How To Convert To Roth Ira Fidelity

Eligible roth 401k and 403b assets may be rolled over to a roth ira to avoid mrds minimum required distributions from those accounts during a clients lifetime.

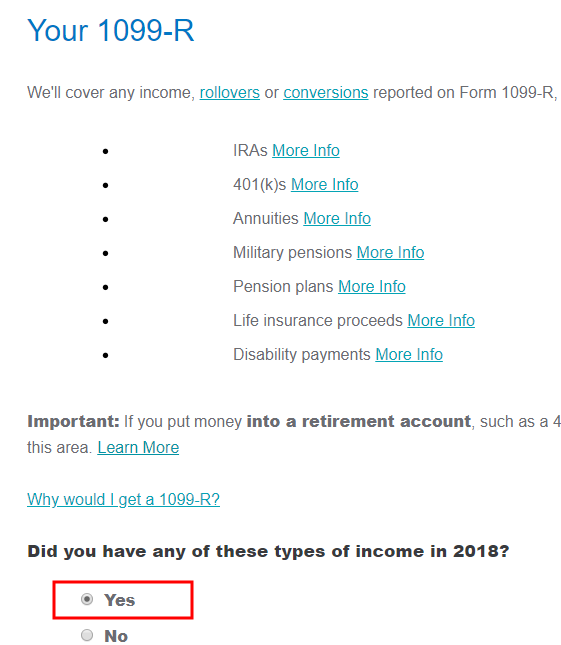

How to convert to roth ira fidelity. I wrote a post here discussing the different asset classes. Converting a 401k to a roth ira. Where you will live in retirement leaving money to others and required minimum distributions rmds.

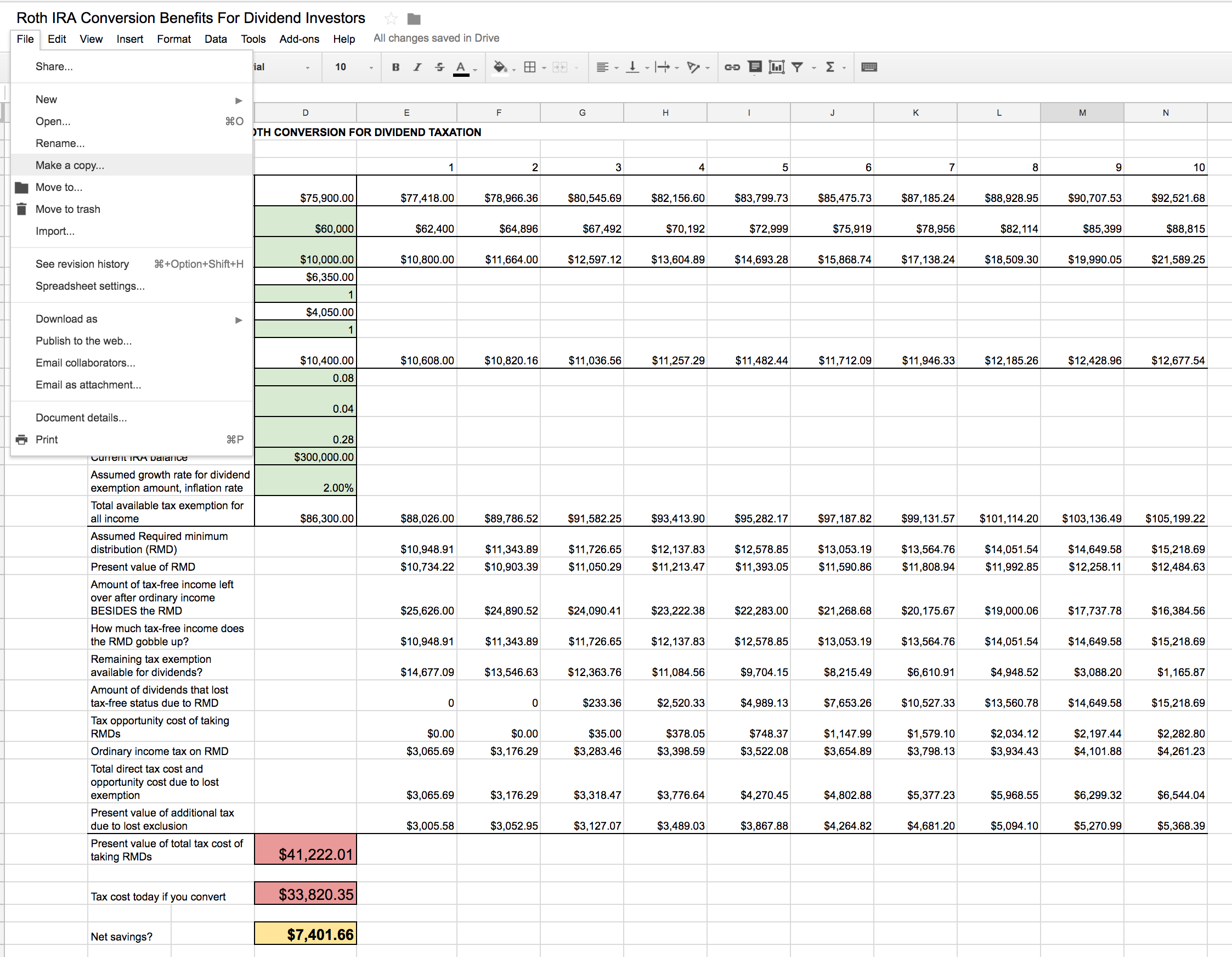

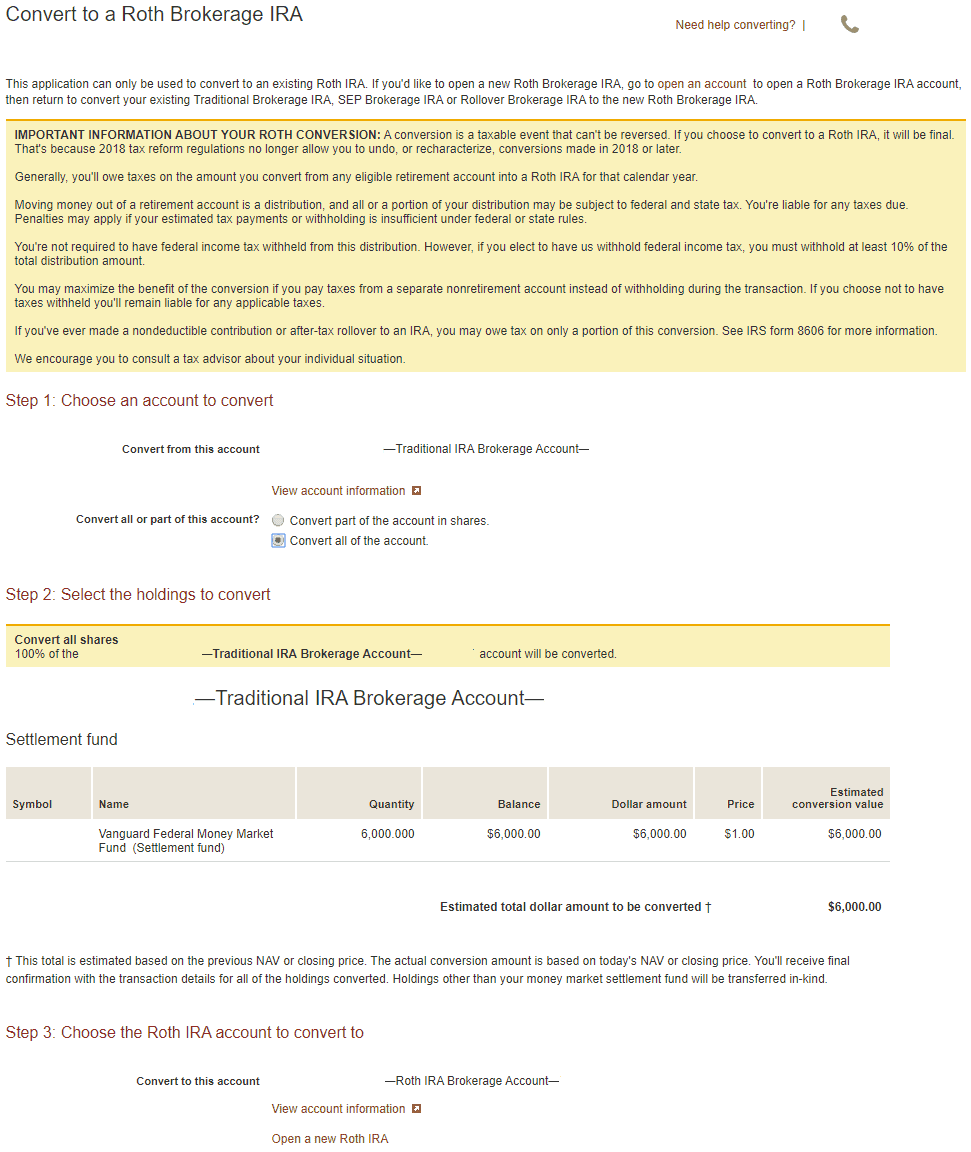

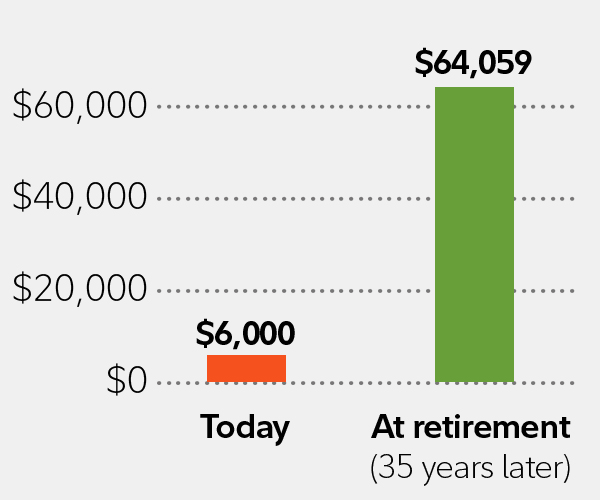

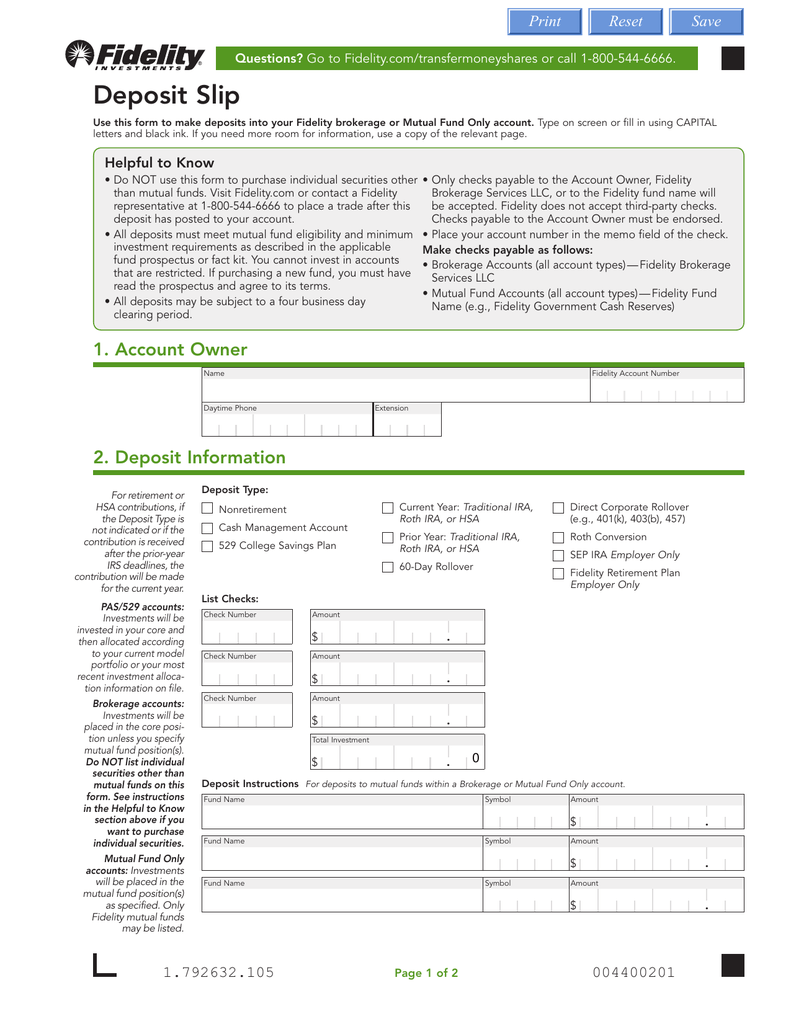

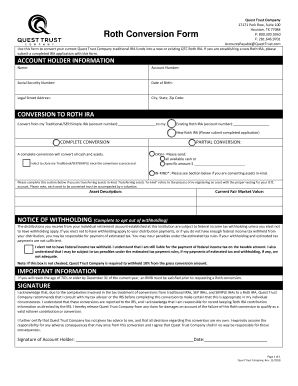

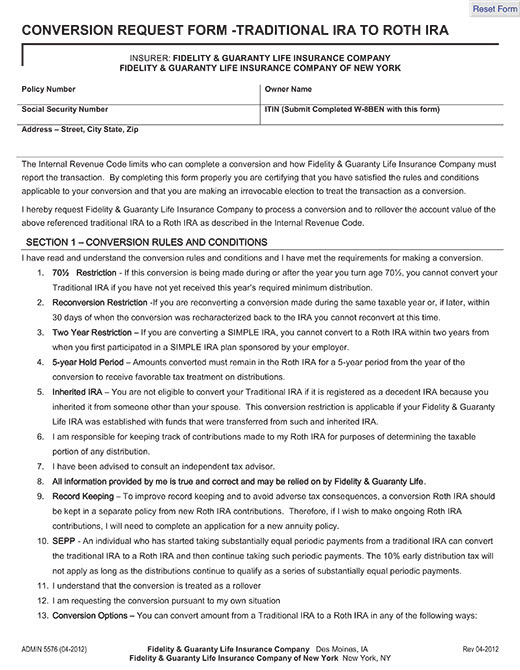

Converting certain ira assets to roth ira assets can help boost after tax retirement income and reduce future required minimum distributions rmds at age 72 since rmds do not apply to roth iras. The last step you have to do is fill out irs form 8606. To move money from a workplace plan to a roth ira call 1 800 fidelity and a fidelity representative will assist you.

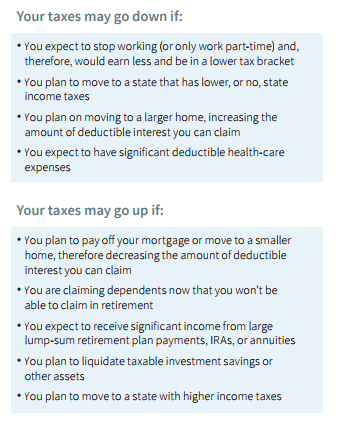

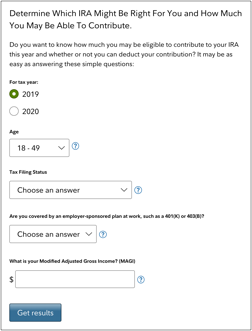

While everyones risk tolerance retirement horizon and lifestyles are different most everyone is interested in saving money on taxes. That includes your spouse if they file one too. How you would pay for it the 38 medicare surtax and gains on company stock in a 401k.

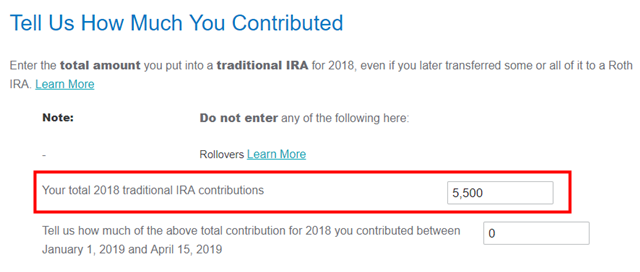

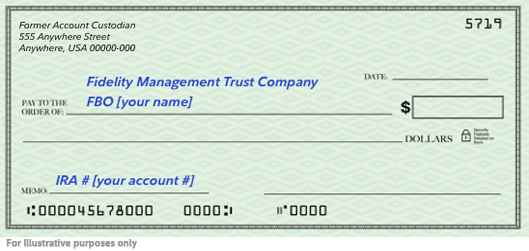

Note also if you have assets in a designated roth account ie roth 401k and would like to roll these to an ira the assets must be rolled into a roth ira. Consider the costs of a conversion. After doing the backdoor roth you need to file irs form 8606 for your taxes for each backdoor roth.

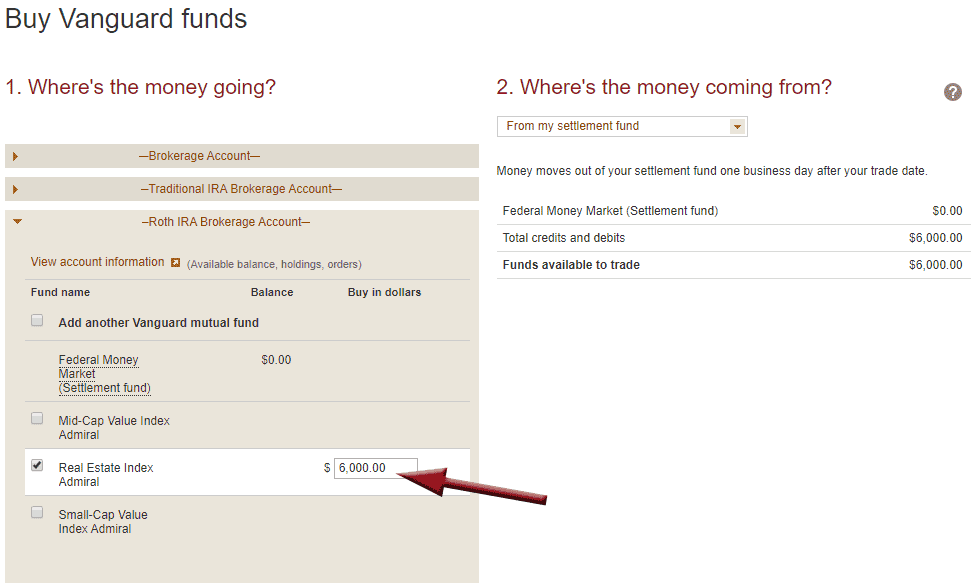

Generally youll only be able to transfer a 401k to a roth ira once youve left the company that provided the 401k or once you reach the age of 59 which is the age most plans allow for in service withdrawals. Next you can buy any of the asset classes. You can also convert traditional 401k balances to a roth ira.

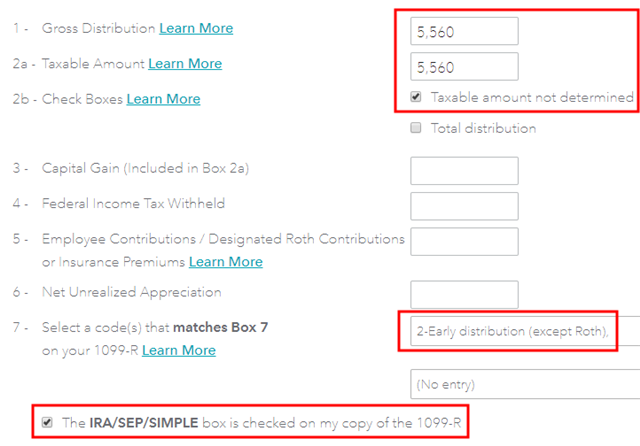

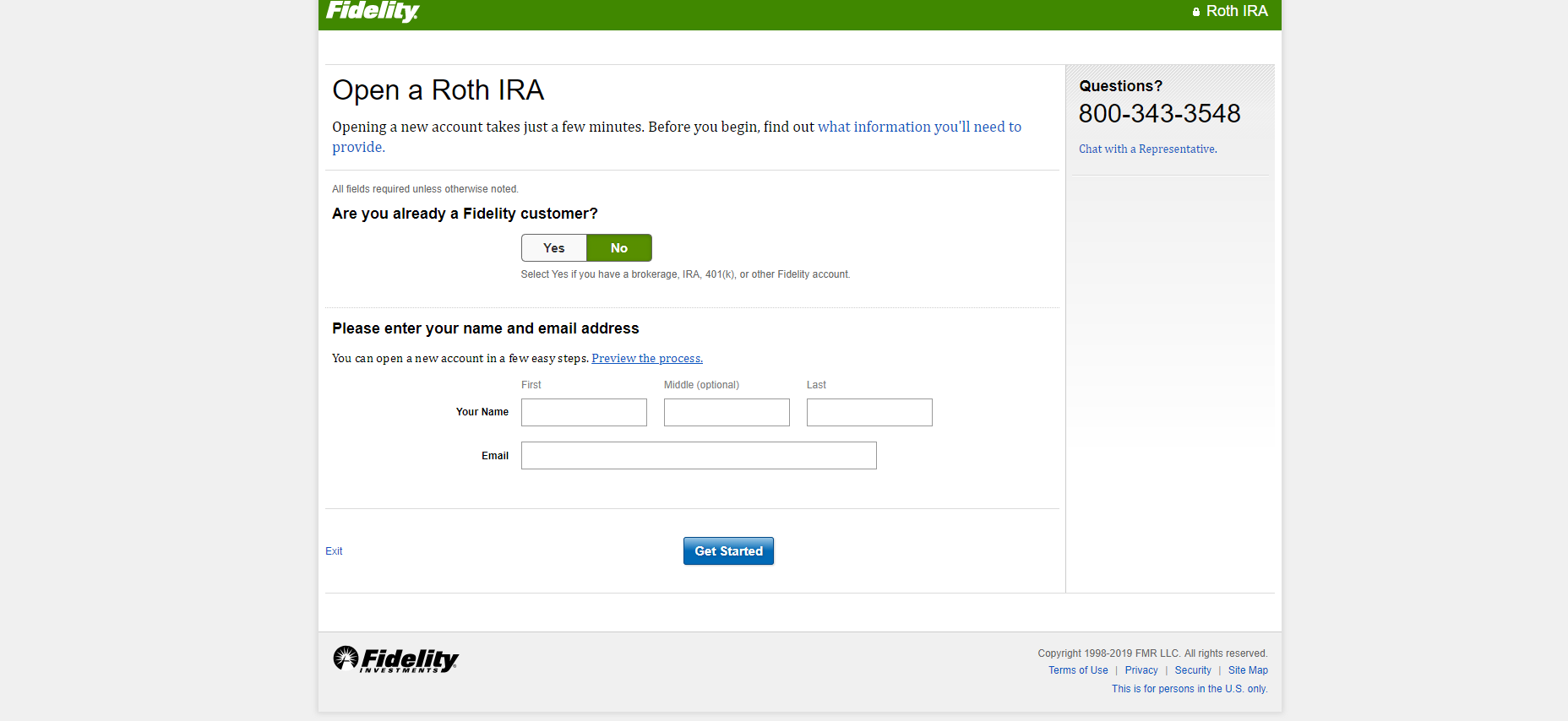

If the client has made nondeductible ira contributions the client must complete irs form 8606 which calculates the tax free return of basis needed to determine the taxable amount of the ira distribution. Open a fidelity traditional ira. All you did was contribute to a traditional ira then convert it to a roth the next day.

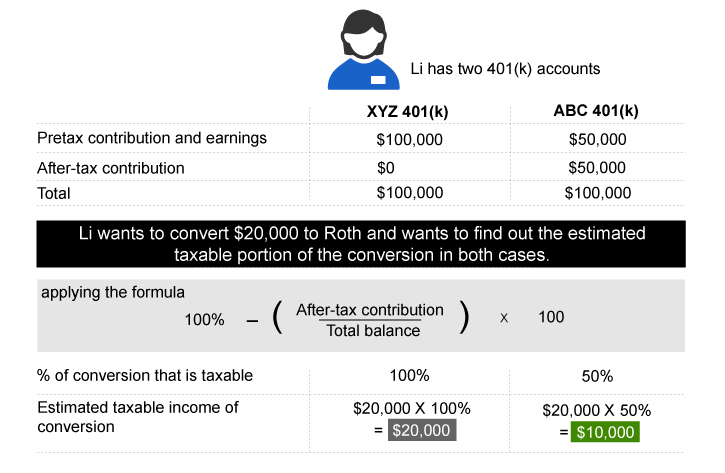

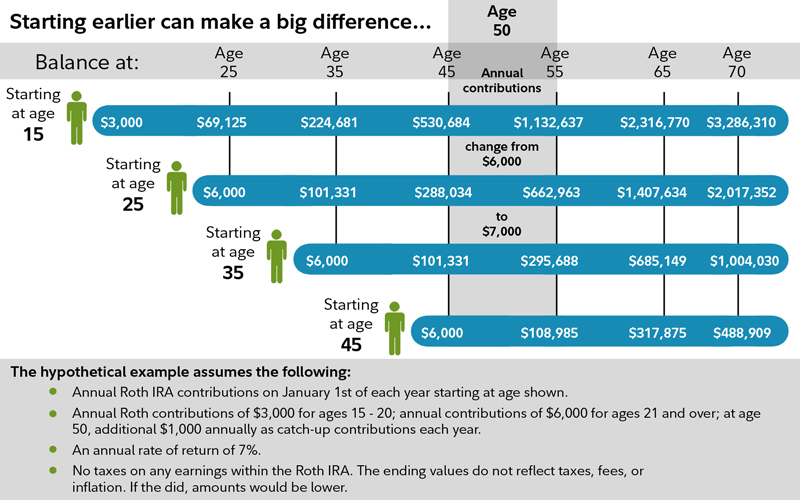

When determining how much of an eligible account to convert you can choose to convert the full amount or a partial balance. Before converting a traditional 401k or ira to a roth 401k or ira think about your future. In addition some workplace plan balances may be eligible to roll over directly to your roth ira.

2 this is filed with the clients tax return for the year in which the conversion is made. As with traditional ira conversions to roth iras if you are required to take an rmd in the year you roll over into an ira you must take it before rolling over your assets.

Fidelity Ira Review What You Need To Know About Fidelity S Ira Roth Ira Fees Minimum Investment Etc Advisoryhq

www.advisoryhq.com

Does Fidelity Have A Built In Backdoor Roth Ira Or Is This Something Else Bogleheads Org

www.bogleheads.org

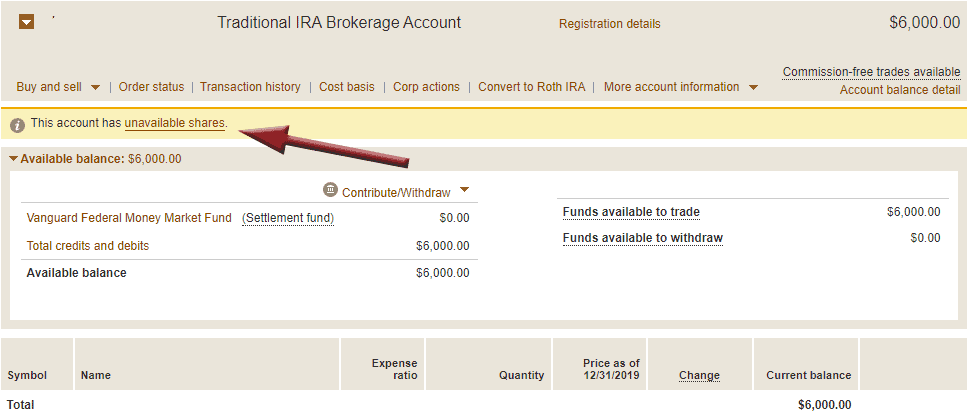

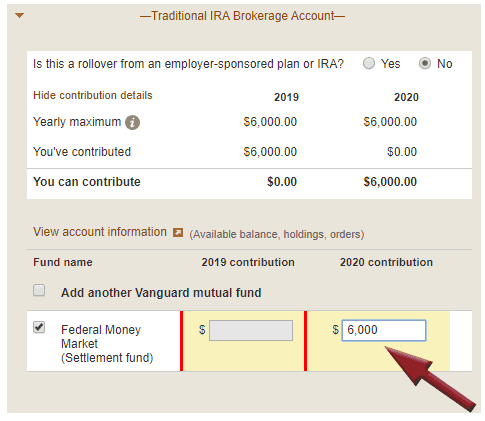

I Maxed Out 401k For 2020 I Opened A Roth Ira Account In Fidelity And Been Doing The Mega Backdoor Roth I Don T Have Any Other Iras I Just Saw This Message

www.fishbowlapp.com

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png)

/Traditional-IRAs-versus-Roth-IRAs-57a520763df78cf4597fb212.jpg)