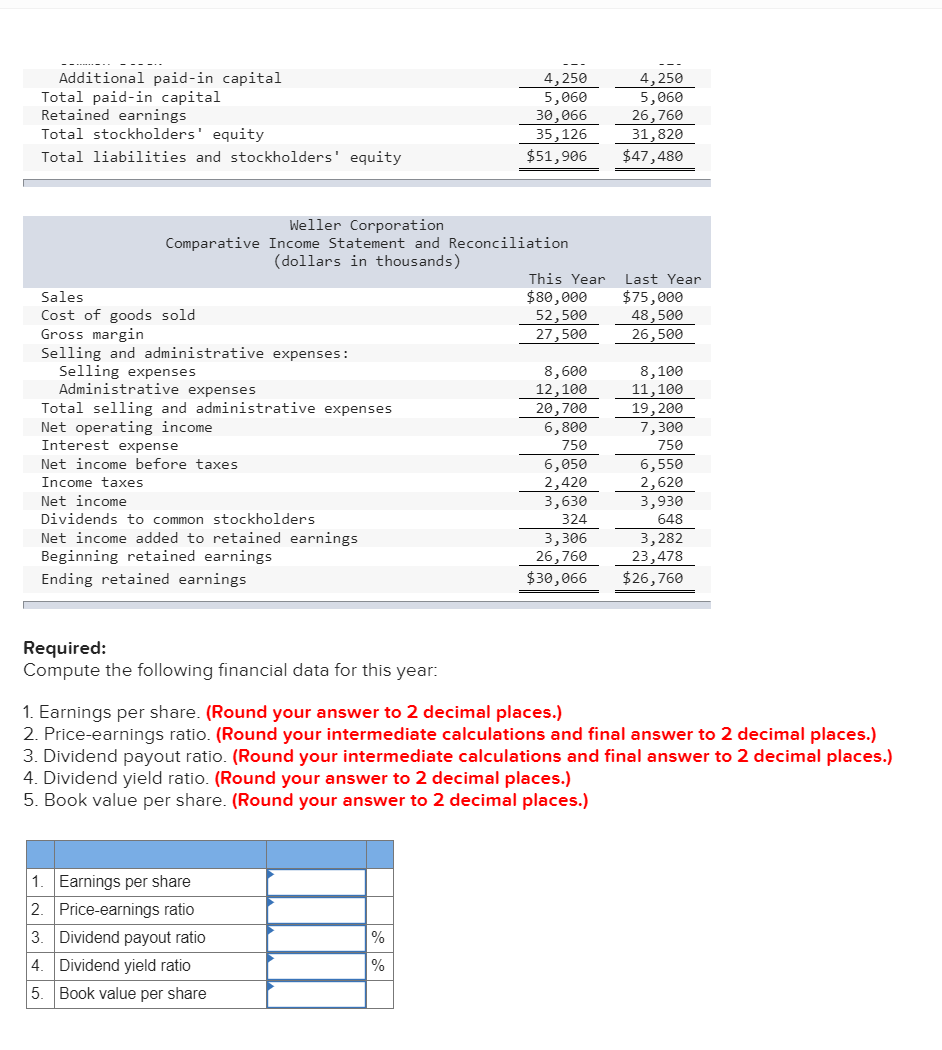

How To Calculate Total Paid In Capital At Year End

Subtract retained earnings from total stockholders equity.

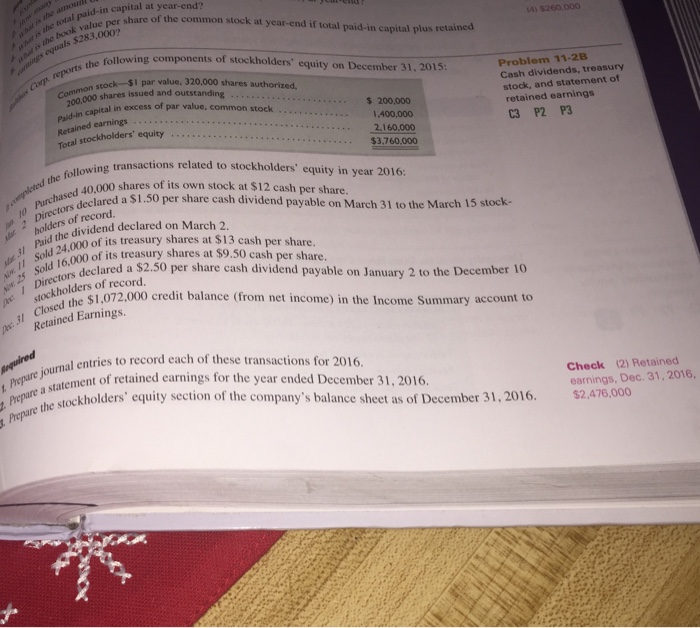

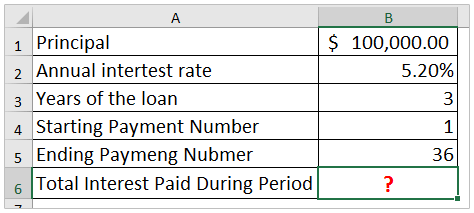

How to calculate total paid in capital at year end. Heres the formula youll need. Thus the formula for paid in capital is. An alternative meaning is that paid in capital equals additional paid in capital so that par value is excluded from the definition.

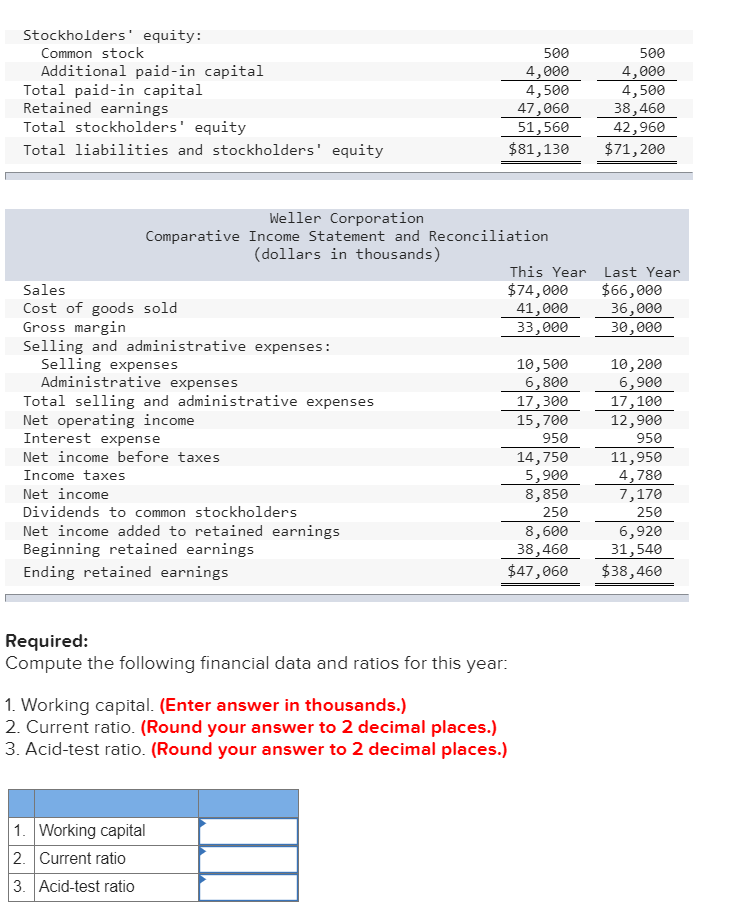

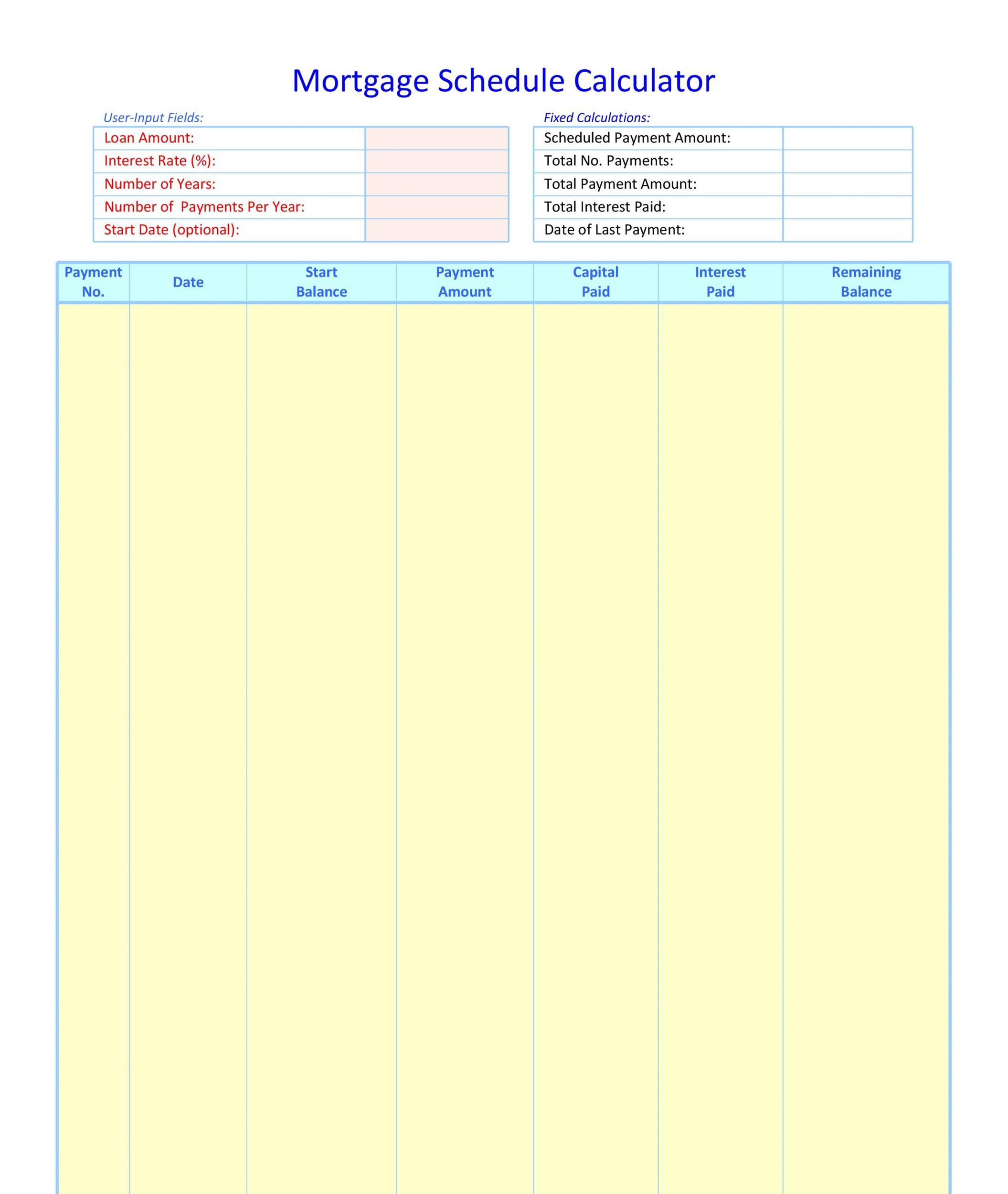

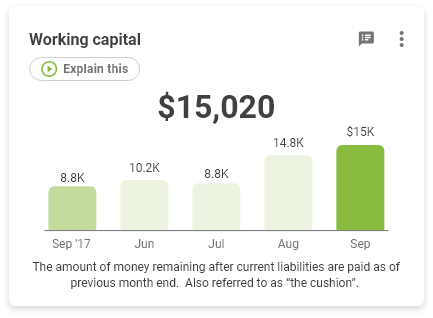

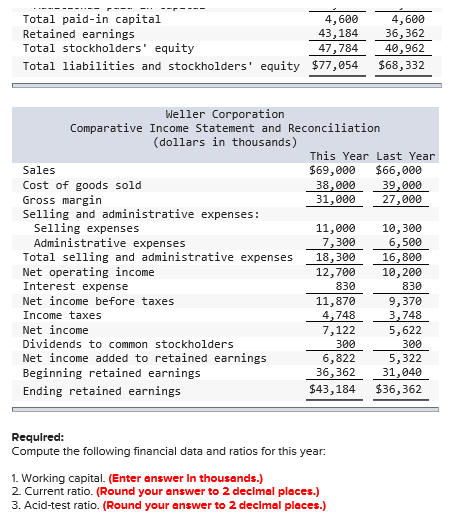

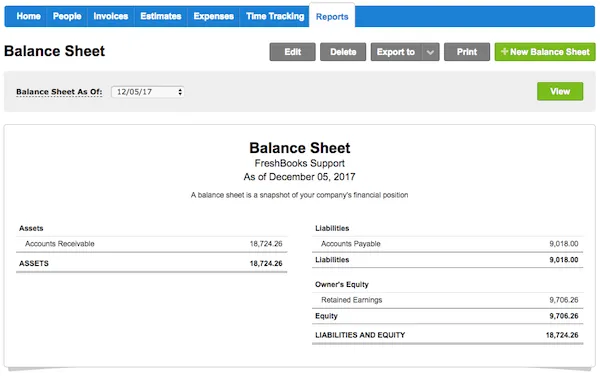

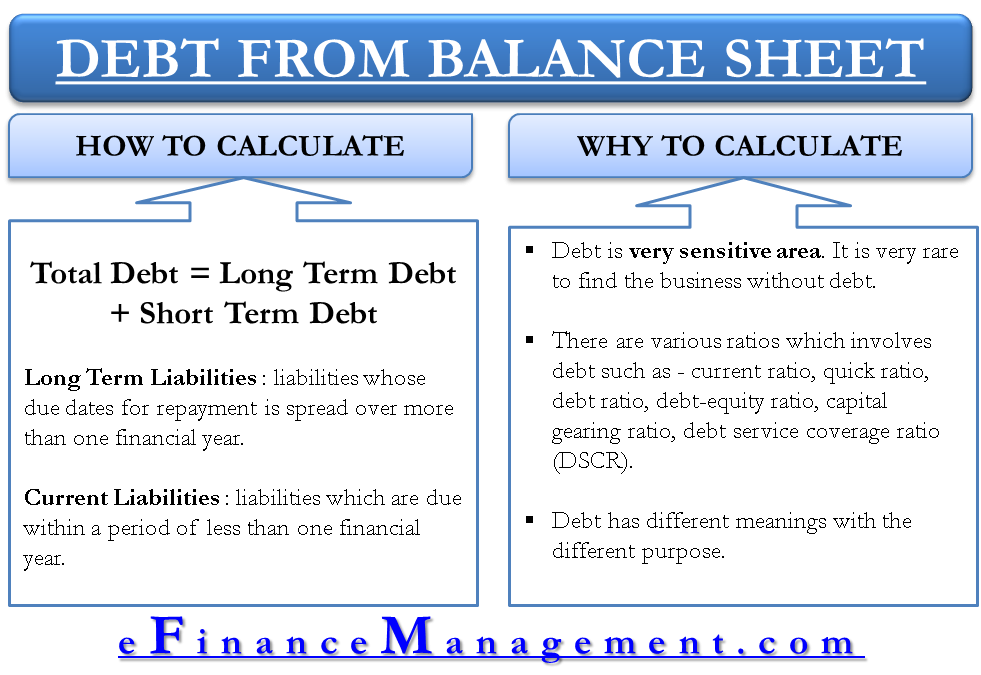

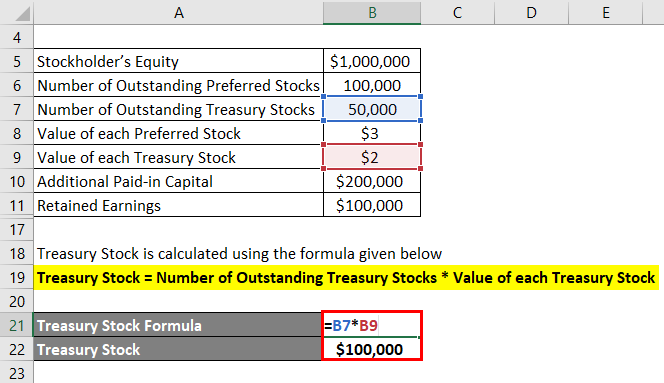

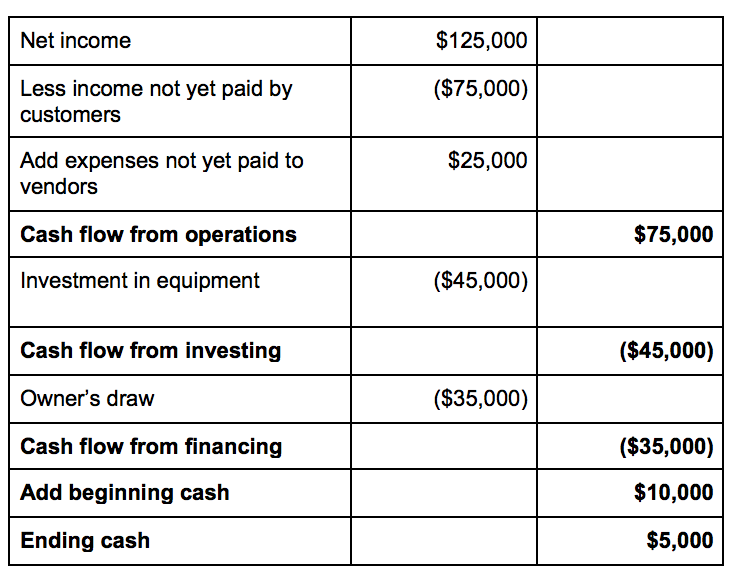

This is an important metric and reflects the amount of money on hand to operate your business day to day. Stockholders equity retained earnings treasury stock paid in capital. Paid in capital par value additional paid in capital.

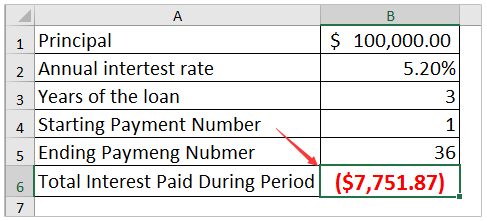

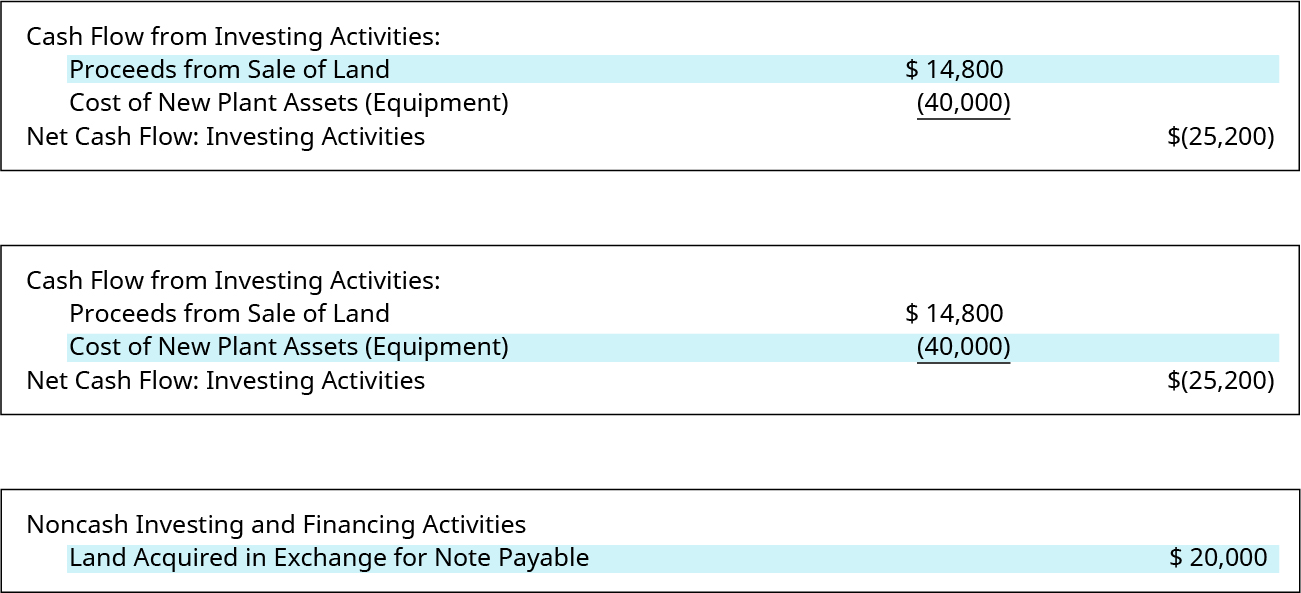

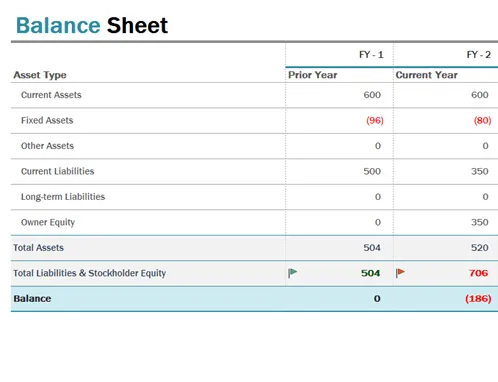

Total working capital is typically calculated as current assets minus current liabilities. Ie common stock additional paid in capital retained earnings and treasury stock. Current assets current liabilities working capital 1 for example say a company has 500000 in cash on hand.

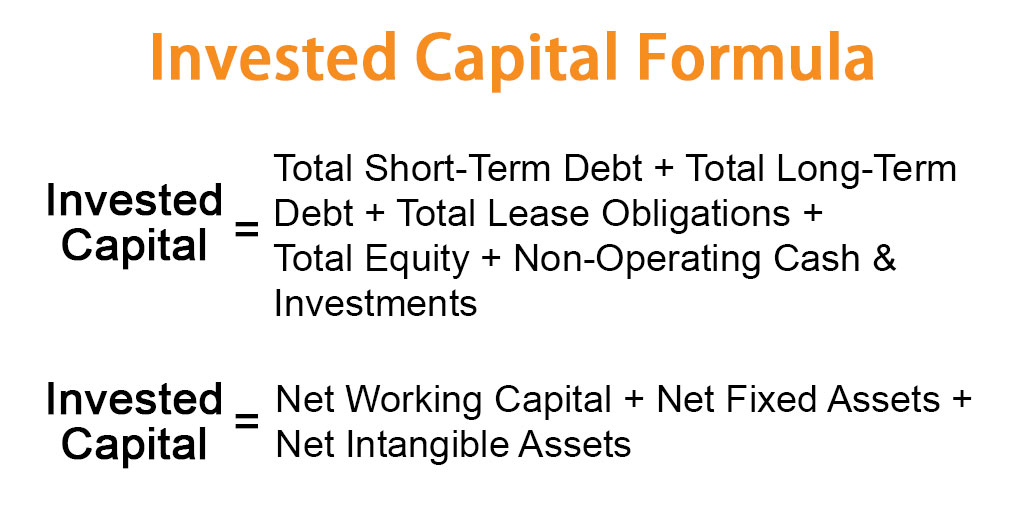

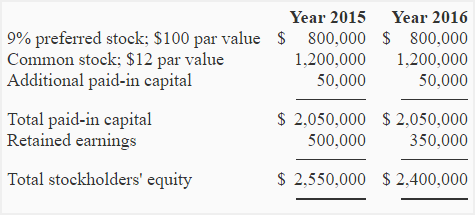

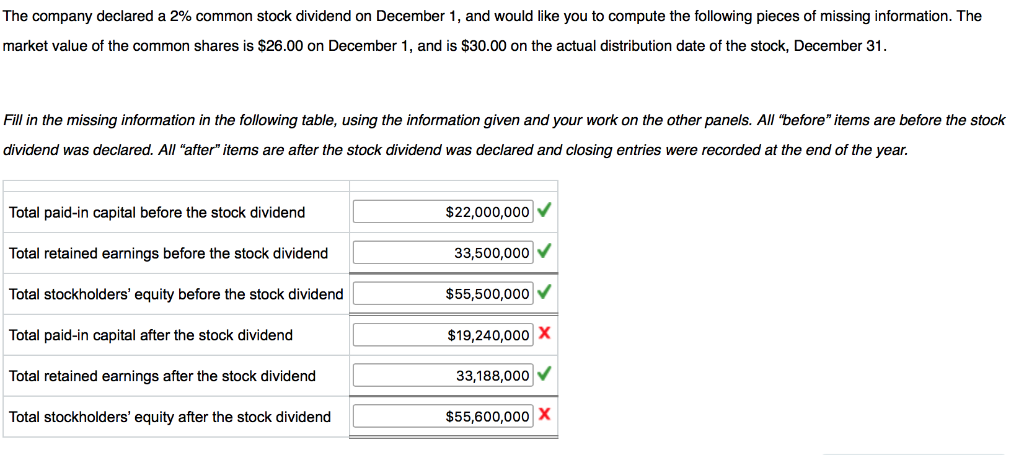

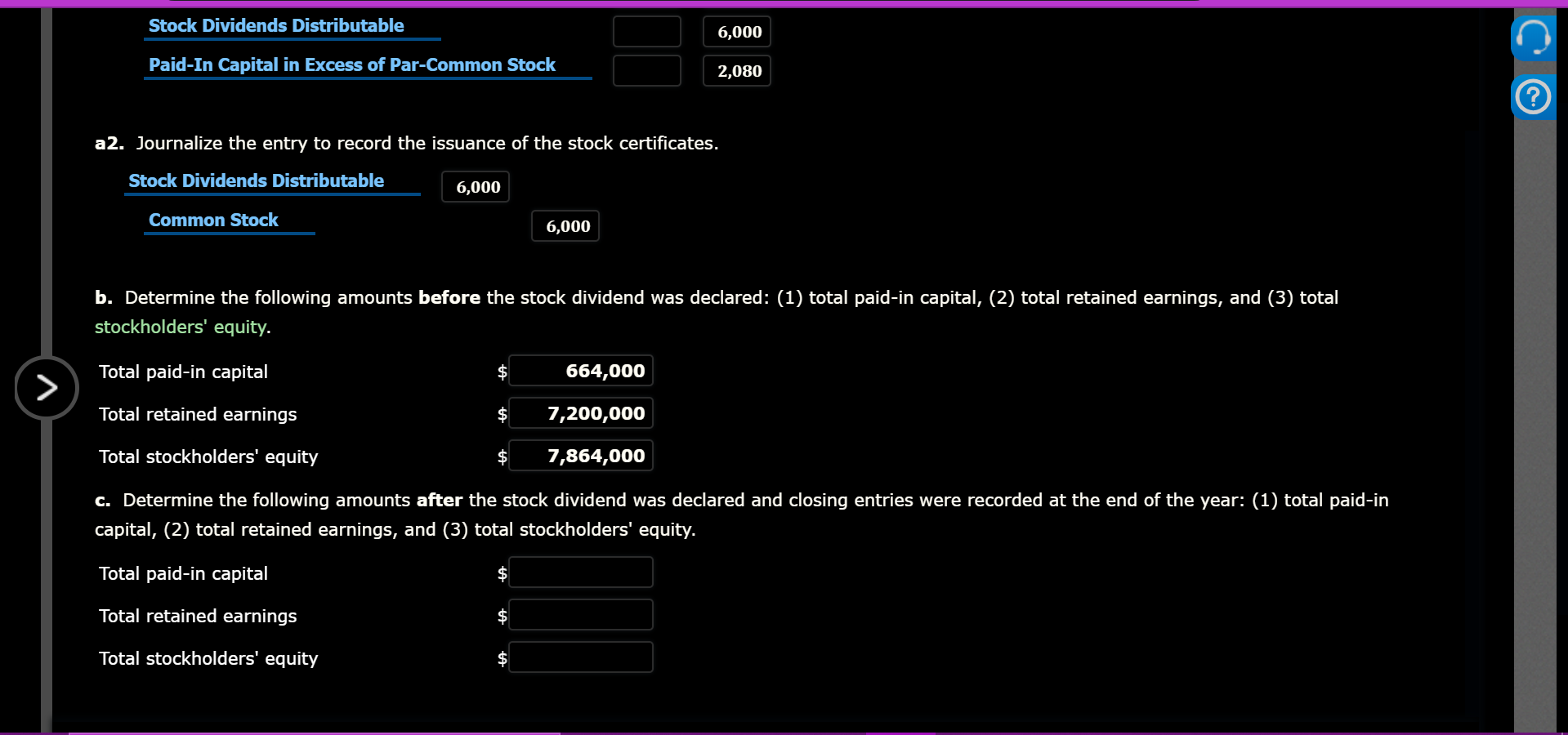

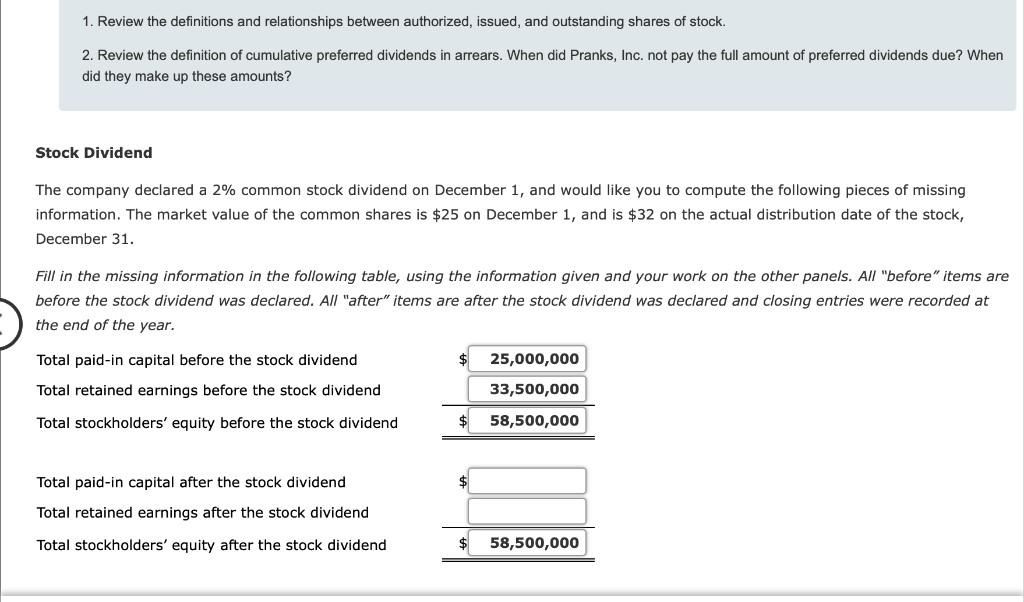

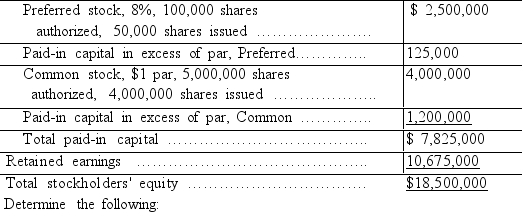

Thus you need to be clear on the definition when discussing paid in capital with other people who may have a different concept of the term. Firstly bring together all the categories under shareholders equity from the balance sheet. Add the total par value of stock and the total paid in capital in excess of par to calculate the companys total paid in capital.

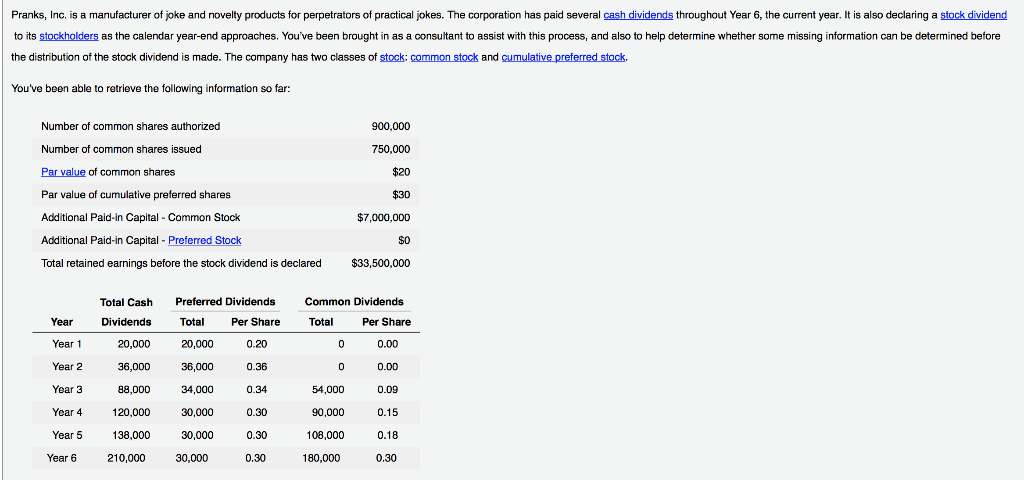

Another 250000 is outstanding and owed to the company in the form of accounts receivable. In this example subtract 60000 from 100000 to get 40000. Paid in capital is the money investors pay a company when the company issues stock.

Add the two amounts of paid in capital in excess of par to calculate the total paid in capital in excess of par. Add treasury stock to your result to calculate total paid in capital. In this example add 40000 and 20000 to get 60000 in total paid in capital.

Then add up all the categories except the treasury stock which has to be deducted from the sum as shown below. In this example add 90000 and 170000 to get 260000 of total paid in capital in excess of par. Business activities that affect the amount of paid in the capital.

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

:max_bytes(150000):strip_icc()/Formula-WACC-6d76647d4d5143ef95f8b568da4856a7.png)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/Formula-EffectiveInterestRate-d01fc509fb3041e787917cc199bdc920.png)

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)