How To Calculate Carrying Value Using Straight Line Method

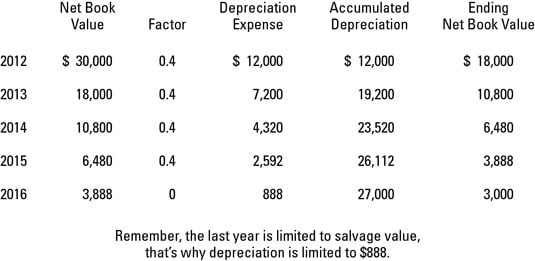

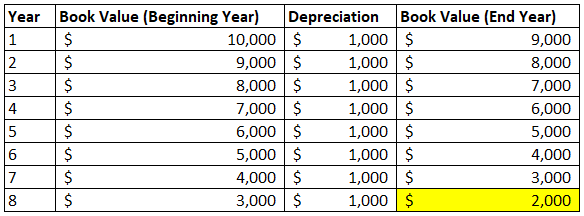

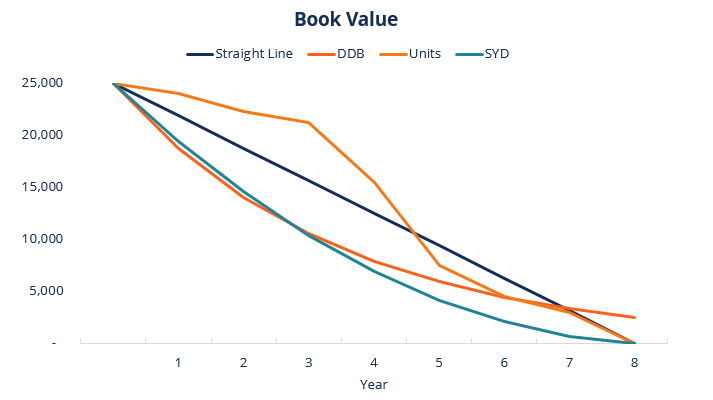

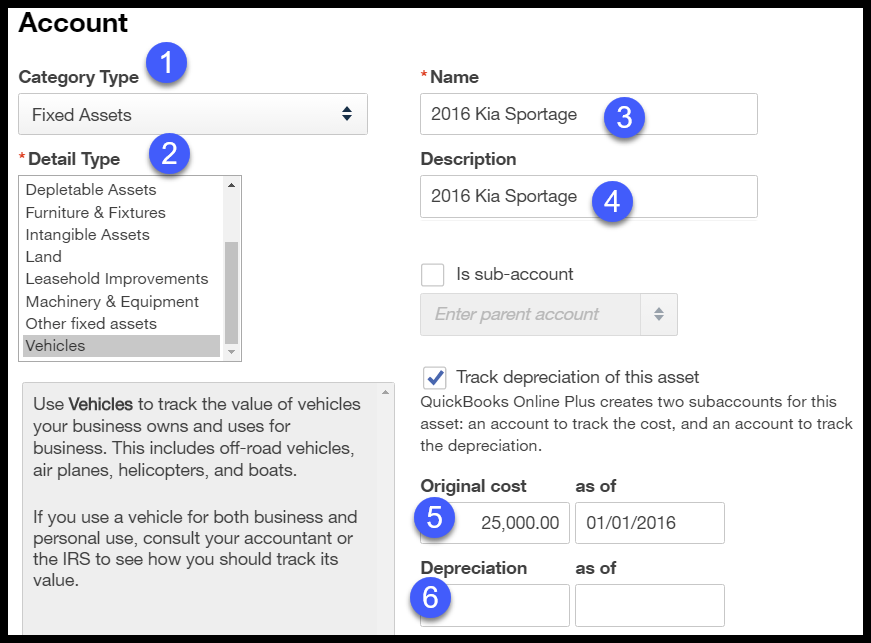

The carrying value would be 200 on the balance sheet at the end of three years.

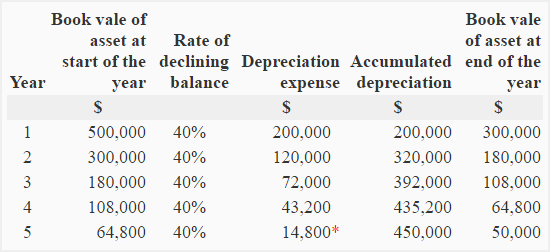

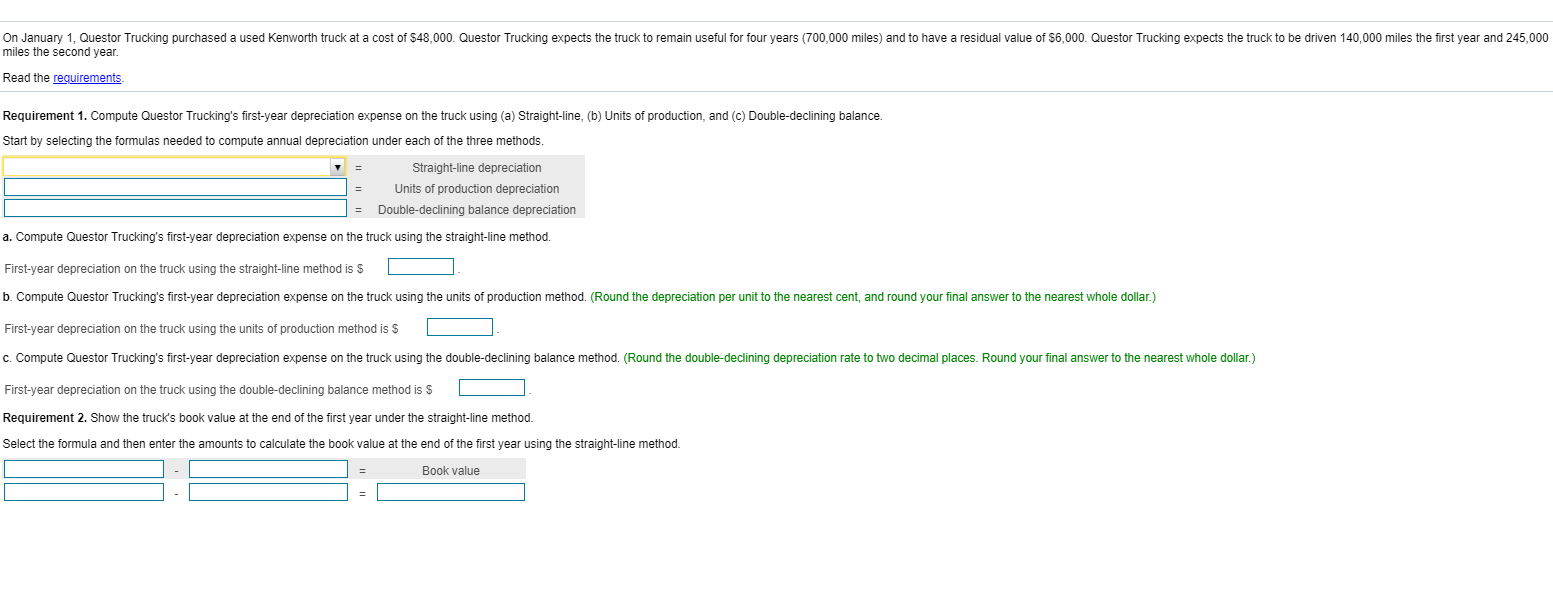

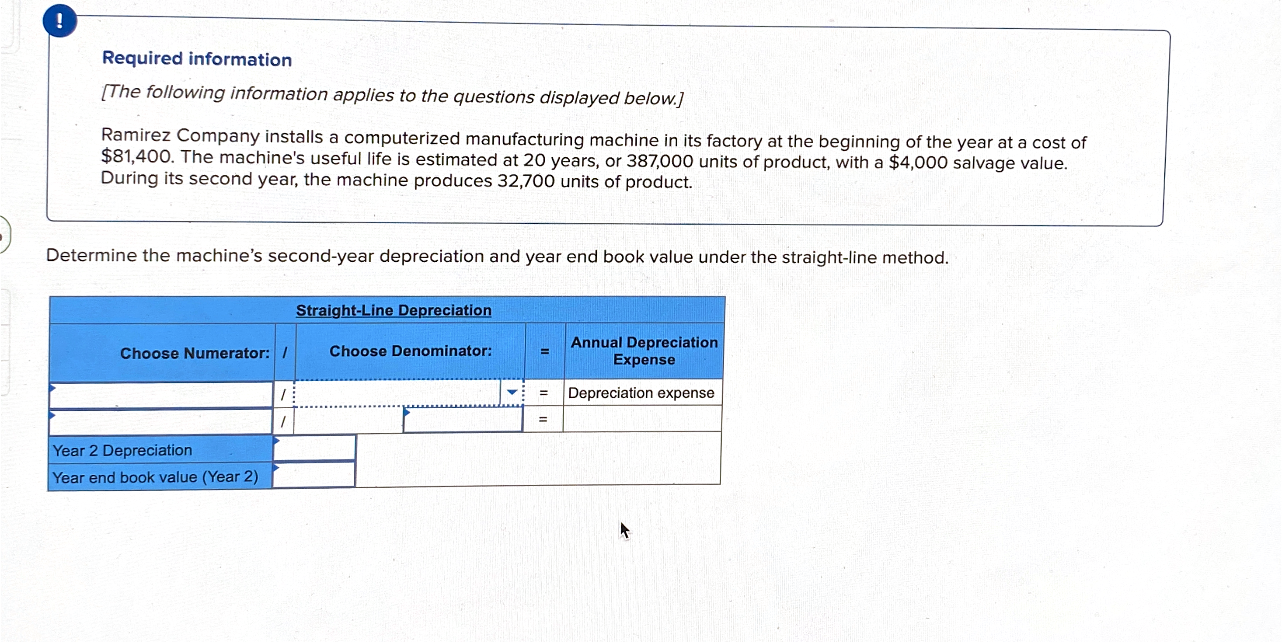

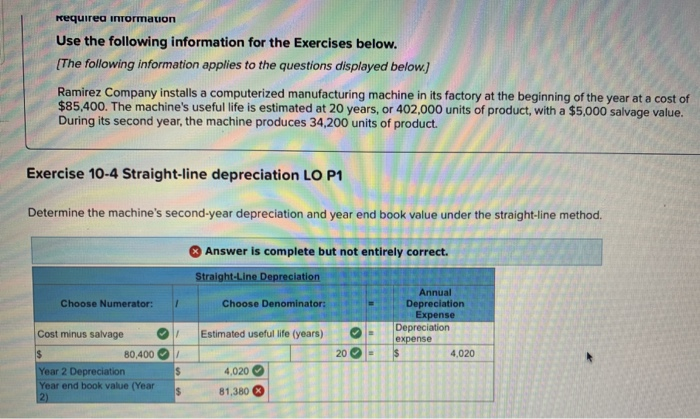

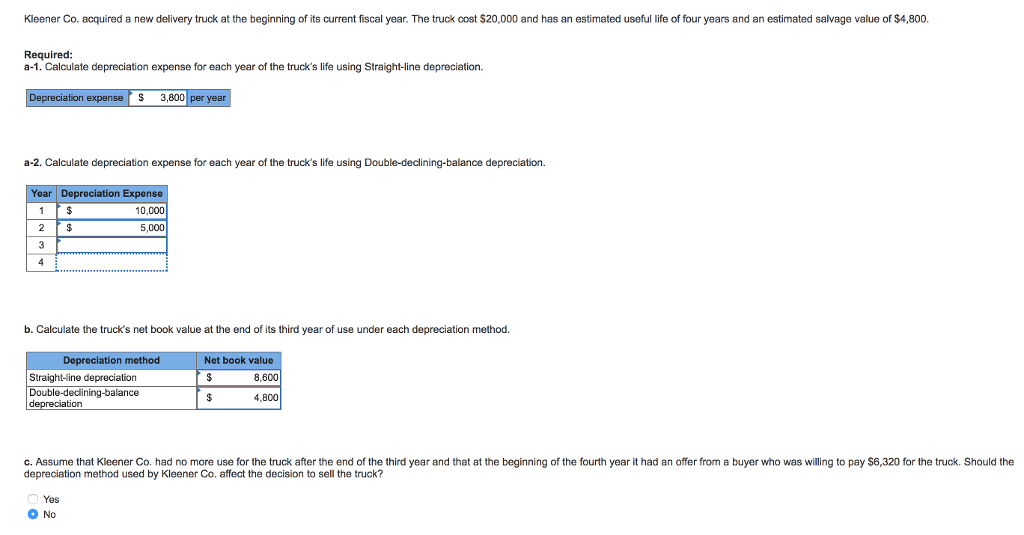

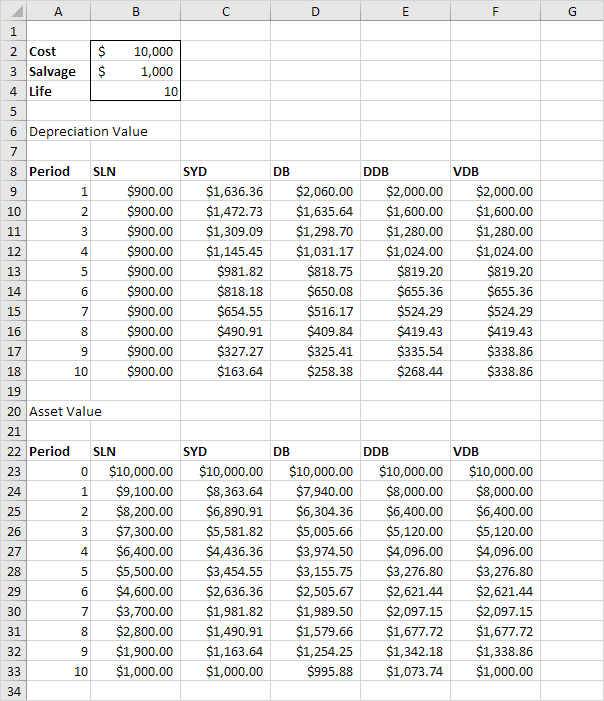

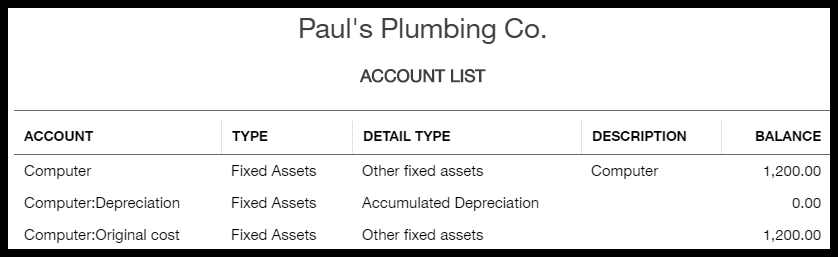

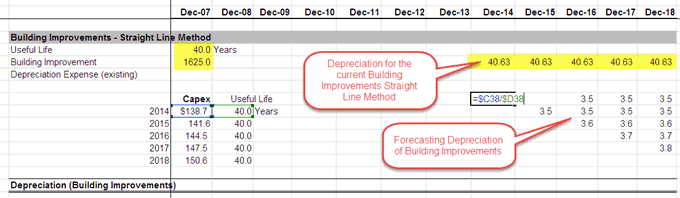

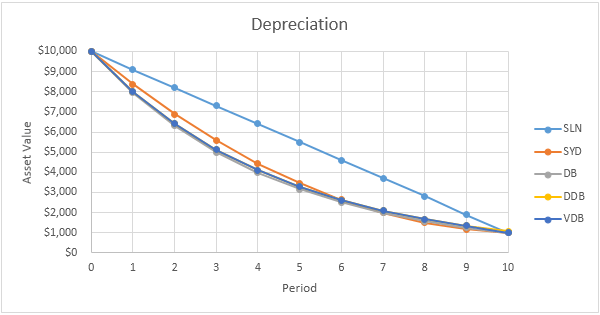

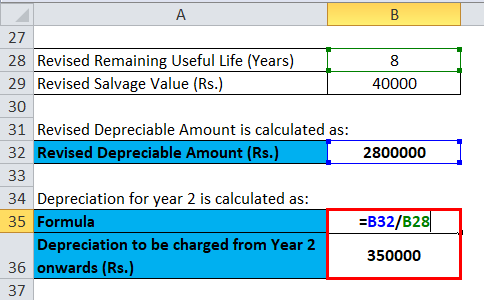

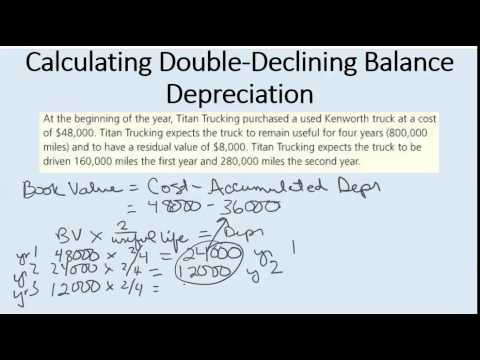

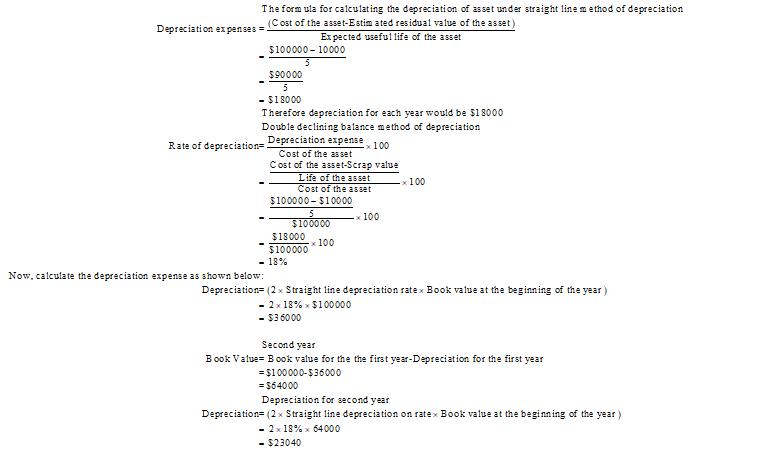

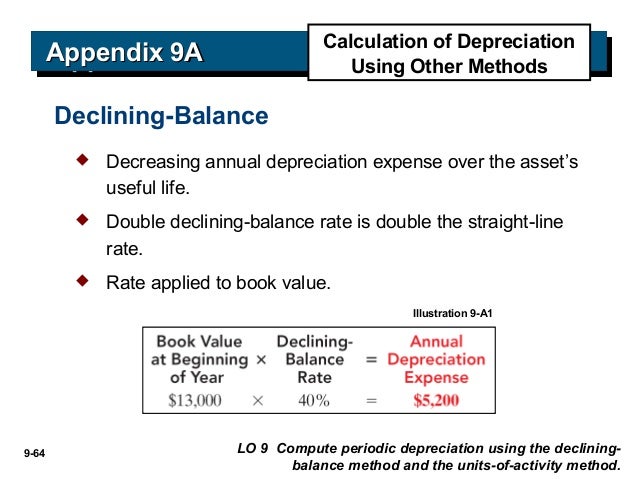

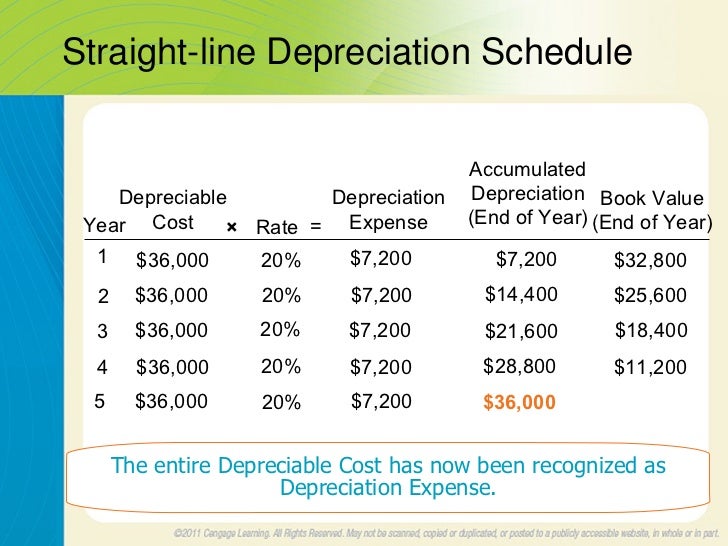

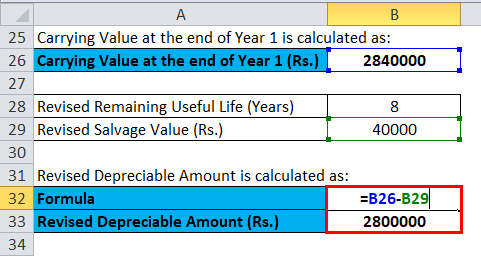

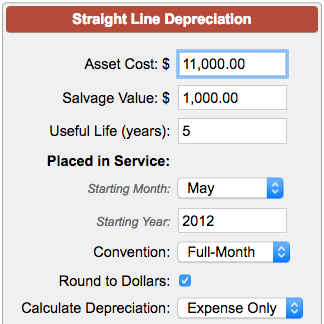

How to calculate carrying value using straight line method. Determine the useful or functional life of the asset. Add up the depreciation or amortization over the years youve held the asset and subtract the total from the purchase price. The depreciation expense would be completed under the straight line depreciation method and management would retire the asset.

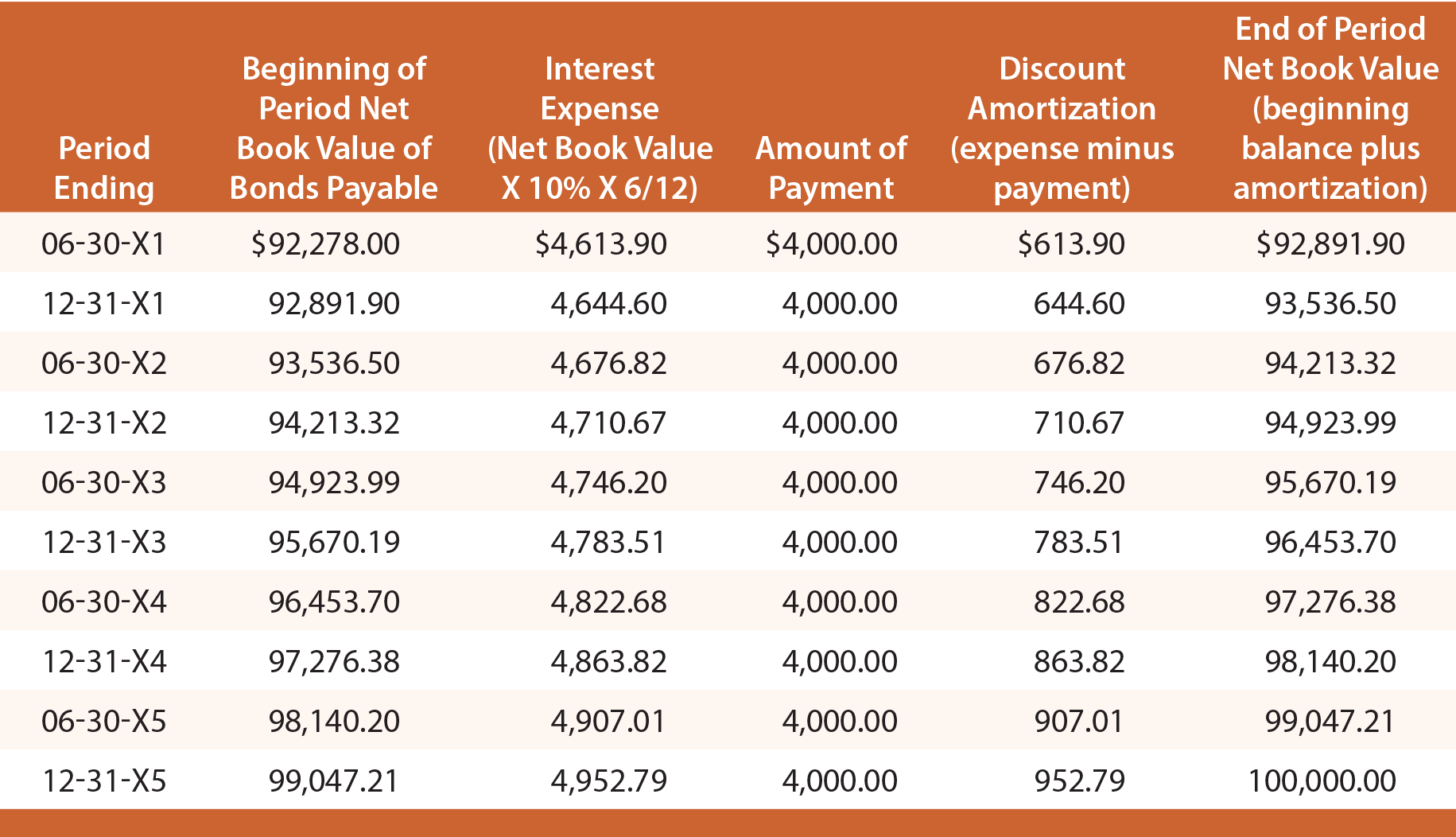

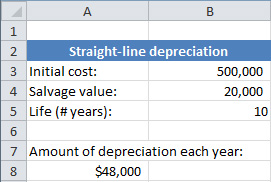

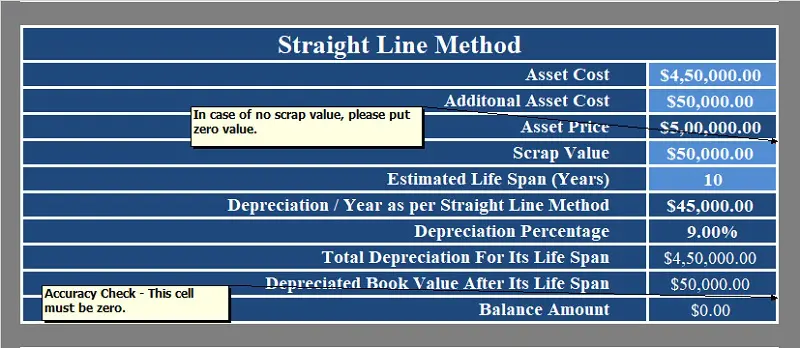

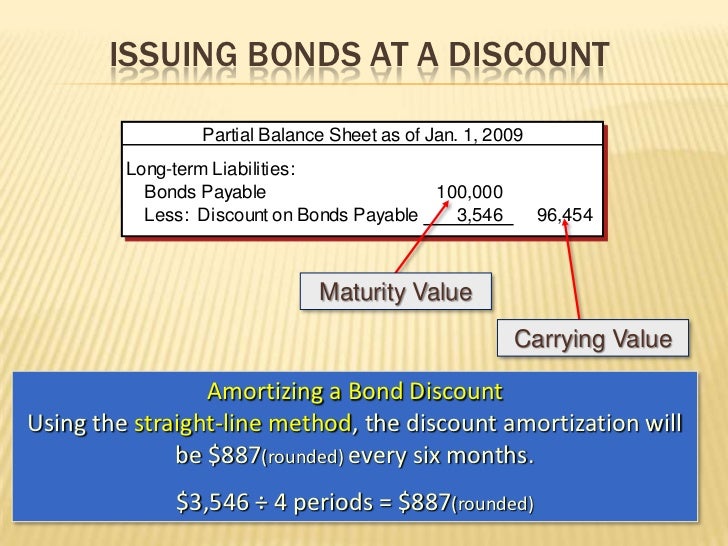

The straight line method of amortization applied to bonds requires little more than basic math. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Then subtract any impairments on the value.

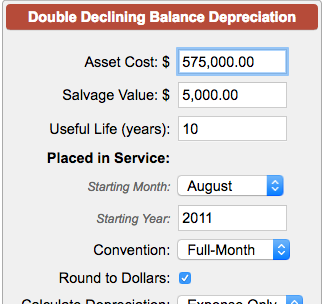

N 1 number of remaining periods pmt 9000 9 coupon rate x 100000 par value int 10 investors required yield to maturity solving for present value we arrive at 9909091 or. The straight line calculation steps are. Determine the initial cost of the asset at the time of purchasing.

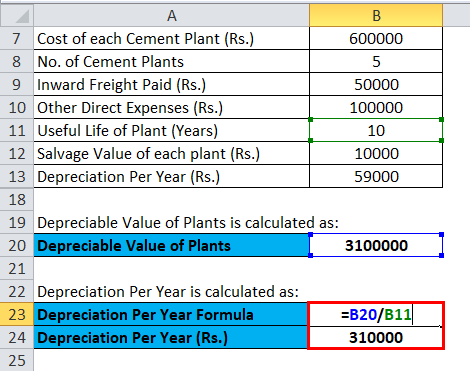

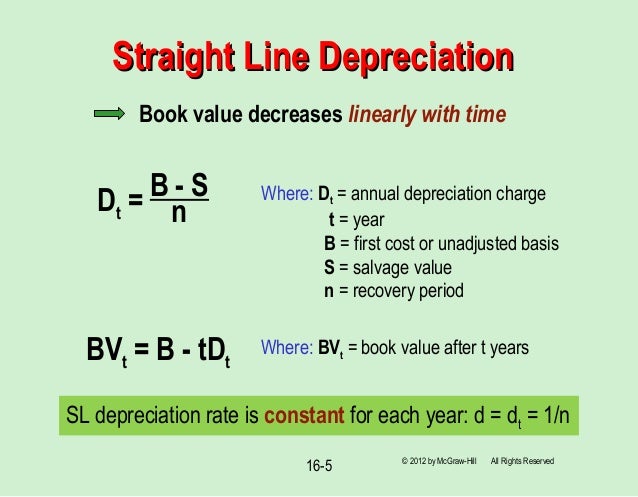

The straight line method of calculating straight line depreciation has the following steps. Determine the cost of the asset. Determine the useful life of the asset.

One of the easiest and most commonly accepted methods of computing for depreciation is the straight line depreciation method straight line depreciation straight line depreciation is the most commonly used and easiest method for allocating depreciation of an asset. Take the original purchase cost. Divide the sum of step 2 by the number arrived at in step 3 to get.

The formula reads amortizationinterest payments bond amount with interest original bond amount number of periods. To calculate straight line depreciation the accountant divides the difference between the salvage value and the cost of the equipmentalso referred to as the depreciable base or asset costby the. Determine the salvage value of the asset ie the value at which the asset can be sold or disposed of after its useful life is over.

:max_bytes(150000):strip_icc()/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)

/pen-and-coins-on-financial-statement-1041019842-3fb97638d9f24424b156c88410a51848.jpg)