How To Calculate Ytm Of A Bond In Excel

Move the mouse pointer over the line separating columns.

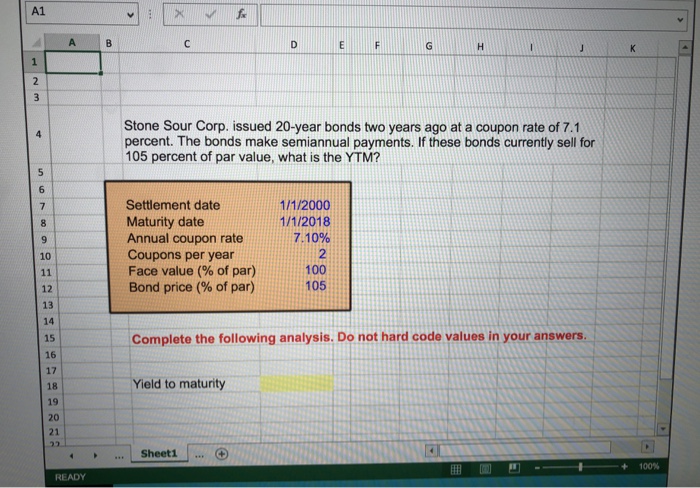

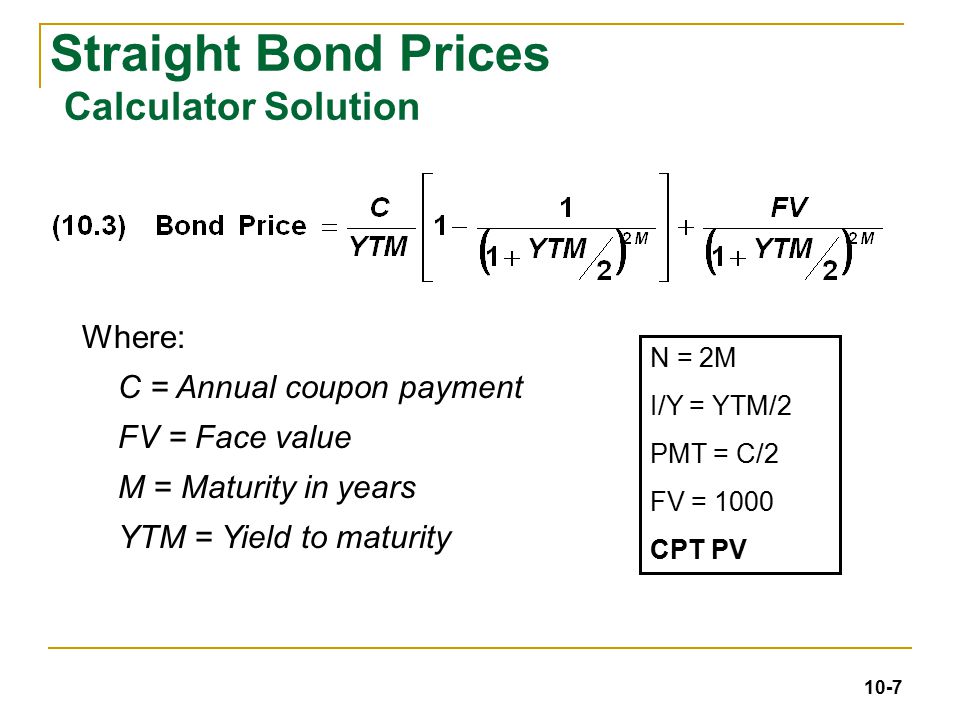

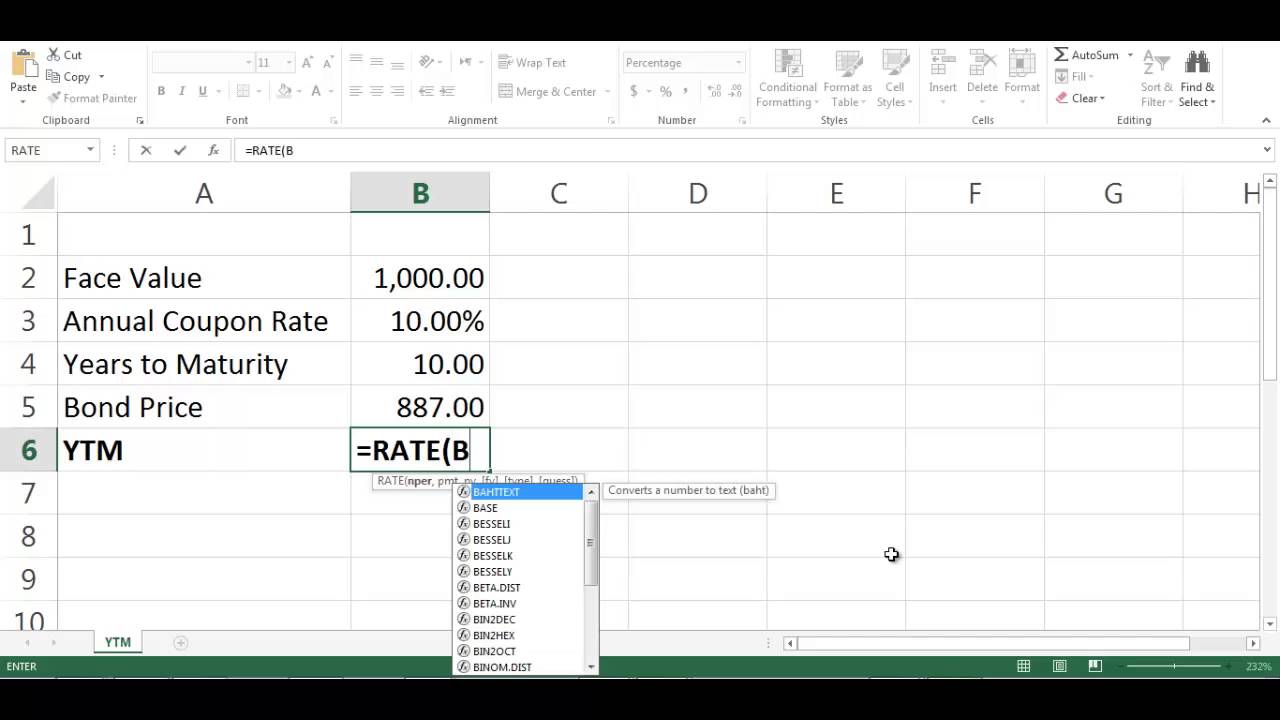

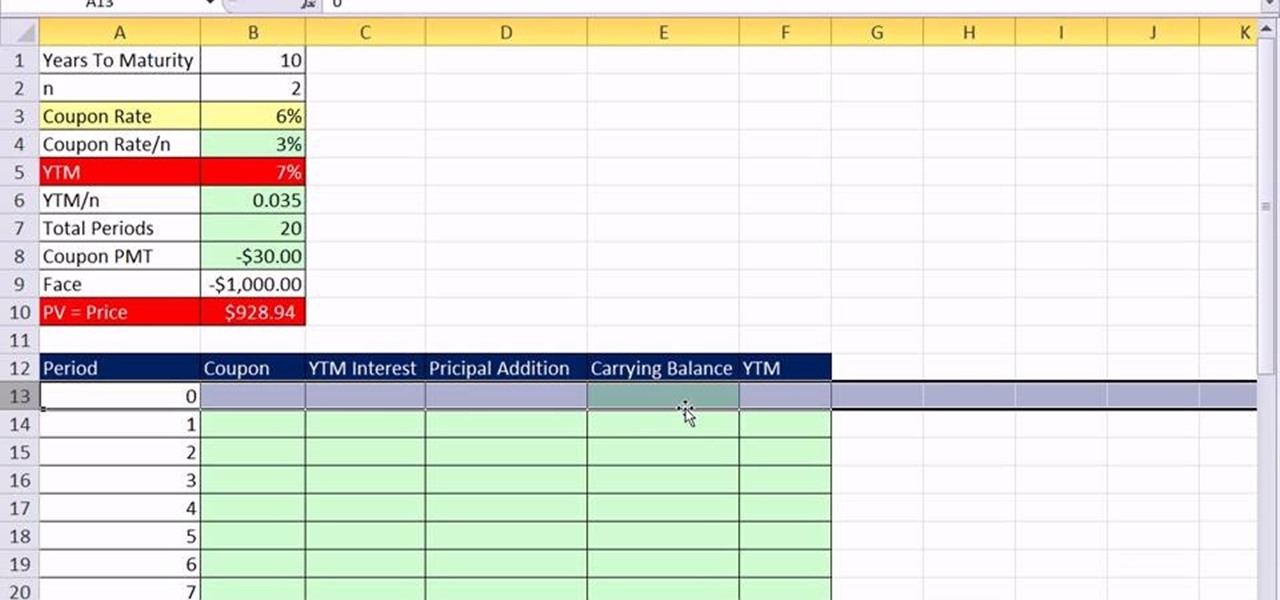

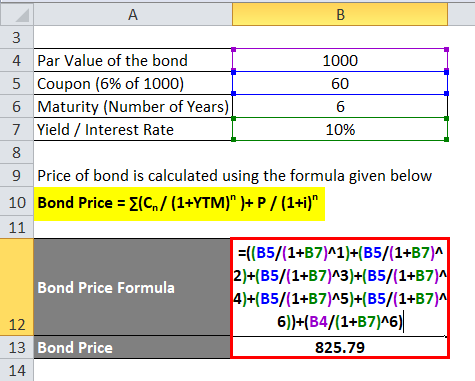

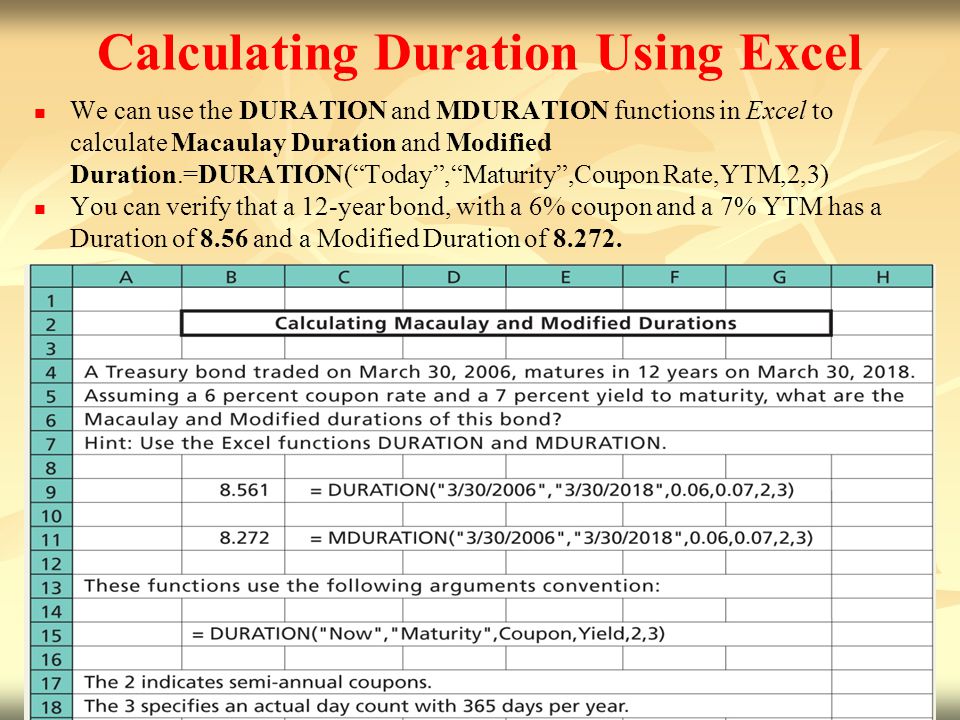

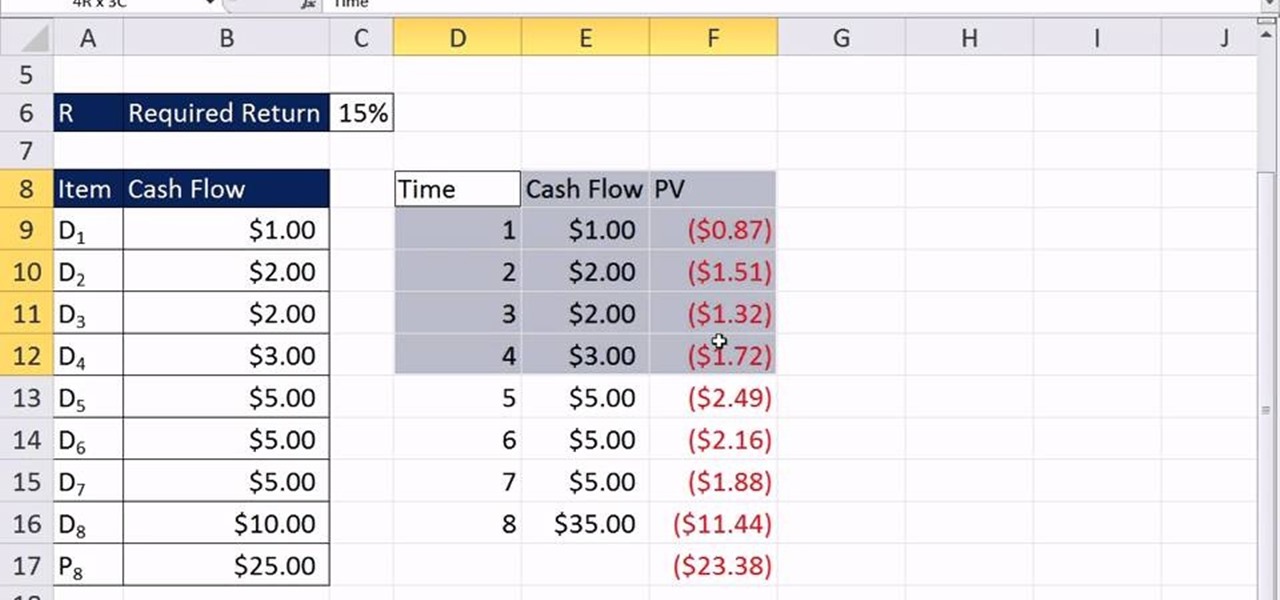

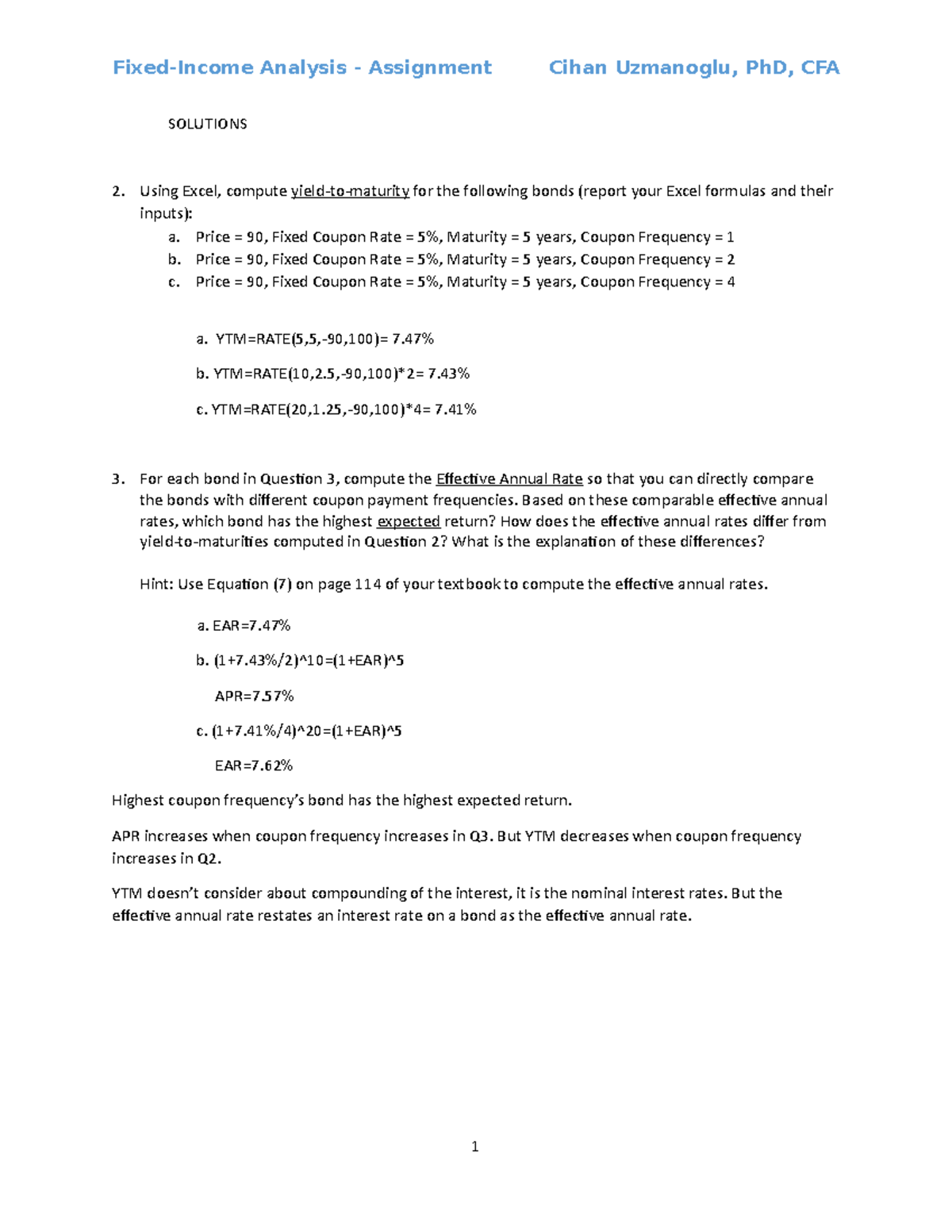

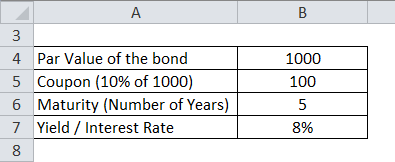

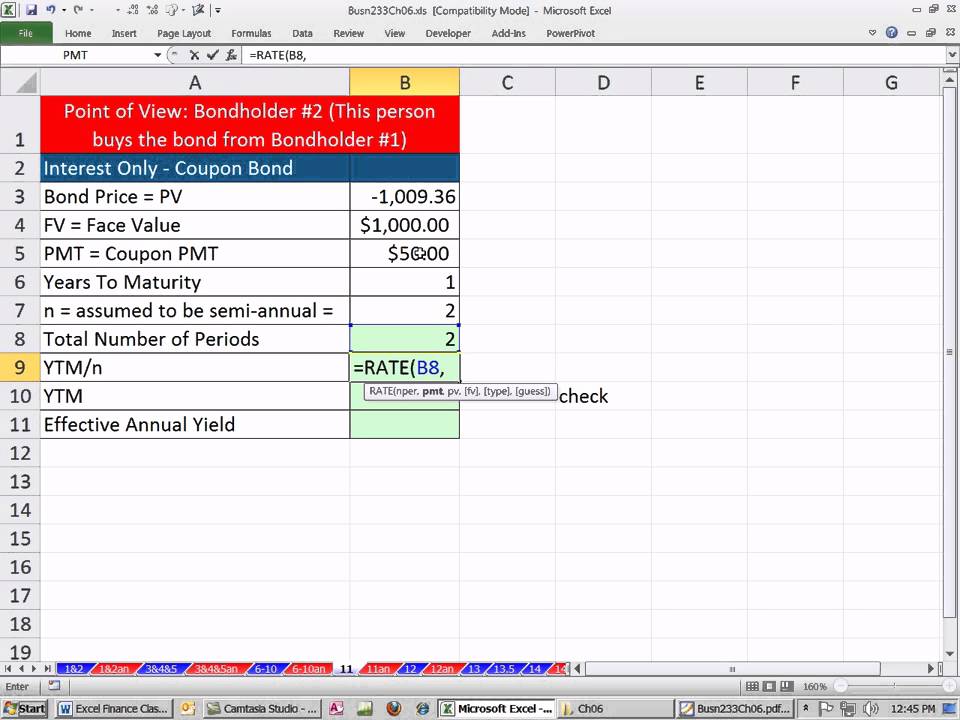

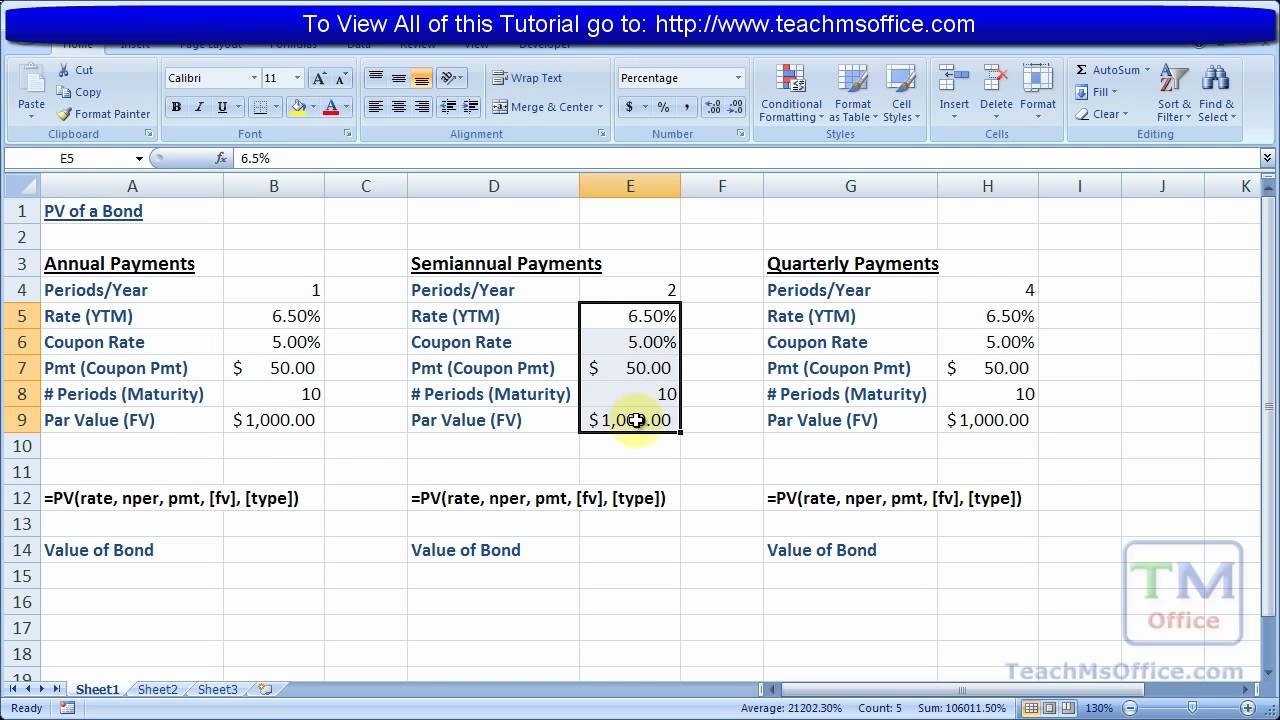

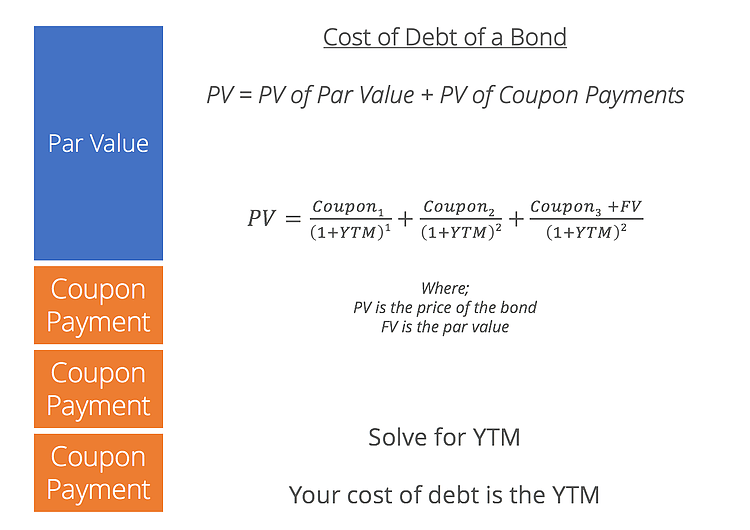

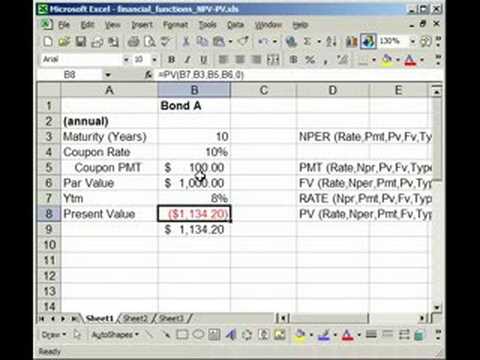

How to calculate ytm of a bond in excel. Insert the following function into b18. The equation below gives the value of a bond at time 0. Pv present value of the bond p payment or coupon rate par value number of payments per year r required rate.

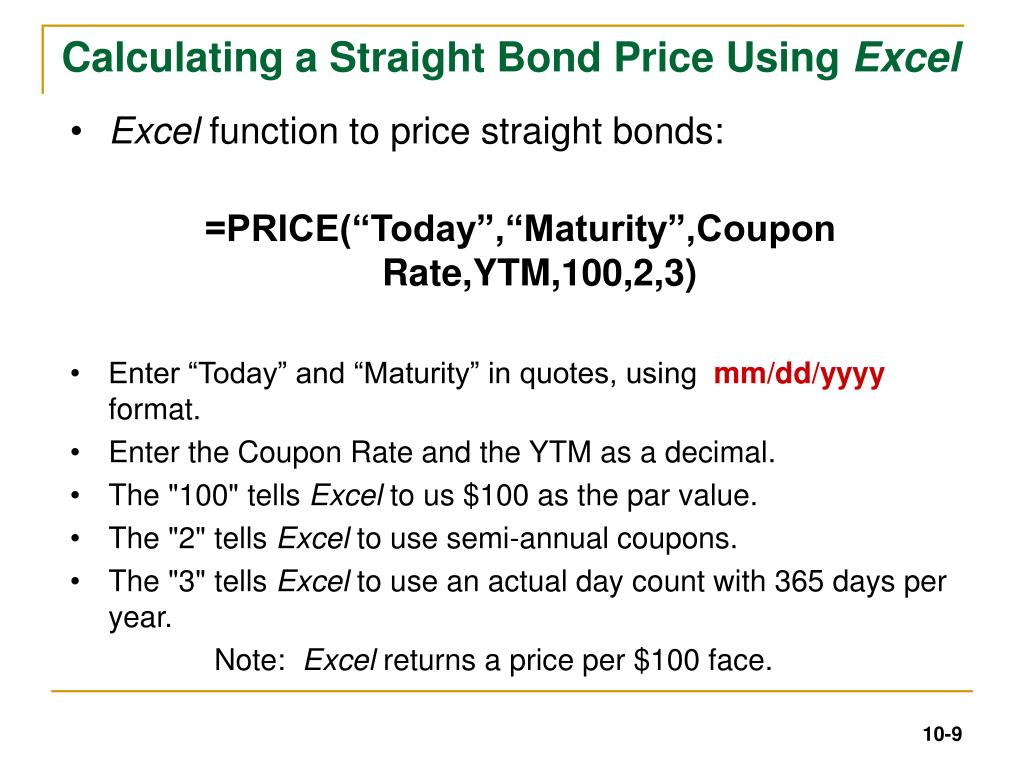

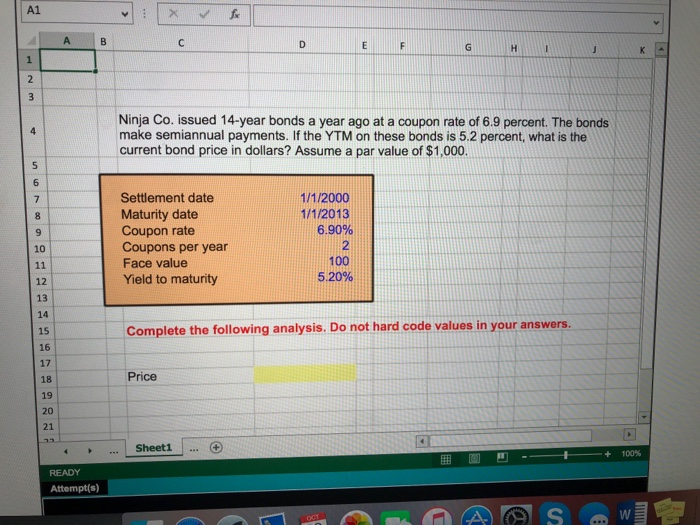

Select the cell you will place the calculated result at type the formula pv b4b30b2 into it and press the enter key. To calculate the current yield of a bond in microsoft excel enter the bond value the coupon rate and the bond price into adjacent cells eg a1 through a3. Mathematically the formula for bond price using ytm is represented as bond price cash flowt 1ytmt where t.

Skip cell a11 and type bond yield calculations in cell a12 current yield in cell step 2 format the column width. Notice that we didnt need to make any adjustments to account for the semiannual payments. So you will be able to sell your bond at 11202559 with a premium of amount 1202559.

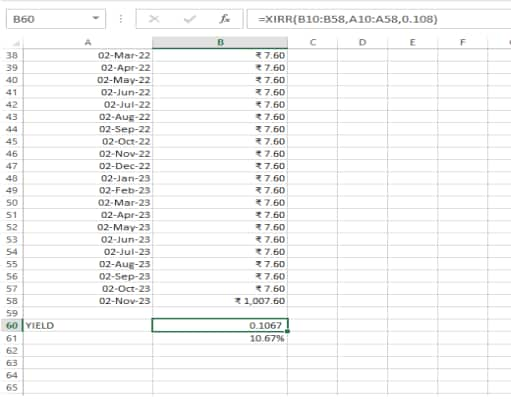

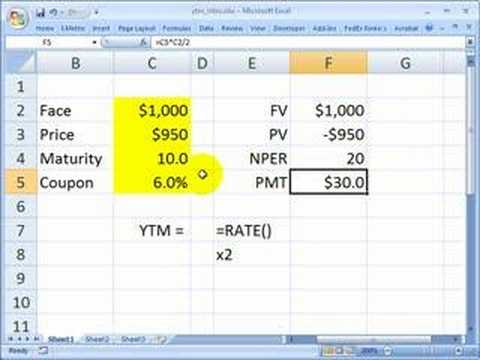

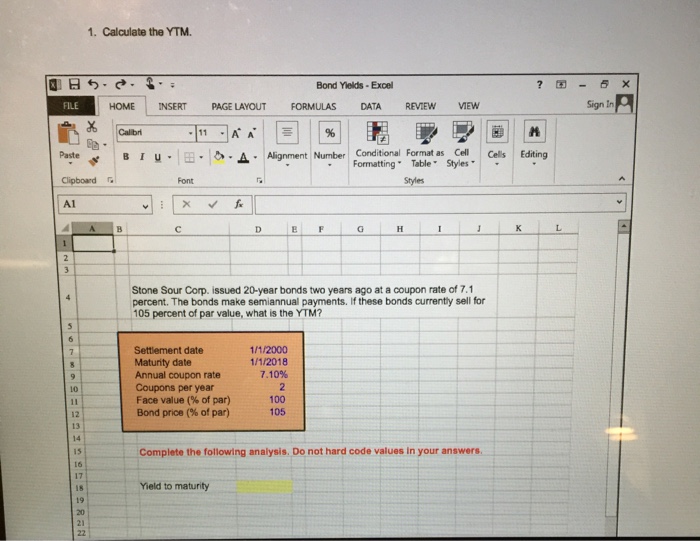

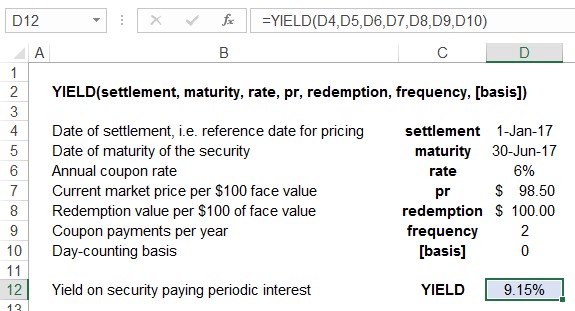

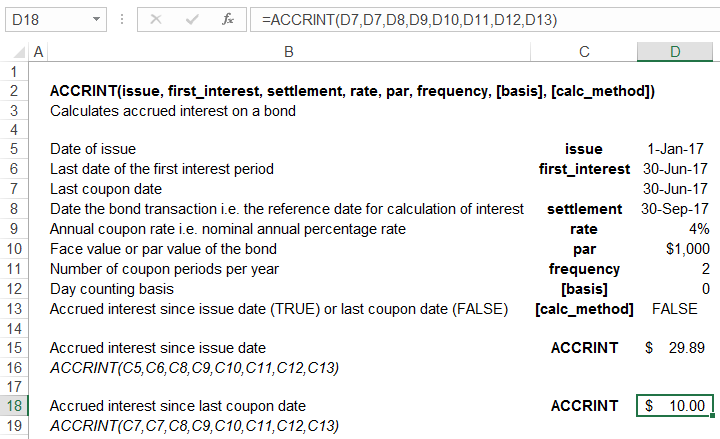

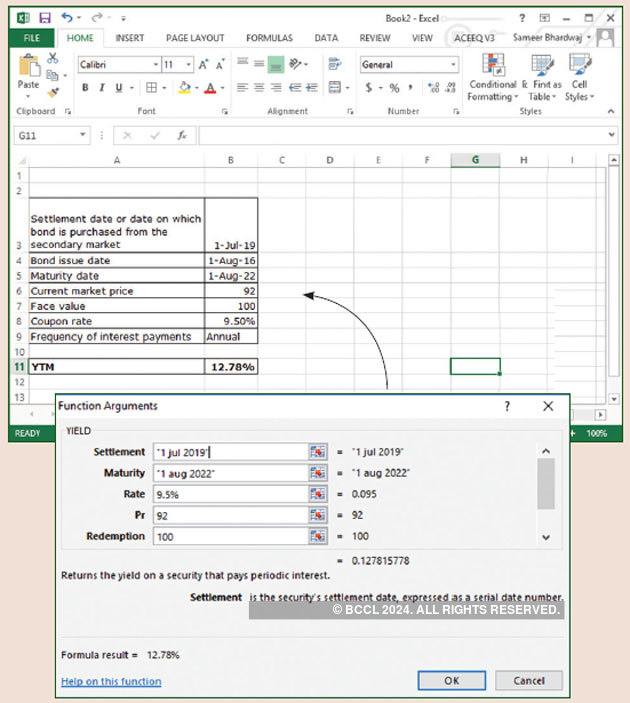

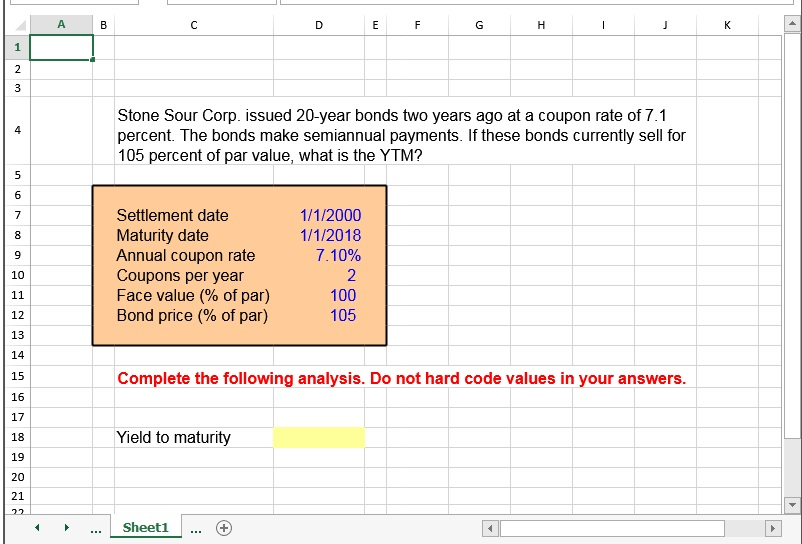

The cash flows of the bond coupon payments cp and maturity value mv principal amount coupon payment have been discounted at the yield to maturity ytm rate r in order to determine the present value of cash flows or alternatively the price or value of the bond v bond. With that additional information using the yield function to calculate the yield to maturity on any date is simple. Bond yield data face value annual coupon rate annual required return years to maturity years to call call premium and payment frequency.

Pv p 1 r 1 p 1 r 2 p principal 1 r n where. Step 1 enter the column headings and data labels. In above formula b4 is the interest rate b3 is the maturity year 0 means no coupon b2 is the face value and you can change them as you need.

The formula for current yield is expressed as expected coupon payment of the bond in the next one year divided by its current market price. Starting in cell a1 type the following text into cells a1 through a8. How to calculate the yield to maturity ytm of a bond.

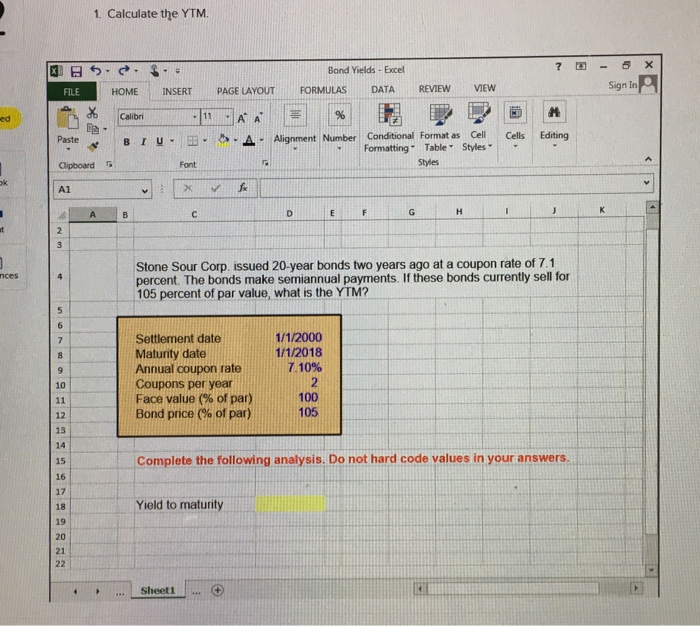

Pv 4504 410 1500 100000 11202559. Yieldb6b7b4b13b3b10b11 and you will find that the ytm is 950. Of years to maturity.

Skipping cell a9 type value of bond in cell a10. Lets calculate now your bond price with the same excel pv function.

Excel Yield Function Equivalent In Python Quantlib Quantitative Finance Stack Exchange

quant.stackexchange.com