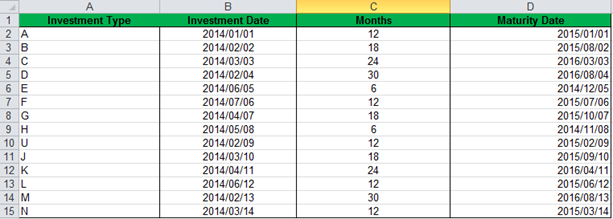

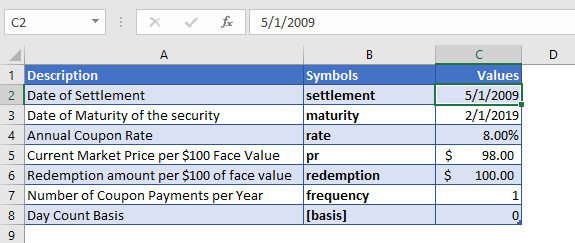

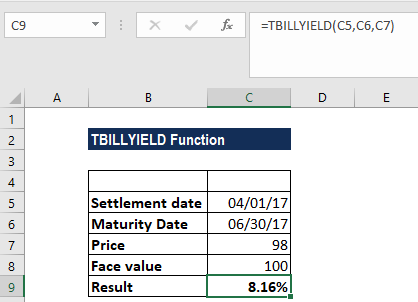

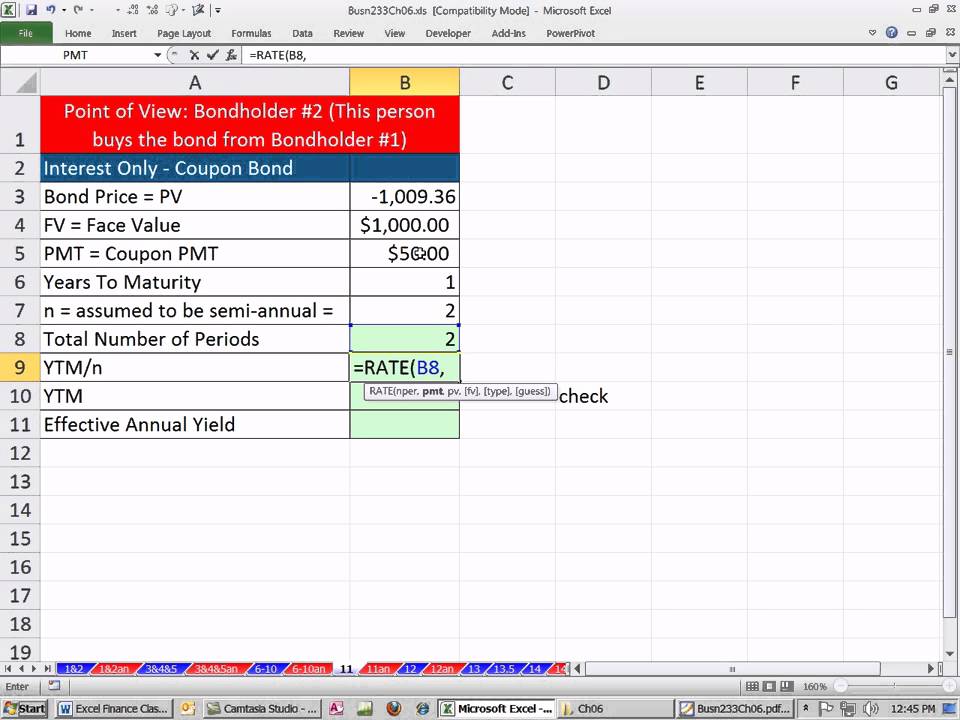

Starting in cell a1 type the following text into cells a1 through a8.

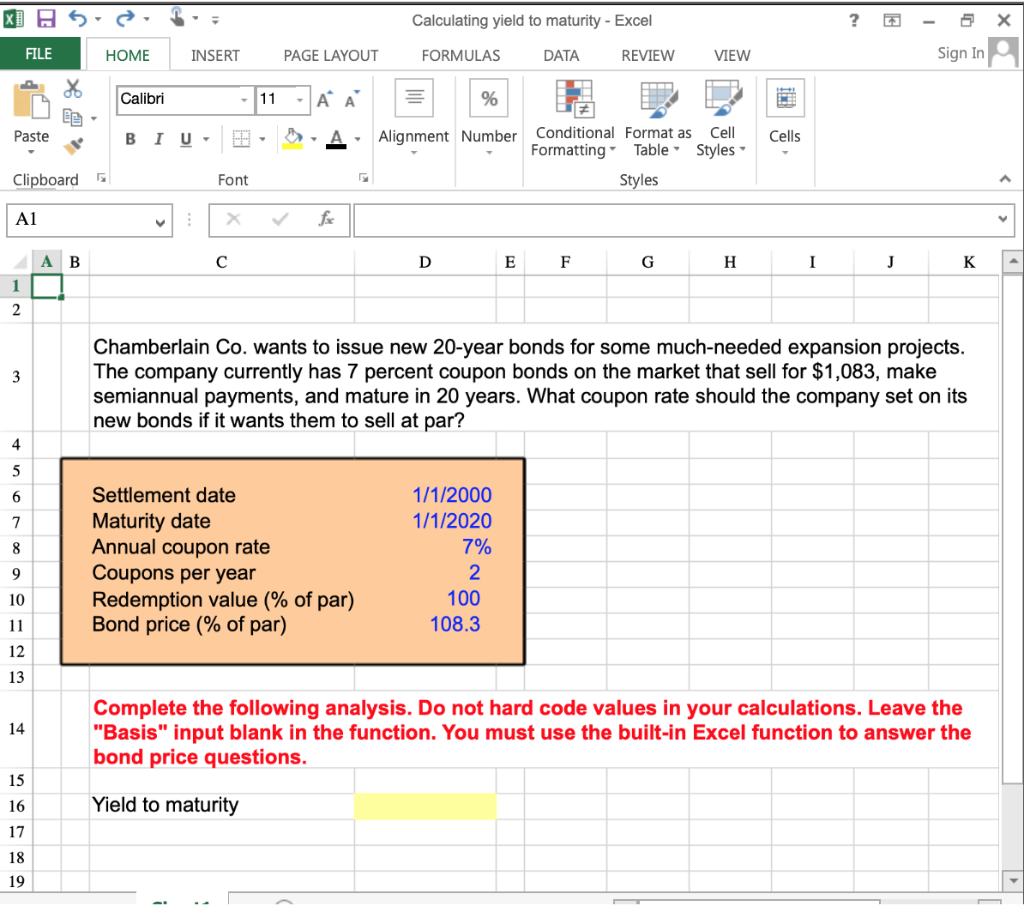

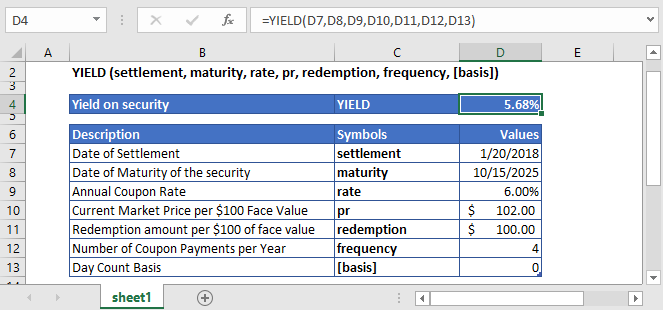

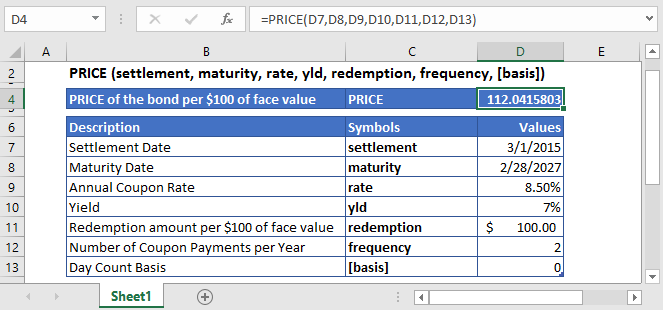

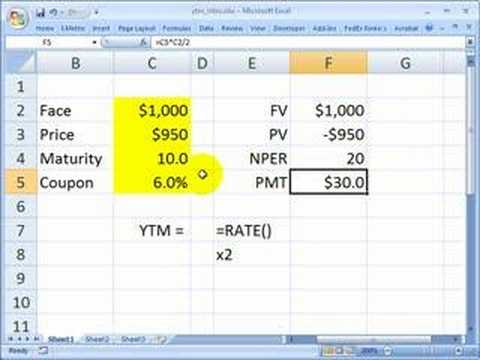

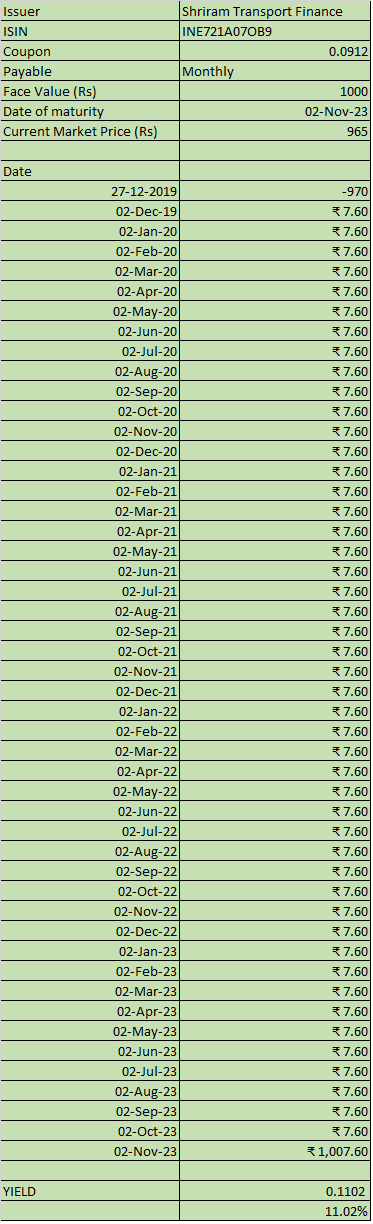

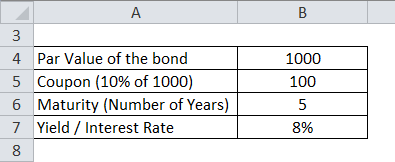

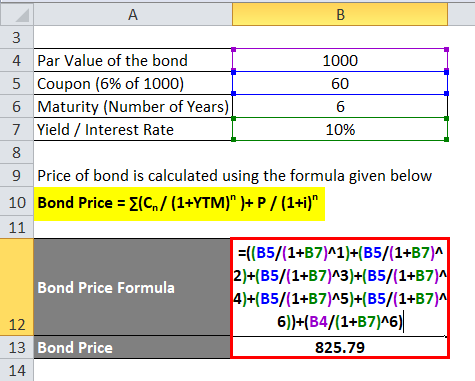

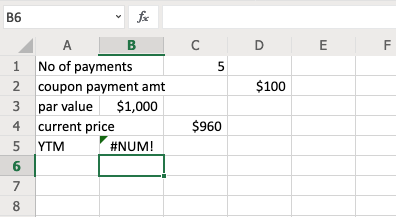

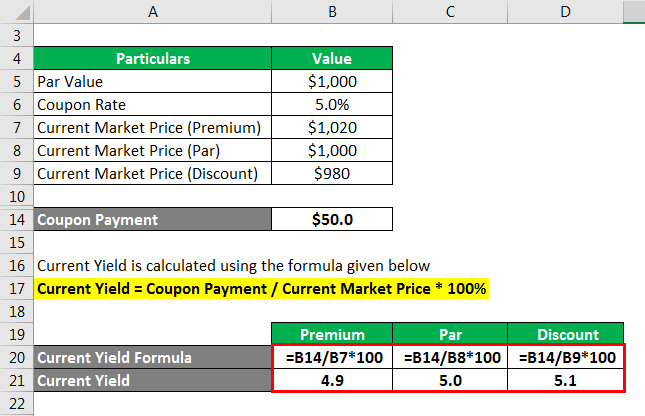

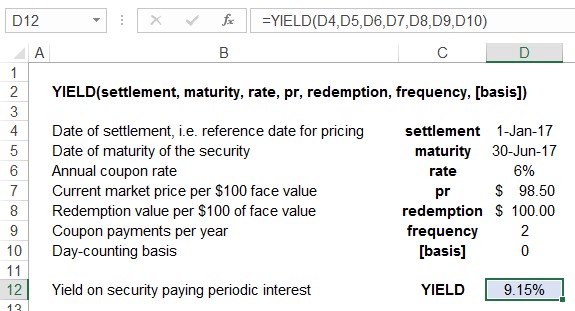

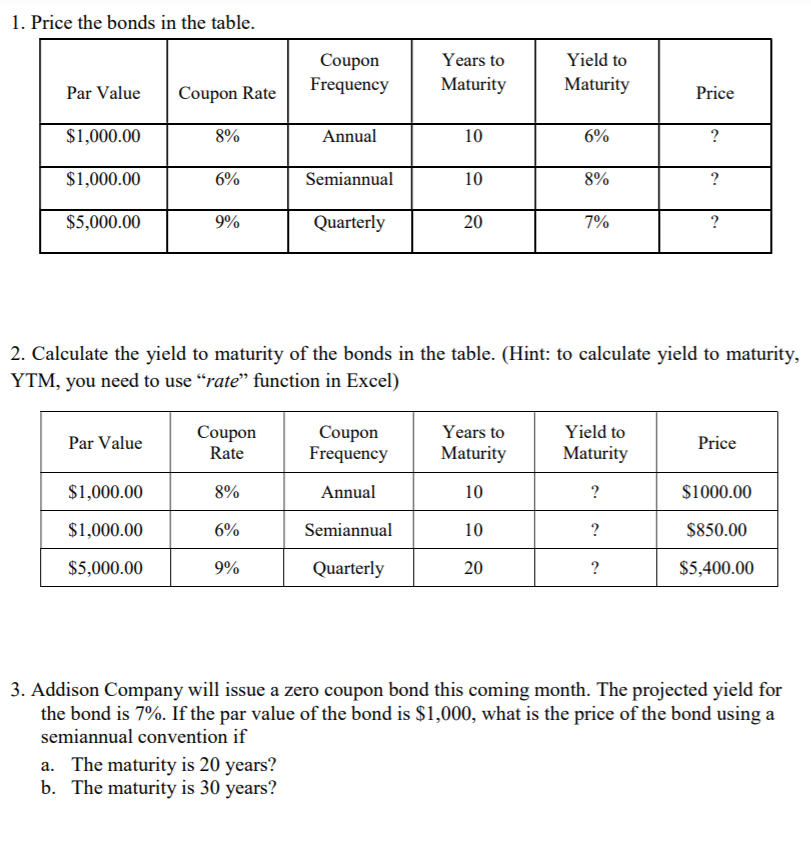

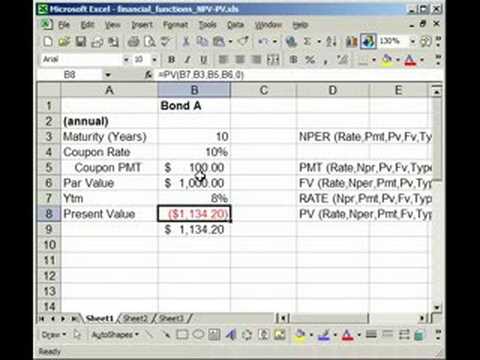

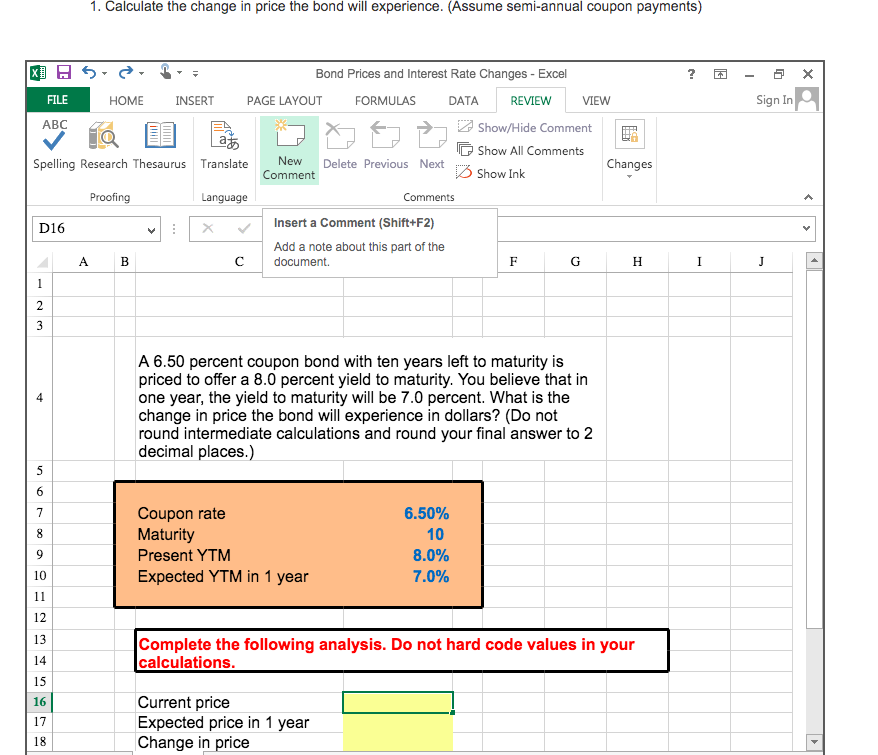

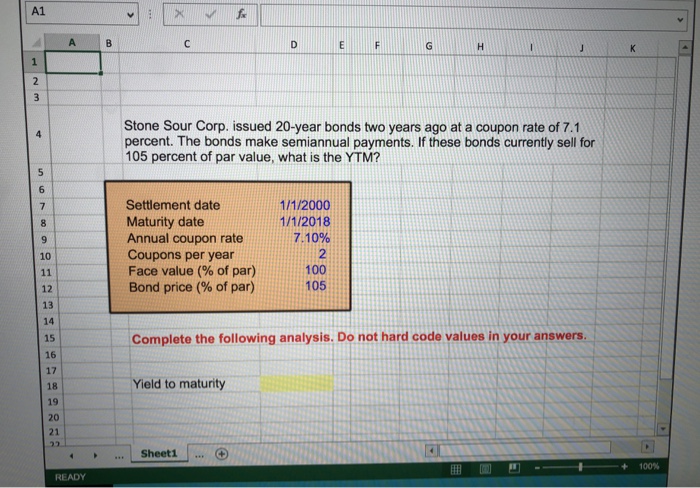

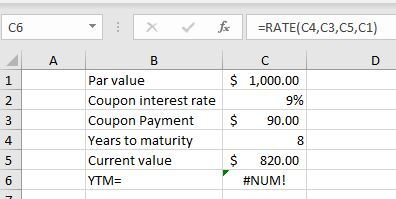

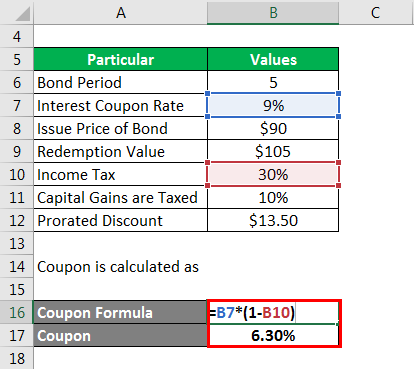

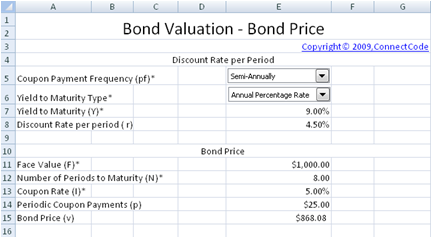

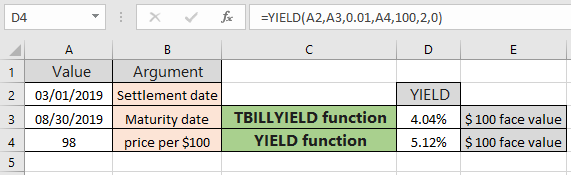

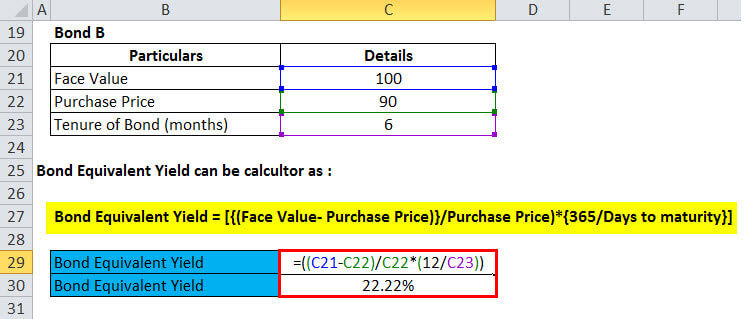

How to calculate yield to maturity in excel. Pv present value of the bond p payment or coupon rate par value number of payments per year r required rate. You will want a higher price for your bond so that yield to maturity from your bond will be 45. Yield to maturity can be calculated by solving the following equation for yld using hit and trial.

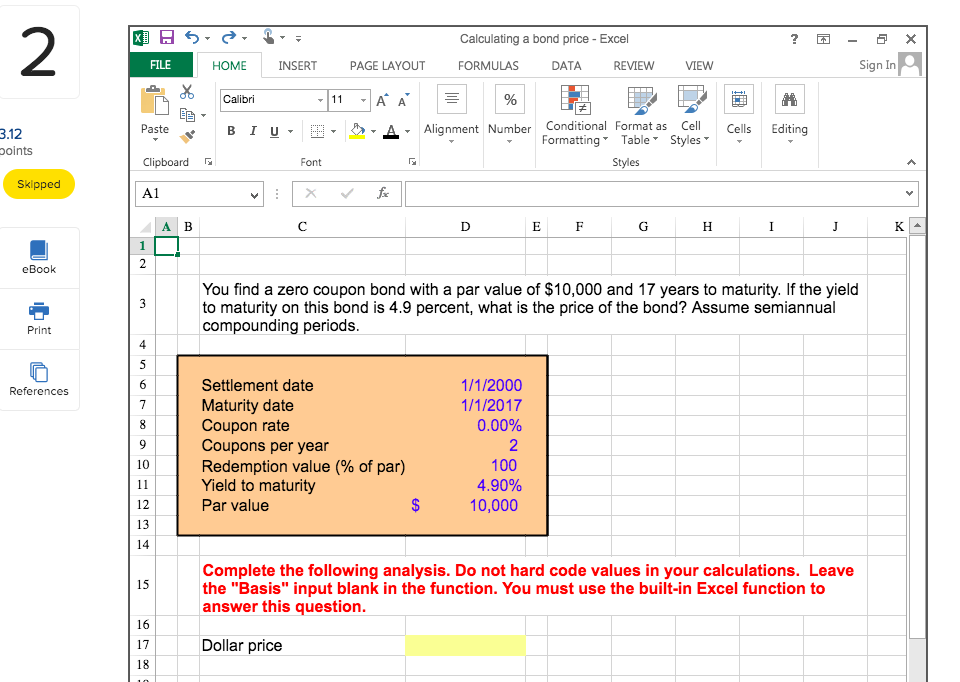

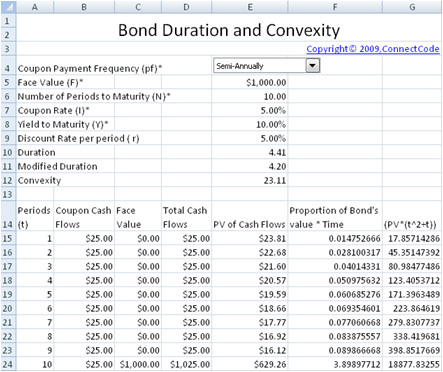

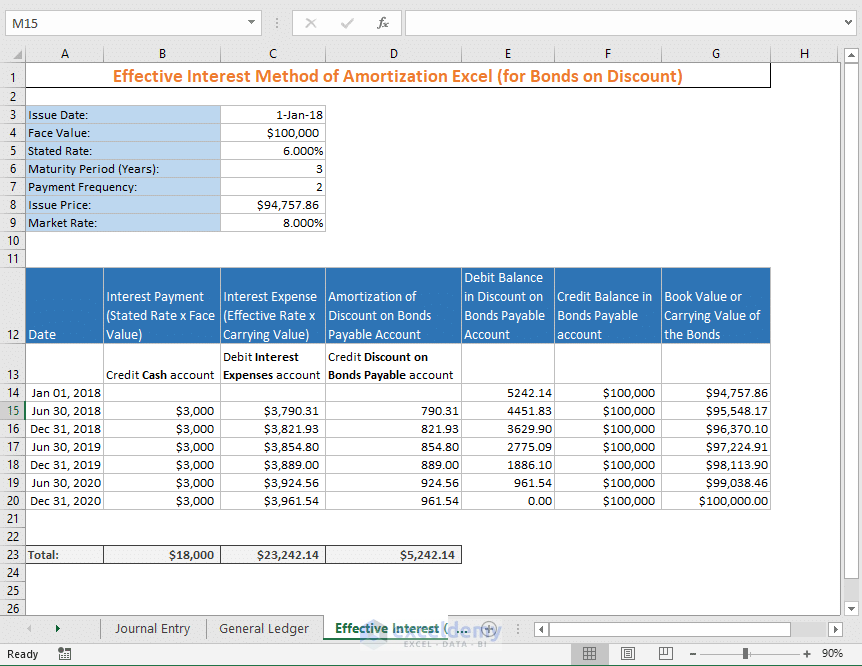

So you will be able to sell your bond at 11202559 with a premium of amount 1202559. Bond yield data face value annual coupon rate annual required return years to maturity years to call call premium and payment frequency. Step 1 enter the column headings and data labels.

Lets calculate now your bond price with the same excel pv function. Pv p 1 r 1 p 1 r 2 p principal 1 r n where. Skipping cell a9 type value of bond in cell a10.

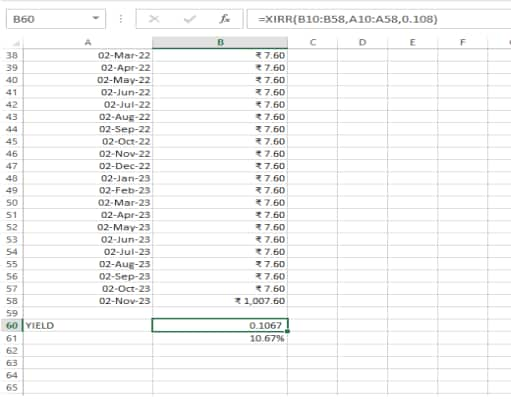

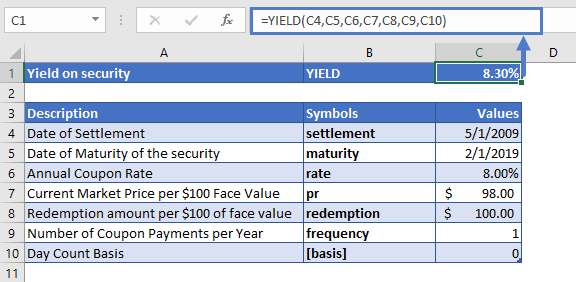

Move the mouse pointer over the line separating columns. Yield to maturity is the internal rate of return of a security which means it is the rate an investor will earn by purchasing the security at its current price and receiving all future cash flows such as coupon payments till maturity and the maturity value. Pv 4504 410 1500 100000 11202559.

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

www.youtube.com