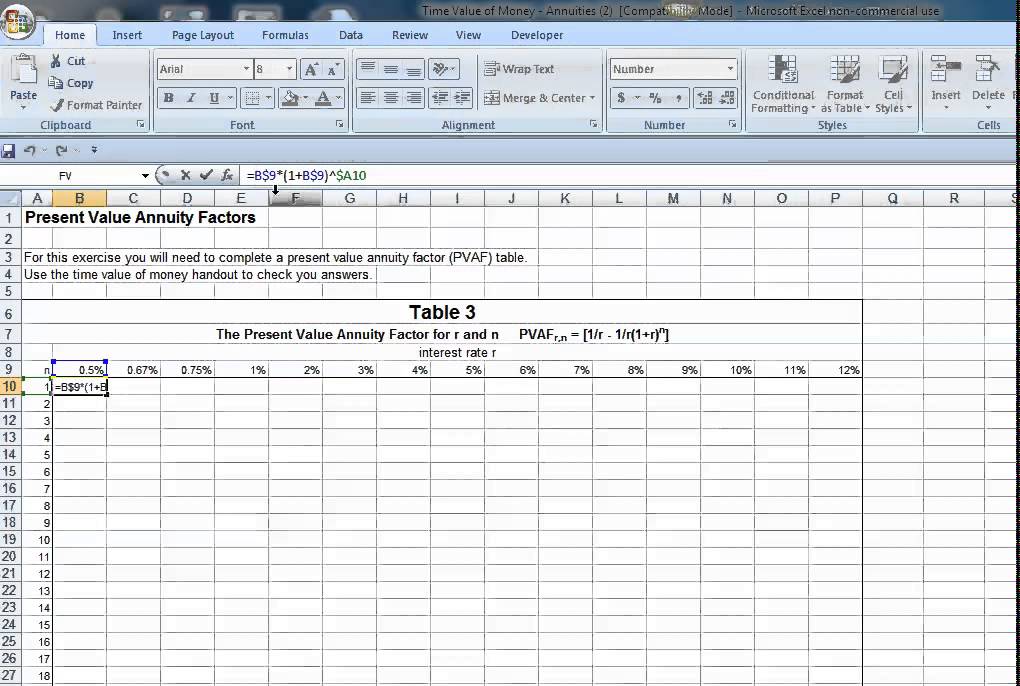

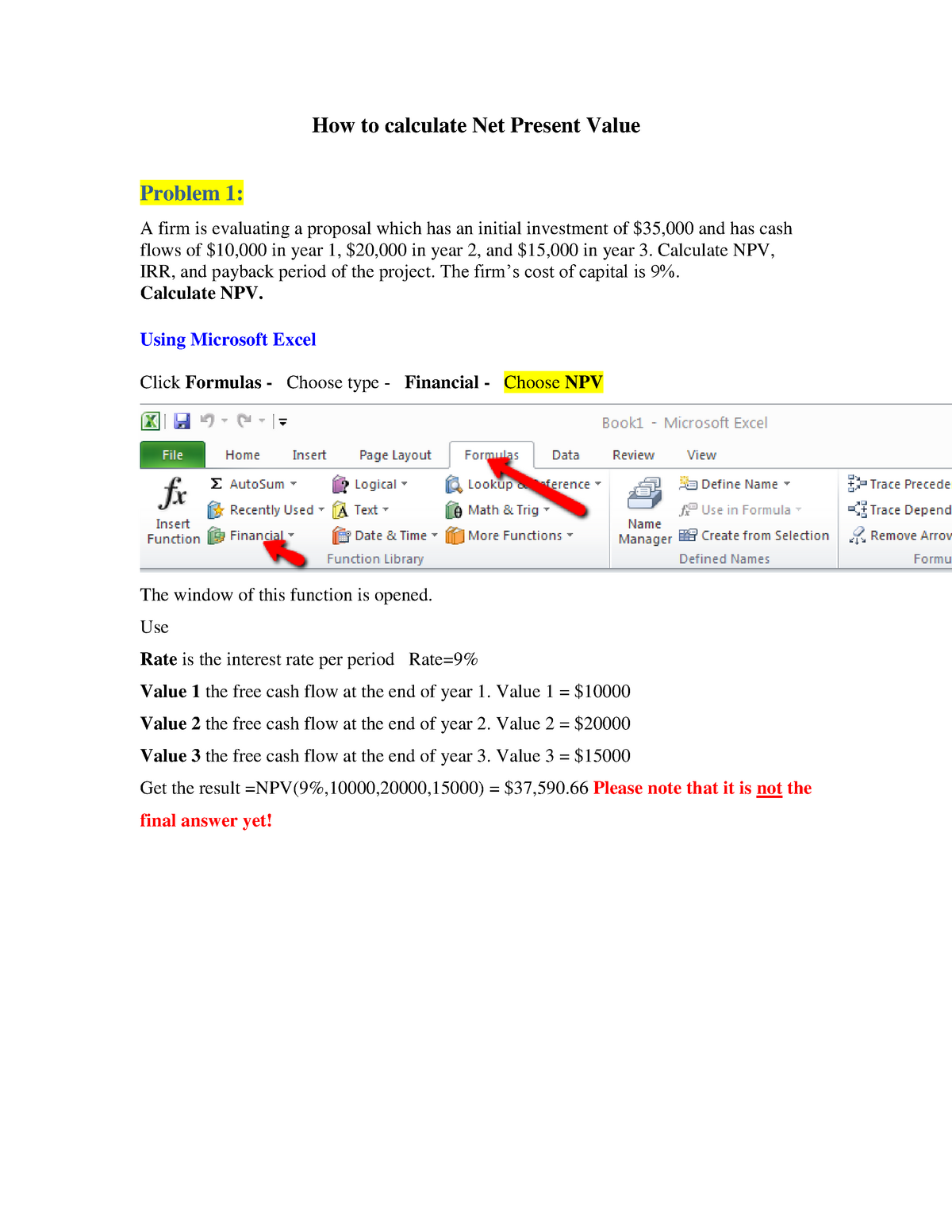

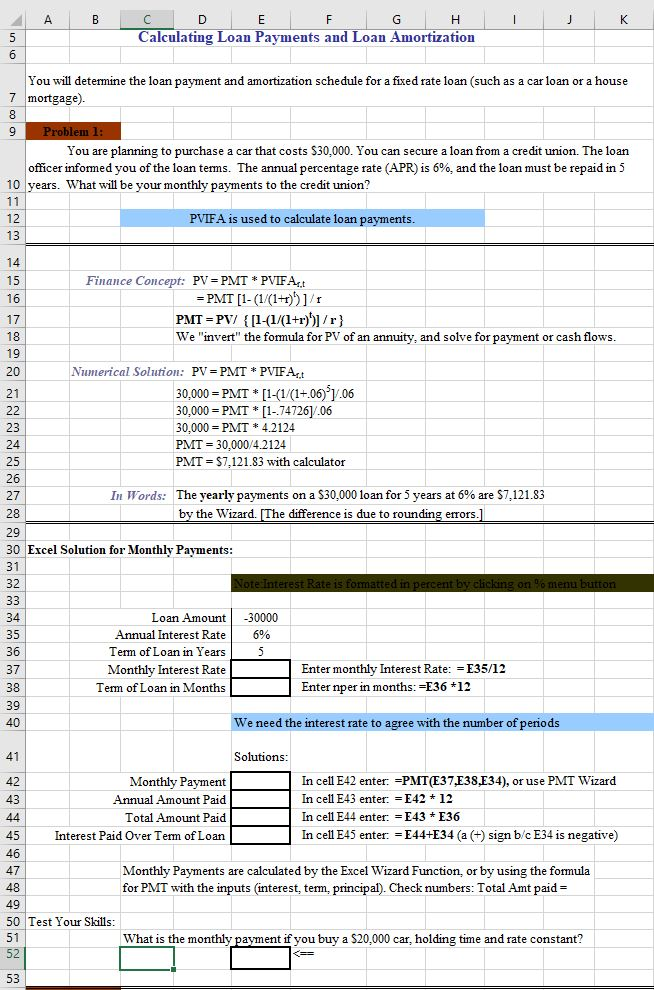

How To Calculate Pvifa In Excel

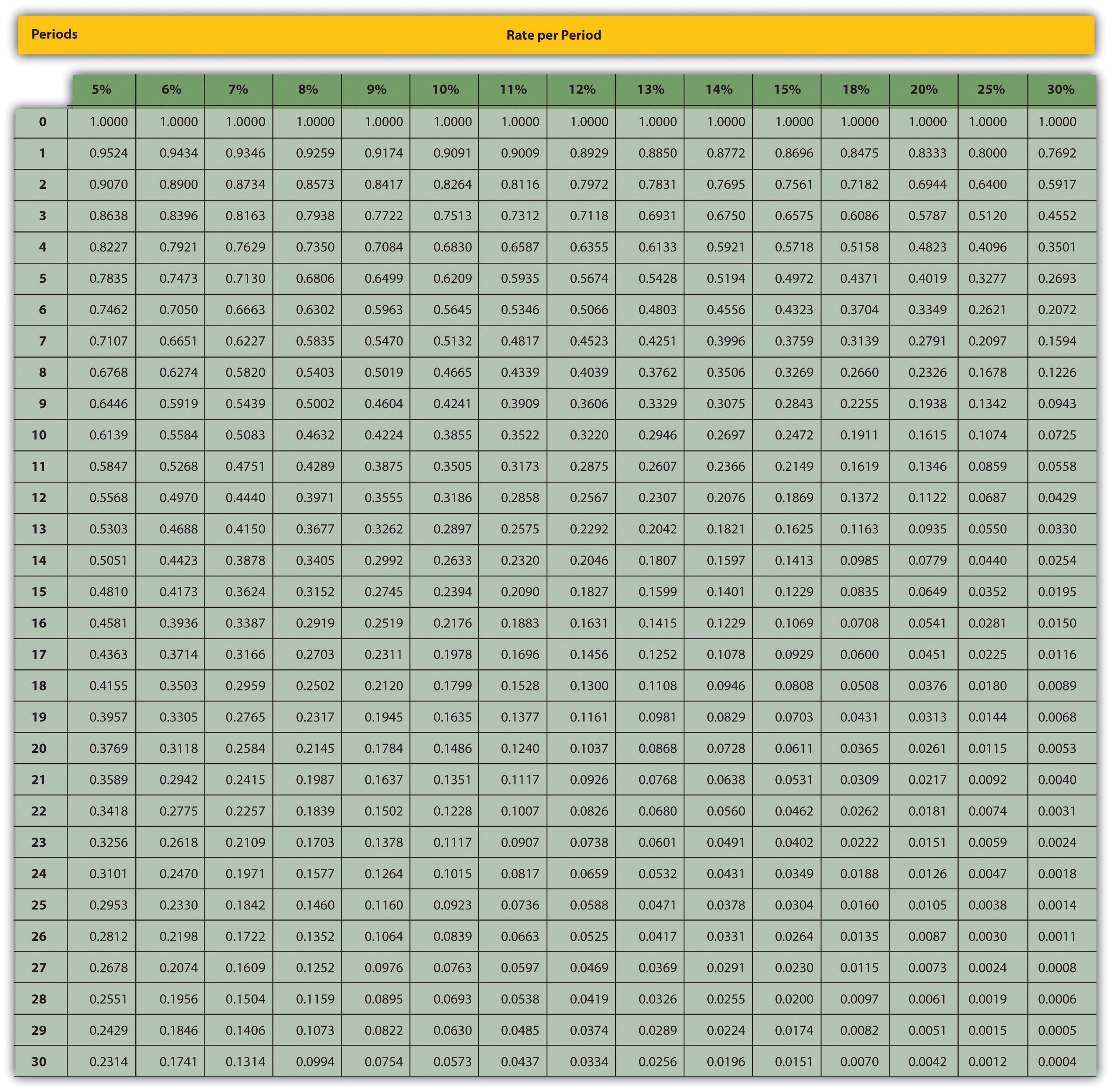

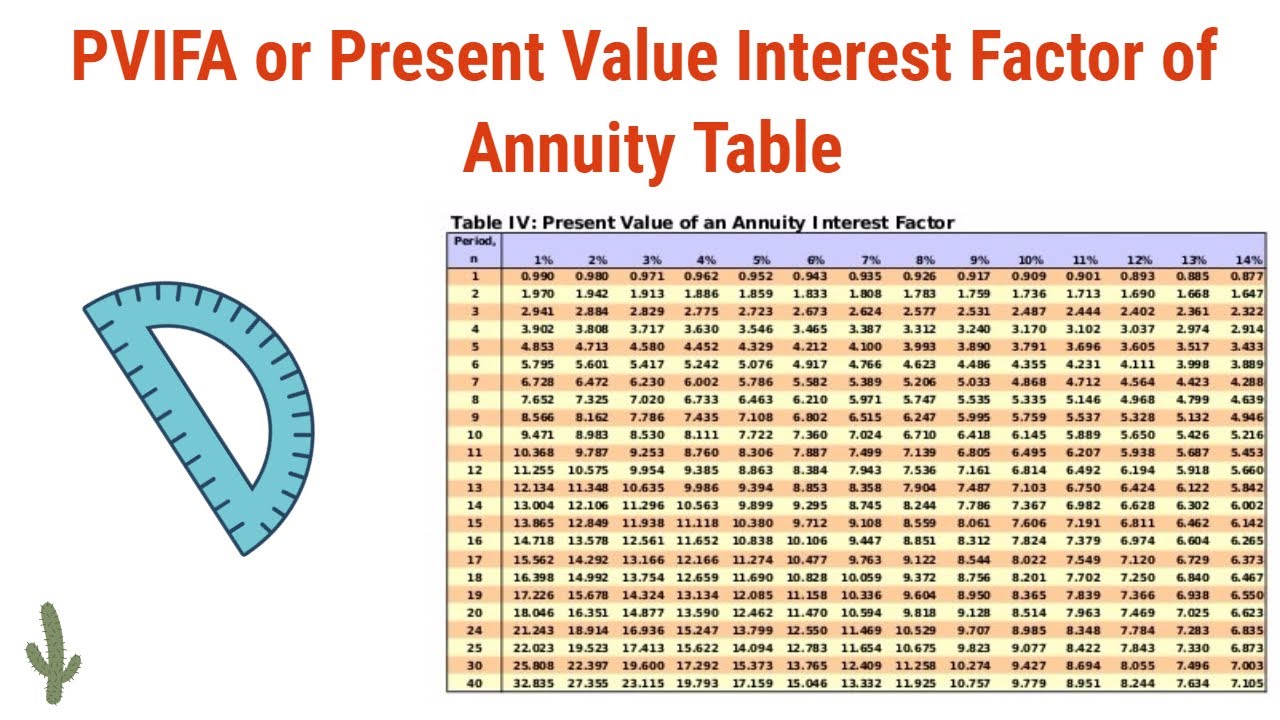

N number of periods.

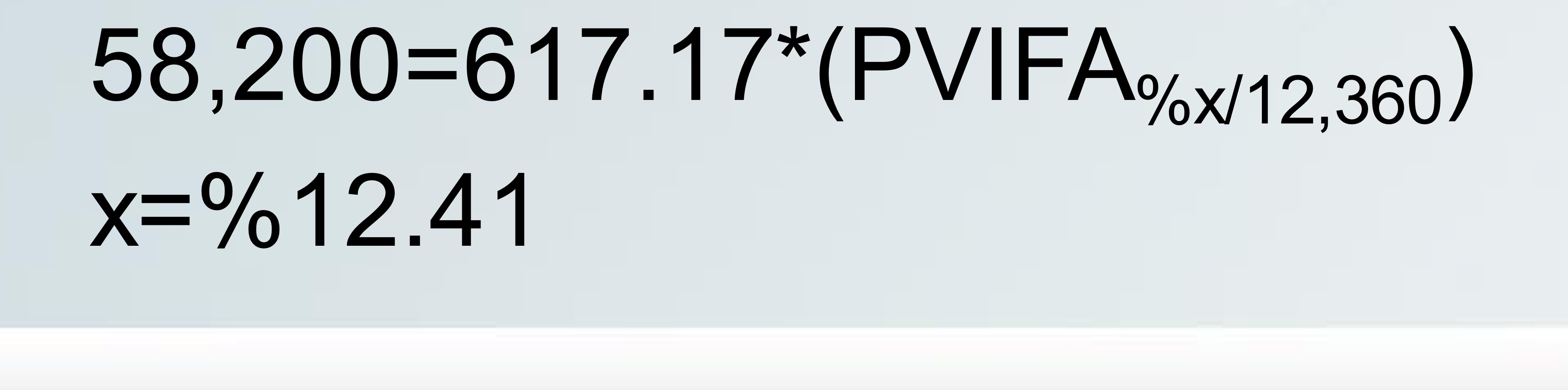

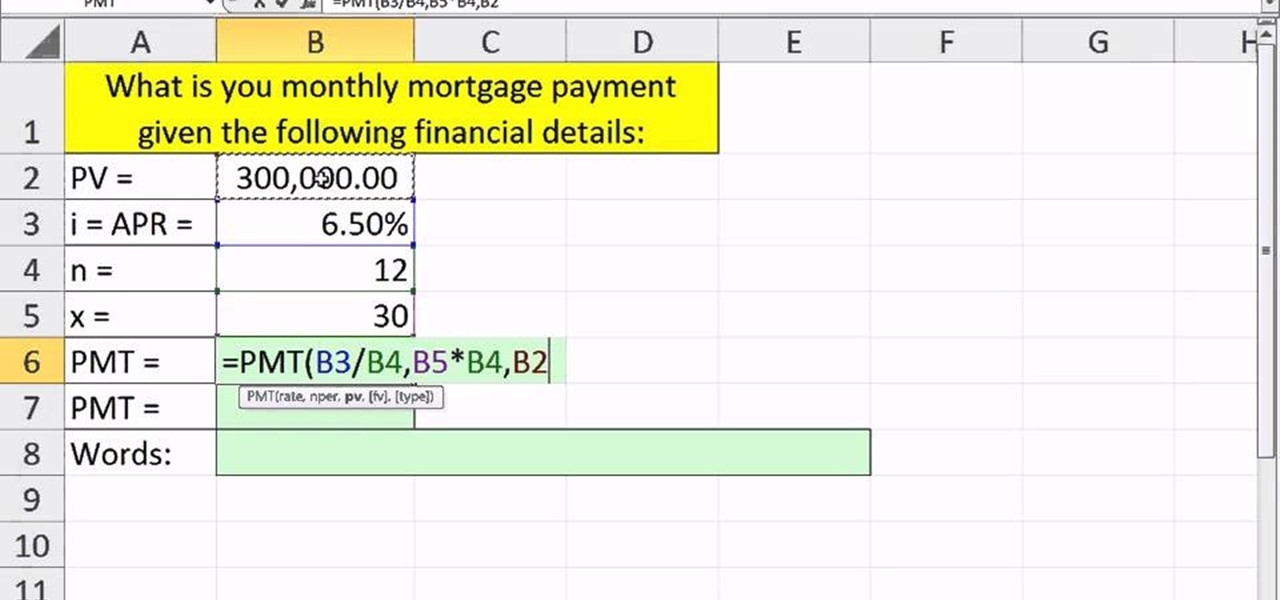

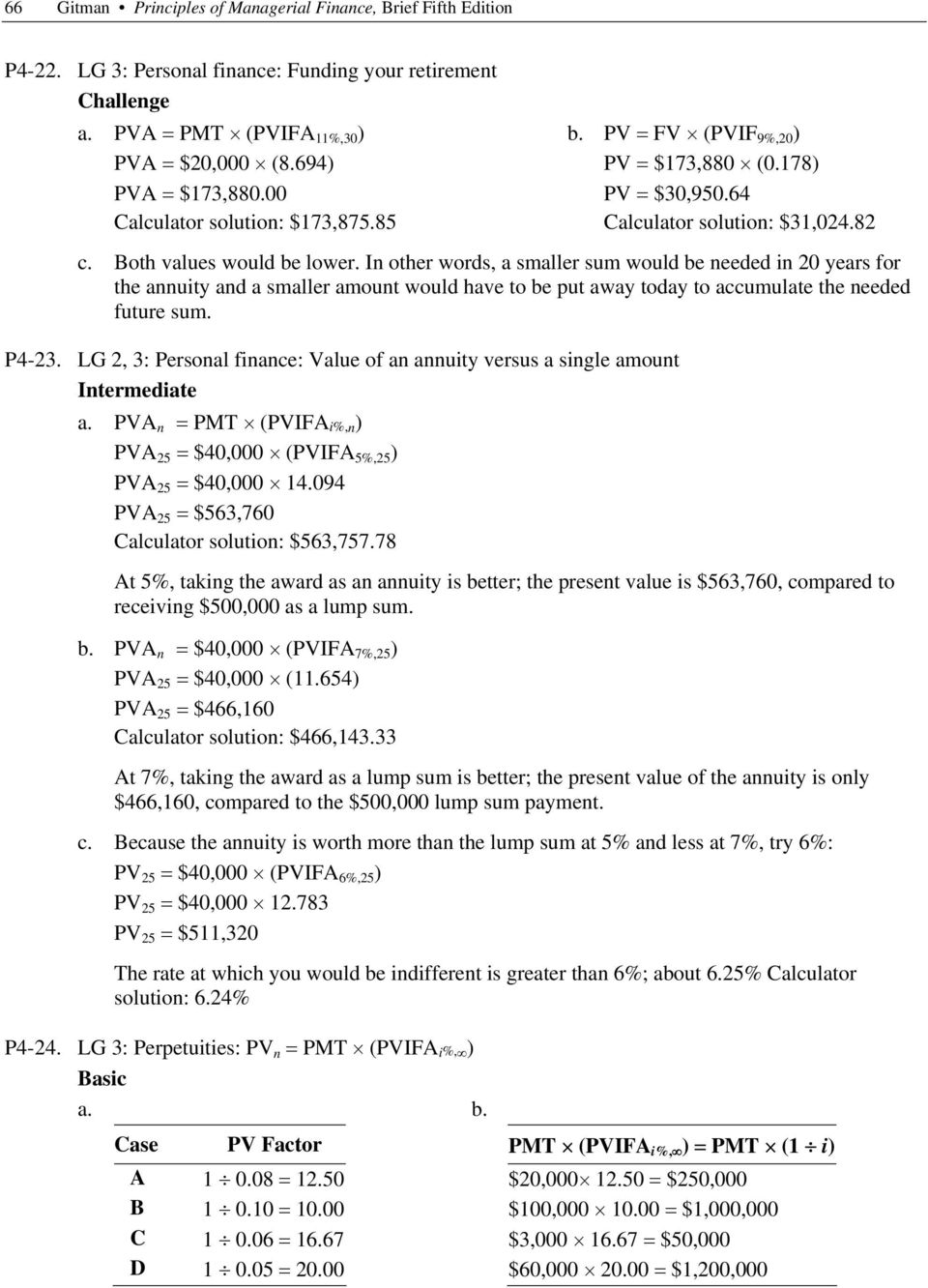

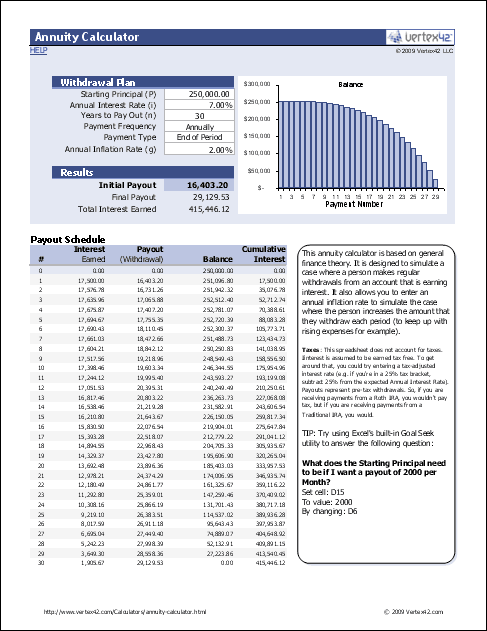

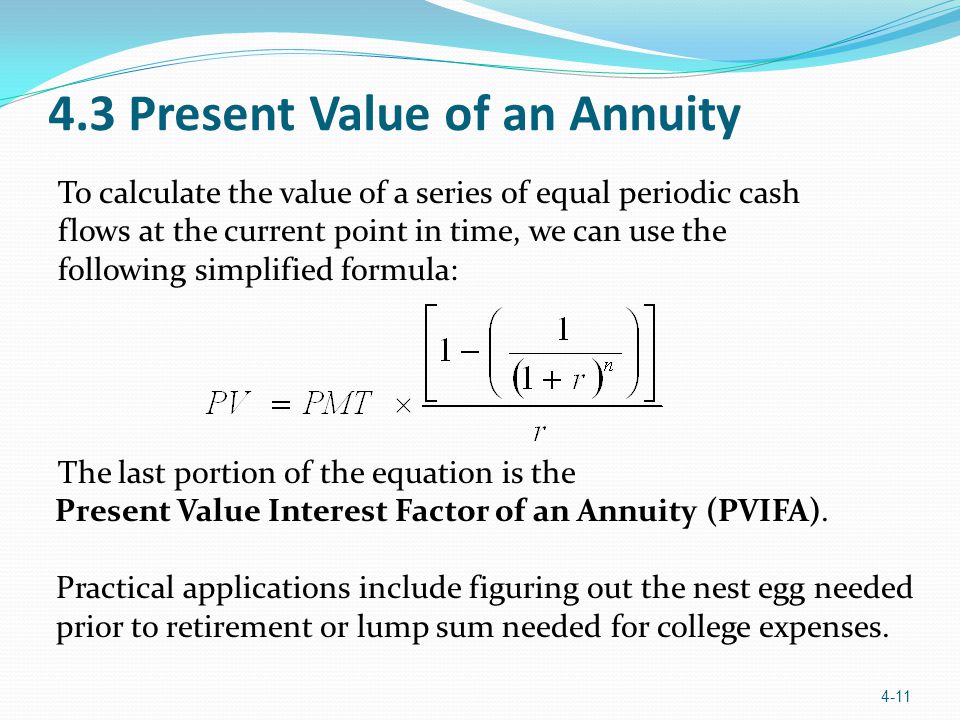

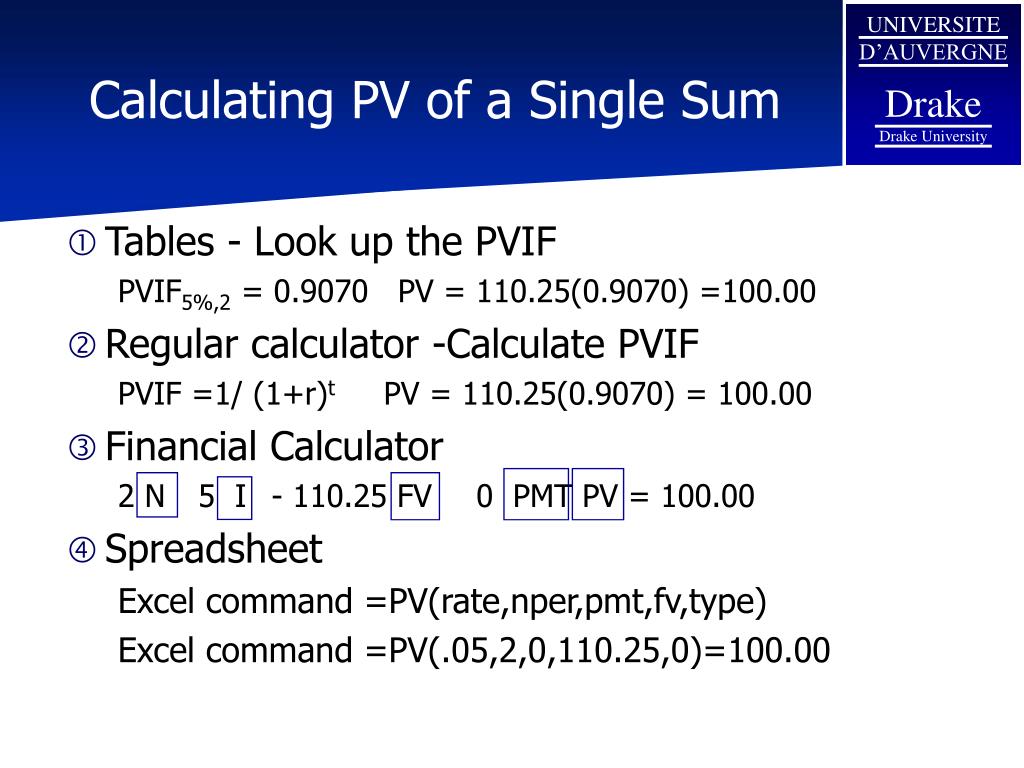

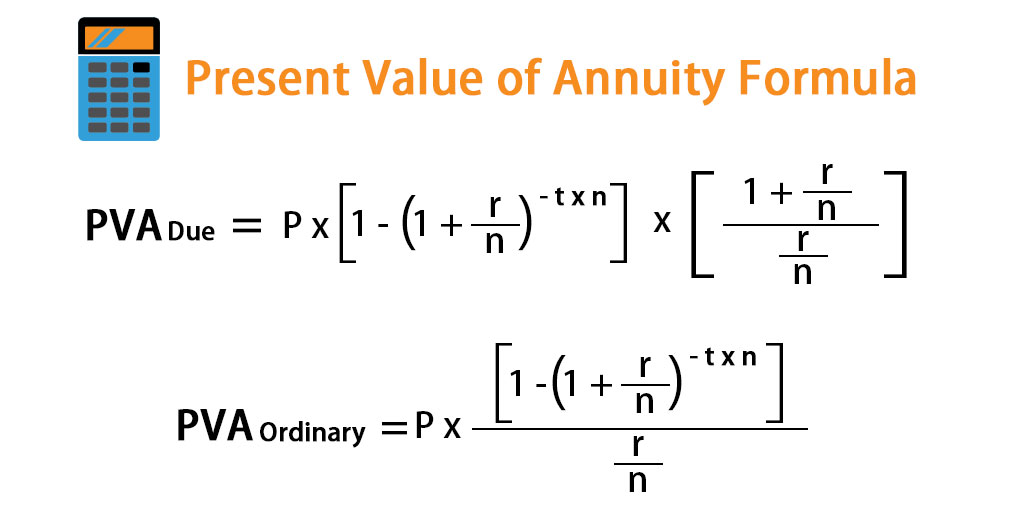

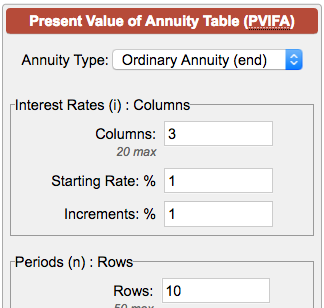

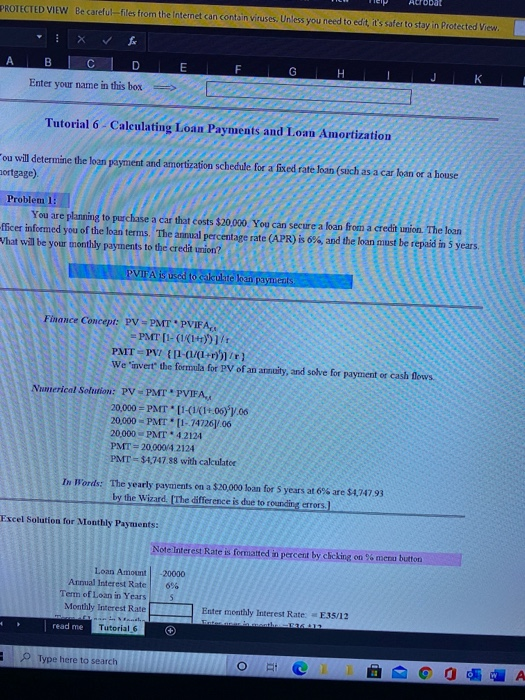

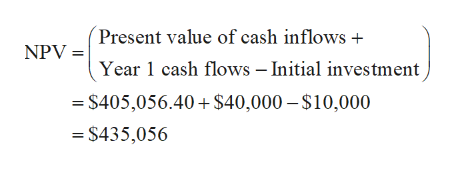

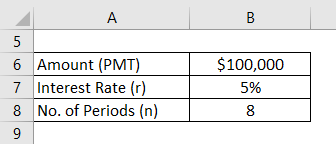

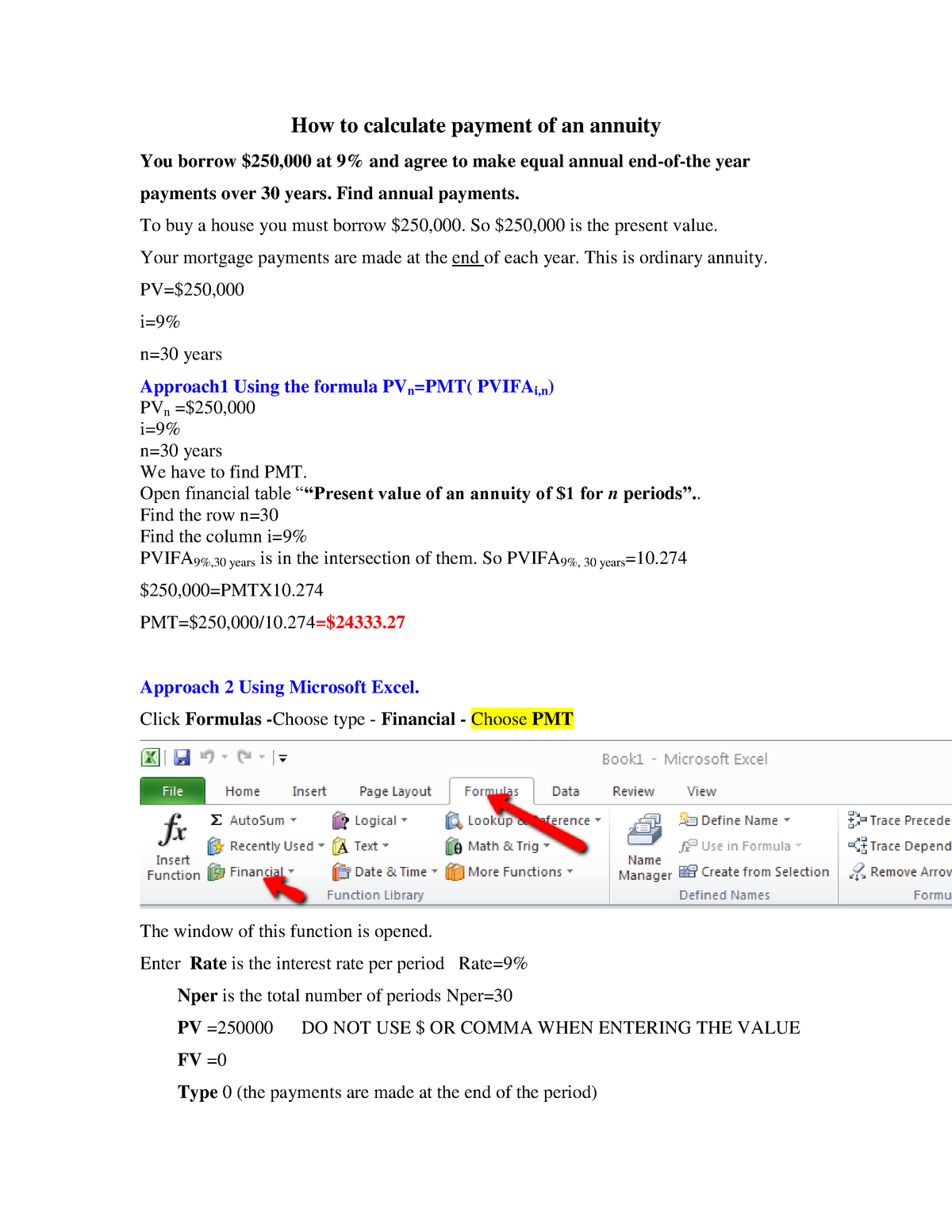

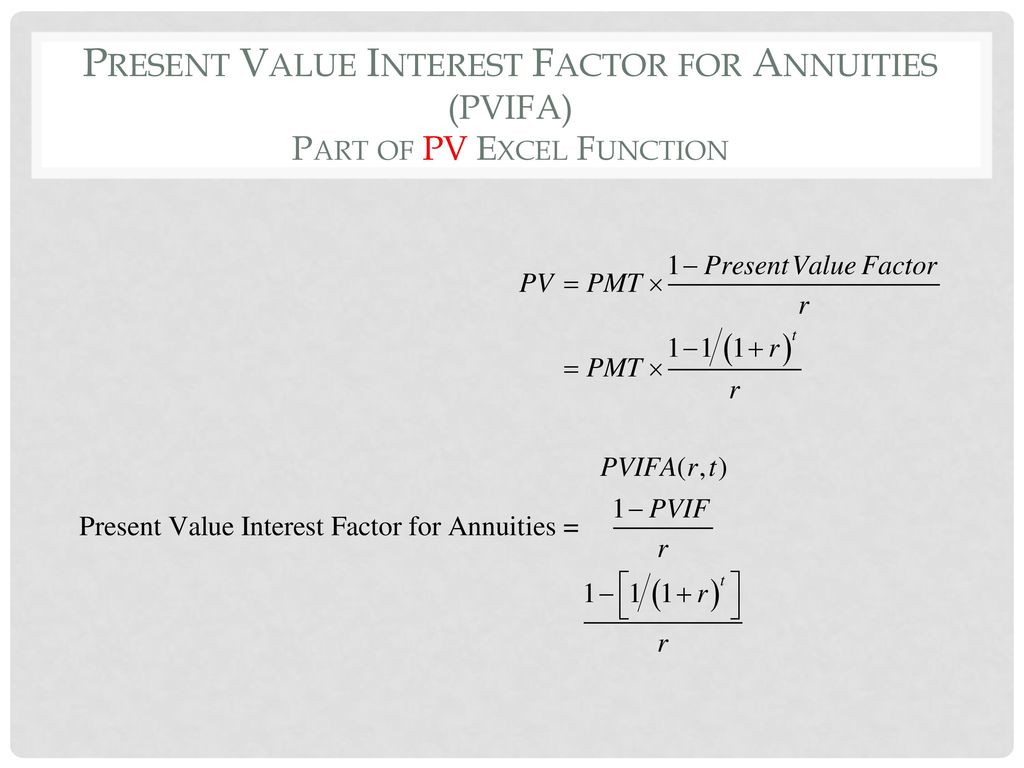

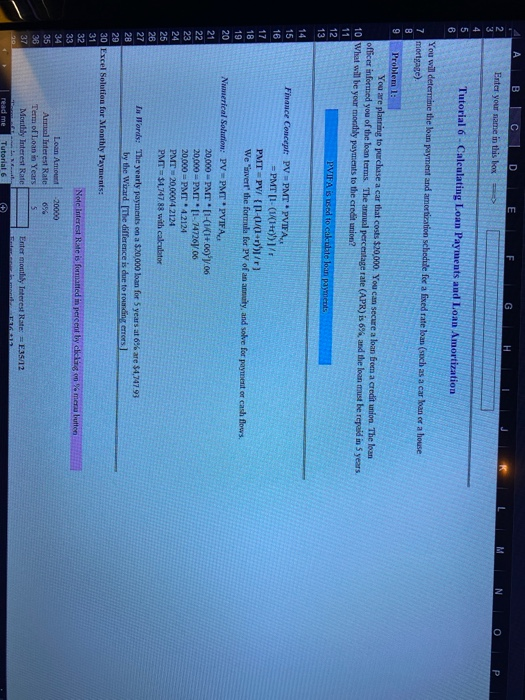

How to calculate pvifa in excel. How do you calculate the pvif or pva on excel. For example if you get a four year. Pvifa 1 1 1 rn r where n is the number of payment periods.

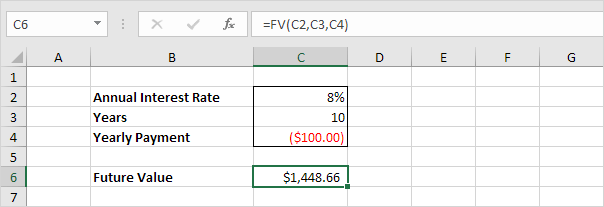

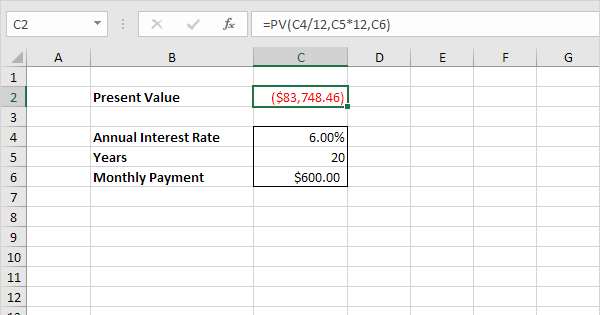

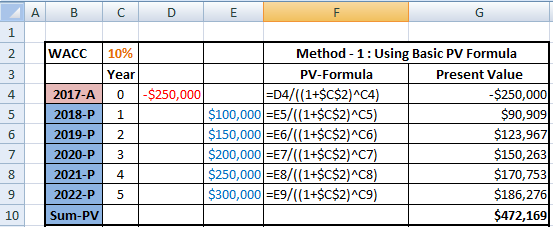

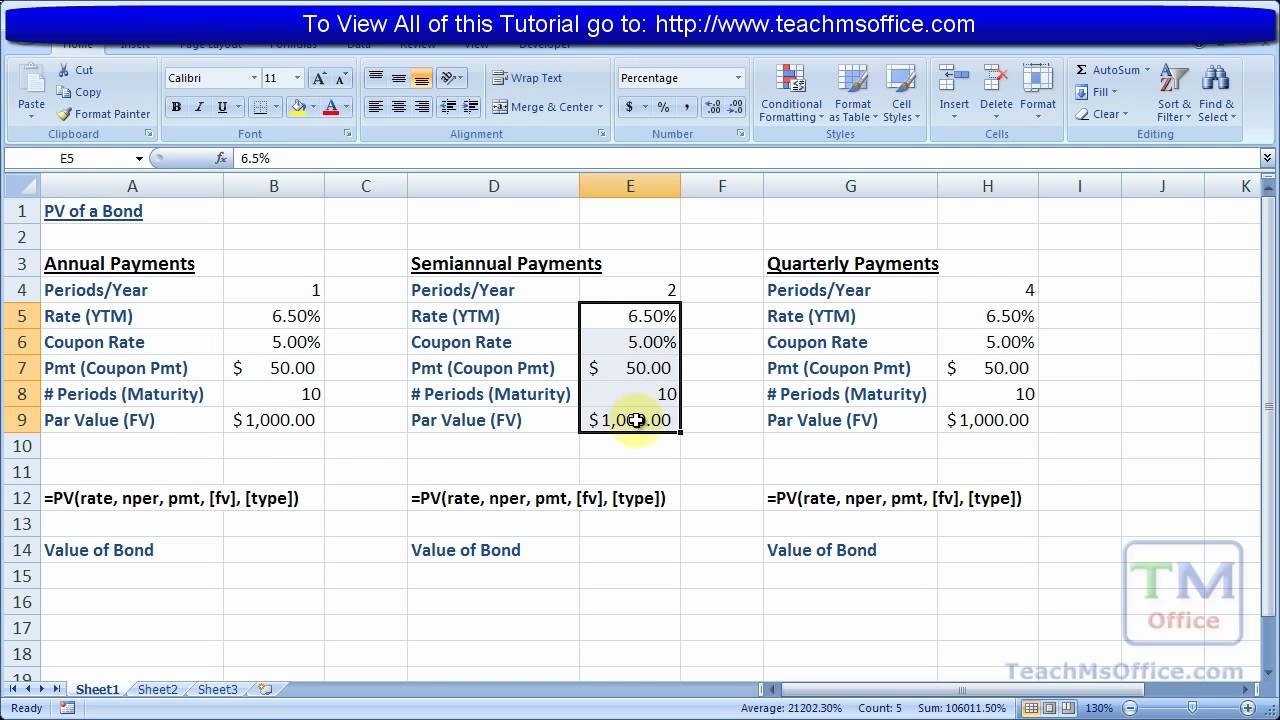

The formula calculates the future value of one dollar cash flows. Pvifa dfrac 1 1 r n r r periodic rate per period. For example if you obtain an automobile loan at a 10 percent annual interest rate and make monthly.

The formula to calculate pvifa is. Find out how to use microsoft excel to calculate the present value of a fixed annuity including proper setup and a calculation example. It works by substituting the a value from the top row and left column into the cells specified f1 and f2.

What does this mean. The total number of payment periods in an annuity. Present value interest factor of annuity pvifa.

Pvifa present value interest factor of annuity r interest rate per period n number of periods. The interest rate per period. Put simply it means that the resulting factor is the present value of a 1 annuity.

Excel does this repeatedly to fill in the table. The initial deposit earns interest at the interest rate r which perfectly finances a series of n consecutive withdrawals and may be written as the following formula.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrc2niqd8xmi23sf 9g7wo2ollb Huk2balmdxz0fzcexyaxlpm Usqp Cau

encrypted-tbn0.gstatic.com

How To Calculate Pvifa R N And Pvif R N Using A Basic Calculator For Jaiib And Caiib Youtube

m.youtube.com

:max_bytes(150000):strip_icc()/businessperson-calculating-invoice-949219374-5258a9aa6bcd48c5b7af835a15a3935c.jpg)

:max_bytes(150000):strip_icc()/net-present-value-785bef0bd7e840438ada6e8abadadb97.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos-479586547-5bfc34cf46e0fb00514690c4.jpg)

/stock-market-836258860-d77c2ae20cf849a491583ed4008547e4.jpg)

:max_bytes(150000):strip_icc()/bonds-lrg-4-5bfc2b234cedfd0026c104ea.jpg)