How To Figure Out Dti

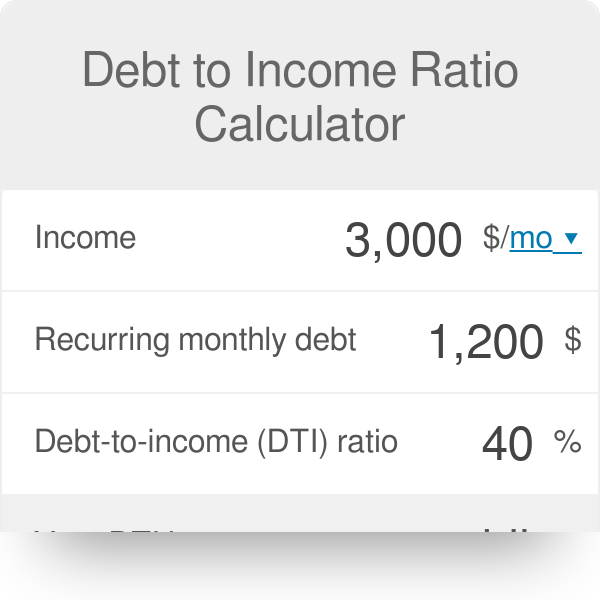

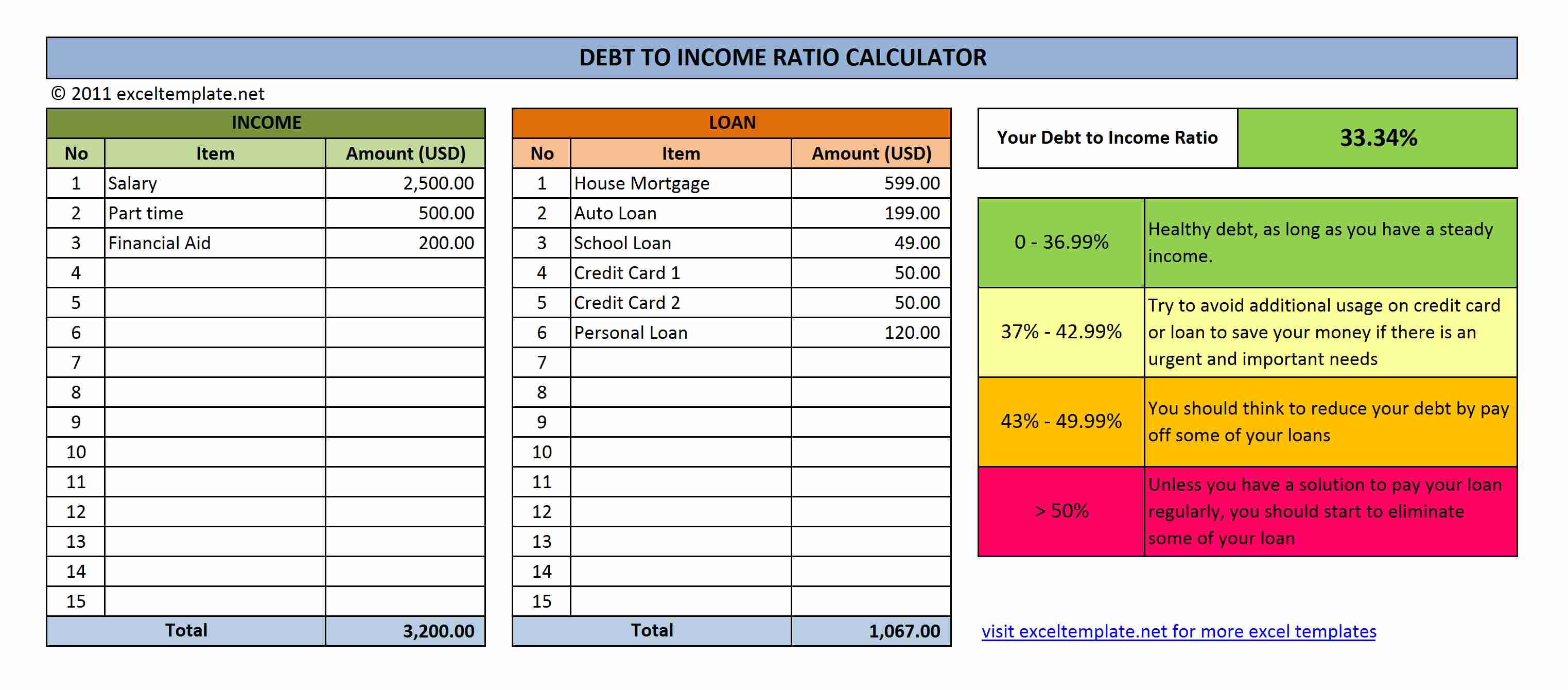

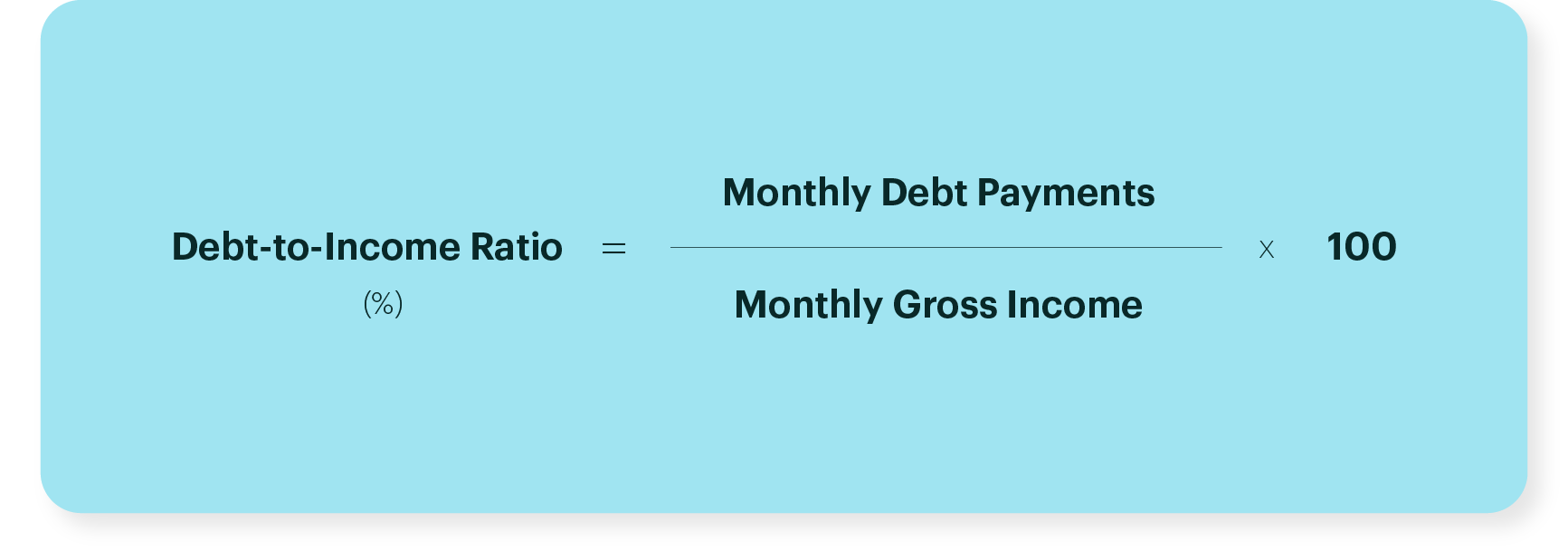

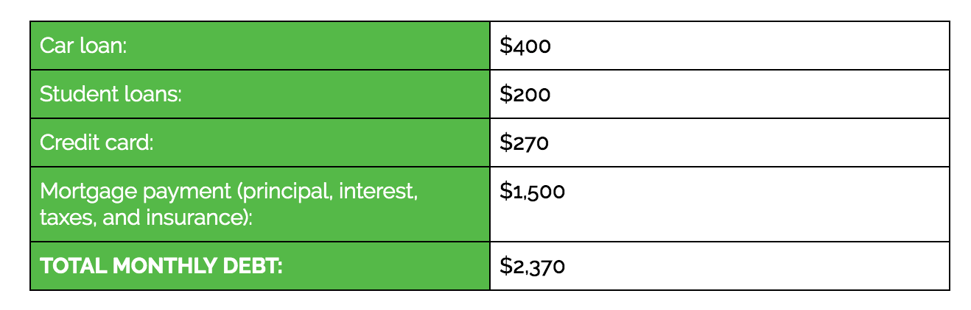

For instance if your debt costs 2000 per month and your monthly income equals 6000 your dti is 2000 6000 or 33 percent.

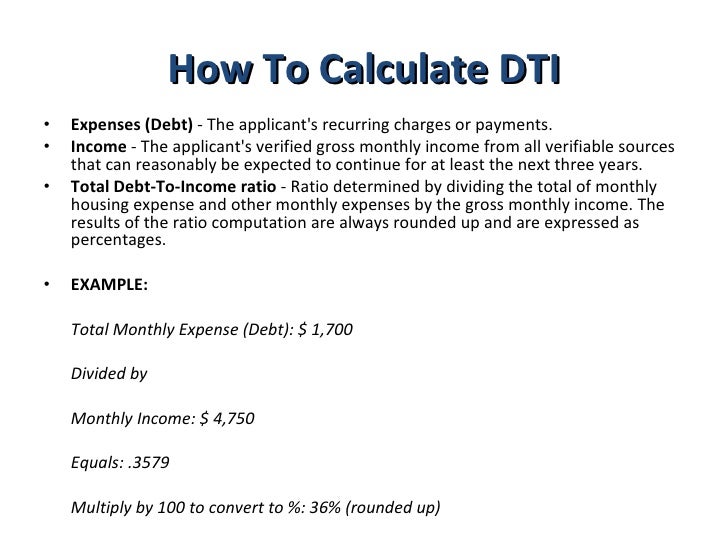

How to figure out dti. You can calculate your dti by adding up your monthly minimum debt payments and dividing it by your monthly pre tax income. Well help you understand what it means for you. The dti ratio you need for loan approval when you apply for a mortgage or any other type of loan the lender calculates your future debt to income ratio.

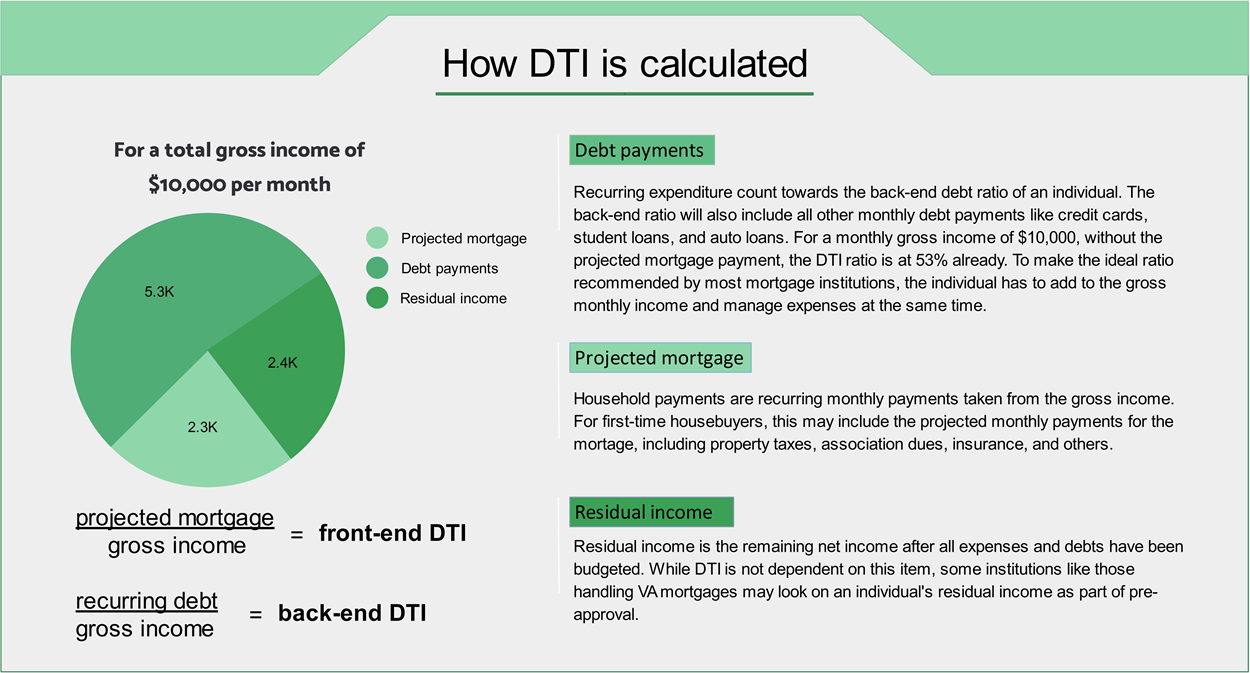

Then adjust the gross monthly. A debt to income or dti ratio is derived by dividing your monthly debt payments by your monthly gross income. The front end dti is typically calculated as housing.

To calculate your dti enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular payments. If they had no debt their ratio is 0. The result is your dti which will be in the form of a percentage.

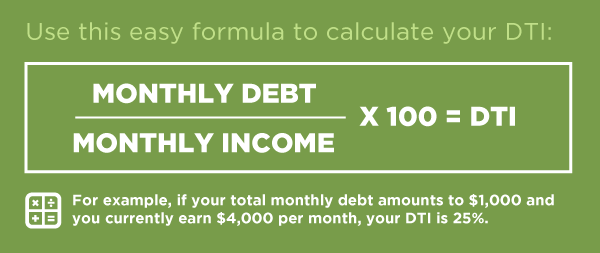

Dti monthly debt monthly income the first step in calculating your debt to income ratio is determining how much you spend each month on debt. To calculate your estimated dti ratio simply enter your current income and payments. Keep in mind that the underwriter assesses your future debt ratio not the one you have right now.

The sweet spot for approval is a ratio of 41 or less. The lower the dti. Divide the total by your gross monthly income which is your income before taxes.

The less risky you are to lenders. The front end debt to income ratio dti or the housing ratio calculates how much of a persons gross income is spent on housing costs. The ratio is expressed as a percentage and lenders use it to determine how well you.

As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their dti ratio is 48. To determine your dti ratio simply take your total debt figure and divide it by your income. Debt to income ratio dti is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

/DTIjpeg-5c5253f846e0fb000167ce85.jpg)

/debt-ratio-on-blackboard-with-hand-172449346-5b01bd2118ba0100376172ce.jpg)