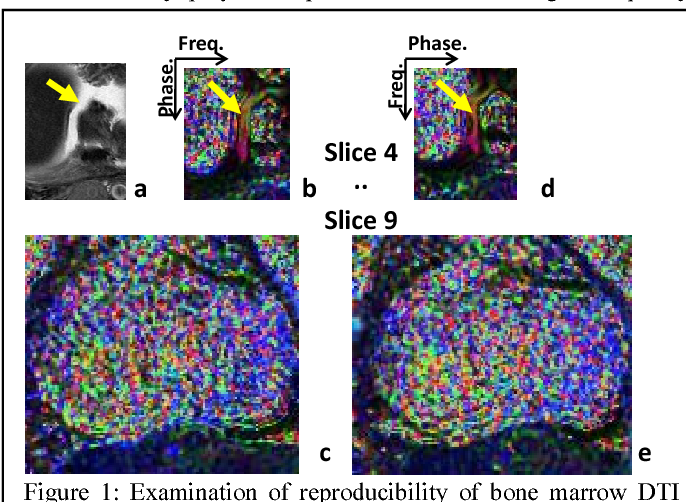

How To Figure Dti

Debt To Income Ratio Dti What It Is And How To Calculate It The Truth About Mortgage Com

www.thetruthaboutmortgage.com

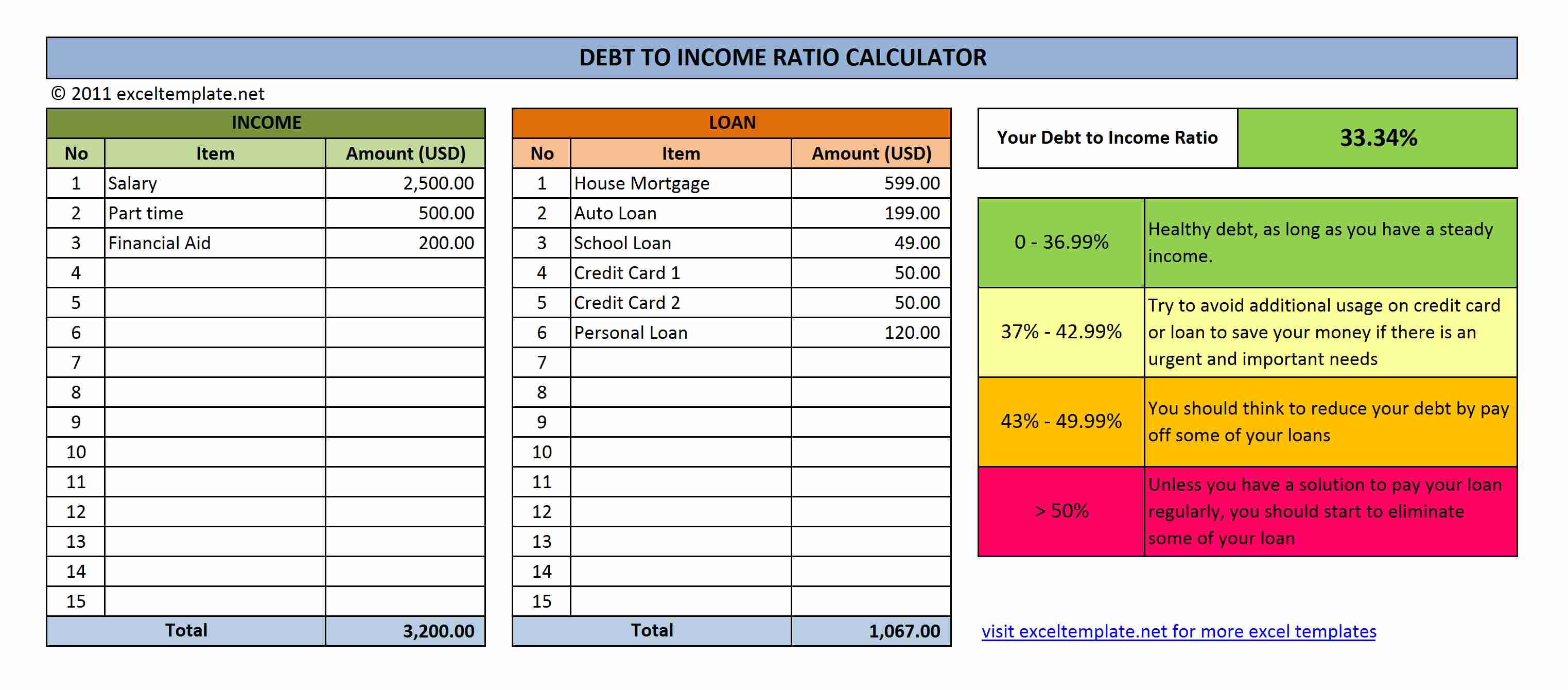

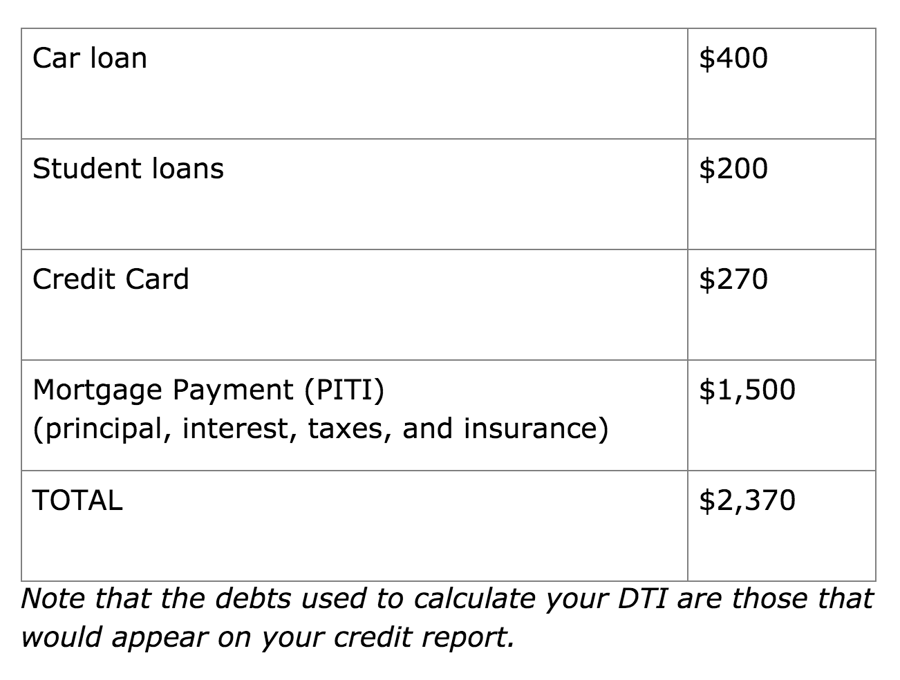

Add up your estimated monthly mortgage payment and other monthly debt payments and write down the total.

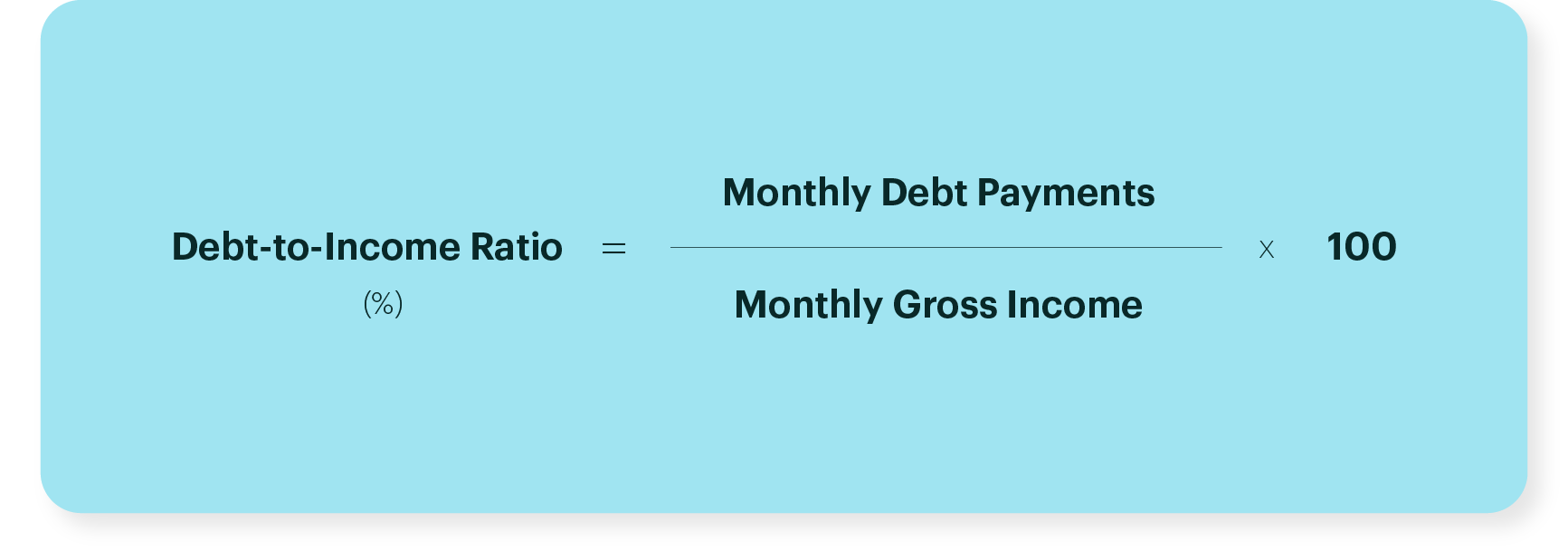

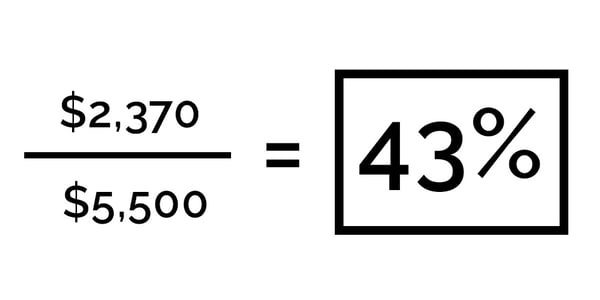

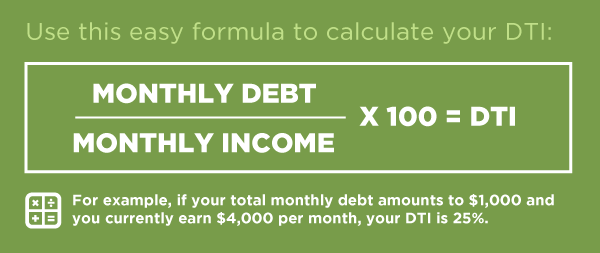

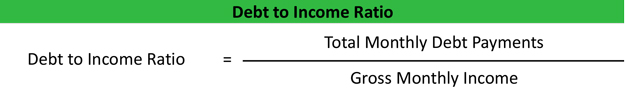

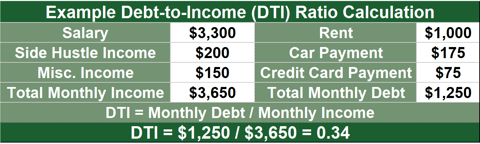

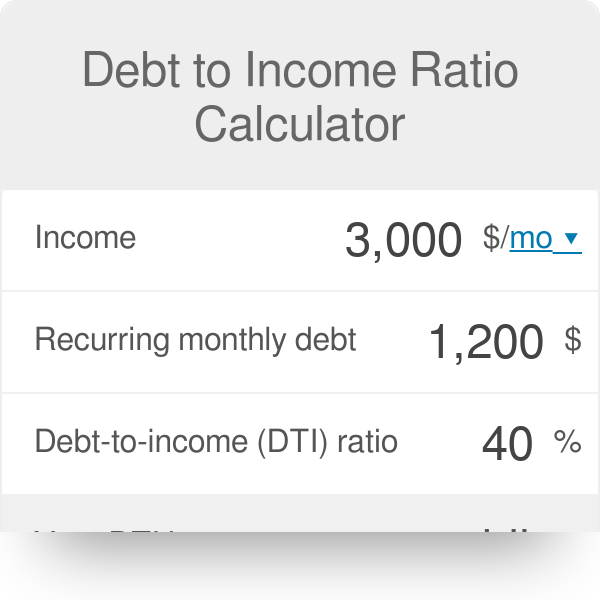

How to figure dti. Then divide that total by your gross monthly income amount. Debt to income ratio dti divides the total of all monthly debt payments by gross monthly income giving you a percentage. To calculate your estimated dti ratio simply enter your current income and payments.

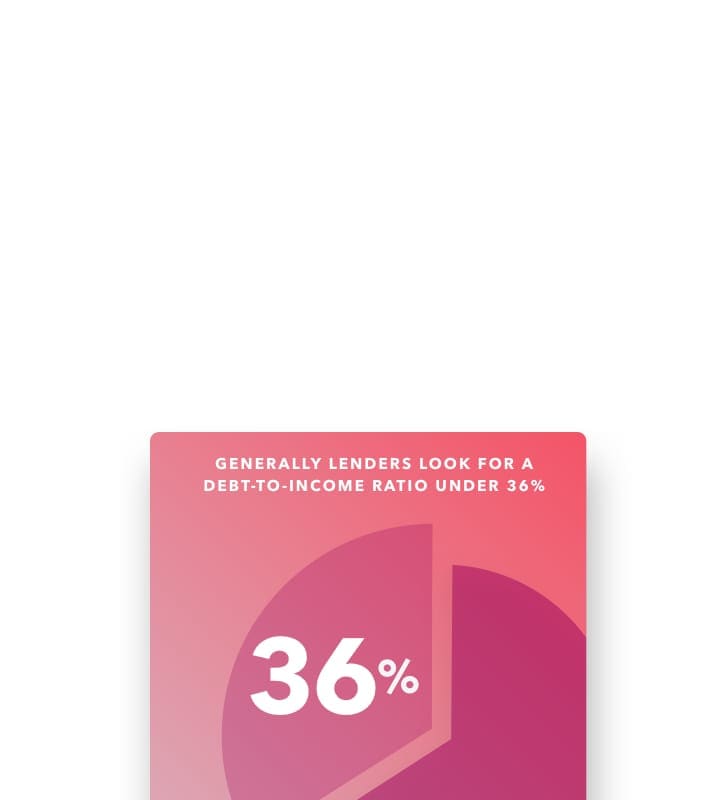

Heres what you should know. Well help you understand what it means for you. Lenders use dti along with credit history.

To start add up the total amount of your monthly debt payments including the following. You can calculate your dti by adding up your monthly minimum debt payments and dividing it by your monthly pre tax income. The result is your dti which will be in the form of a percentage.

A debt to income ratio example. Your debt to income ratio dti is a percentage that tells lenders how much money you spend versus how much money you have coming into your household. Divide the total by your gross monthly income which is your income before taxes.

Youll have a decimal number multiply that figure by 100 to get your dti ratio calculation. This number will be compared against your income to calculate your back end ratio. To determine your dti ratio simply take your total debt figure and divide it by your income.

The less risky you are to lenders. Your debt to income dti ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. For instance if your debt costs 2000 per month and your monthly income equals 6000 your dti is 2000 6000 or 33 percent.

Https Www Corelogic Com Blog 2020 8 Conventional Loans Near 60 Of The 1 8 Million Loans With A Dti Over 43 Percent Aspx

www.corelogic.com

A Scheme Representing The Newmark B Implicit Dti Scheme Standard Download Scientific Diagram

www.researchgate.net

:max_bytes(150000):strip_icc()/DTIjpeg-5c5253f846e0fb000167ce85.jpg)