How Much Should I Save Up To Move Out

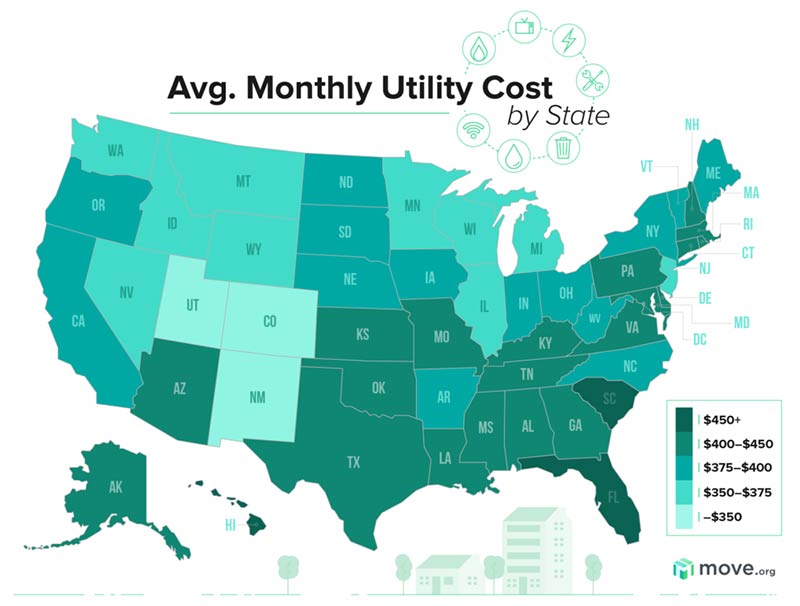

Utility bills like wifi water and.

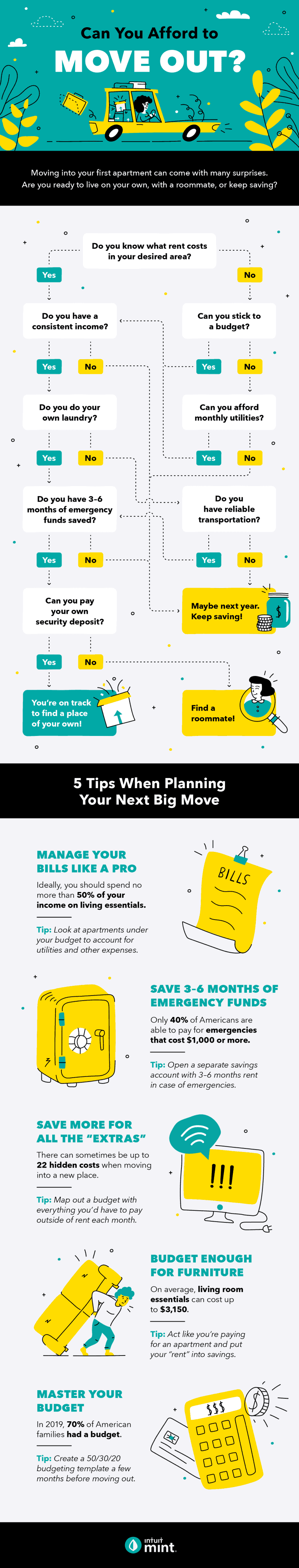

How much should i save up to move out. Having a clear goal like knowing that you need 2500 saved up before moving out can make saving easier but there are. Parking may be an additional monthly expense if street parking isnt an option. Its less than 200 a year and should you suffer a fire flood or break in youll be able re purchase your possessions and have someone else put you up in a hotel until your place is livable.

A common mistake people make when budgeting is underestimating how much theyll need. Make a habit of saving. One common recommendation is.

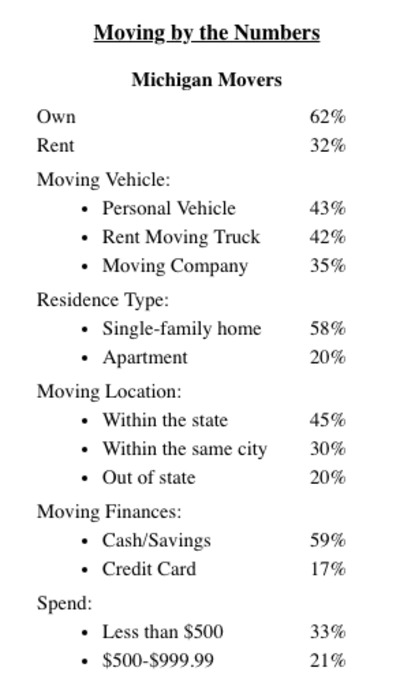

Most landlords will charge first and last months rent as well as a security deposit. You save about 3 months worth of salary as back up anything beyond this you can spend but make sure you will maintain above this value. If youre renting then youll definitely need to save enough to cover your security deposit.

You might need to pay. Demaria advises his utility budget came out to roughly 175month but. Now if you add a 10 percent buffer to your 1500 which we recommend your monthly budget comes to 1650.

Practice saving not just for the move but to establish an emergency fund once you do move. Start small with 1000 to 2000 in your emergency fund. Somewhere around 100 150 monthly per person whos moving is a reasonable.

1000 annual 40k divided by 40 security deposit. Fooddrink includes groceries and dining out. Moving expenses checklist 1.

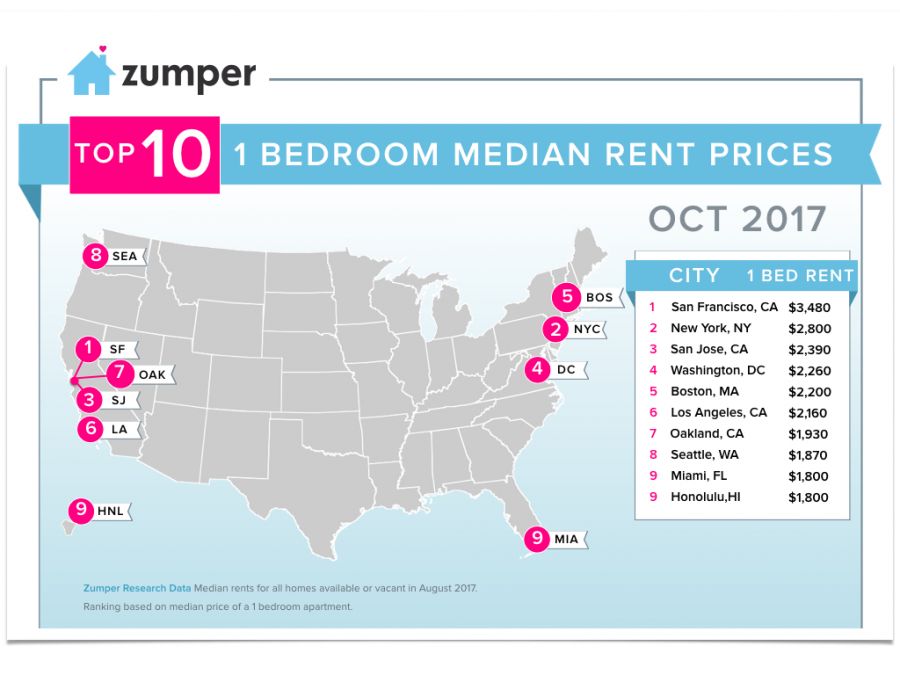

When it comes to moving rentmortgage is arguably the biggest expense youll need to save for. Then moment you dig into this back up fund you know youre making insufficient funds. So before moving out of your parents house you should consider having about 5000 after paying the deposit on your apartment.

You should eventually save an amount equivalent to three to six months of living expenses before moving out so you can handle unanticipated expenses such as medical bills insurance deductibles and vacations. Target pre move savings on 40000 salary 1st months rent 1000 40000 salary40. As far as how much you should save before moving out there are several other expenses to consider.

So get renters insurance. So heres the bottom line.

Tara You Ve Mentioned Moving Out From The Group Home And That Is A Huge Step To Take I Have Found A Website With Moving Out Checklist Moving Out How To

www.pinterest.com

/are-you-ready-to-move-out-2385960-final-9064ca501b7a4222b601916b1bd9ebd8.png)

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2020/10/13/this-23-year-old-recent-grad-is-unemployed-and-job-searching-amid-covid-19-thankfully-hes-living-with-his-parents-and-has-no-student-debt-his-goal-is-to-move-out-to-downtown-toronto-when-he-finds-a/emailedphoto_.jpg)

:max_bytes(150000):strip_icc()/close-up-of-unrecognizable-delivery-man-with-cardboard-box--1186577710-258abdf7e4a44f8ab8bf72ee80a4b9a4.jpg)