How To Become A Cpa In California

California Cpa Requirements Cpa Exam And Licensing Eligibility Requirements For California State Youtube

www.youtube.com

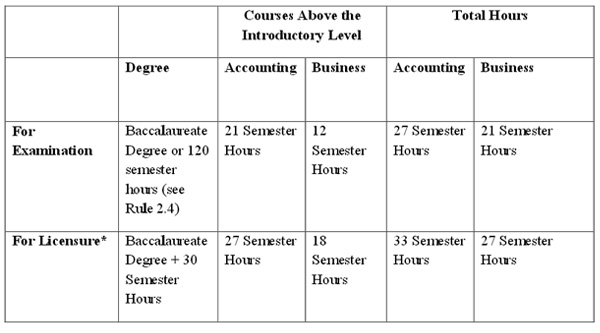

24 semester units in business related subjects.

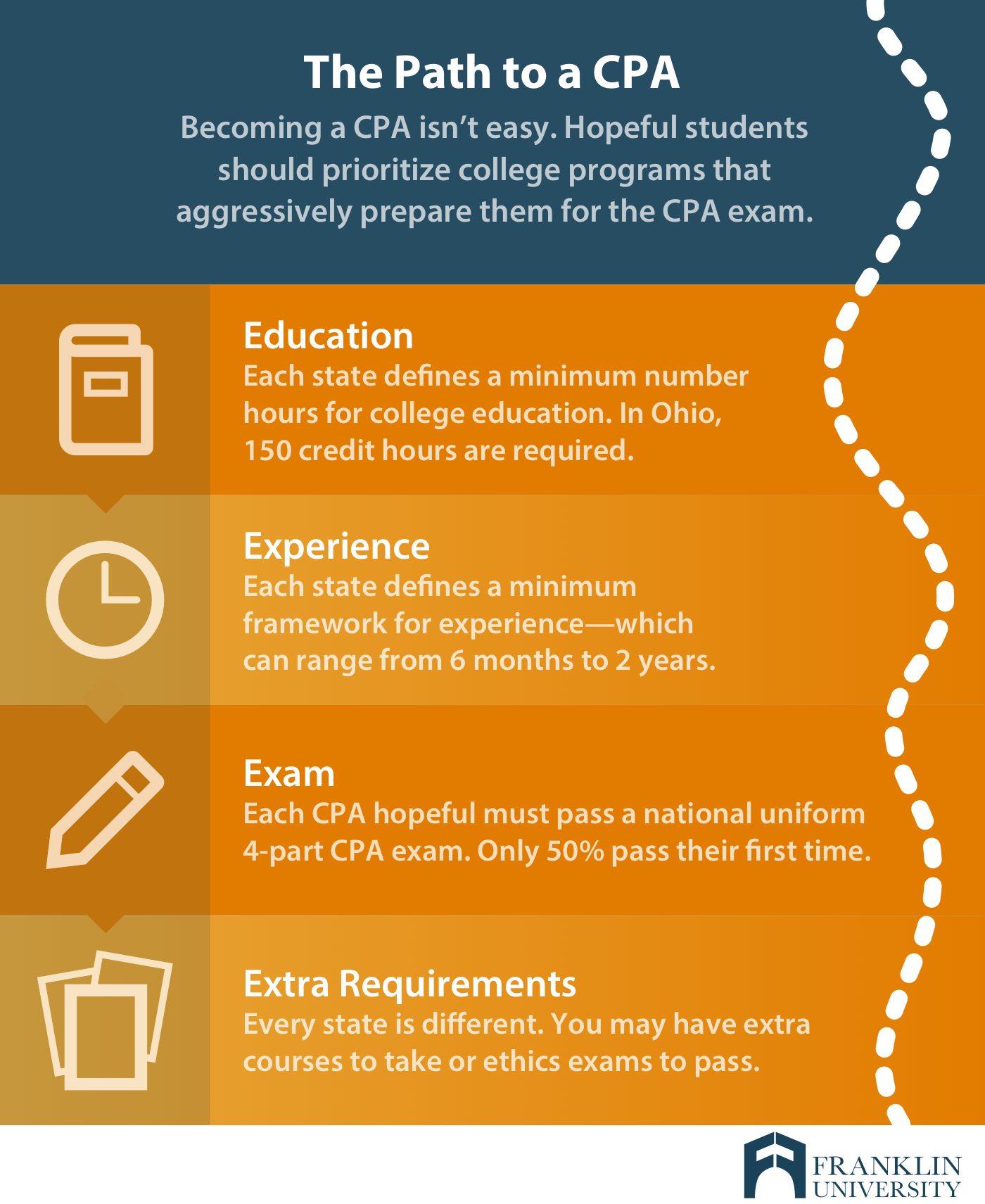

How to become a cpa in california. The path to cpa. There are a few general requirements that california. Once you have been granted a bachelors degree and fulfilled the course requirements of.

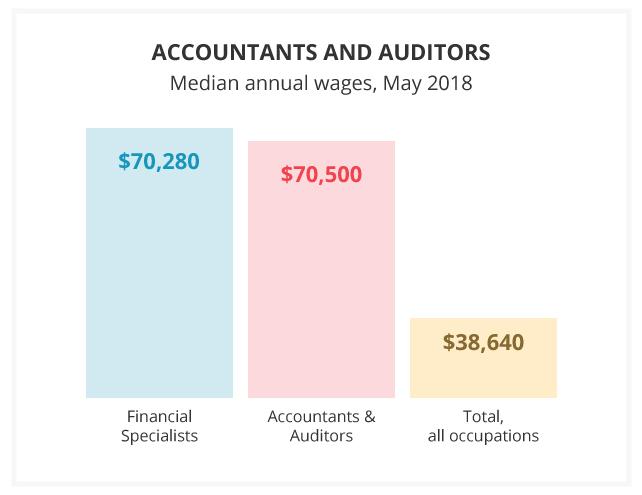

Find out about accounting programs at california colleges and universities. Degree requirements for accountants in california. It can prepare students for entry level work in the field.

The educational requirements for california cpas includes a minimum of 150 semester hours of. You will set up an online profile as part of the application process. Apply to sit for the uniform cpa examination.

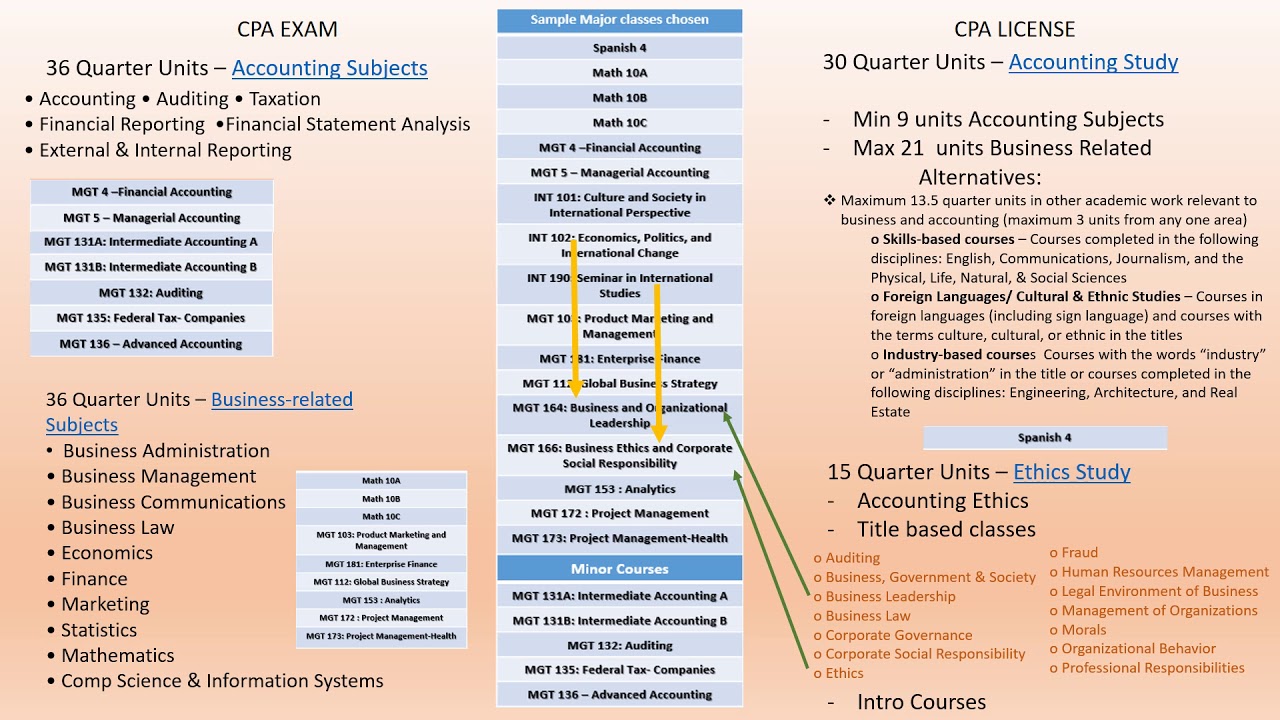

24 semester units in accounting related subjects. Passing the uniform cpa exam. California cpa exam license requirements 2020 educational requirements.

You can take each part. The cpa exam is a prerequisite by the board for applying for full licensure. Steps to becoming an accountant in california in 2014 the california board of accountancy fully integrated the protocols of the uniform accountancy act uaa and now requires all applicants for cpa licensure to have 150 semester hours of college credit and one year of accounting experience.

5 steps to becoming a cpa in california 1. How to become a cpa in california ca cpa exam requirements license and certification qualifications 1 determine if you eligible to sit for the cpa exam in ca. You can request a hard copy of the application but it will take much longer for your application to be processed.

Basic courses may. Take the uniform cpa exam. Complete cpa exam applications received by have been processed and the applicant has been notified of the outcome.

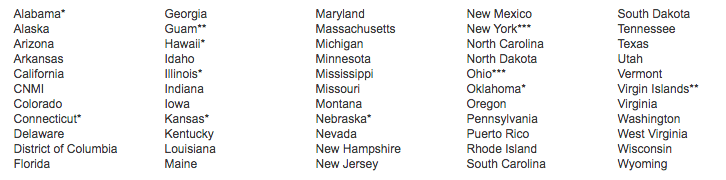

Check out aicpas this way to cpa check out the california board of accountancys educational requirements. 150 semester units or 225 quarter units of education. What are the education.

How To Become A Cpa In California Exam License Requirements Discover Accounting

discoveraccounting.org