How To Calculate Extra Mortgage Payments In The Payoff

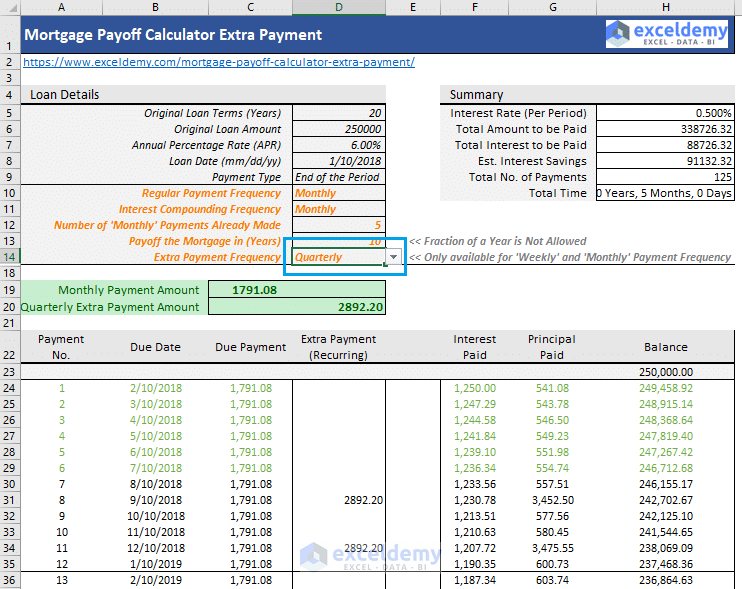

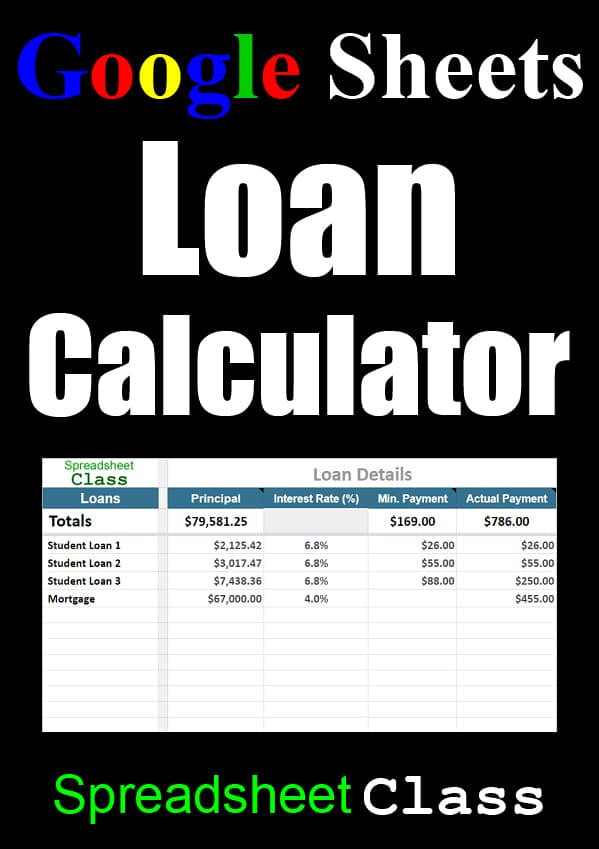

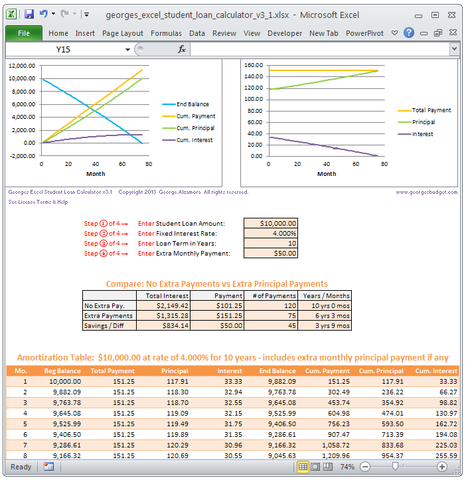

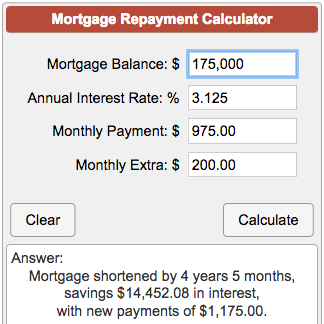

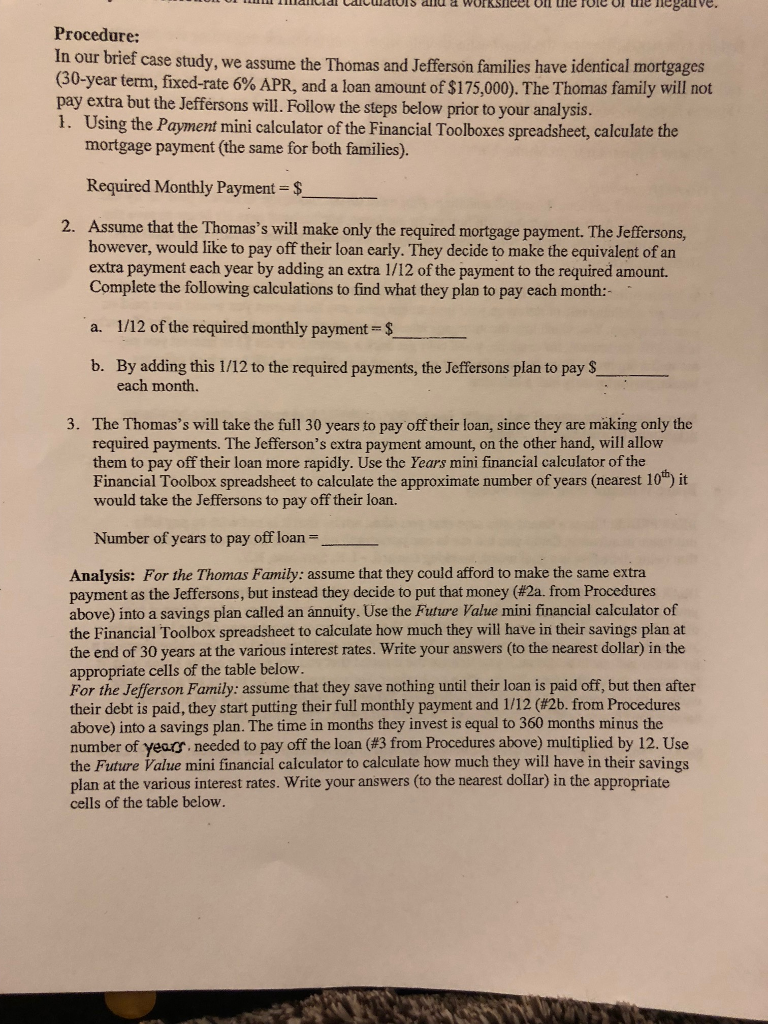

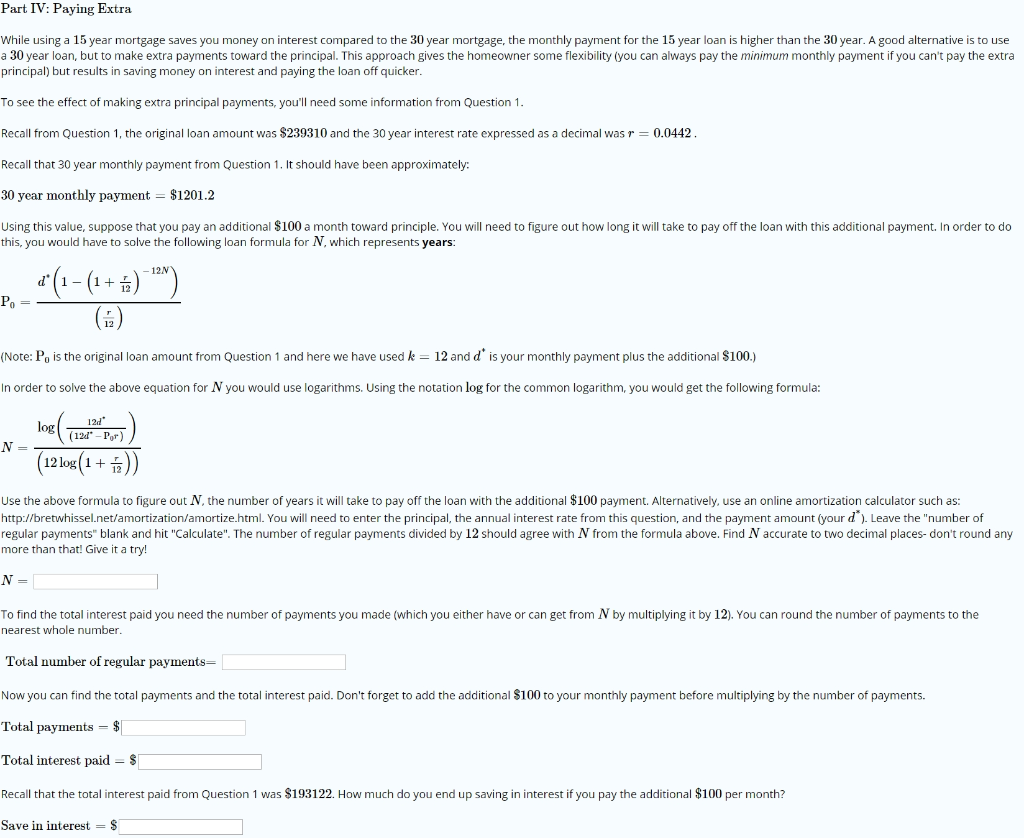

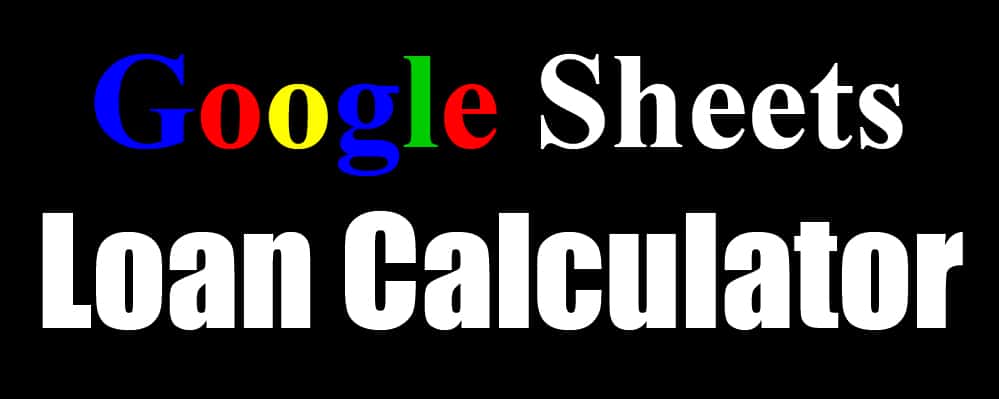

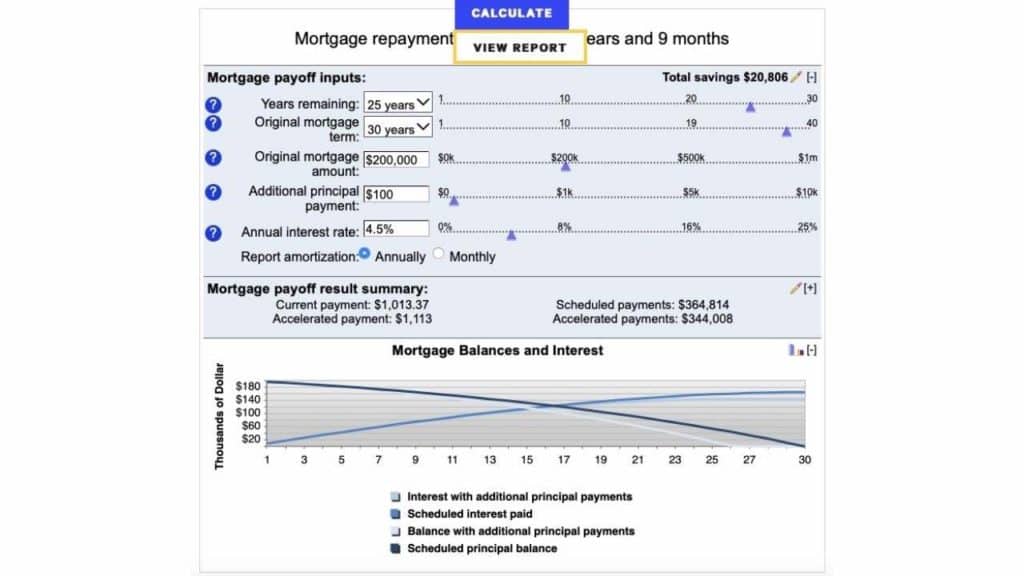

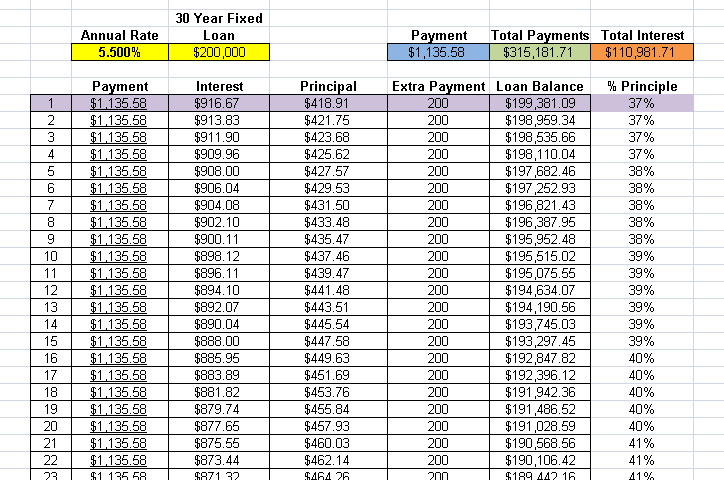

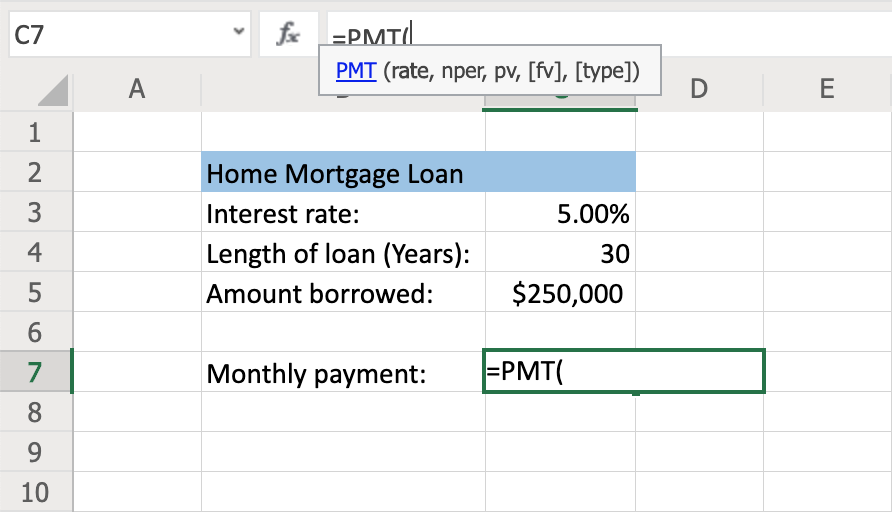

Simply enter the original loan term how many years you have remaining on the loan the original mortgage amount the interest rate charged on the loan the amount you would like to add as an extra payment to each monthly payment.

How to calculate extra mortgage payments in the payoff. For example if you are 35 years into a 30 year home loan you would set the loan term to 265. Divide your monthly principal payment by 12 then add that amount to each monthly payment. In other words use this calculator to define time period and payment amount and use the other calculator to define optimum early payoff strategy.

For example a 4 interest rate on a 200000 mortgage balance would add around 652 to your monthly payment. A structured way to add extra. The unpaid principal balance interest rate and monthly payment values can be found in the monthly or quarterly mortgage statement.

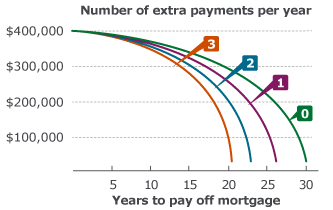

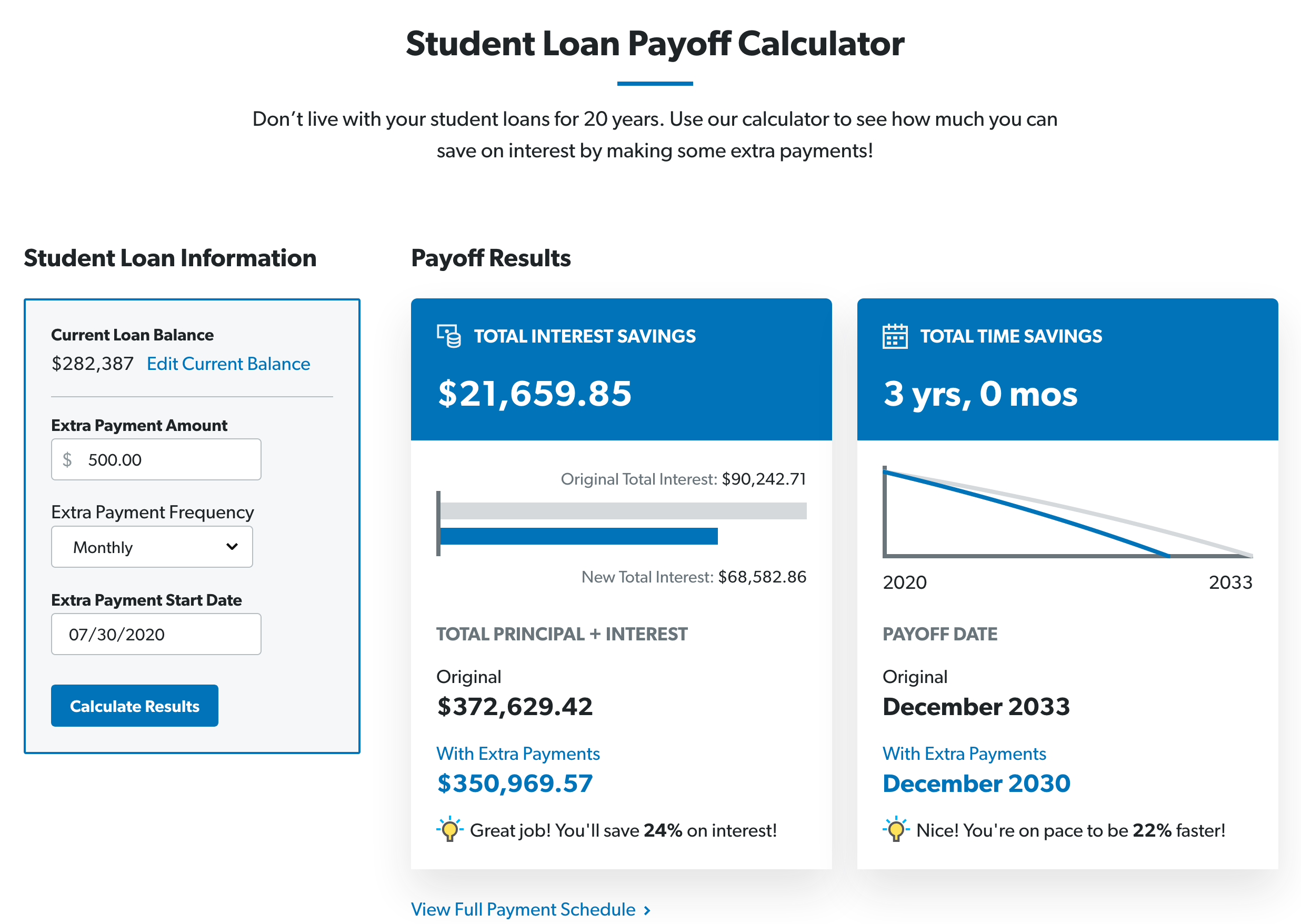

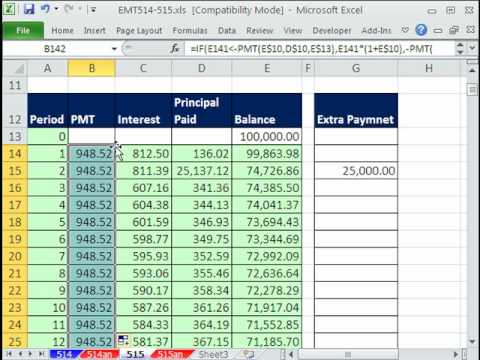

For a 100000 loan at 6 percent interest for 30 years the monthly payment is 59955. Payoff in 14 years and 4 months the remaining term of the loan is 24 years and 4 months. By paying extra 50000 per month the loan will be paid off in 14 years and 4 months.

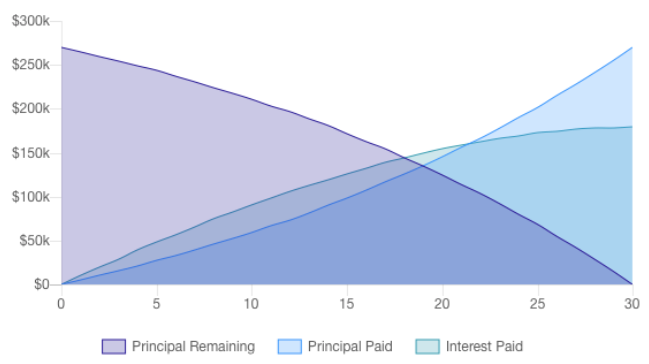

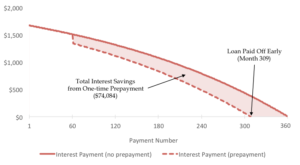

Frequently the recommended method suggests making an extra payment equal to the principal amount owed on each monthly bill. You end up making 13 payments instead of the required 12 payments every. As your principal balance is paid down through monthly or additional payments the amount you pay in interest decreases.

The following calculator makes it easy for homeowners to see how quickly they will pay off their house by making additional monthly payments on their loan. Extra payments in the middle of the loan term. This breaks down to a payment of 500 towards interest and 9955 towards the principal.

Please see our bi weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. Make extra payments and repay your loan faster. Original loan balance annual percentage rate 0 to 40 initial term in months 30yrs360 1 to 360 number of payments already made 0 to 999 proposed additional monthly payment.

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal Mortg Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Refinance Calculator

www.pinterest.com

/sick-of-mortgage-payments-pay-off-your-home-early-453826_Final-201fc508b83c4f839d73a7a8bb4d1098.png)

/how-do-i-make-extra-payments-on-my-loans-2385993-Final-37d8f0ec56174885a783a241a3045332.png)

/157194462-56a2eeb23df78cf7727b359e.jpg)

/loan-principal-questions-and-answers-52ba5408c43b44fc940ac8b4c1446f24.png)