How To Get Your Mortgage License In Texas

5 easy steps to a getting a texas loan originator license.

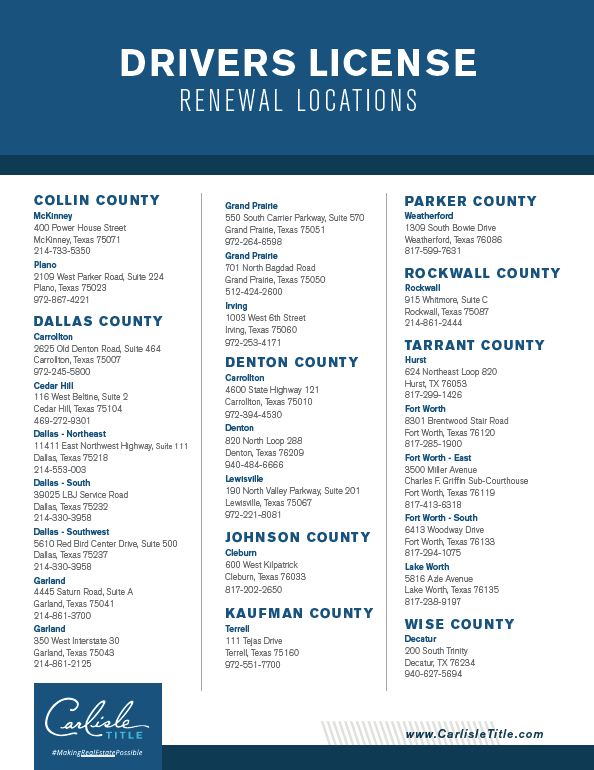

How to get your mortgage license in texas. Take the pre licensure class. Application for the issuance of a driver license. All mortgage loan brokers must be licensed.

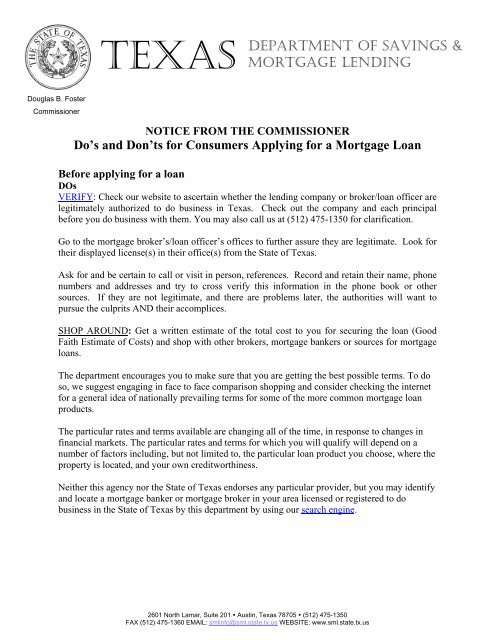

If your company is being required to register your mortgage loan originators with a federal agency occ ots fdic frb ncua or fca select federal registration. The nmls system is used to process mlo licensing requests for all 50 states including texas. Prior to submitting the license renewal you are also required to complete at least eight hours of continuing education additional state specific hours may be needed.

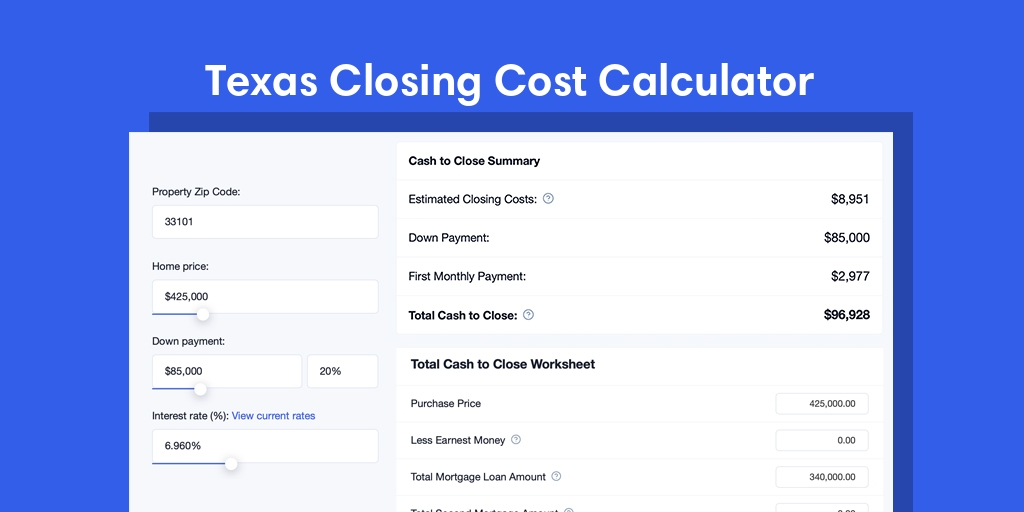

As for other financial professionals the process is handled via the website of the nationwide mortgage licensing system nmls. Pass the nmls test. In texas all residential mortgage lenders are required to complete at least 23 hours of pre licensure education.

How to become a mortgage broker. Complete the driver license application before arriving at your local office this form is also available at all driver license offices. Pass the state exam at prometric learn more.

This education needs to be nmls approved in order to qualify. Get your mortgage license in texas step 1. To become a texas licensed mlo youll need to complete the required 20 hour nmls safe pre licensing course.

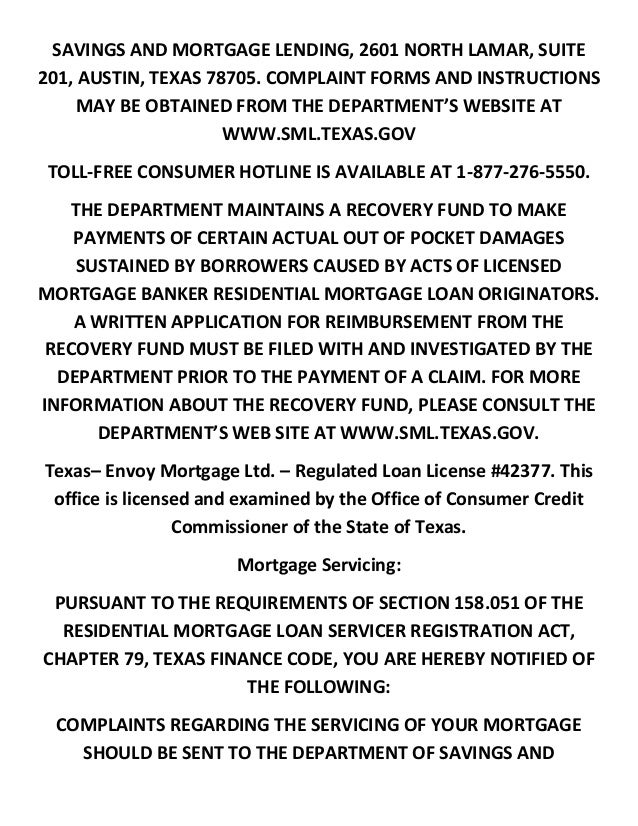

Aspiring brokers need to complete a pre licensure program a 20 hour. Most residential mortgage loan originators rmlo in texas have to undergo a licensing procedure with the department of savings and mortgage lending. Additionally three of those 23 hours must be texas specific.

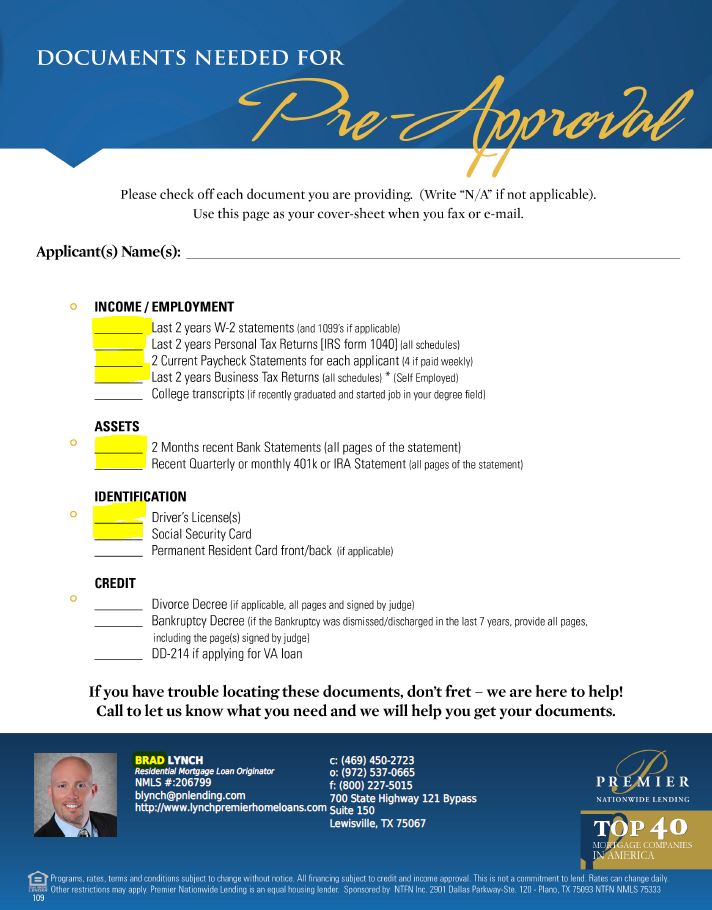

4 steps to a career in home loans. In case you have to get licensed with the department you have to fulfill the following requirements. Provide the following documentation to the license and permit specialist.

The requirements for your texas mortgage broker license. You will need to submit a license renewal request and then pay all associated fees through nmls. Make an appointment at your local driver license office.

If your company plans to request a license or registration with texas sml select state licensing and follow the steps listed on the web page. Other recent website updates ssb notice precomment draft and stakeholder webinar publication annual financial report fy2020 ssb 2020 virtual thrift industry day presentations email loan payoff statements form 7 tac 1552 email mortgage rules 7 tac 791 7 tac 792 7 tac 80 and 7 tac 81 proposed amendments to rules 7 tac 791 792 ssb email assessments first quarter fy2021. Complete education requirements learn more.

You must then attest to all your information in the nmls system.

Https Mortgage Nationwidelicensingsystem Org Slr Publishedstatedocuments Tx Occcrenewalchecklist Pdf

/static.texastribune.org/media/files/e636fe34382dc731c1aebc8df273499b/hardtocount-leadart.png)

_Page_1.jpg)

/https://static.texastribune.org/media/files/b9e32f82387d943d815932fc3c91ab2e/License_Reclamation_1_RZ_TT.jpg)