How To Figure Out Gross Pay From Net Pay Canada

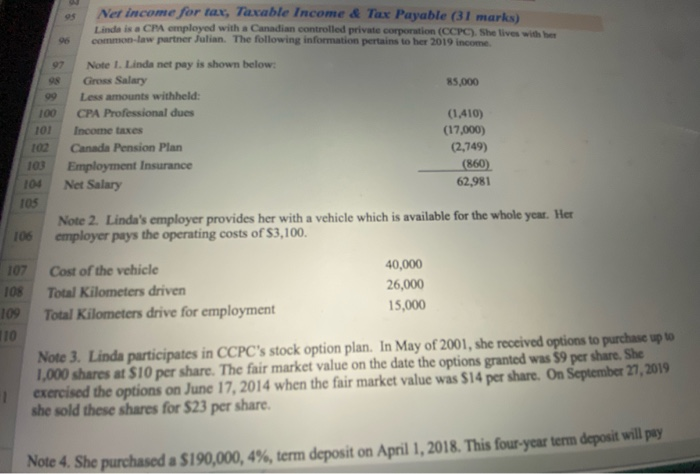

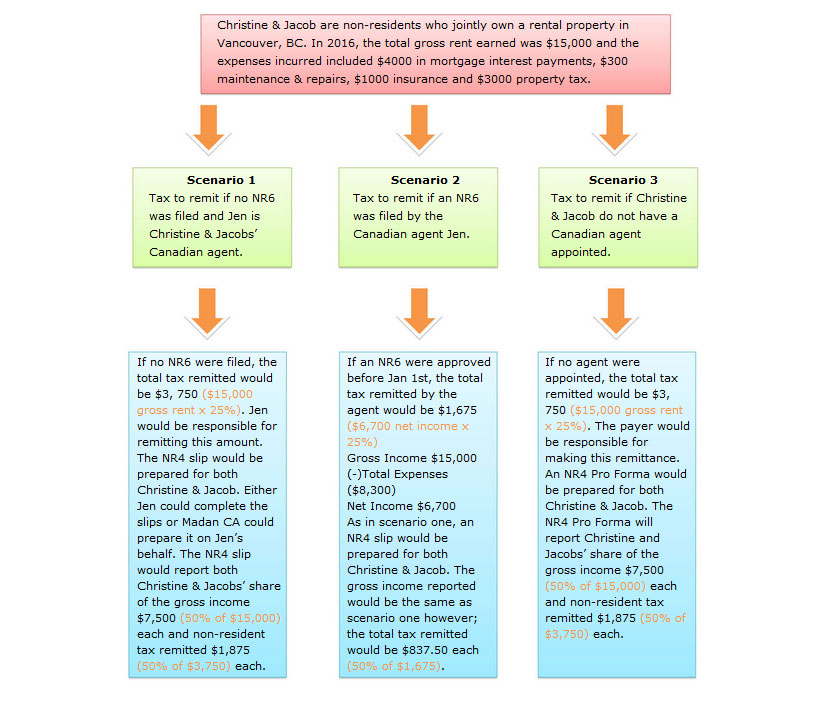

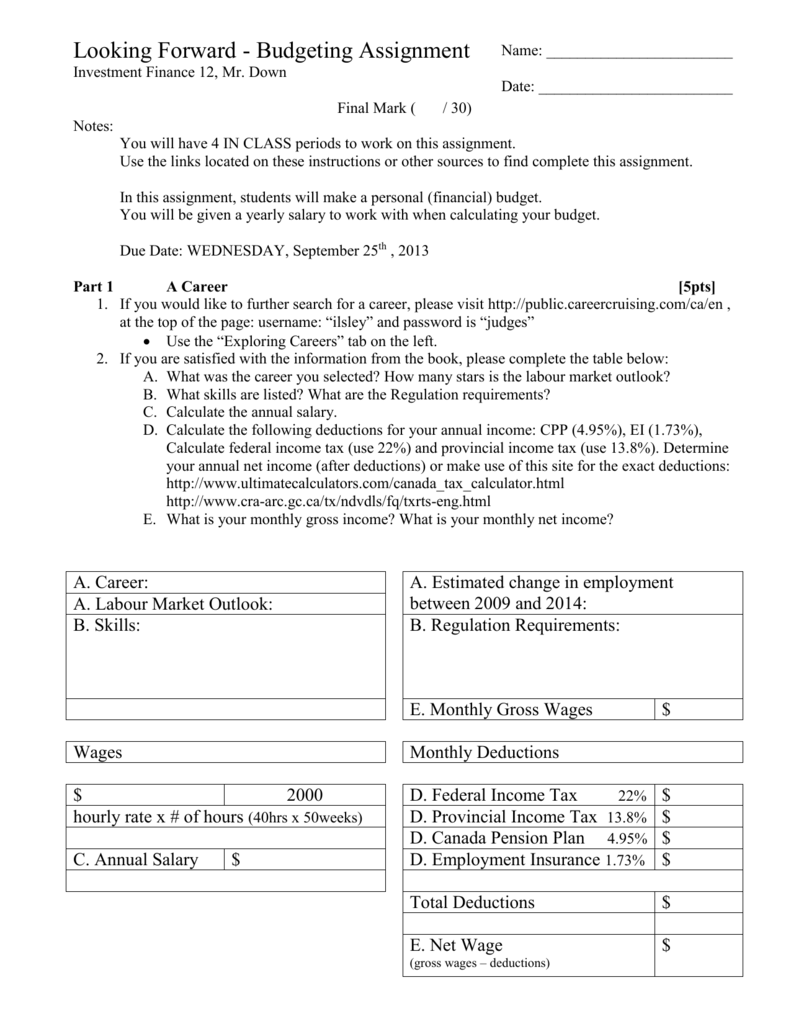

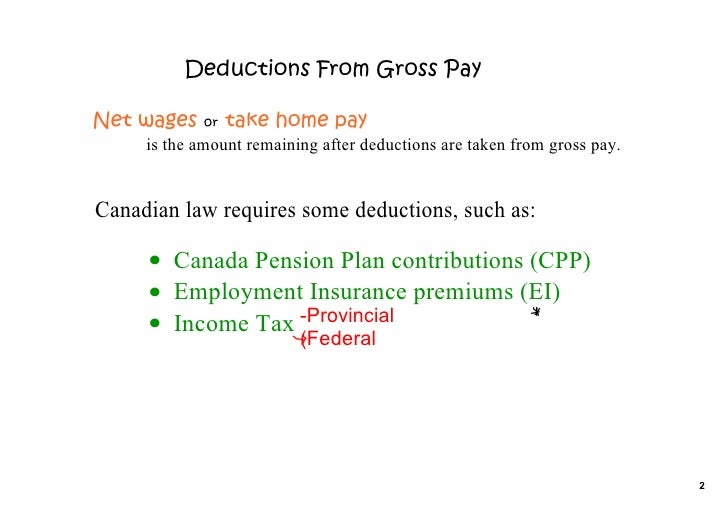

In the steps that follow weve broken out deductions into three parts.

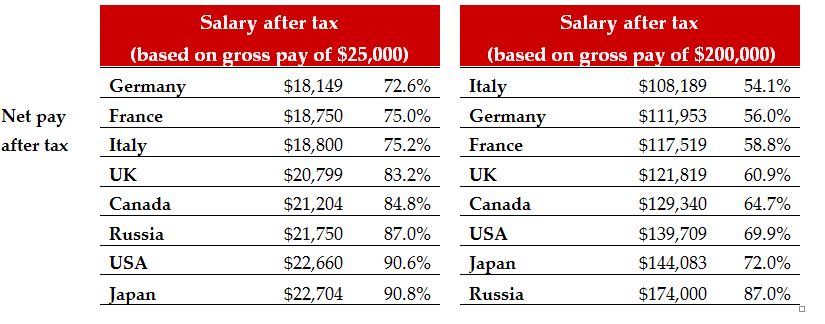

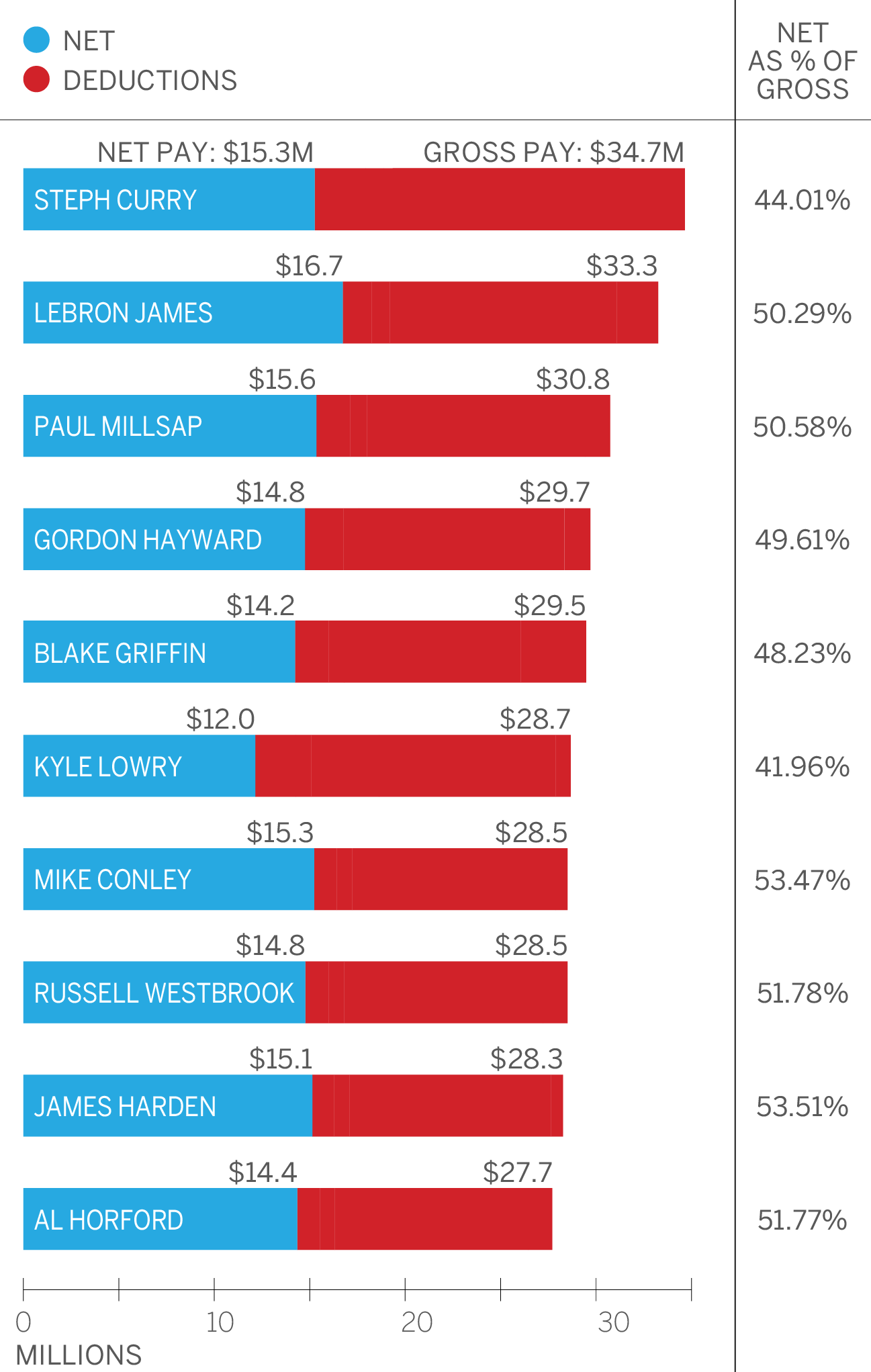

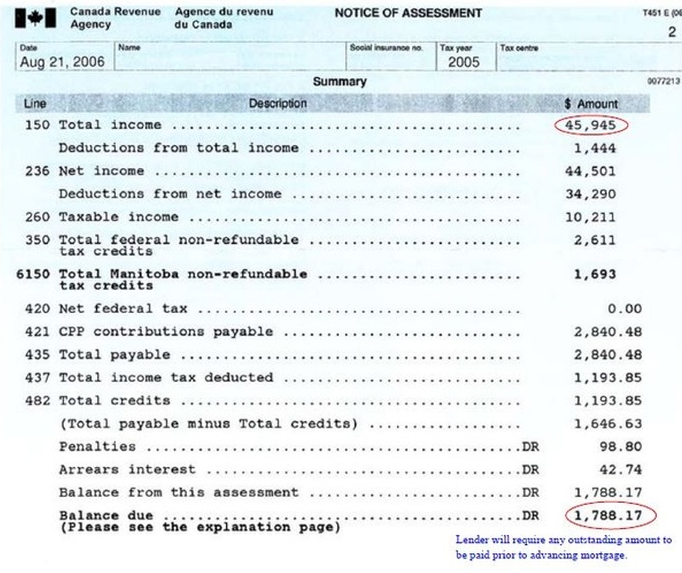

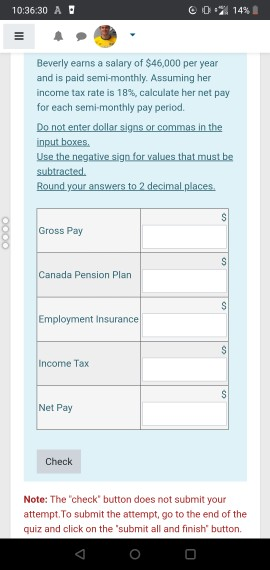

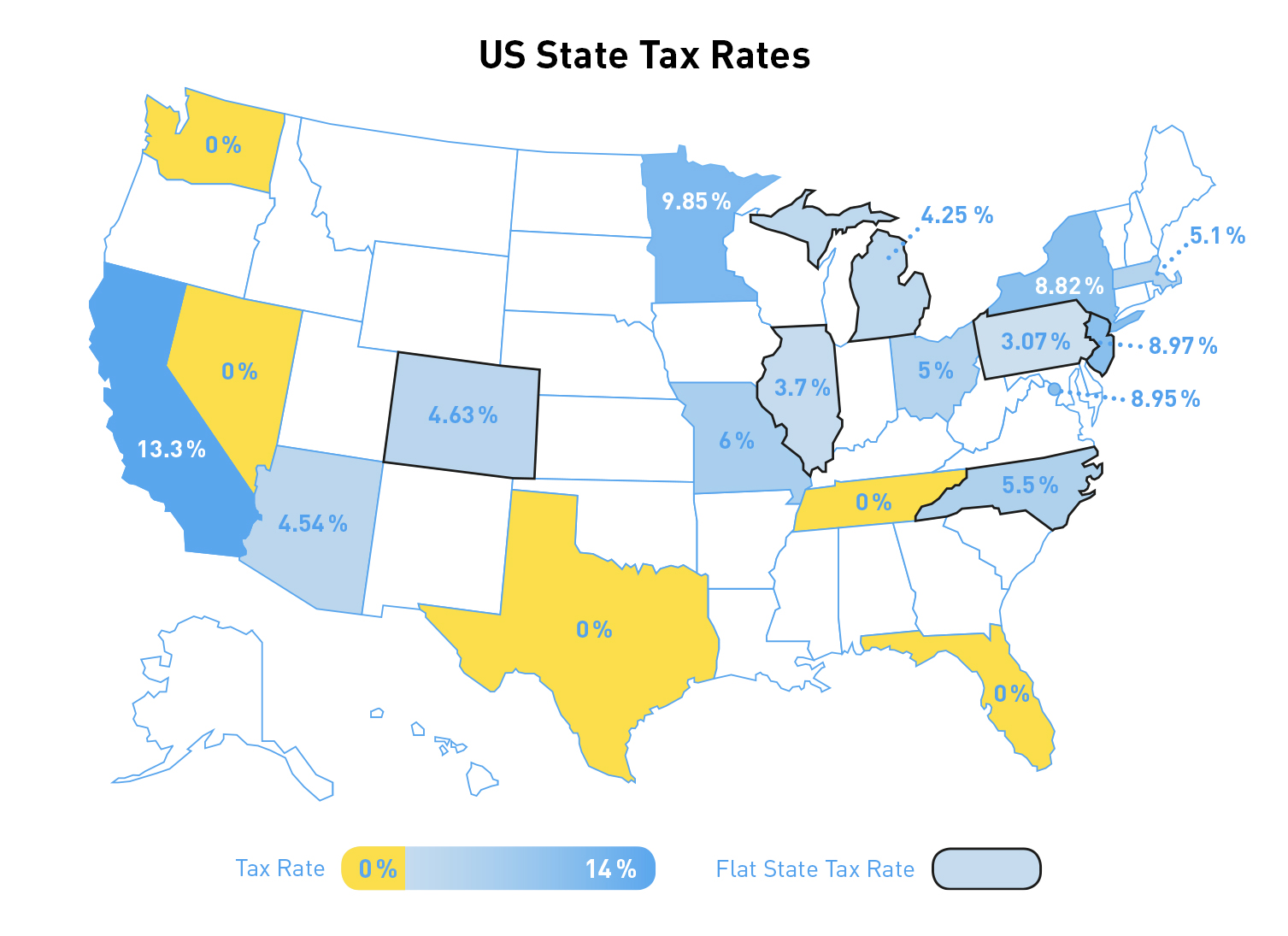

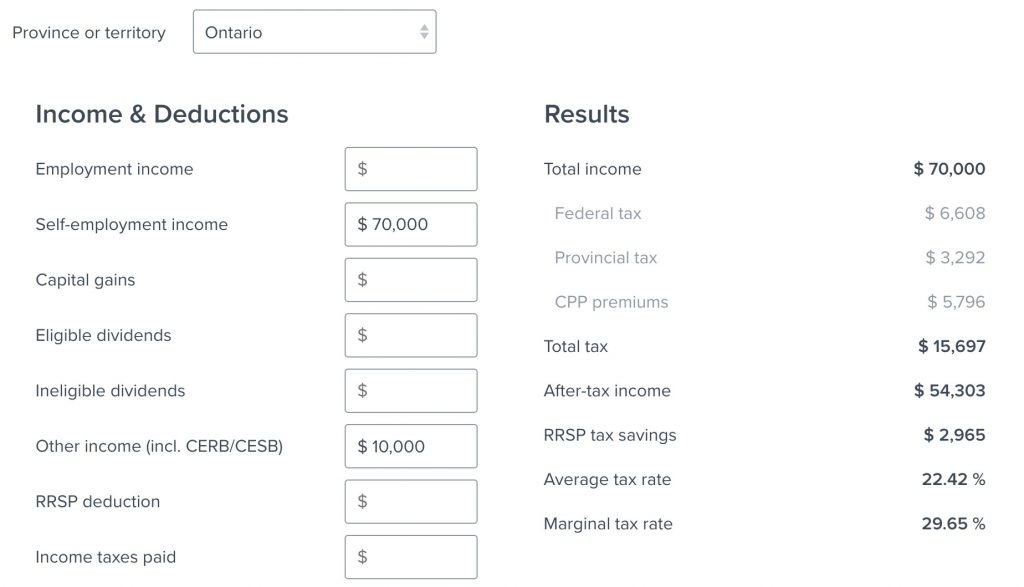

How to figure out gross pay from net pay canada. You can change this to monthly weekly four weekly hourly salary etc. If you make 52000 a year living in the region of ontario canada you will be taxed 11959that means that your net pay will be 40041 per year or 3337 per month. Gross annual income taxes surtax cpp ei net annual salary.

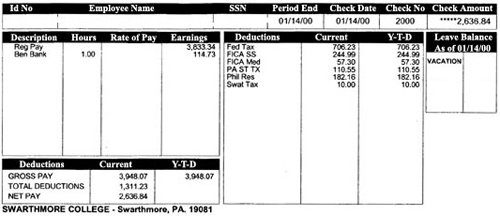

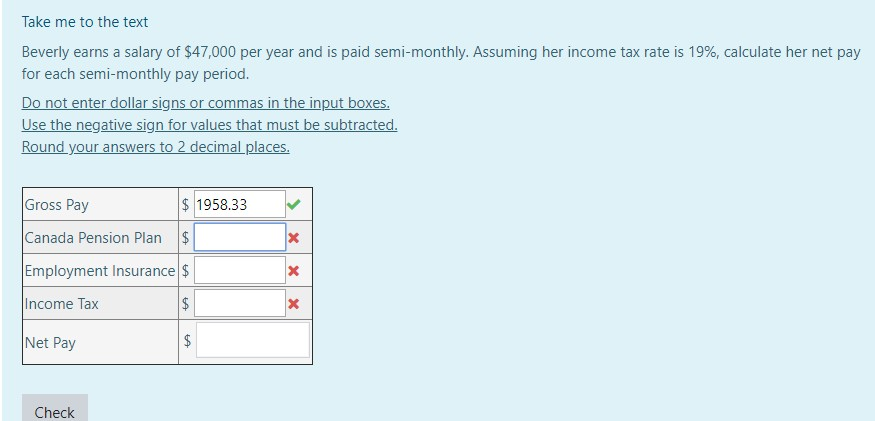

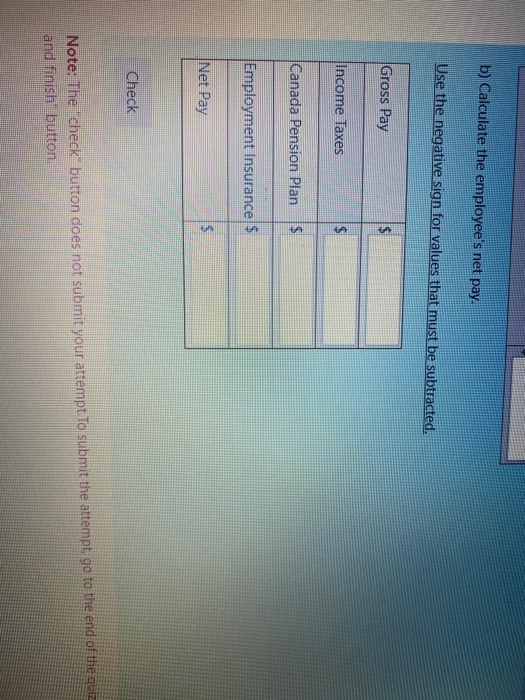

Were making it easier for you to process your payroll and give your employees a great experience with their payslips. Net annual salary weeks of work year net weekly income. The net pay formula subtracts an employees gross pay from their paycheck deductions.

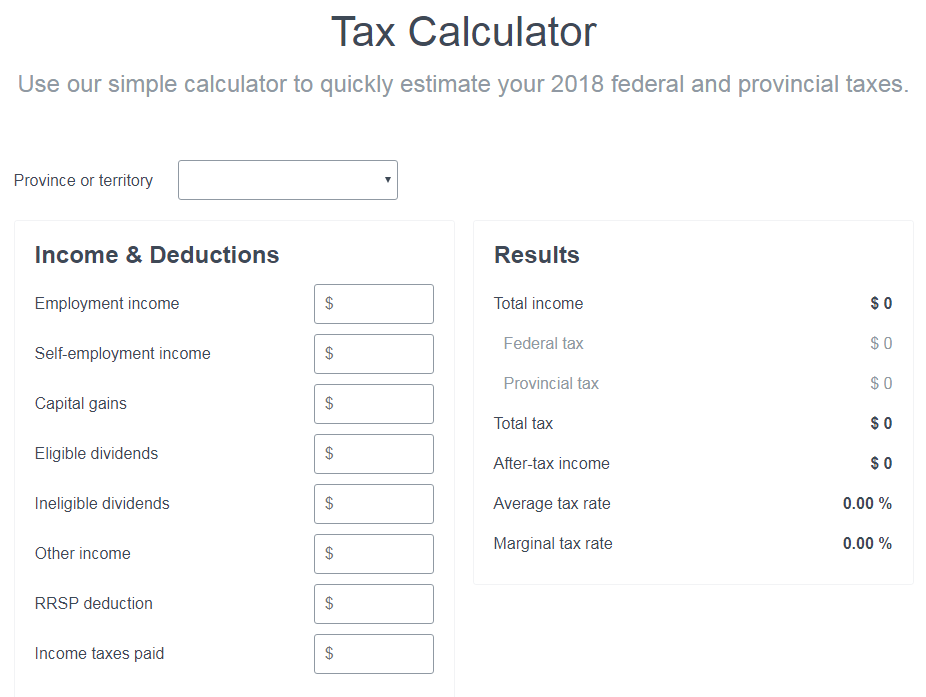

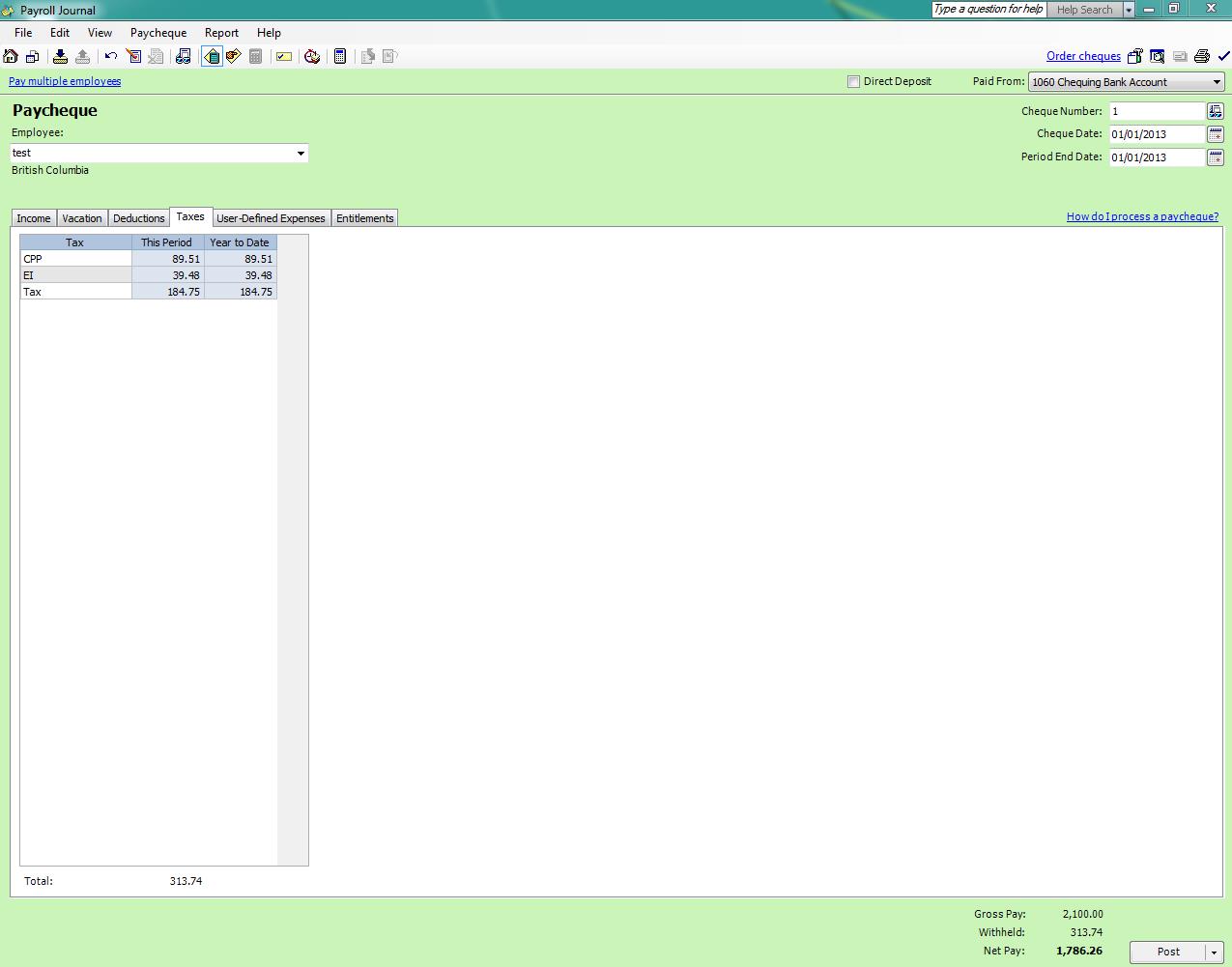

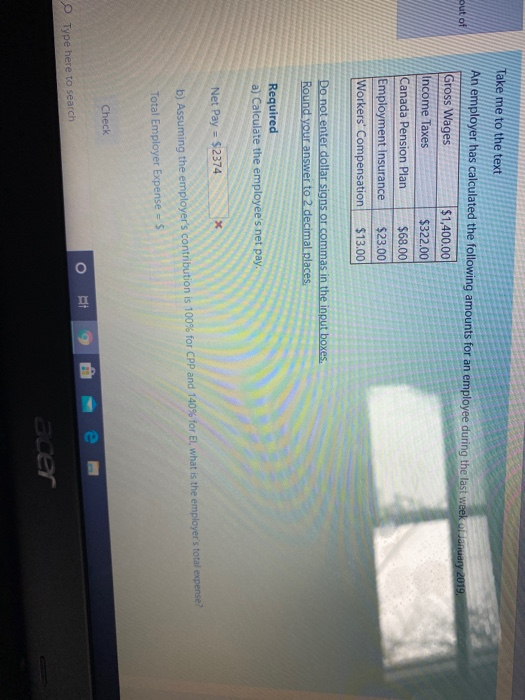

Income tax calculations and rrsp factoring for 202021 with historical pay figures on average earnings in canada for each market sector and location. You can use our payroll deductions online calculator pdoc to calculate payroll deductions for all provinces and territories except quebec. Once you finish entering employee information the payroll deductions calculator generates a salary calculation result that shows the gross wages federal and provincial deductions cpp and ei contributions and the employees actual net pay.

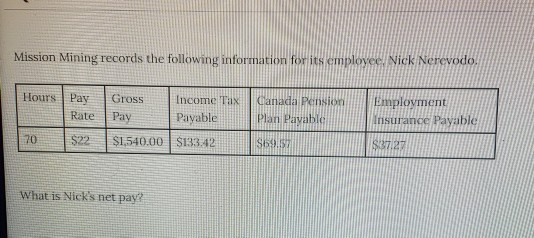

How to calculate net pay. Formula for calculating net salary. The annual net income is calculated by subtracting the amounts related to the tax canada tax and ontario tax the ontario surtax the canadian pension plan the employment insurance.

As required to calculate your net pay in canada. Is your annual salary before tax. You perform a job and your gross pay is 50.

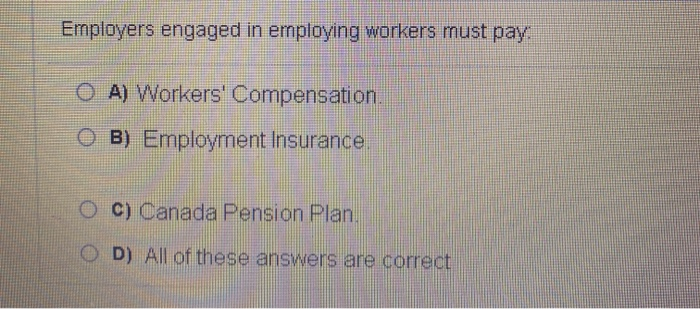

Pre tax deductions taxes and additional deductions. The income tax is 20 so your net income is 50 20 50 10 40. Were bringing innovation and simplicity back into the canadian payroll market from new ways to pay your employees to our open developer program.

Salary calculations include gross annual income tax deductible elements such as child care alimony and include family related tax allowances. Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage. Net price is 40 gross price is 50 and the tax is 25.

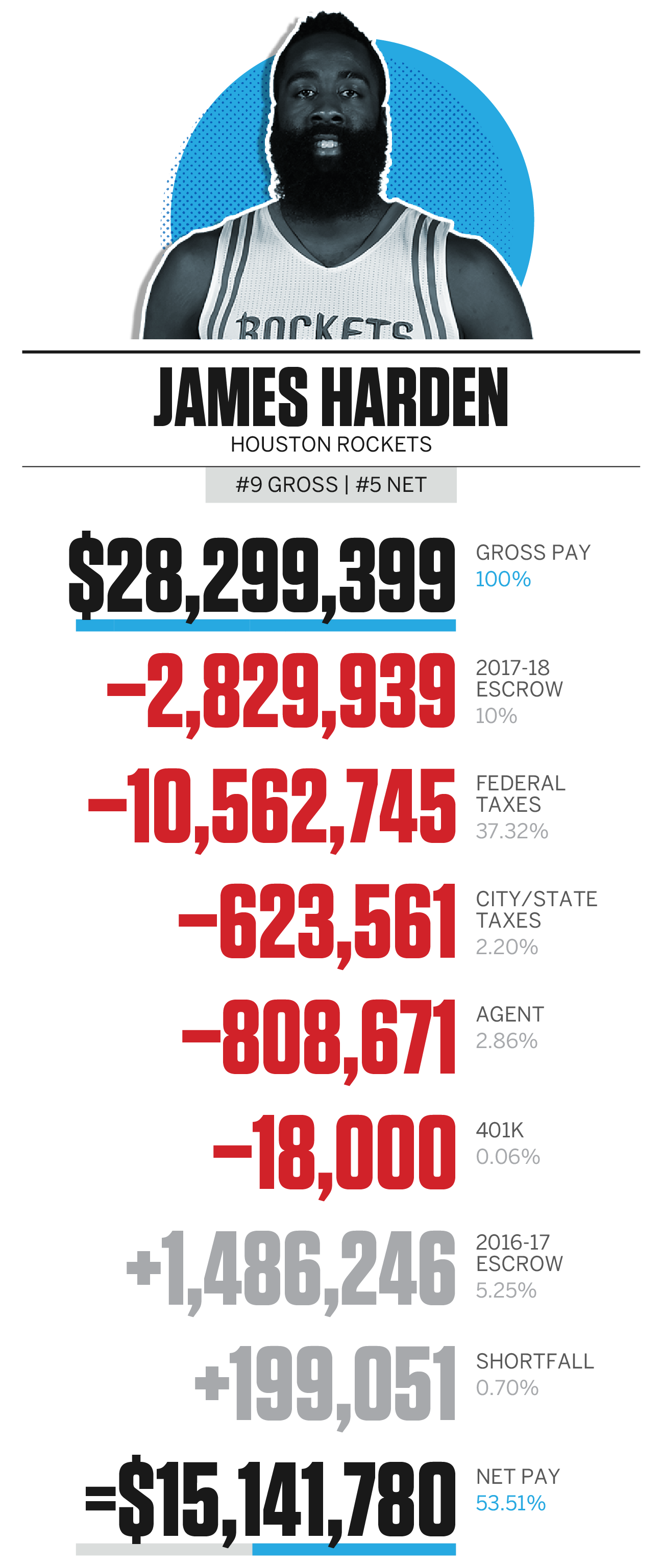

Gross pay deductions net pay. Your average tax rate is 2300 and your marginal tax rate is 3526this marginal tax rate means that your immediate additional income will be taxed at this rate.

Oc Monthly Gross Earnings Before Taxes Vs Net Income After Taxes Usd Ppp Oecd Dataisbeautiful

www.reddit.com

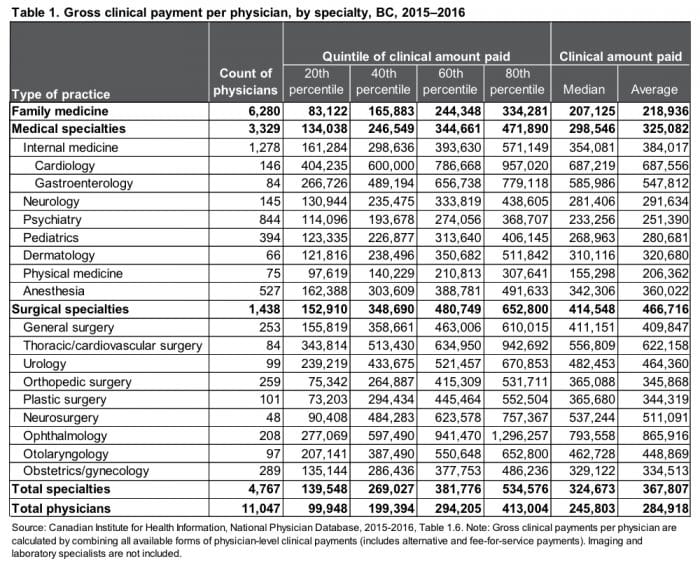

Net Income Of Canadian Physicians And Average Citizens With Gross Download Scientific Diagram

www.researchgate.net

Canadian Net Farm Income Green And Gross Revenue Blue Inflation Download Scientific Diagram

www.researchgate.net

/paper-pay-slip-with-tax-and-pension-information-137555952-5bcb8401c9e77c0051c7b3e7.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/what-is-a-pay-period-what-are-types-of-pay-periods-398392_final-7948322d88a2460fa54578889ddae395.jpg)

:max_bytes(150000):strip_icc()/Netoftax-taxrates-464cac356d8c468c97eb98a8e92f4052.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9278701/lowry_salary.jpg)