How To Find Your Business Tax Id Number

The hours of operation are 700 am.

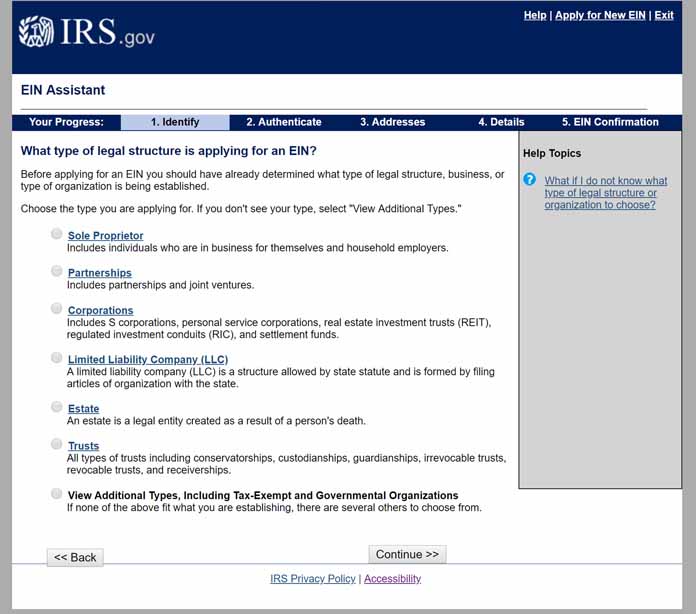

How to find your business tax id number. Local time monday through friday. Generally businesses need an ein. The irs sends out an ein confirmation letter when new businesses are registered.

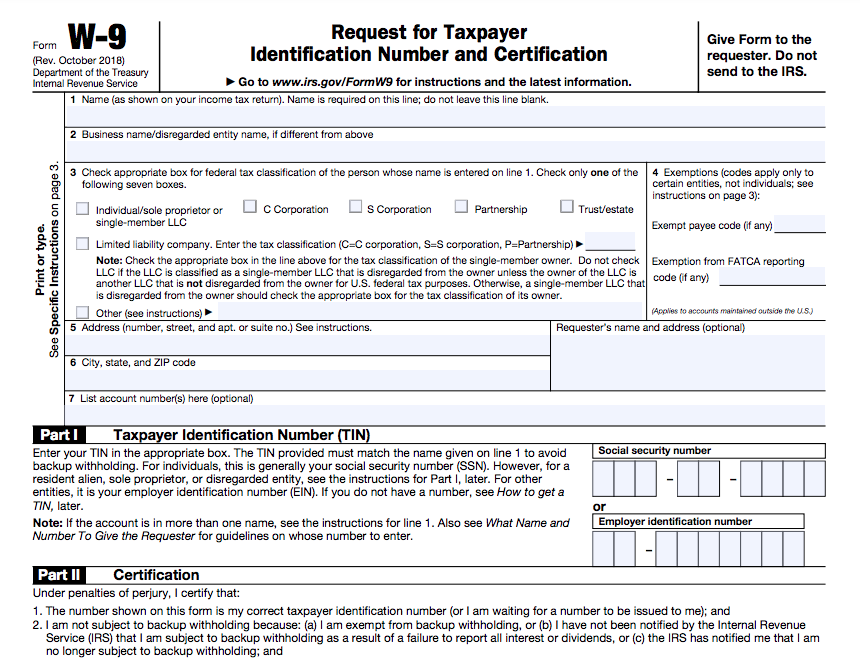

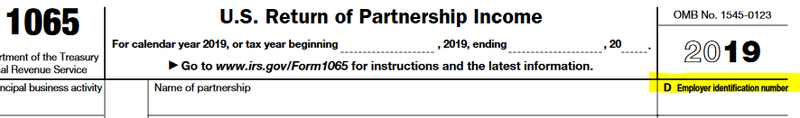

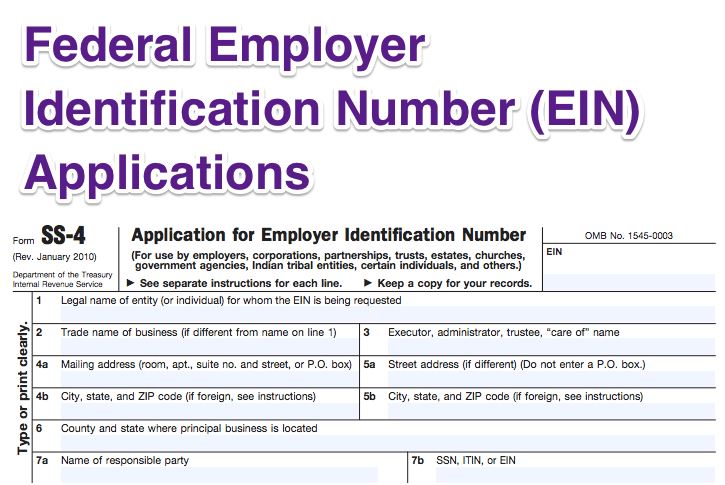

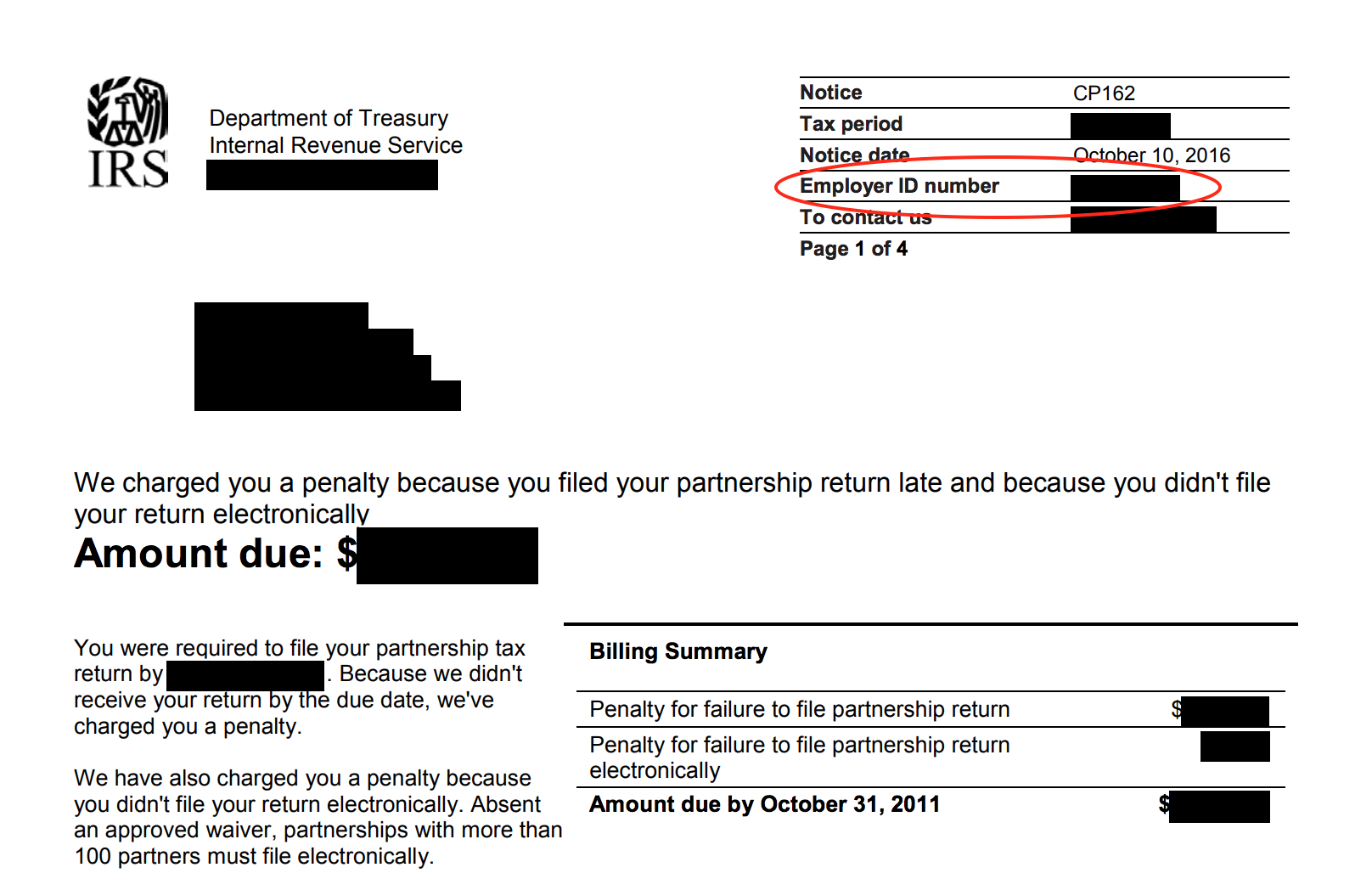

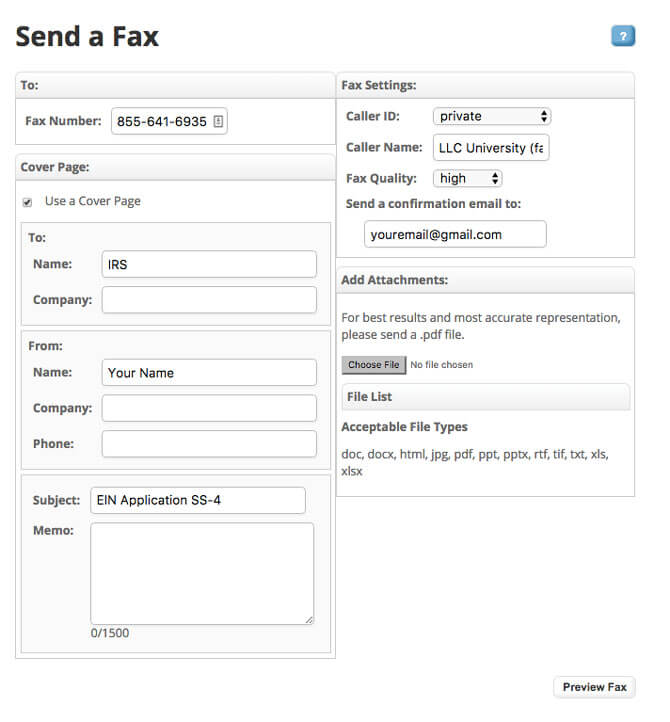

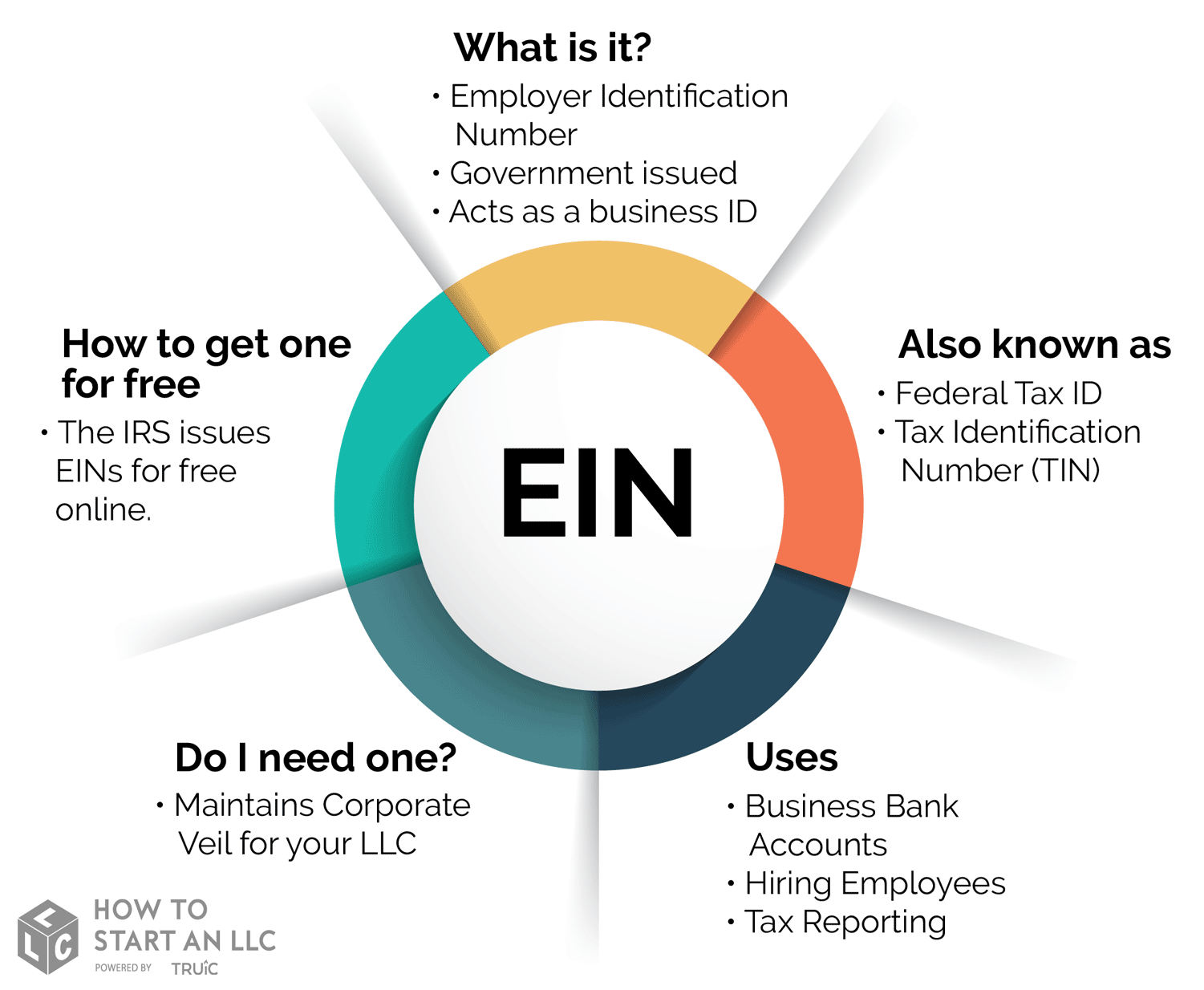

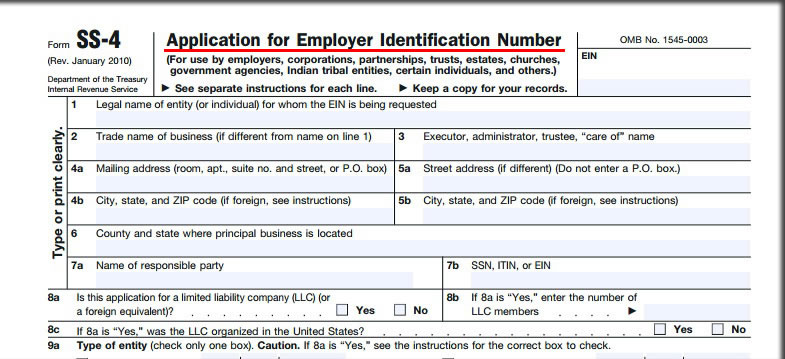

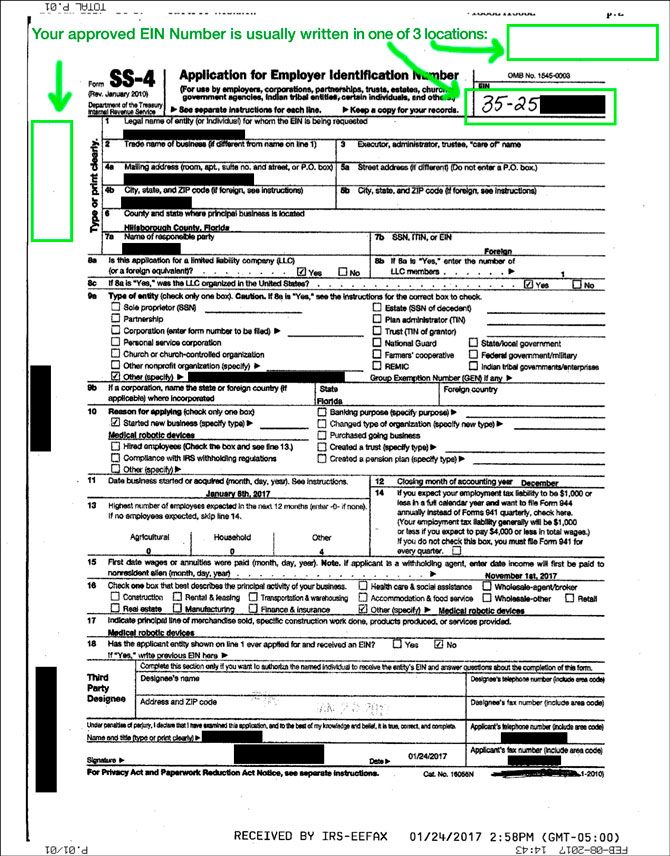

You can find the number on the top right corner of your business tax return. A business tax id number also called an employer identification number ein or federal tax id is a unique nine digit number that identifies your business with the irs. Ask the irs to search for your ein by calling the business specialty tax line at 800 829 4933.

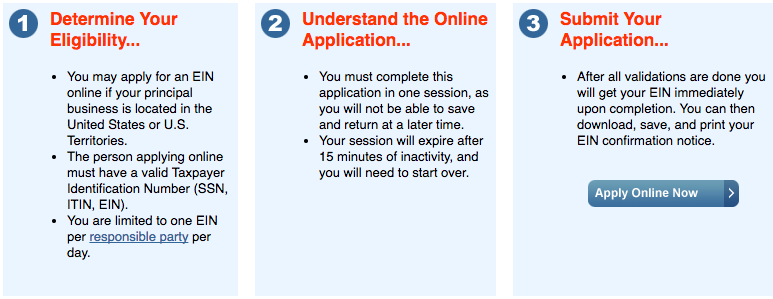

Make sure to call between the hours 7 am. This is a free service offered by the internal revenue service and you can get your ein immediately. Your previously filed return should be notated with your ein.

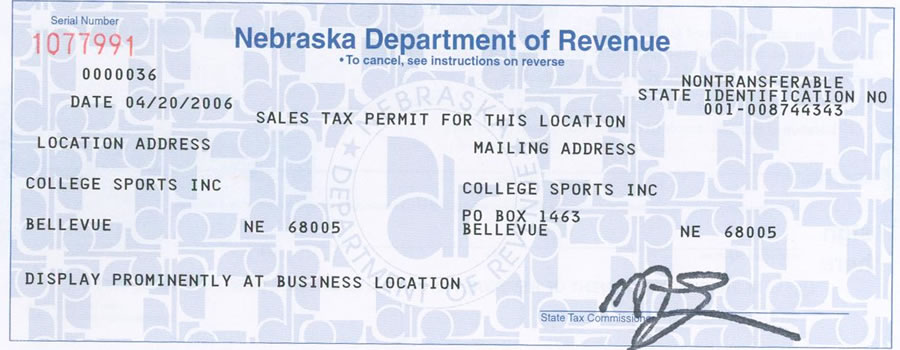

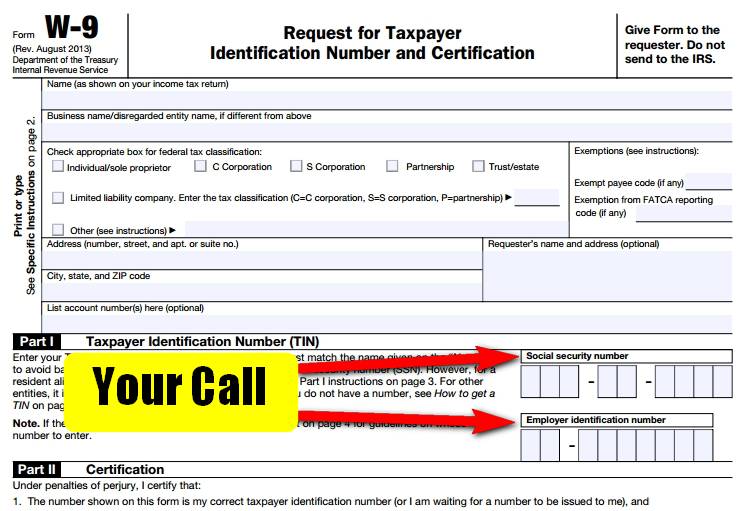

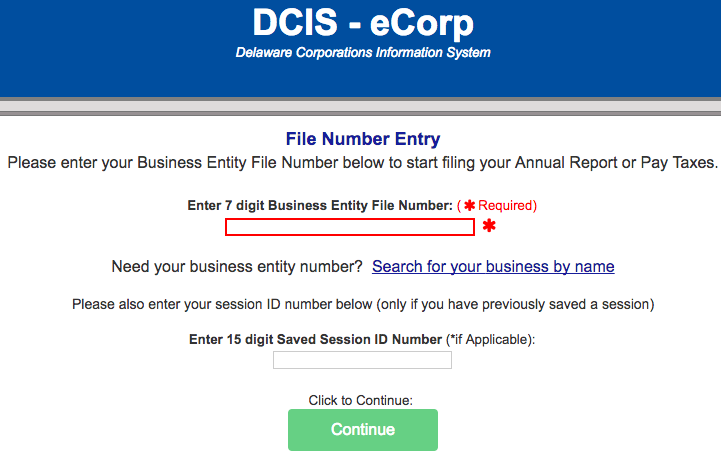

Most states use the federal nine digit ein number for tax purposes so that is often the number you need. If you are doing business with a company you may need to have its state tax id number. Owners of most types of business entities need a business tax id number to file taxes open a business bank account obtain a business license or apply for a business loan.

Ways to find your business ein number check your entity documents. An employer identification number ein is also known as a federal tax identification number and is used to identify a business entity. Find a previously filed tax return for your existing entity if you have filed a return for which you have your lost or misplaced ein.

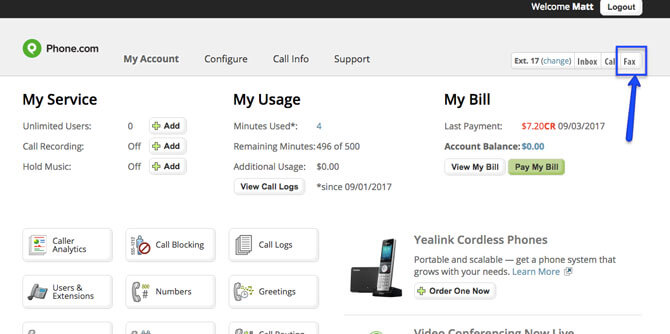

If you open the. Once you know this you can find the number on documents from the irs or ssa. An assistor will ask you for identifying information and provide the number to you over the telephone as long as you.

If your ein has changed recently which could render any old documents useless you should definitely call the irs. You can find a tax id number online on specific forms and documents or by contacting the appropriate department within the company. If all else fails and you really cannot find your ein on existing documents you can reach out to the irs by calling the business specialty tax line at 800 829 4933.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Canada-getty-Arnold-Media-84373043-56a1c24c5f9b58b7d0c25625.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/508064993-56a0a4a95f9b58eba4b261d2.jpg)

/application-form-w-9--request-for-taxpayer-identification-number-tin-and-certification-close-up-shot-867665546-af6d55c962a24fe38165f2a1aa45f726.jpg)

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)

:strip_icc()/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)