How To Create A Trading Algorithm

How to write a successful trading algorithm 1.

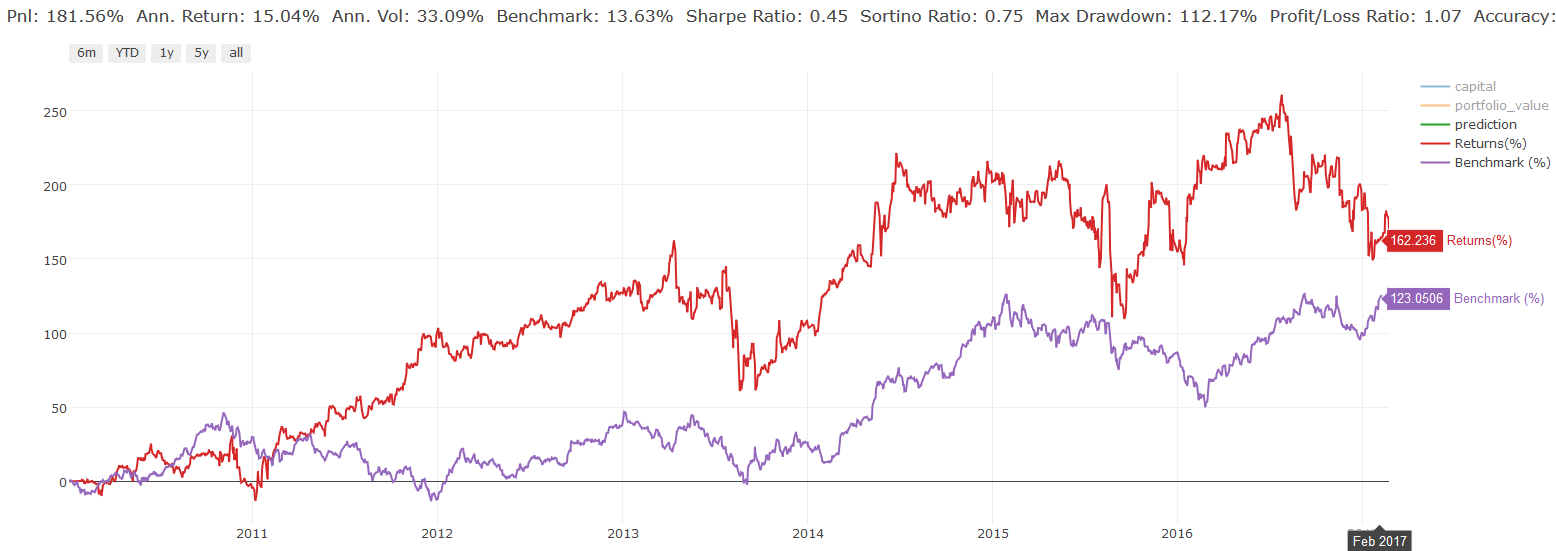

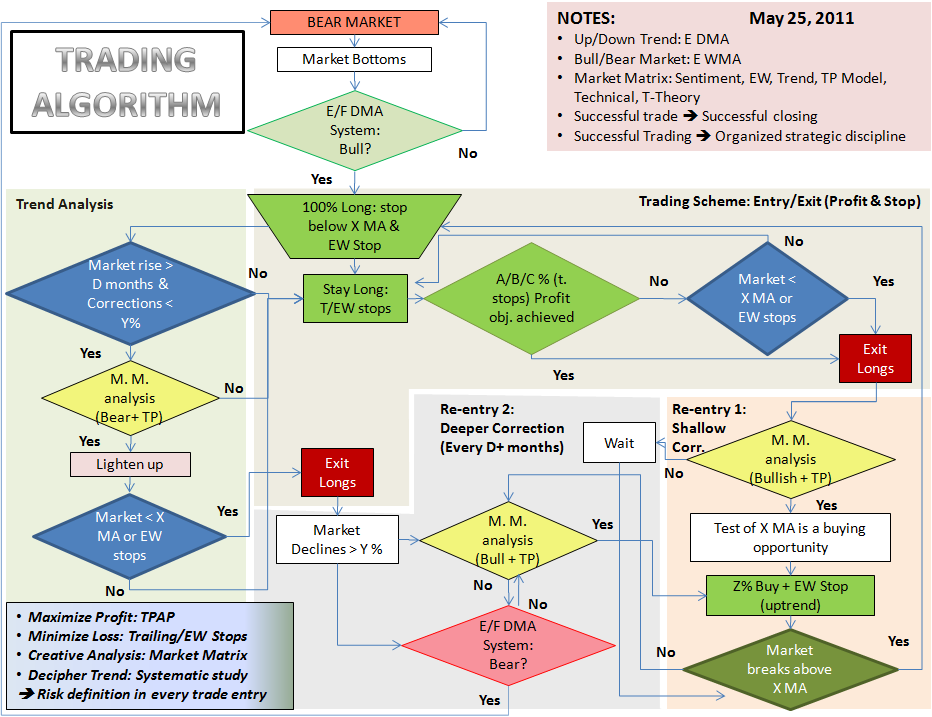

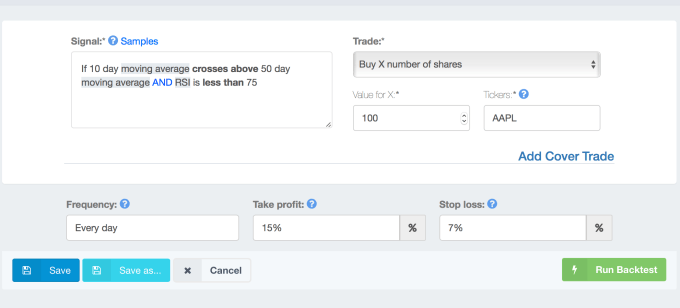

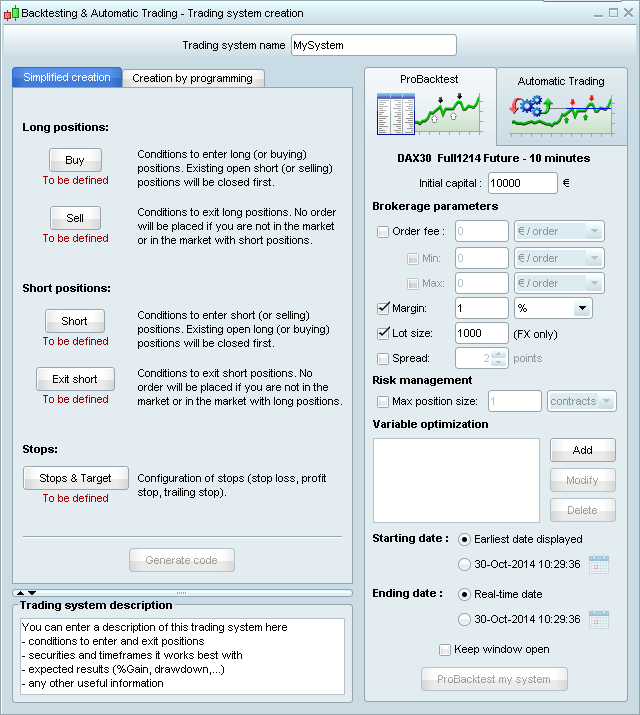

How to create a trading algorithm. You need to back test and optimize the parameters and analyze before automation. To create an algorithm you could write if snap is up 3 from yesterday and the sp is down sell 100 shares of snap the platform also supports more complicated technical. Keep it simpleif you want to create a good algorithmic ie.

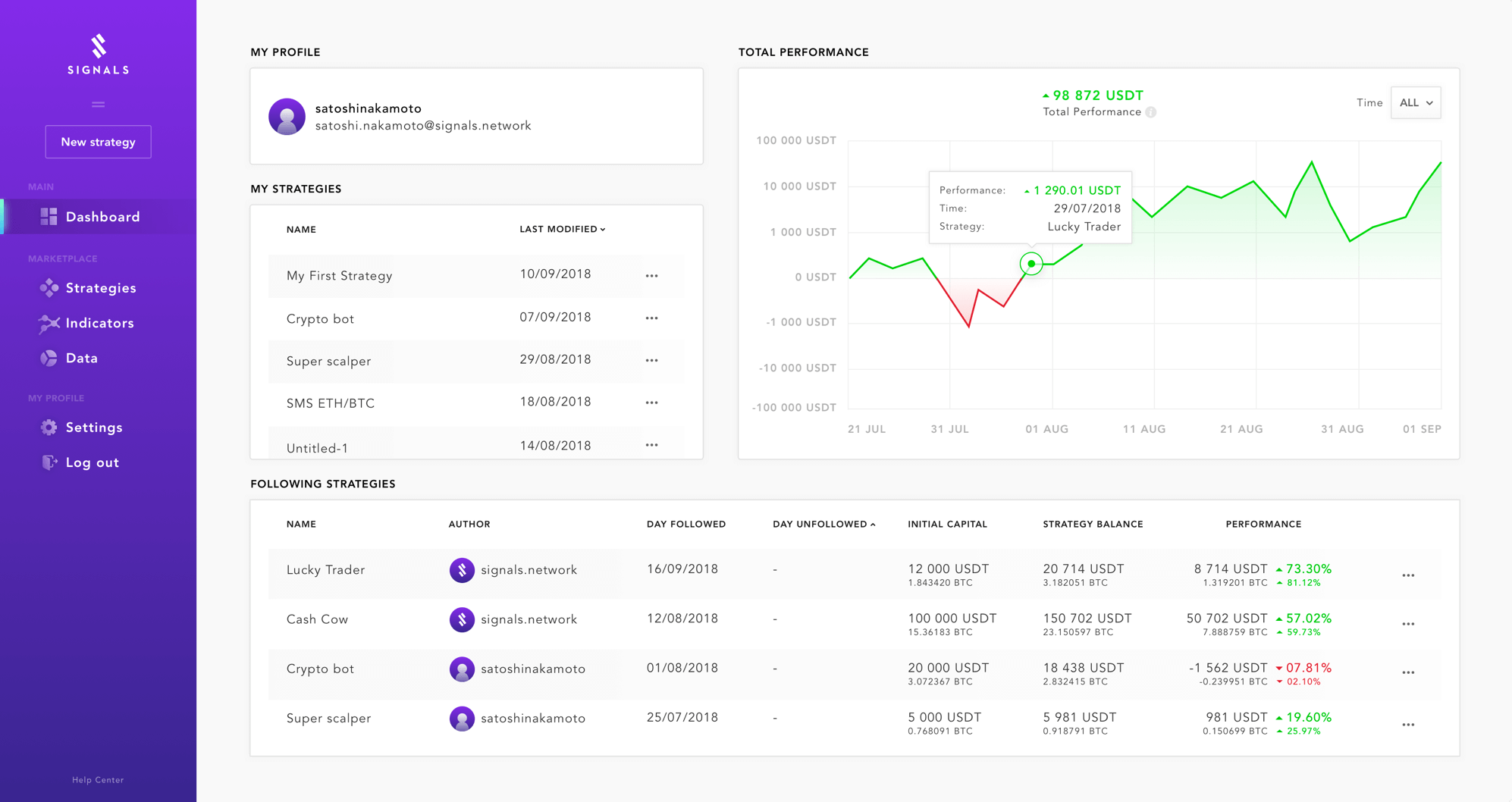

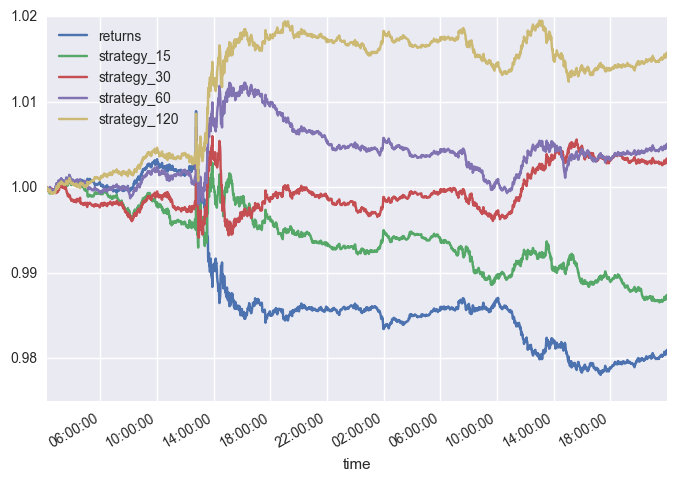

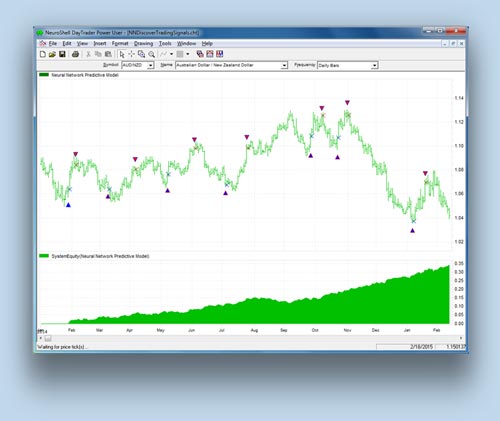

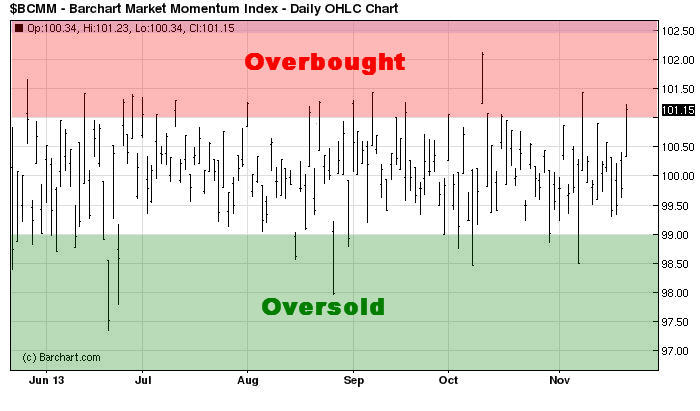

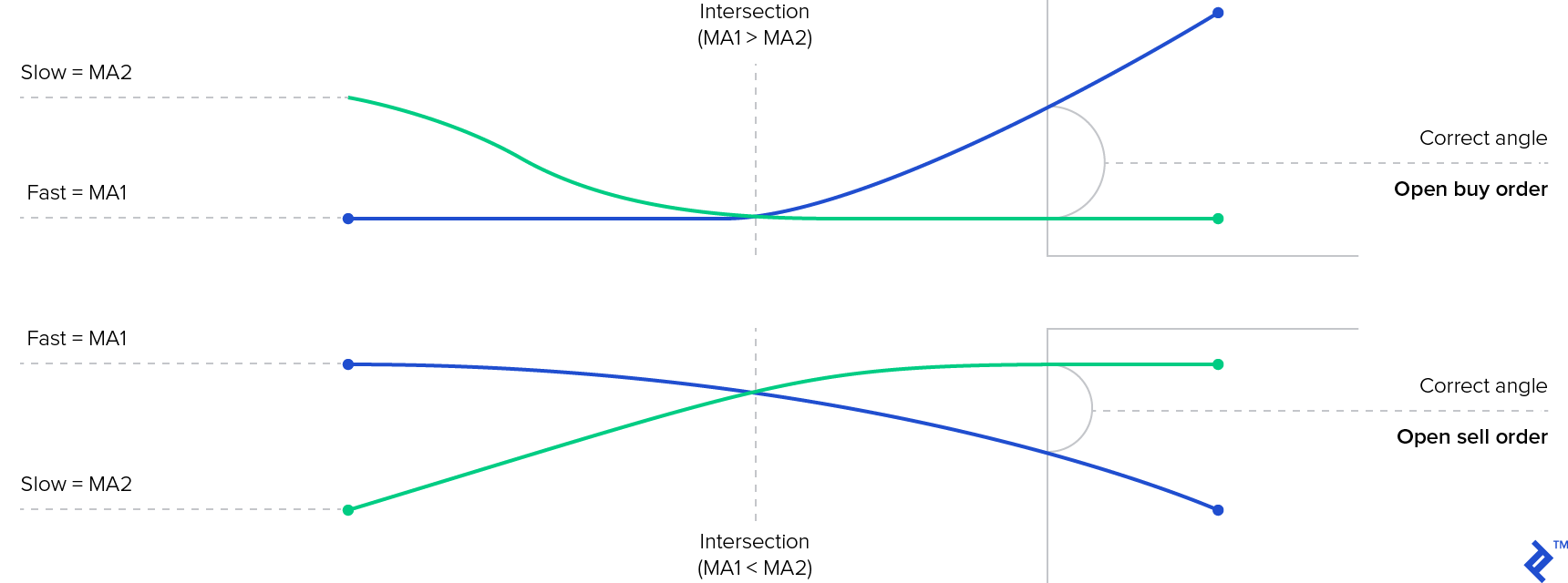

Quantitative trading isnt accessible solely to institutional traders. Find indicators that help identify a new trend. However you need to observe the performance of algo trading strategies in the real market scenario to ensure its utility.

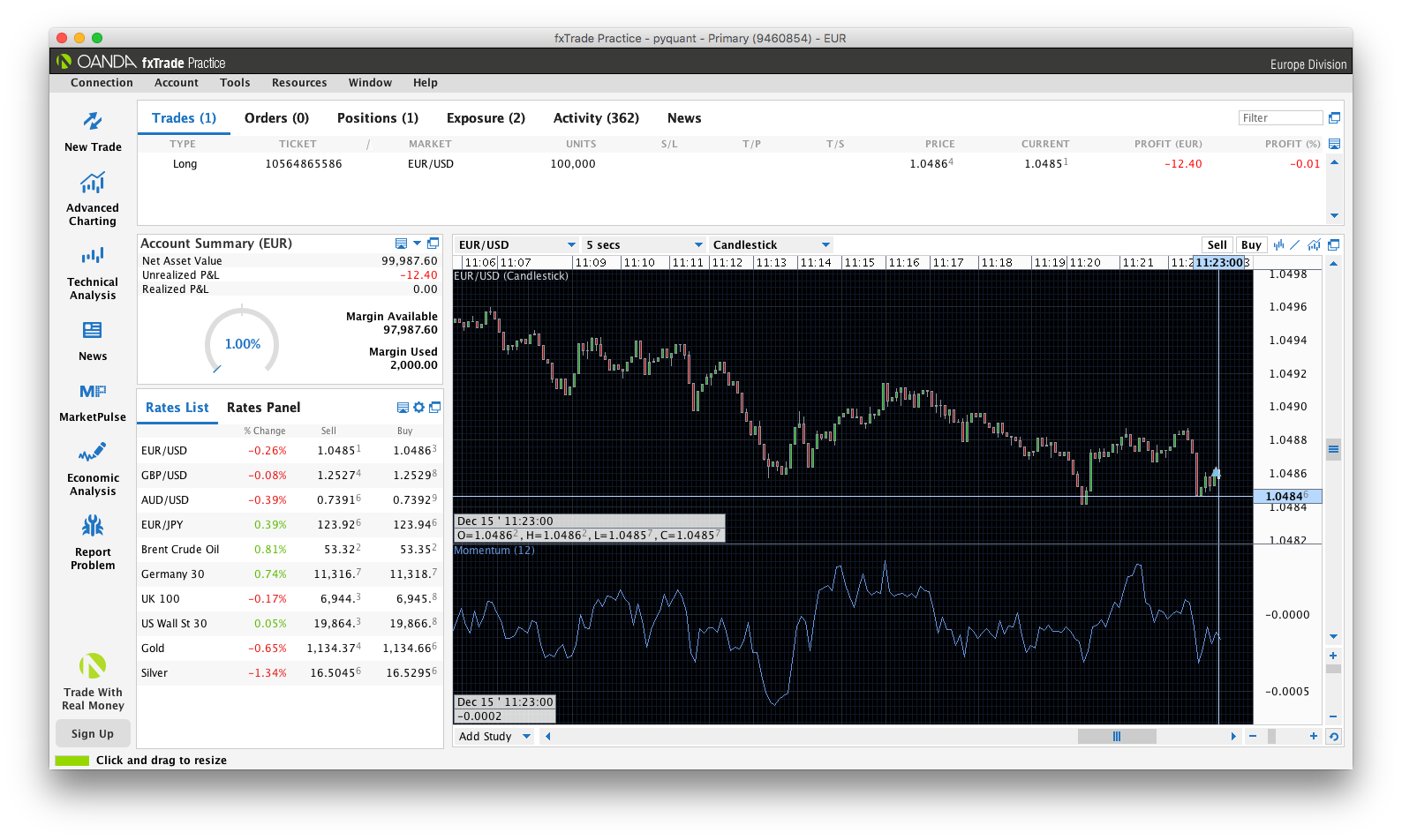

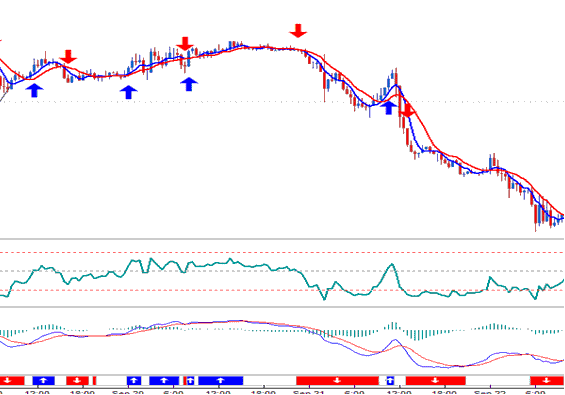

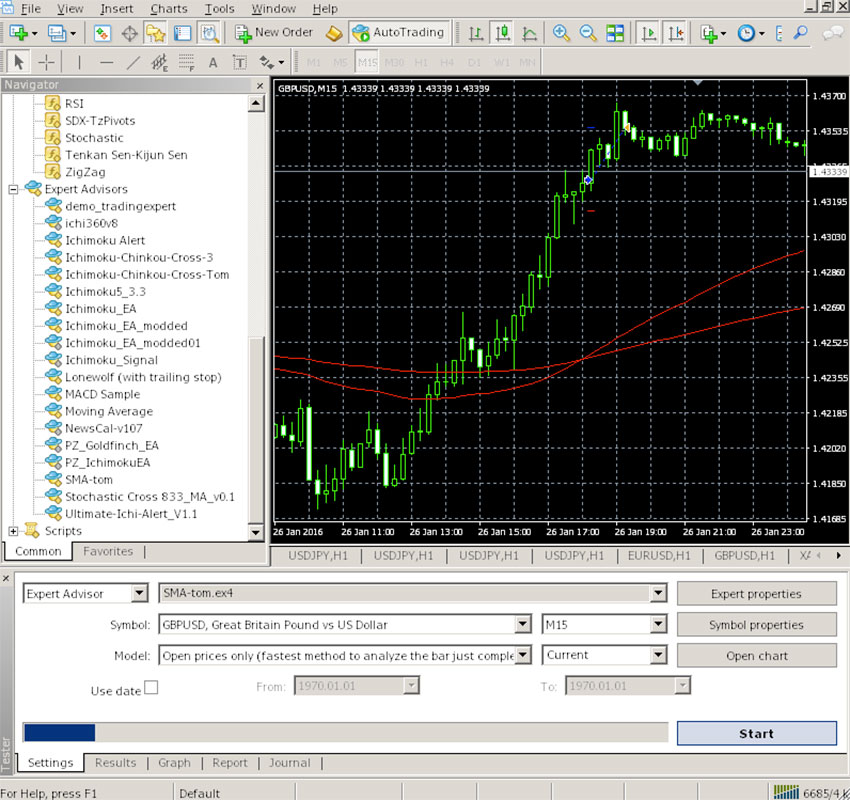

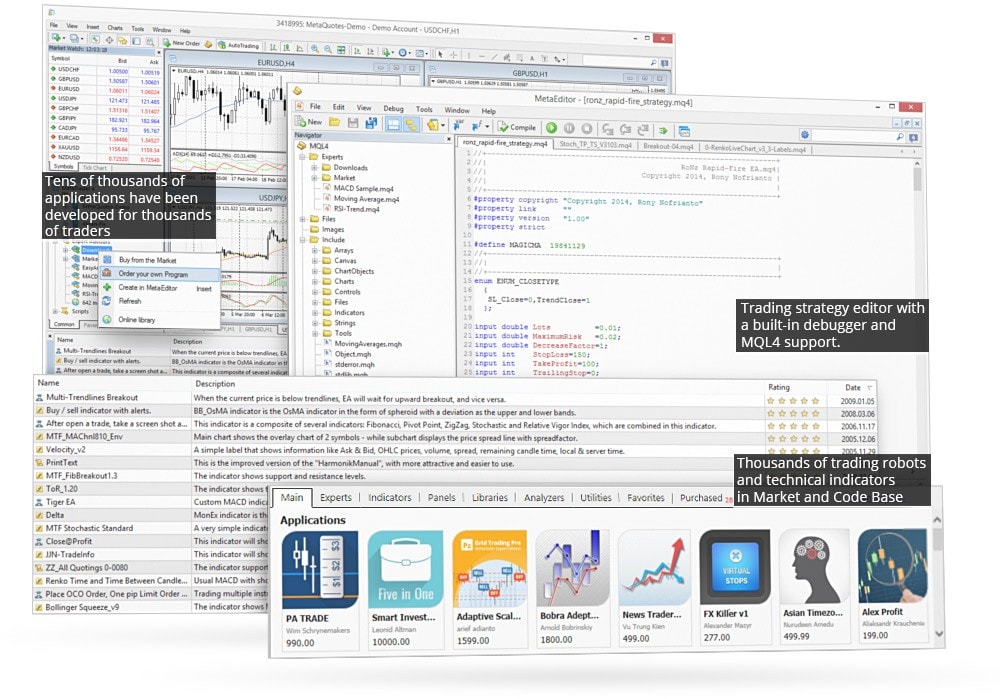

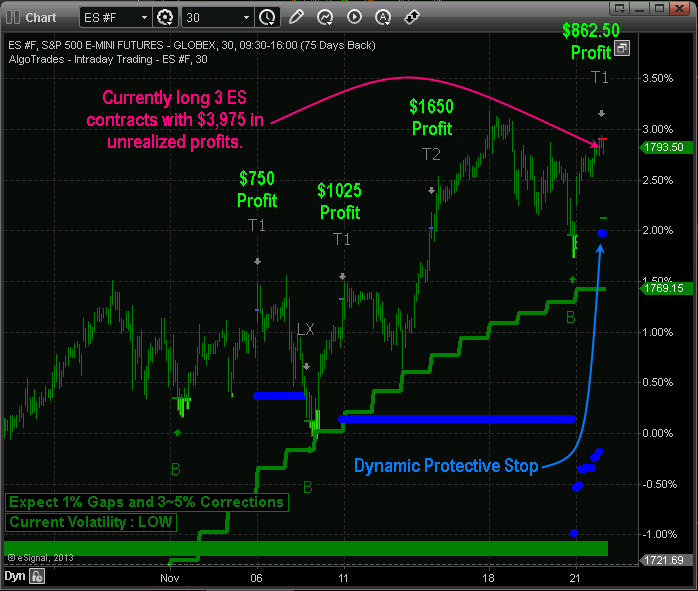

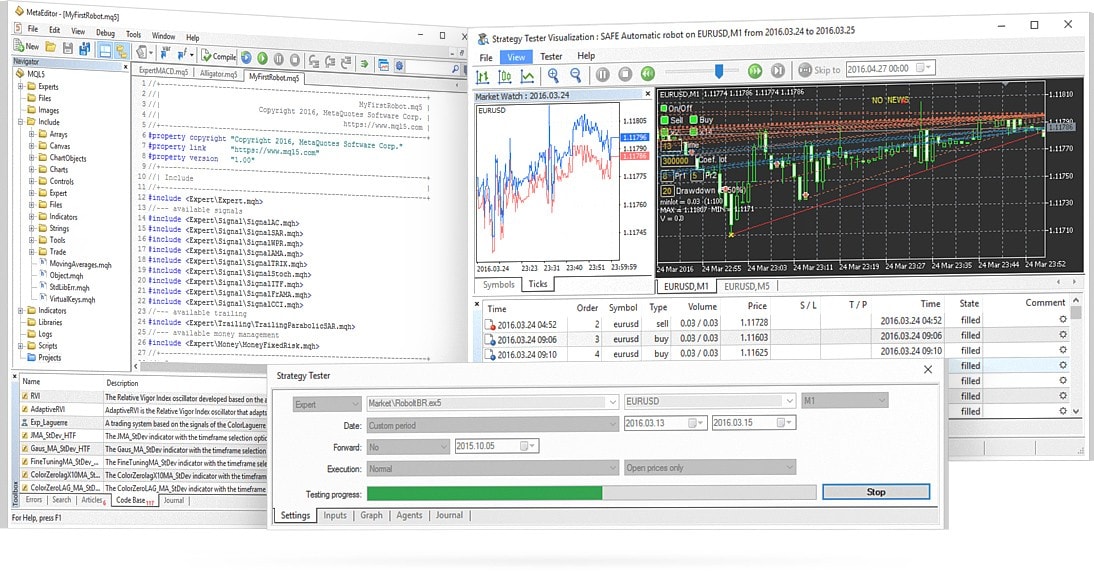

Understand the parts of a mt4 trading algorithm. The first thing you need to decide when creating your system is what kind of forex trader you are. Algorithmic trading strategies follow a rigid set of rules that take advantage of market behavior and the occurrence of one time market inefficiency is not enough to build a strategy around.

An algorithm can be built by formulating a trading plan and converting it into an algorithm. Are you a day trader or a swing. Find indicators that help confirm the.

Retail traders are getting involved as well. Choose and install software. The algorithmic trading strategy can be executed either manually or in an.

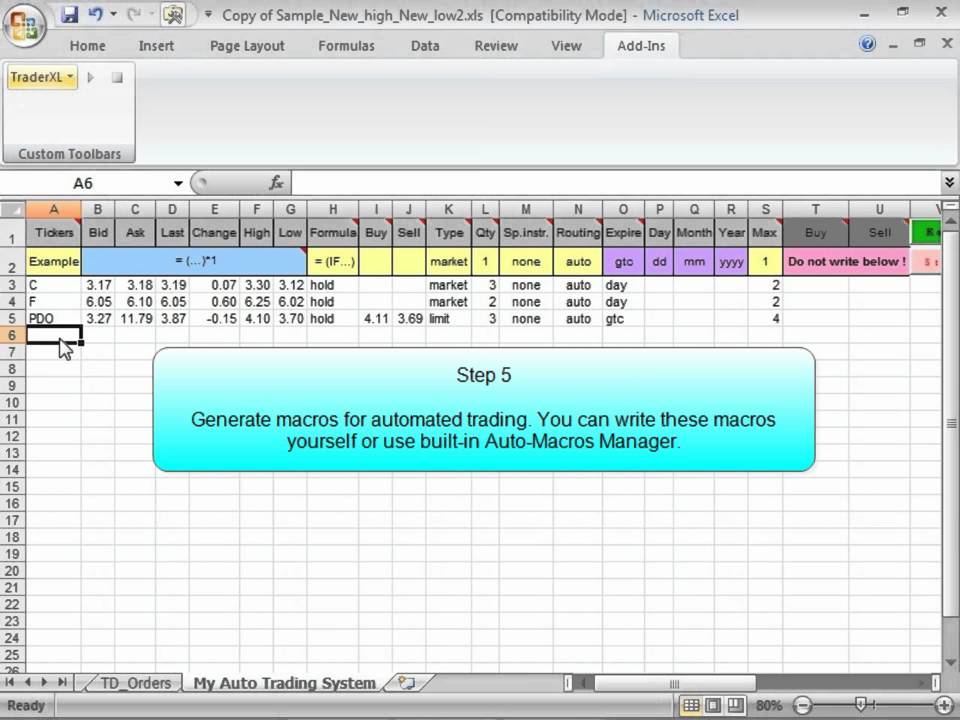

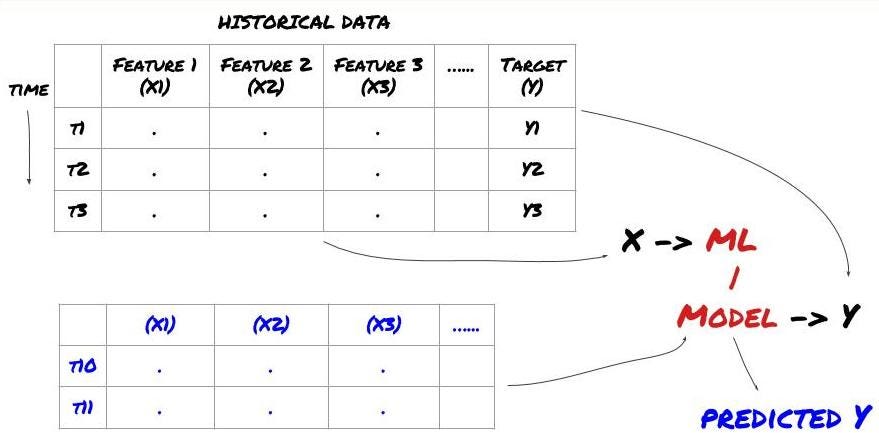

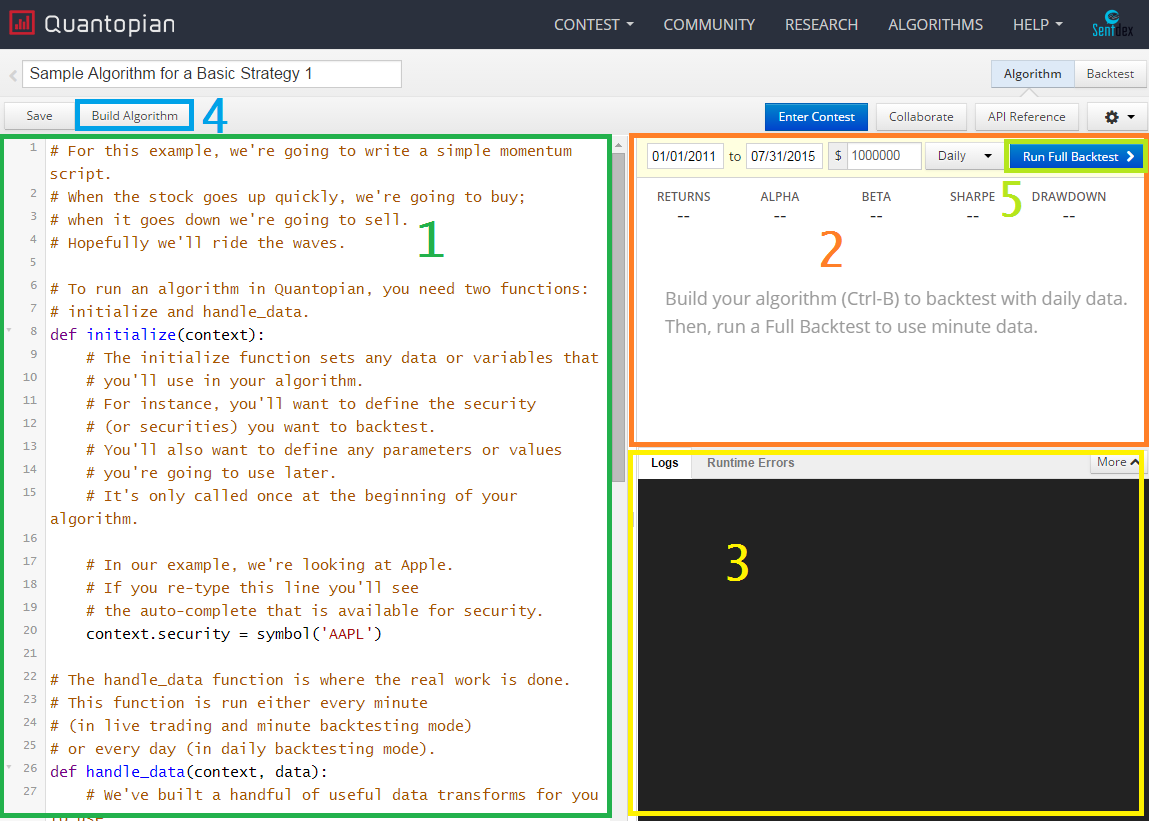

Code the rules for entering and exiting trades. Algorithmic trading algorithmic trading means turning a trading idea into an algorithmic trading strategy via an algorithm. Heres how it works.

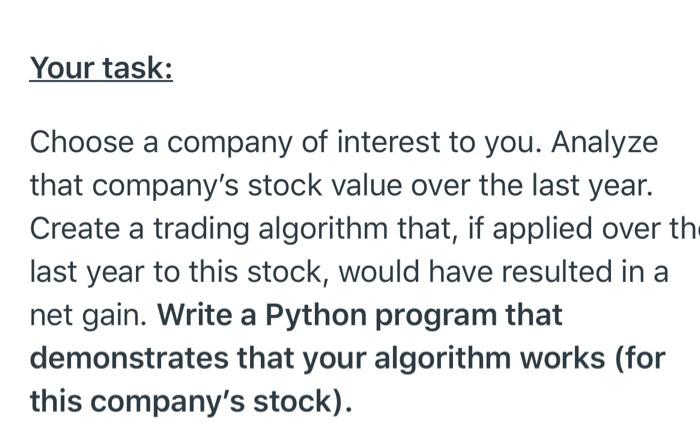

Holdings rbuildholdings holdingsdf pddataframe for i in rangelenholdings. Define your approach to timeolsen uses a so called endogenous time scale in which time isnt time as we usually. Ticker listholdingsitemsi0 holdingdf pddataframelistholdingsitemsi1 index i holdingdfticker ticker holdingsdf pdconcatholdingsdf holdingdf holdingsdf holdingsdfticker price quantity percentchangeaveragebuyprice equity equitychangeperatio type name id for j in rangelentrading.

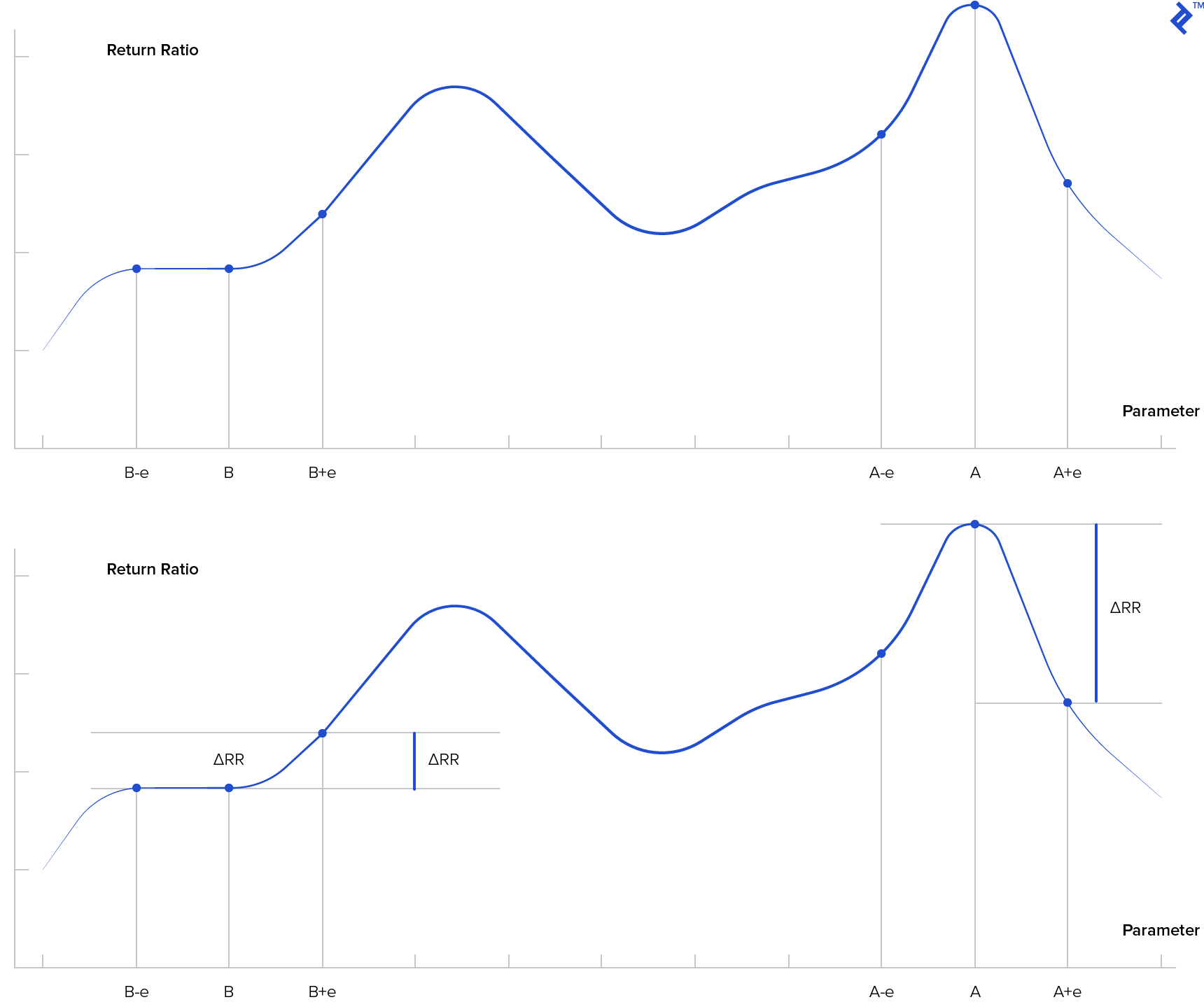

Mathematical model of reality olsen says you need to. Here are the steps for coding an algorithmic trading strategy. Formulate your trading planthe very first step would be to make a checklist of the parameters based on which.

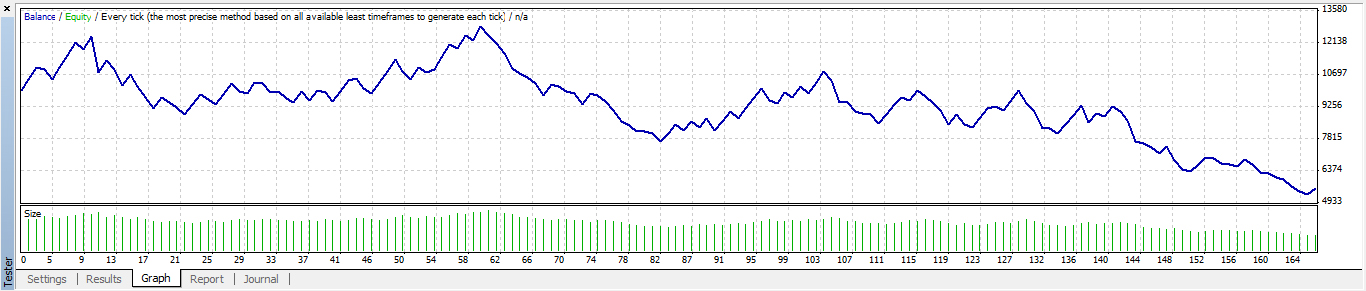

Convert your idea into an algorithmnext you should start writing a code for your formulated trading plan. Set up an account with a broker. The algorithmic trading strategy thus created can be backtested with historical data to check whether it will give good returns in real markets.

While programming skills are recommended if you want to produce algorithms even.

Algorithmic Trading Bot Python The Rise Of Commission Free Trading By Rob Salgado Towards Data Science

towardsdatascience.com

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

/GettyImages-1151577420-0a1caa7c85a34411820816f7653c3c58.jpg)

/shutterstock_268518818-5bfc35e5c9e77c005145dc24.jpg)

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg)

/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg)