How Long Do You Have To Close An Estate

Most people only have to handle final affairs a few times in their life.

How long do you have to close an estate. The estate settlement website suggests a nine month time line from reading the will to closing the estate. Creditors are allowed to make a claim usually five to seven months depending on the state. Thereafter the internal revenue service takes between six and nine months to process the return and send a closing letter.

During this time the executor must notify heirs banks the social security administration creditors and others of the death. When an estate can expect a tax closing letter according to the irs website heirs can expect a closing letter within four to six months from the date form 706 is filed. But the executors liability also remains.

It just ran out of things to do. Closing a persons estate after they die can often be a long detailed process. However even if the estate has no outstanding issues an executor or personal representative cannot seek to close the estate until after the time.

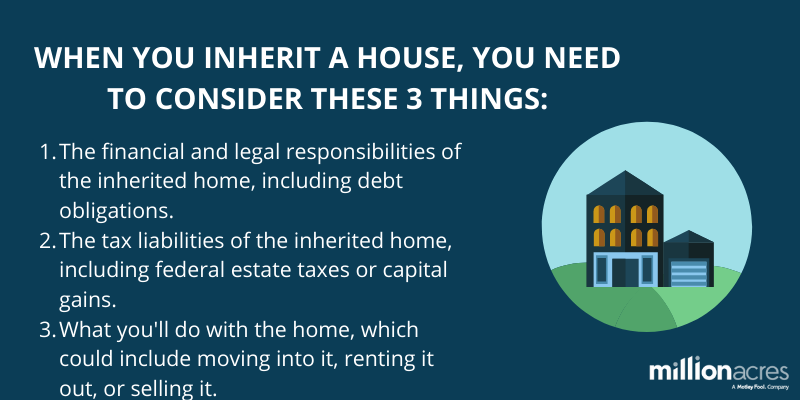

The administrators power remains. For those subject to this tax the executor has nine months to file a tax return with the option to obtain a further six month extension. The executor may have distributed all other assets 19 years before but the executor still has the right to gather this new bank account.

The executor still has this power because the estate never closed. During the probate process you may distribute some assets like tangible personal property. However when family members or beneficiaries do not get along or the estate plan was not carefully crafted complications can arise.

As of 2019 any estate valued below 114 million escapes federal estate taxes. According to bankrate the probate process can take from six months to two years. Final distribution and closing the estate.

Dont make assumptions that someone else is handling it problems can be avoided if heirs seek professional help earlier in the estate closing process. Most estates run smoothly and may often be completed and closed within 8 to 14 months after opening. Closing the bank account typically is the last step after the court or beneficiaries have approved the executors accounting and the estate is ready to close.

Volume increases after death for about six to eight months. However in most states you are required to wait to distribute financial assetssuch as proceeds from the property saleuntil the final probate hearing. There may be a few final bills requiring payment such as compensation to the executor for her services.

Courts will certainly understand situations like these. If you have been named an estate executor it is important to do these steps in the right order.

Is An Estate Taking Too Long To Close File A Status Report With The Probate Court Law Office Of James F Roberts Associates Apc

www.webuildyourtrust.com

:max_bytes(150000):strip_icc()/man-signing-will-88295268-5b8858ec4cedfd00252f4583.jpg)

/GettyImages-182806278-5771dcb95f9b5858752202f7.jpg)

/GettyImages-1054012072-4213d8015ede4240982b56cdb179134c.jpg)

/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png)

/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png)

:max_bytes(150000):strip_icc()/last-will-182671743-5b885a3f46e0fb005021652c.jpg)

:max_bytes(150000):strip_icc()/200439150-001-56aa10be5f9b58b7d000ab01.jpg)

/old-couple-signing-papers-with-young-executor-122552852-5b885a63c9e77c00255d7bcd.jpg)

:max_bytes(150000):strip_icc()/131260388-56aa10cd3df78cf772ac394d.jpg)

:max_bytes(150000):strip_icc()/183295240-56aa10db3df78cf772ac3a21.jpg)