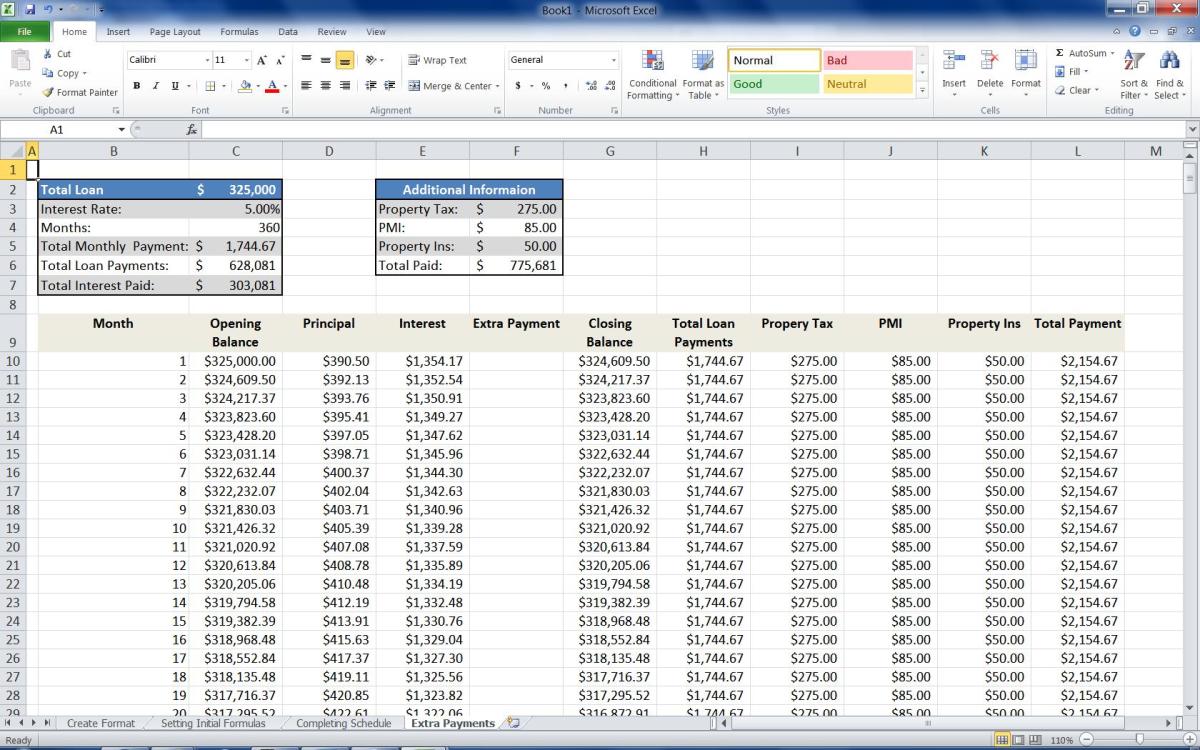

How To Calculate Extra Mortgage Payments

Extra payments in the middle of the loan term.

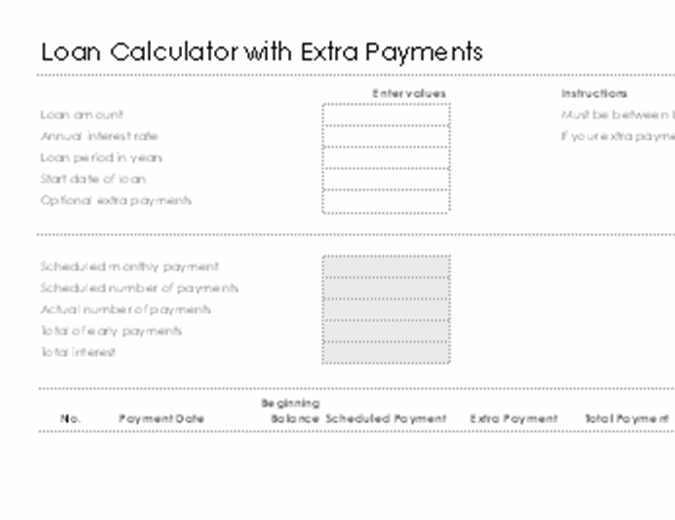

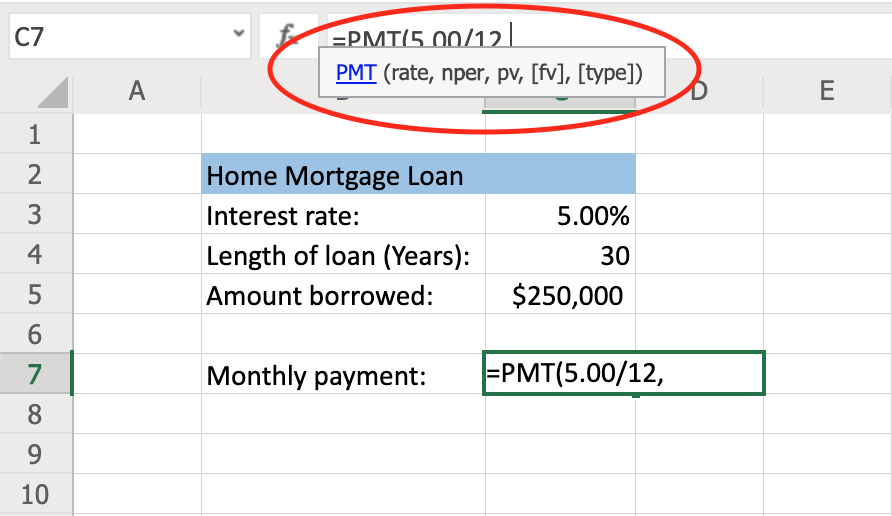

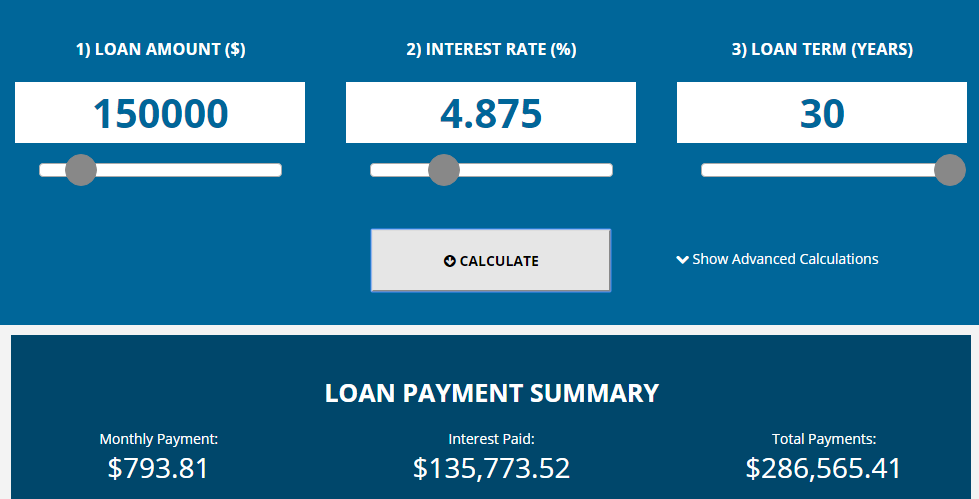

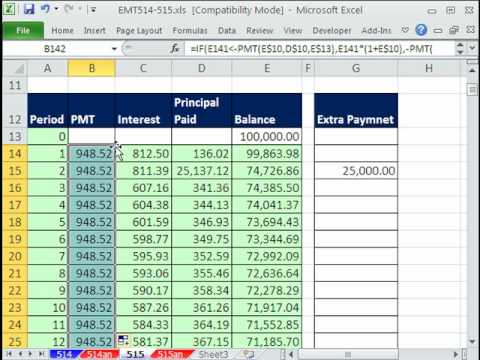

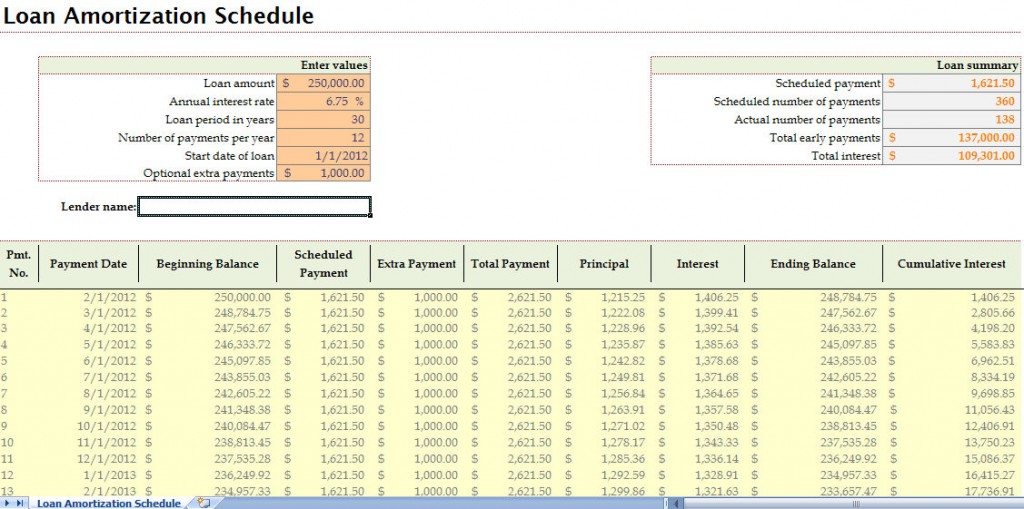

How to calculate extra mortgage payments. Then examine the principal balances by payment total of all payments made and total interest paid. Do you need more advanced calculation options. Save money by refinancing your 45 apr 30 year 26000000 home loan today.

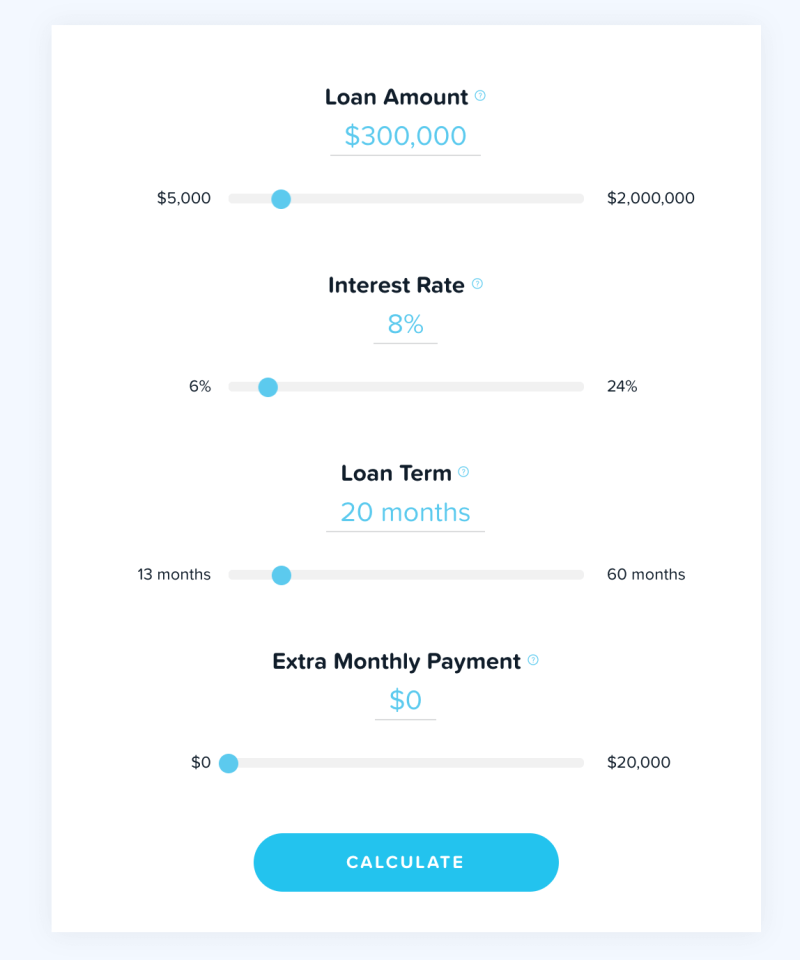

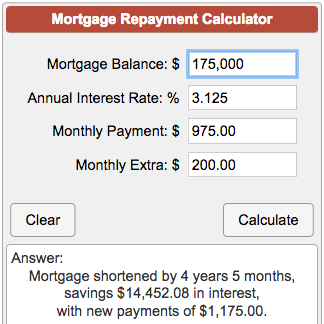

Your interest rate is typically represented as an annual percentage of your remaining loan balance. Please see our bi weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. Can you make payments directly to your principal.

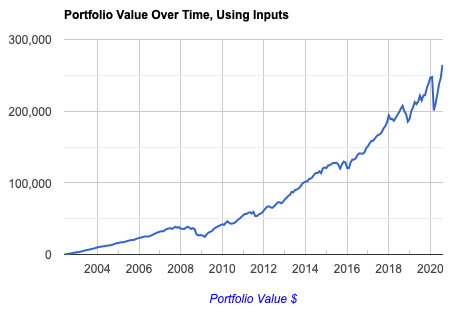

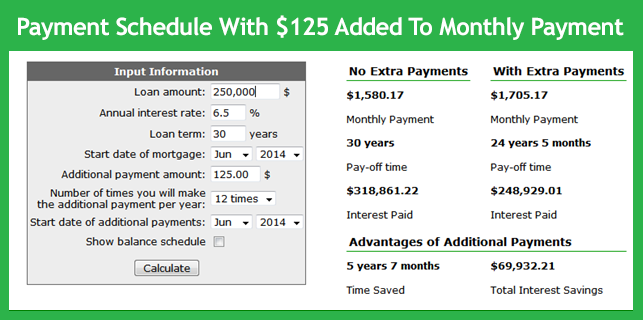

But as youre about to discover you will certainly notice the increased cash flow that will occur when you pay your mortgage off way ahead of schedule. In effect you will be making one extra mortgage payment per year without hardly noticing the additional cash outflow. The extra payments lower future interest for the remaining months and years which becomes more apparent if you make extra payments in the early years.

If half of each of your paychecks goes to your mortgage you still have only 24 mortgage based payments leaving two extra paychecks per year that do not apply to your mortgage. The following table highlights locally available current mortgage rates. Get to know you options.

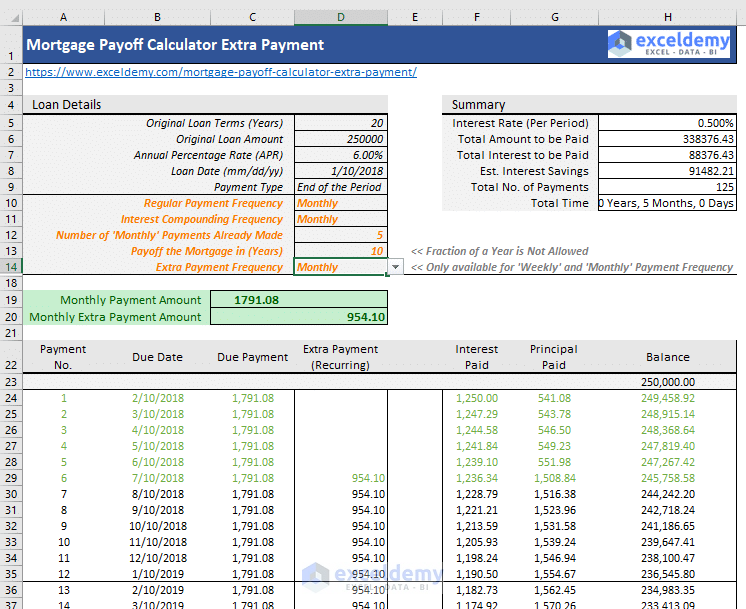

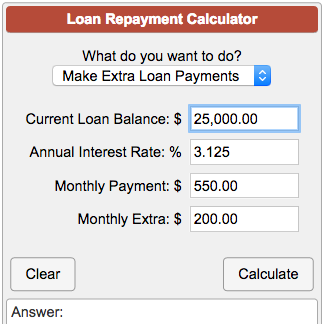

If you start making extra payments in the middle of your loan then enter the current loan balance when you started making. Want to make irregular payments. When you have a mortgage on your home the interest rate is the ongoing amount you pay to finance your home purchase.

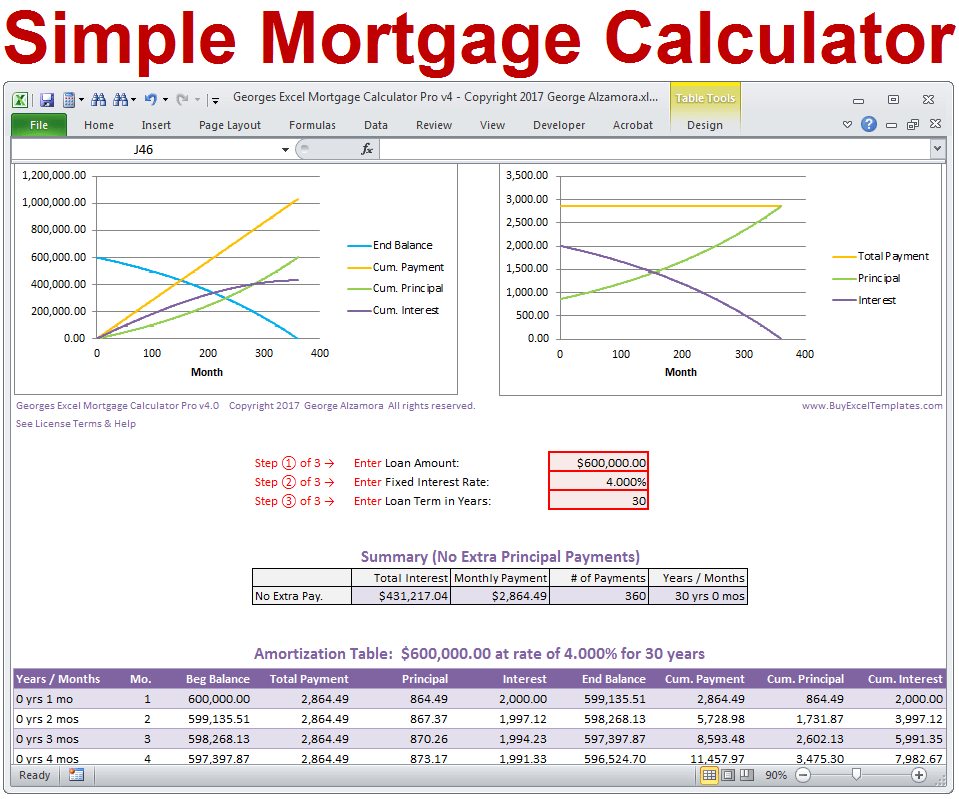

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Buyexceltemplates Com

www.buyexceltemplates.com

/157194462-56a2eeb23df78cf7727b359e.jpg)

:max_bytes(150000):strip_icc()/sick-of-mortgage-payments-pay-off-your-home-early-453826_Final-201fc508b83c4f839d73a7a8bb4d1098.png)

/how-do-i-make-extra-payments-on-my-loans-2385993-Final-37d8f0ec56174885a783a241a3045332.png)