How To Calculate Monthly Interest On A Loan In Excel

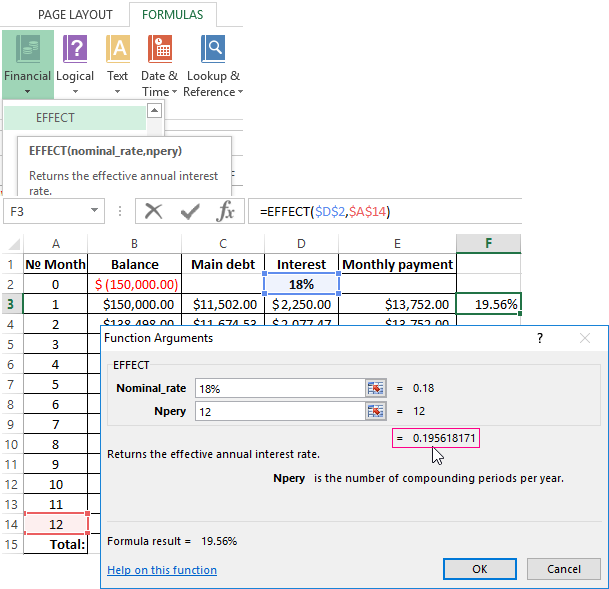

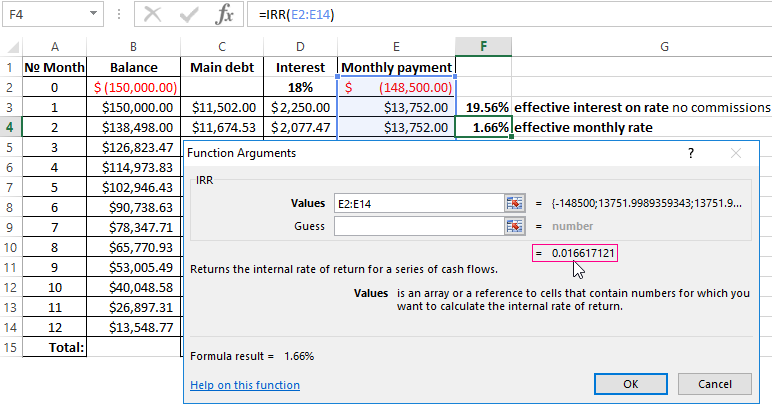

The result as a decimal insertion we put in the field bet.

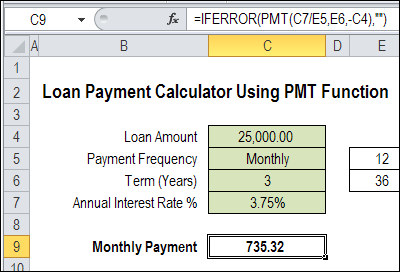

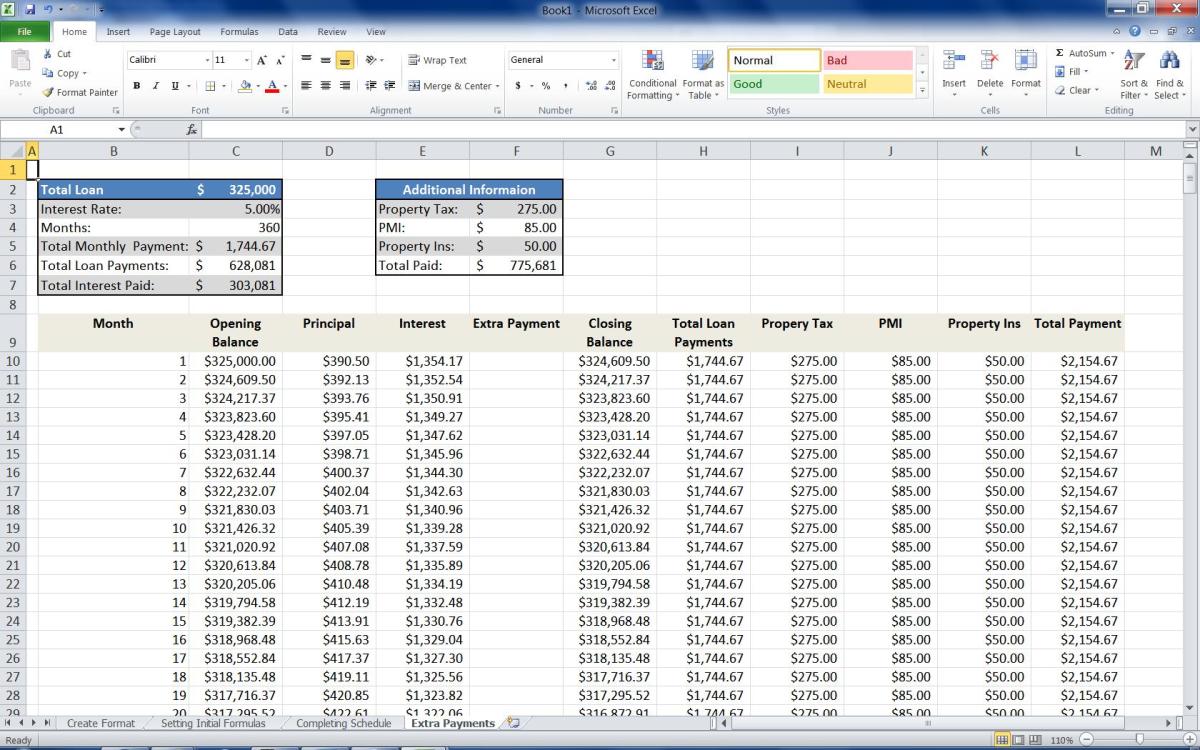

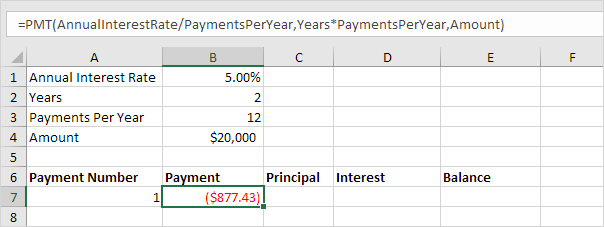

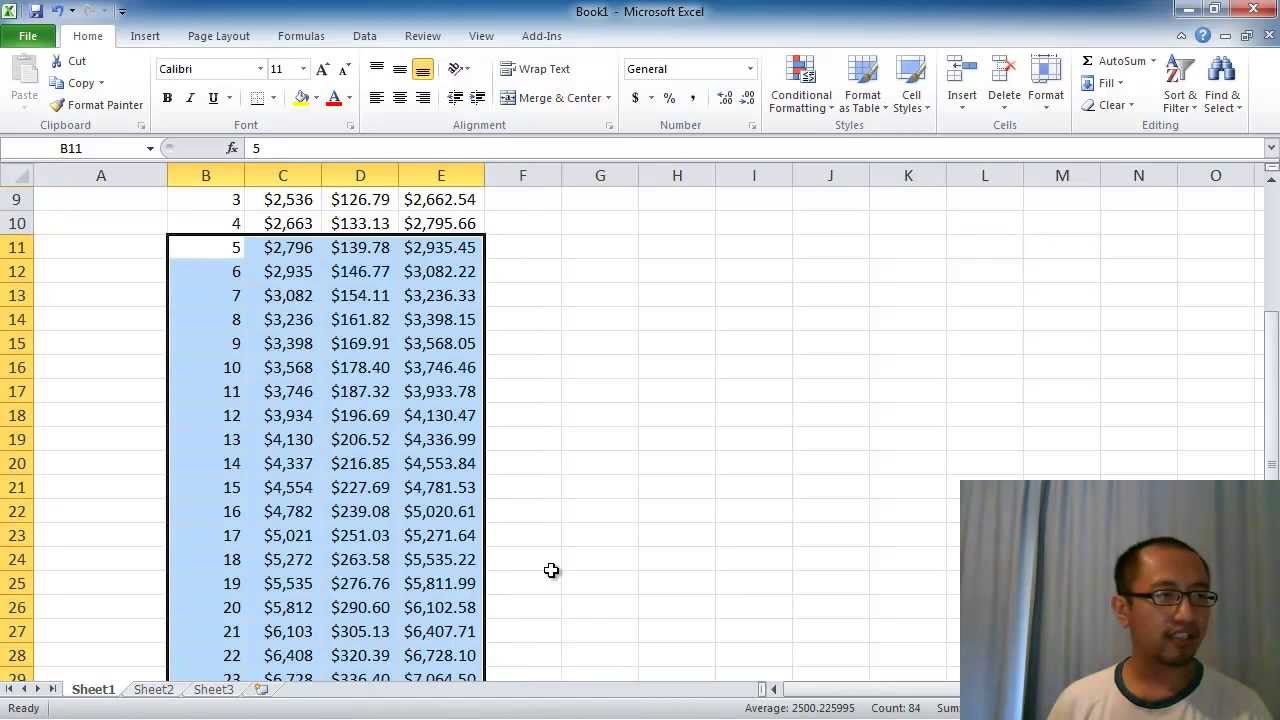

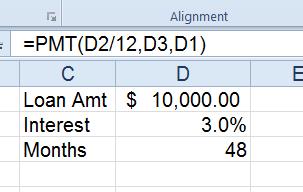

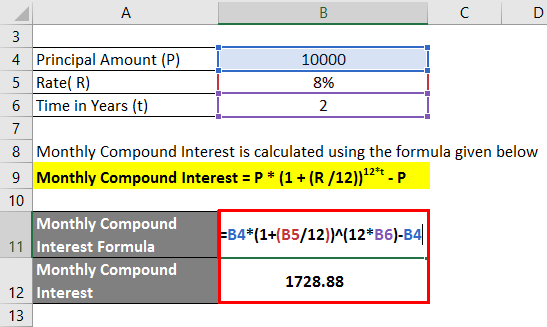

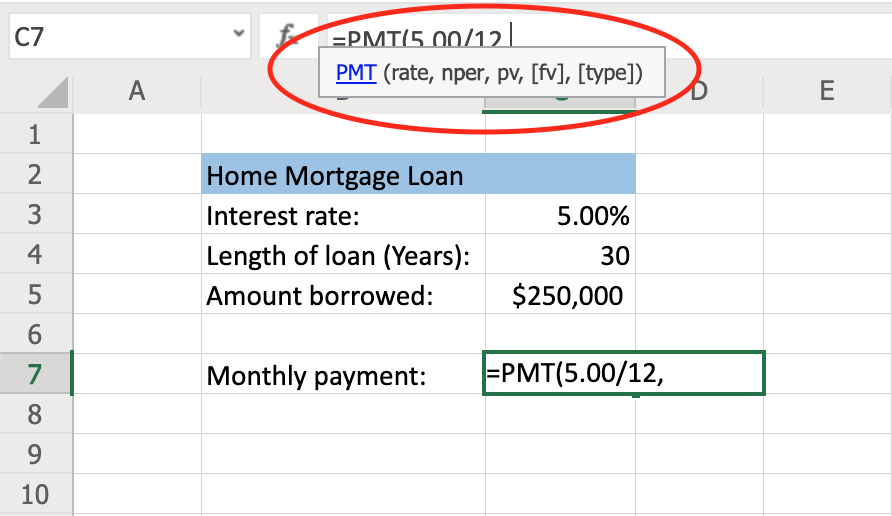

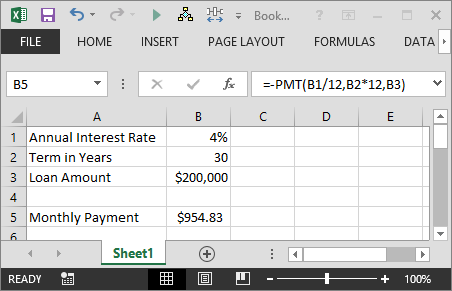

How to calculate monthly interest on a loan in excel. Suppose that the interest to capitalize by monthly. In the formula b2 is the annual loan interest rate b212 will get the monthly rate. We divide 5 by 12 because 5 represents annual interest.

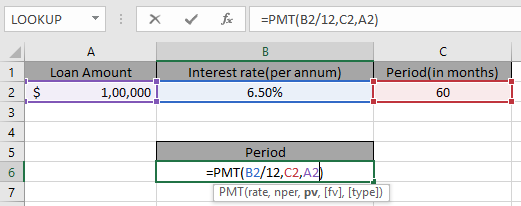

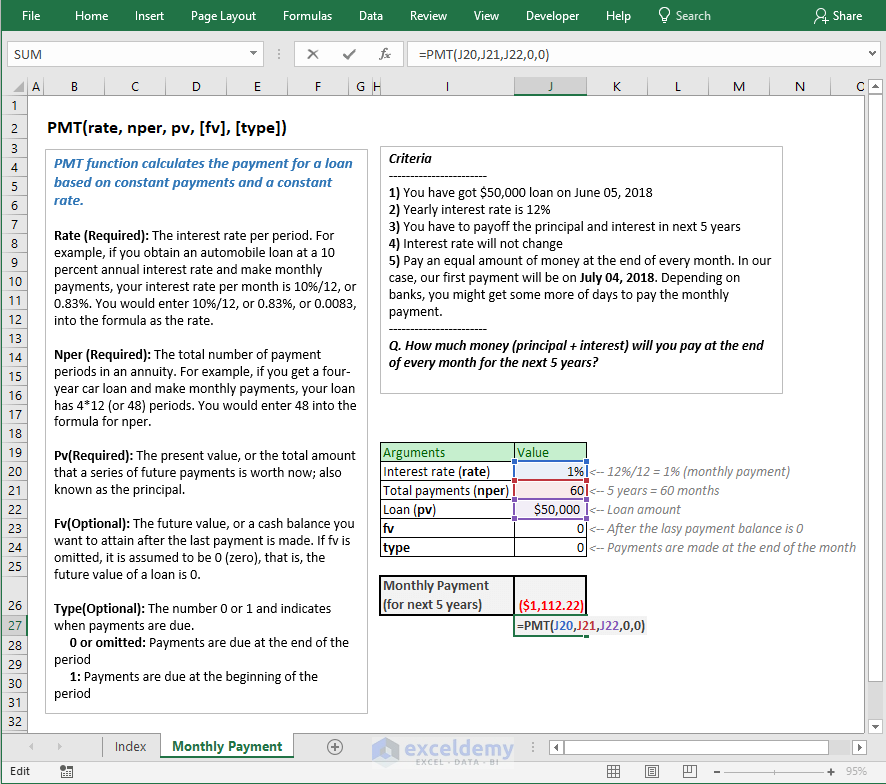

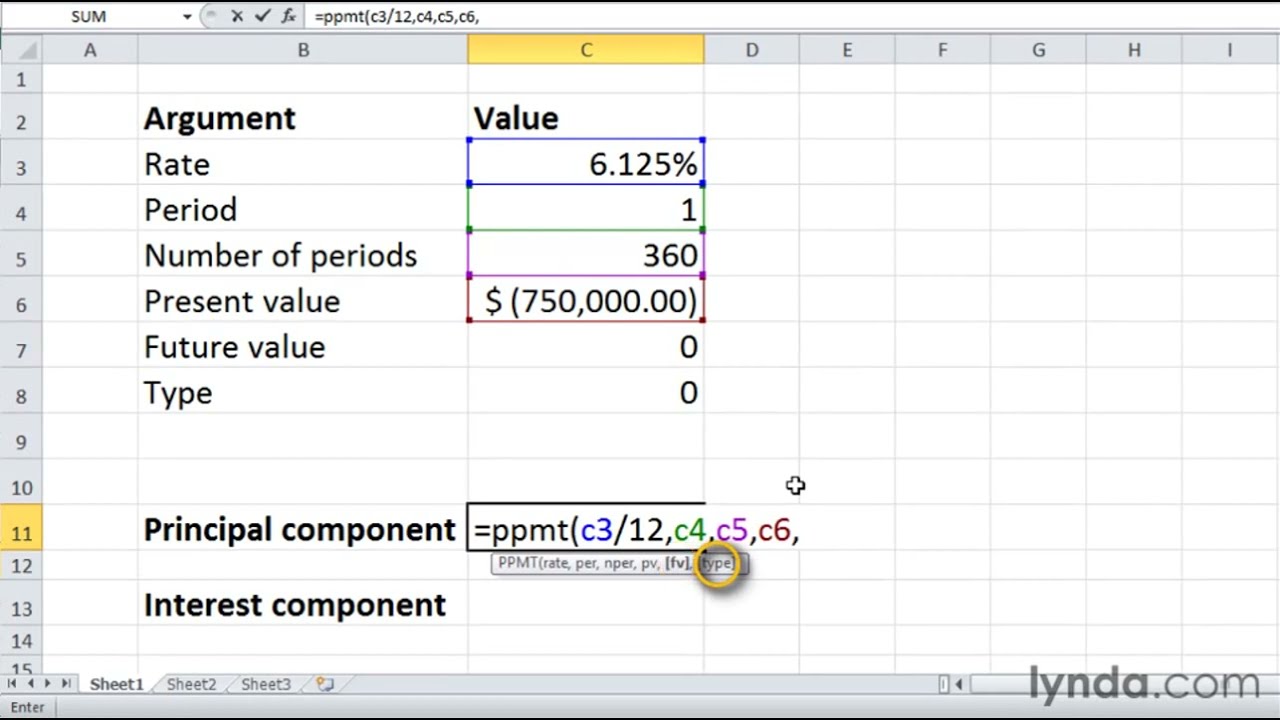

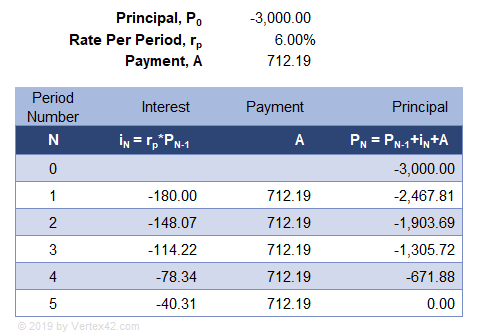

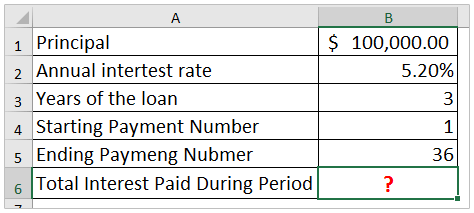

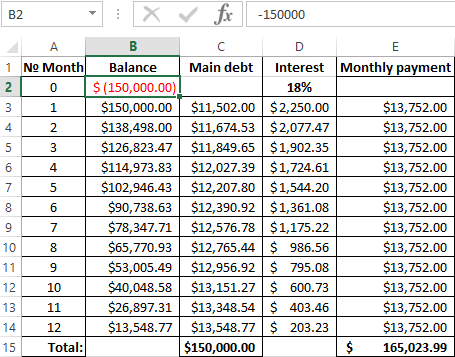

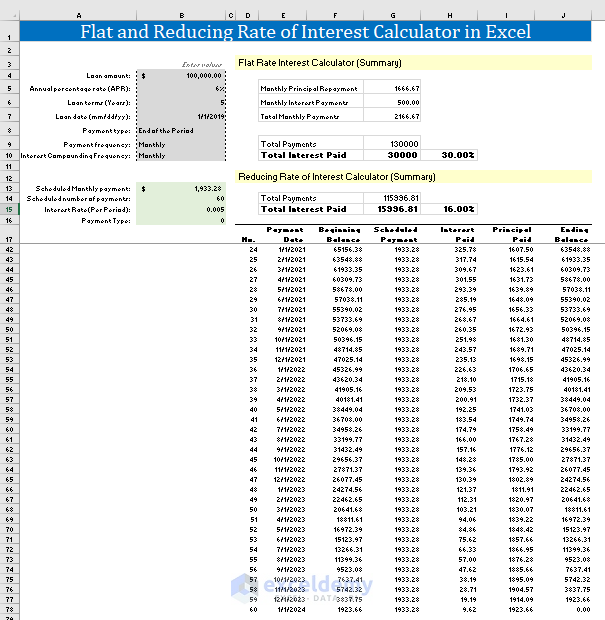

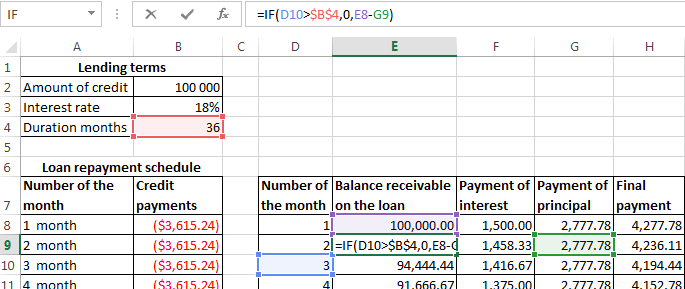

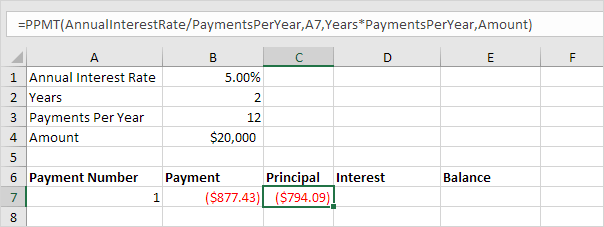

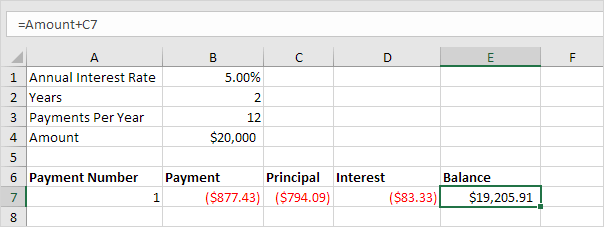

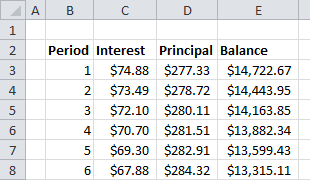

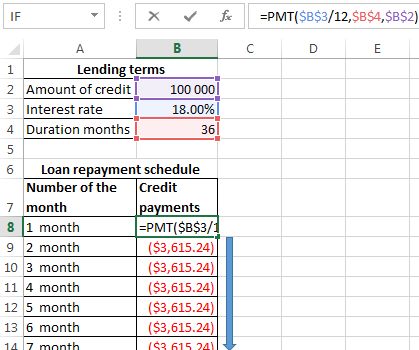

Rate the interest rate per period. The fourth column is the interest for which we use the formula to calculate the principal repaid on our monthly amount to discover how much interest is to be paid. B3 is the years of the loan b312 will get the total number of periods months during the loan.

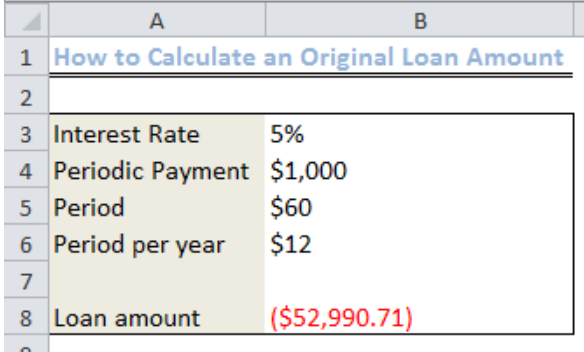

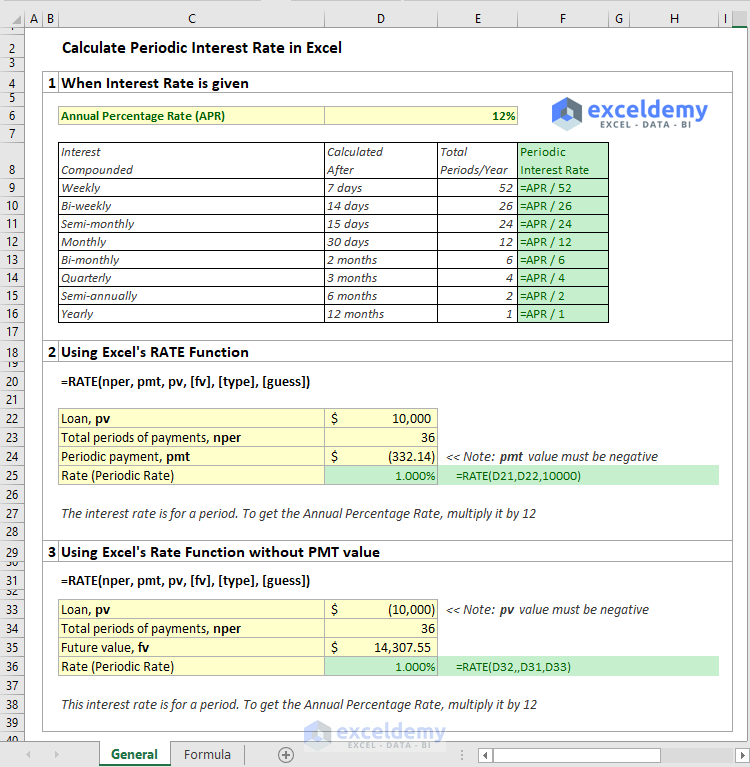

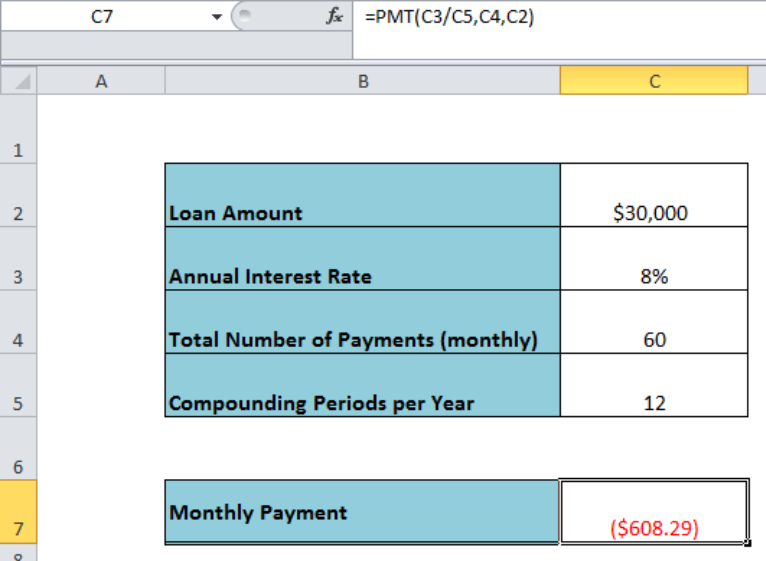

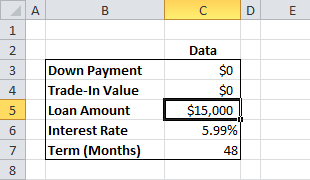

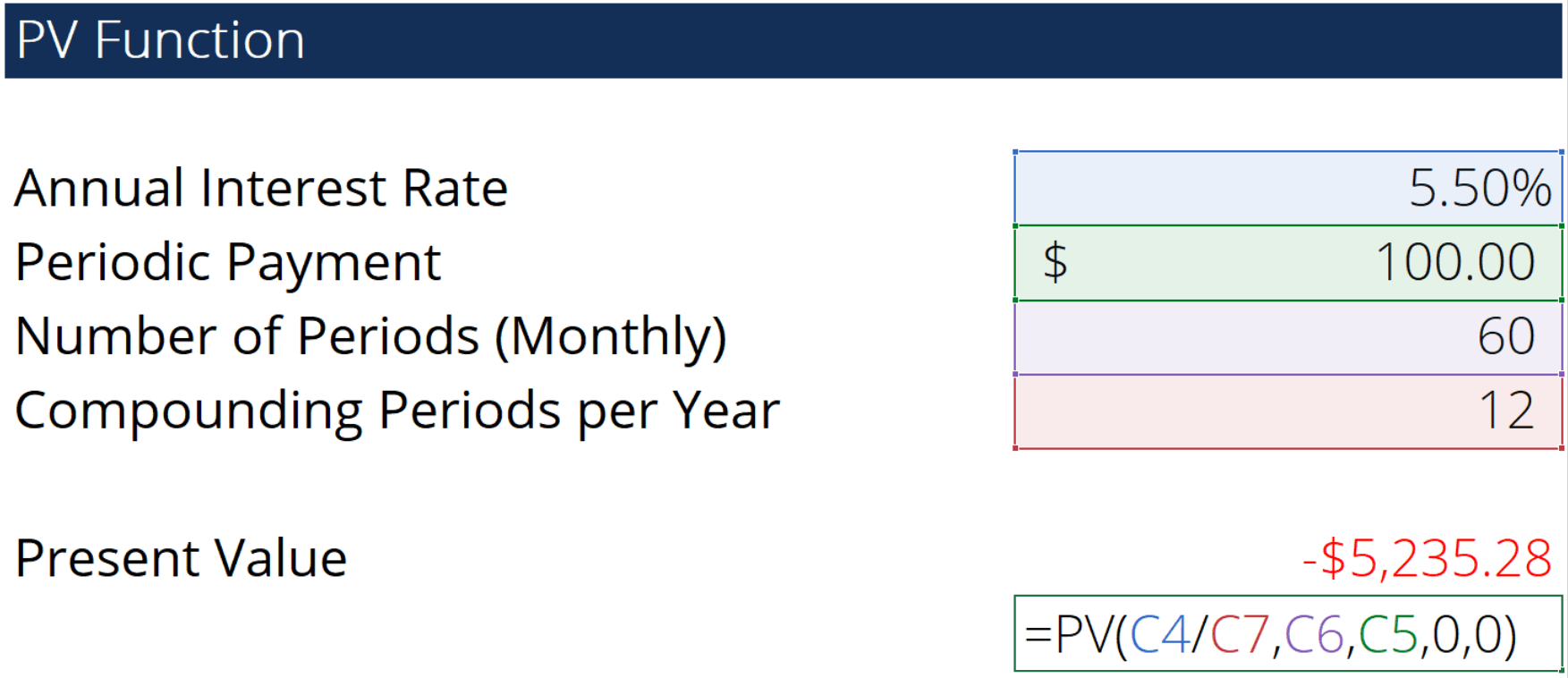

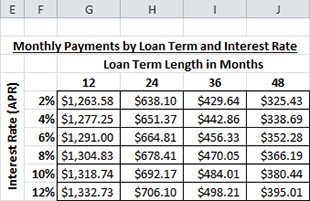

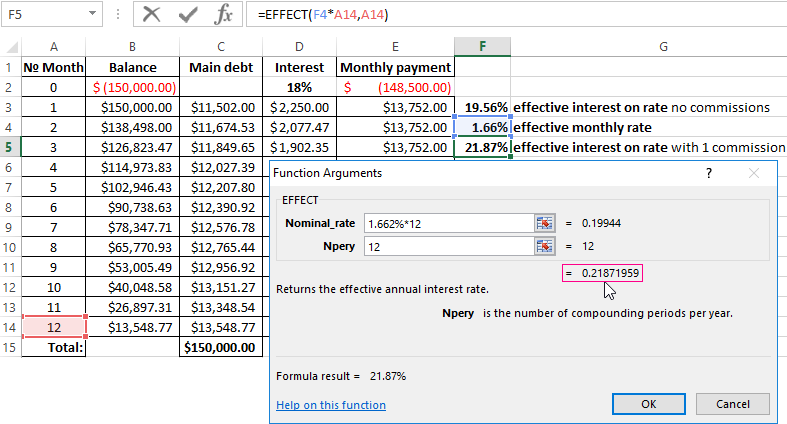

Nper the total number of payment periods for the loan 60. Therefore we divide 17 by 12. In this example we want to calculate the interest rate for 5000 loan and with 60 payments of 9322 each.

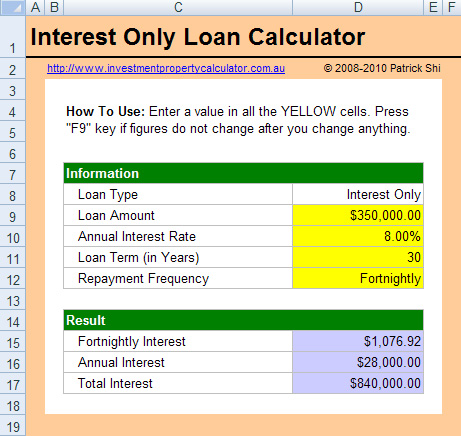

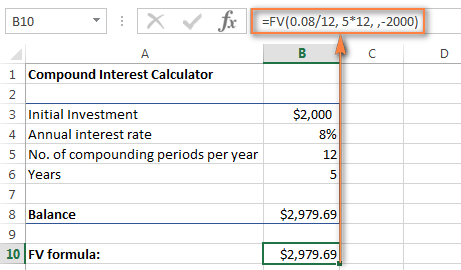

Enter the interest payment formula. It requires three data points. To calculate your income using the function fv.

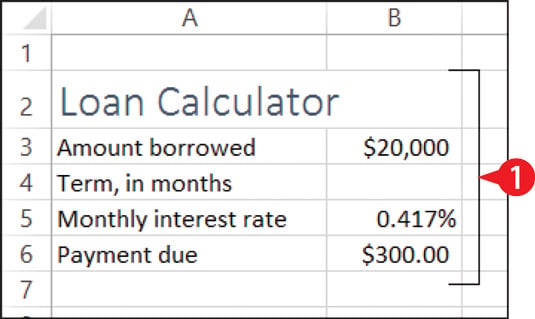

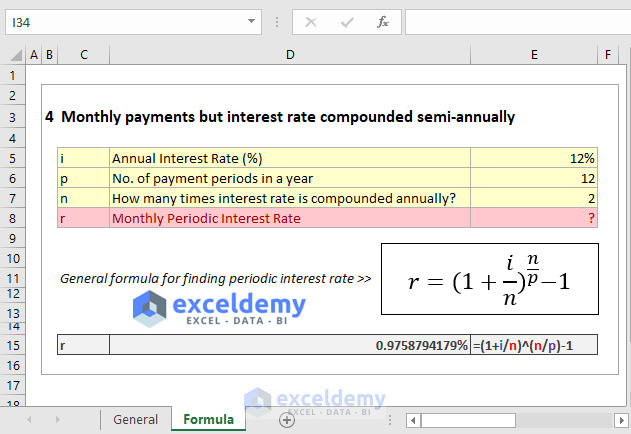

Doing so will calculate the amount that youll have to pay in interest for each period. Interest rate of the loan. In the nper we enter to the number of periods of compounding.

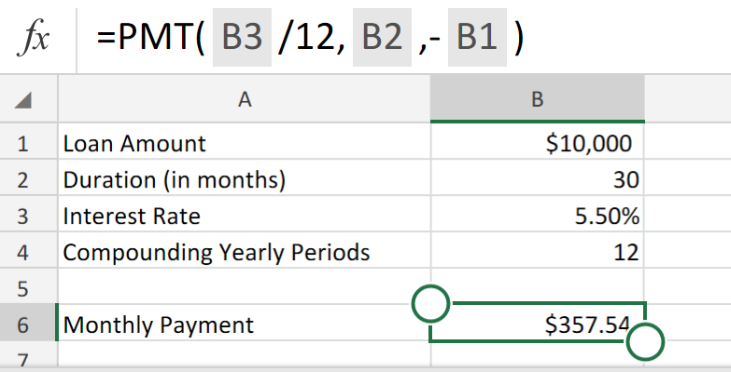

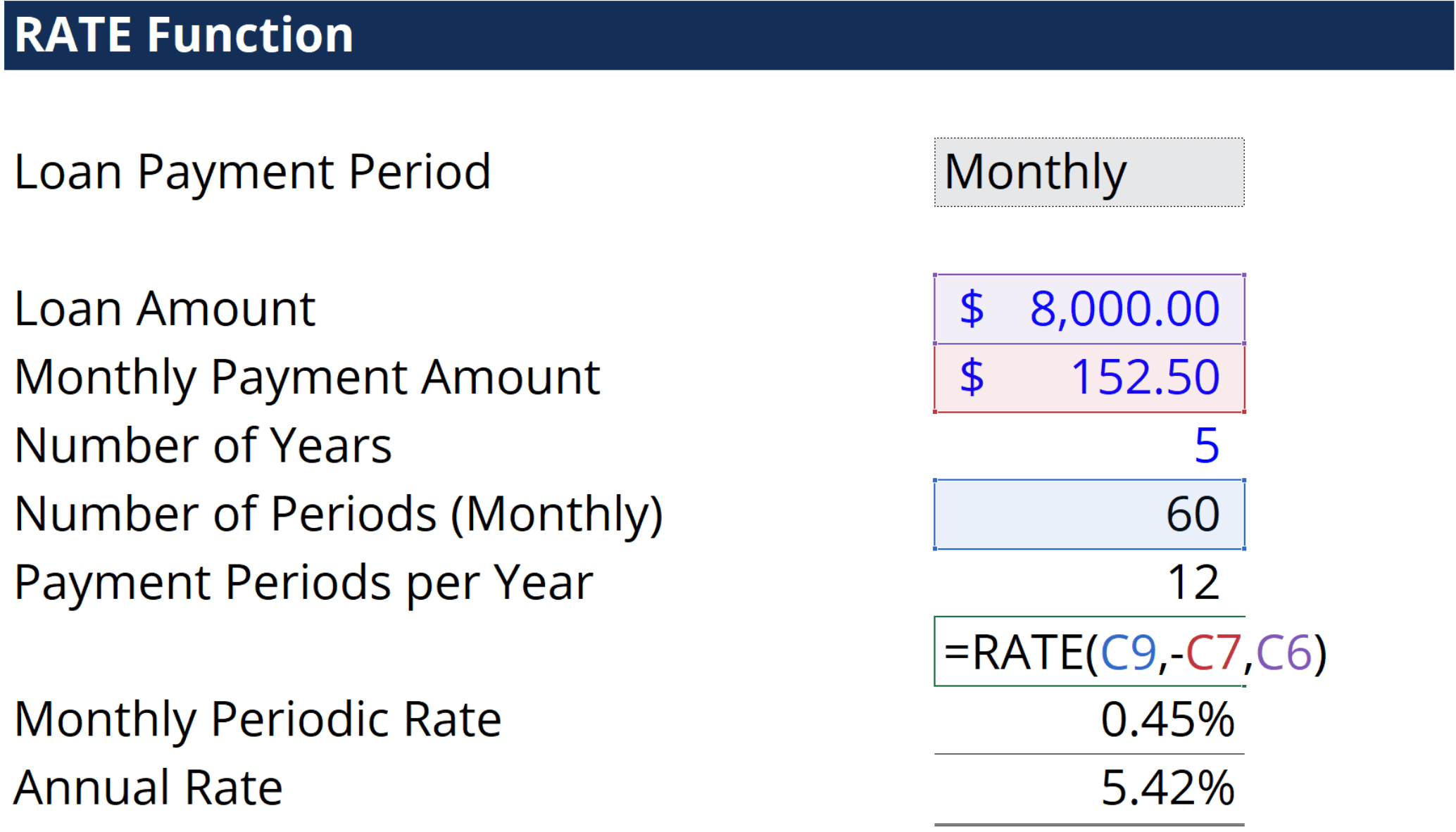

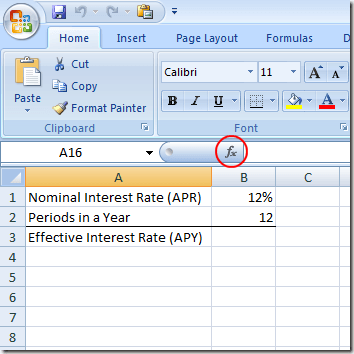

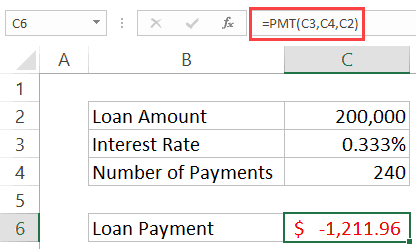

What is the pmt function in excel. This doesnt give you the compounded interest which generally gets lower as the amount you pay decreases. One use of the rate function is to calculate the periodic interest rate when the amount number of payment periods and payment amount are known.

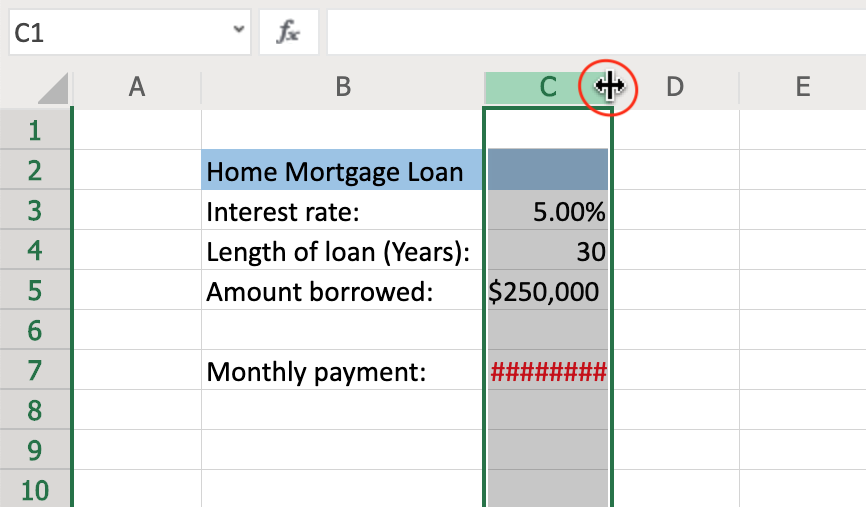

How to calculate monthly loan payments in excel. The rate function is configured as follows. Type ipmtb2 1 b3 b1 into cell b4 and press enter.

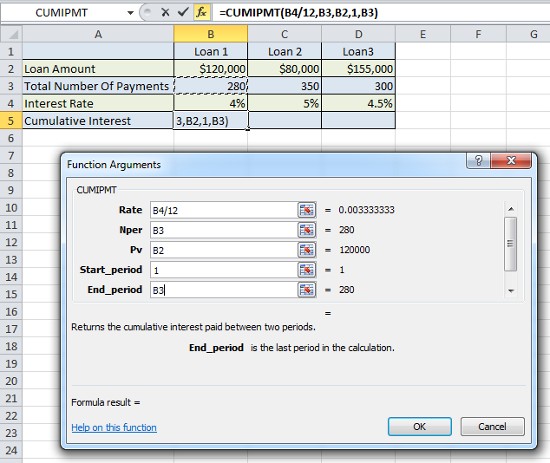

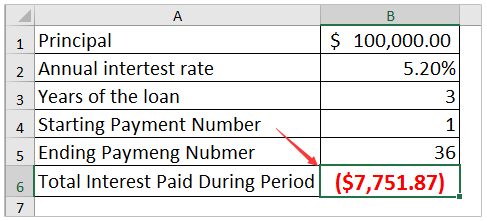

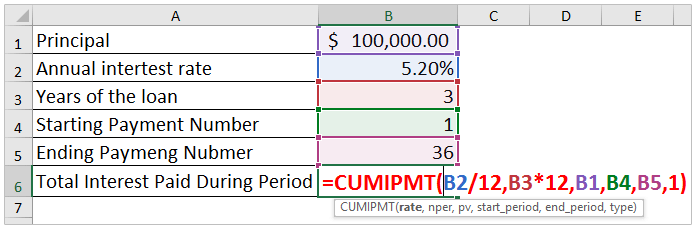

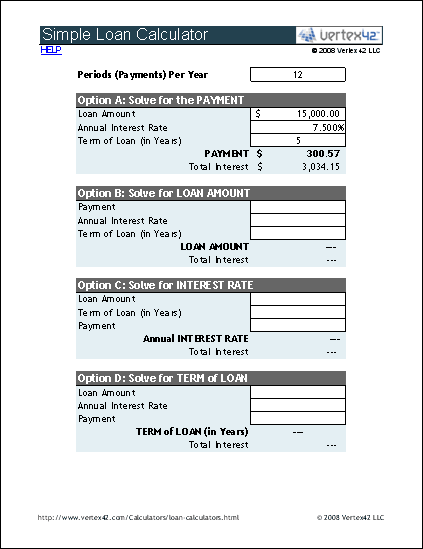

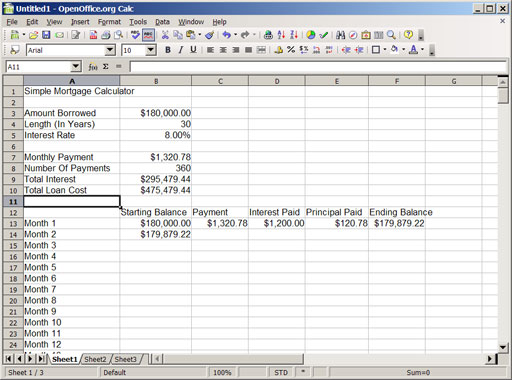

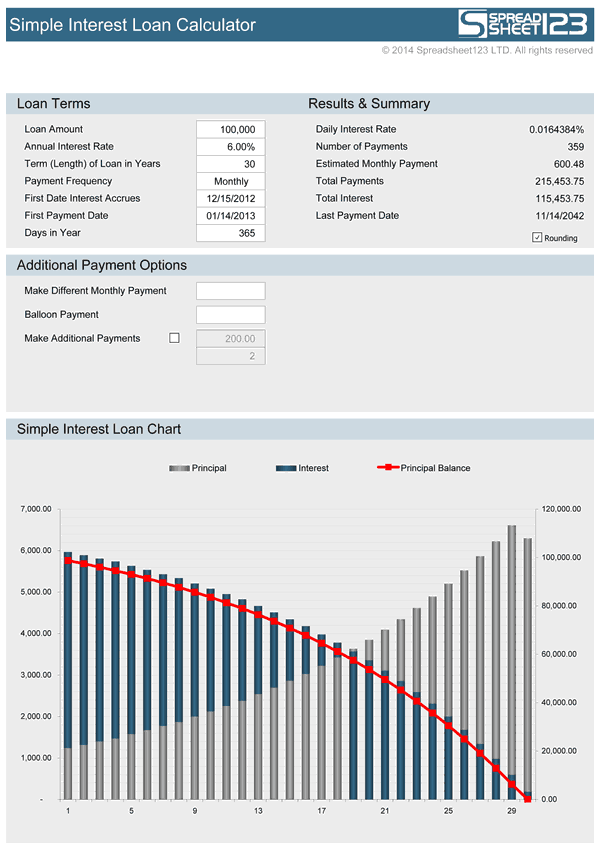

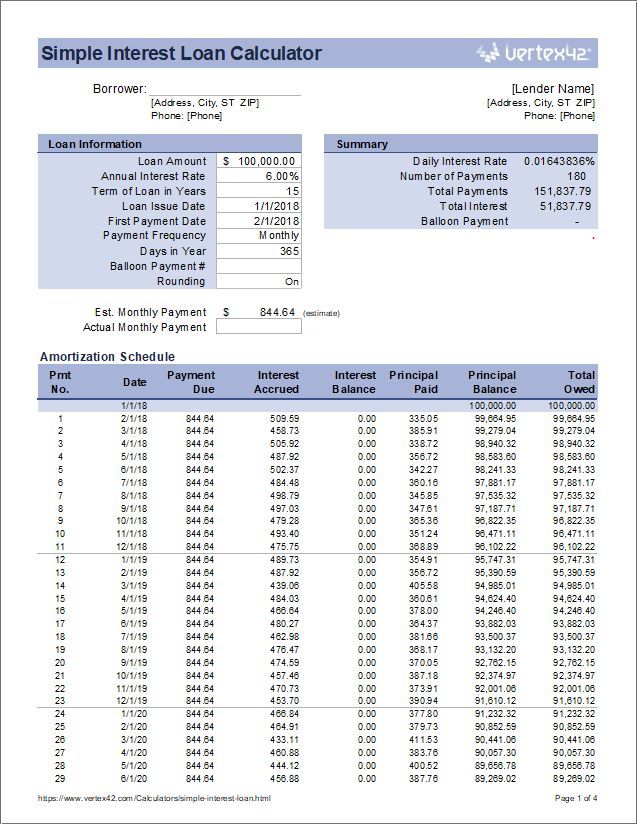

For this example we want to calculate the interest paid during each year in a 5 year loan of 30000 with an interest rate of 5. Simple loan calculator and amortization table know at a glance your balance and interest payments on any loan with this loan calculator in excel. B4 is the first period you pay the bank while b5 is the last period you pay the bank.

B1 is the total amount of loan. In above formula c3c4 will calculate the monthly interest rate c4c5 will get the total number of periods c2 is the loan amount you received 1 means the first period you will pay back the loan 6 indicates the last period there are 6 periods in total and 0 indicates you repay at the end of every period. To do this we set up cumipmt like this.

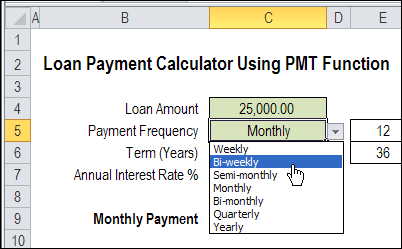

To calculate a monthly payment for a loan using excel youll use a built in tool called the pmt function. Monthly fixed payments we will not get so the field pmt leaving free. The pmt function calculates the monthly loan payment based on constant payments and a constant interest rate.

Say if you make quarterly payments on a loan with an annual interest rate of 6 percent use 64 for rate. If you make weekly monthly or quarterly payments divide the annual rate by the number of payment periods per year as shown in this example.

/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

:max_bytes(150000):strip_icc()/CalculateCardPayments3-71e54f8a7aaf487fac3795df9708ec42.jpg)

/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a.png)