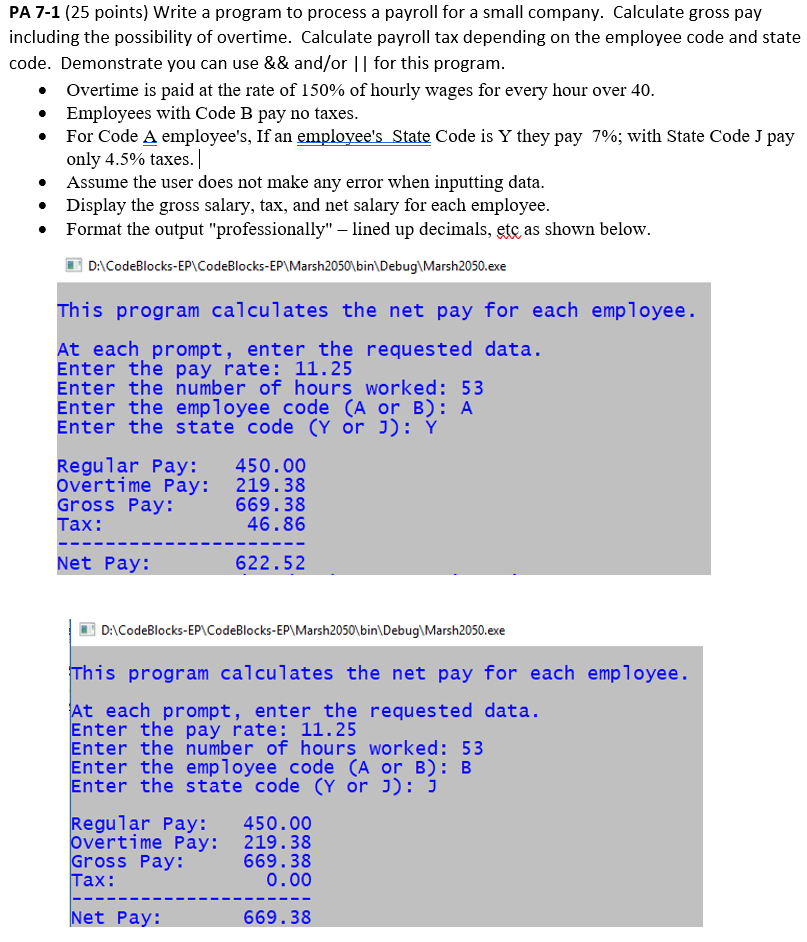

How To Figure Out Gross Pay From Net Pay

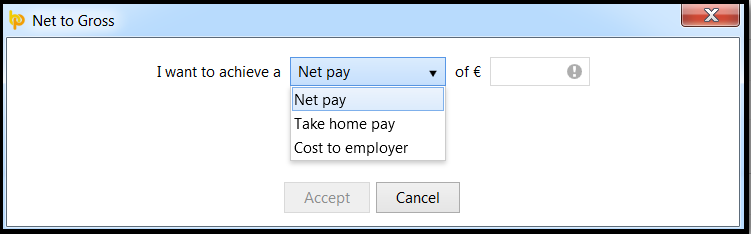

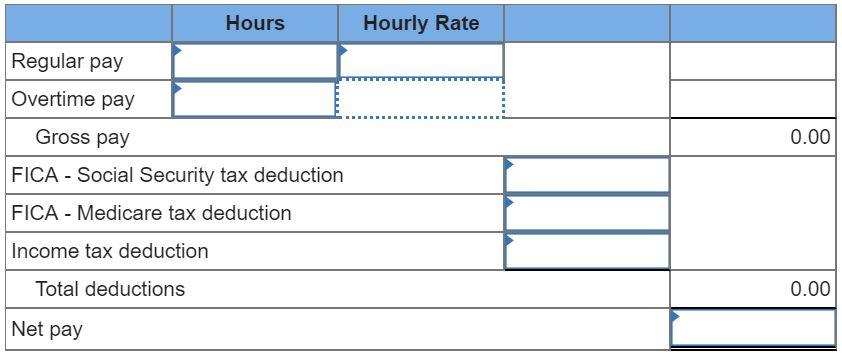

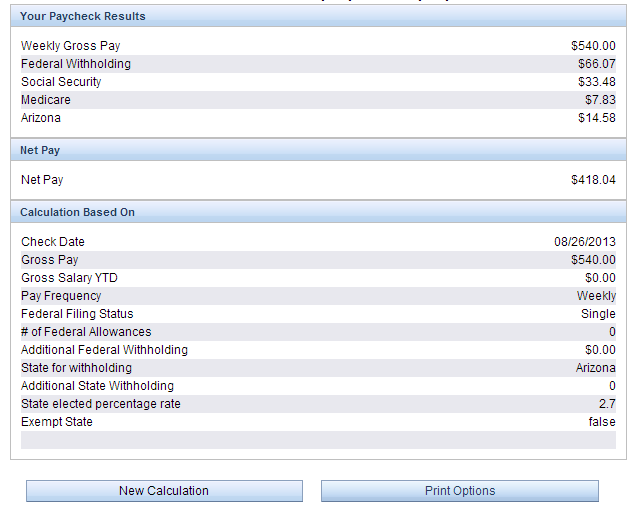

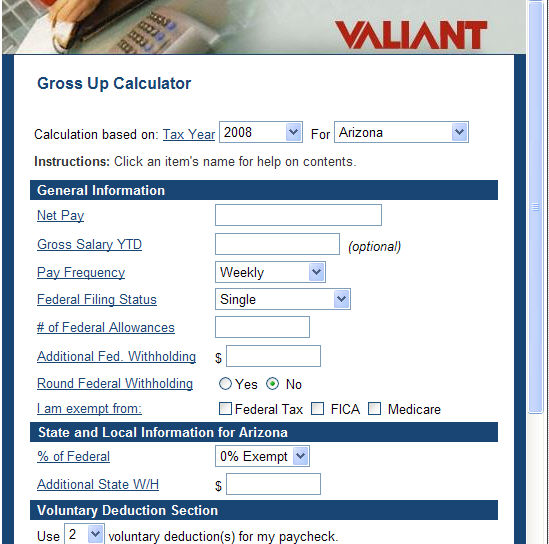

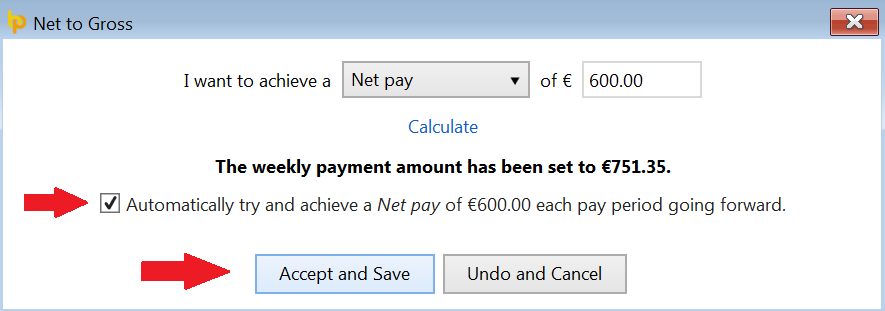

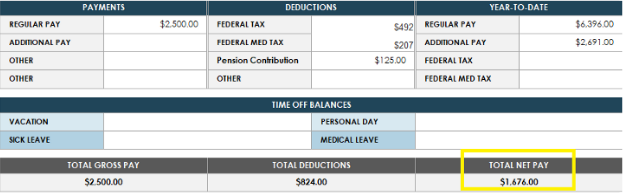

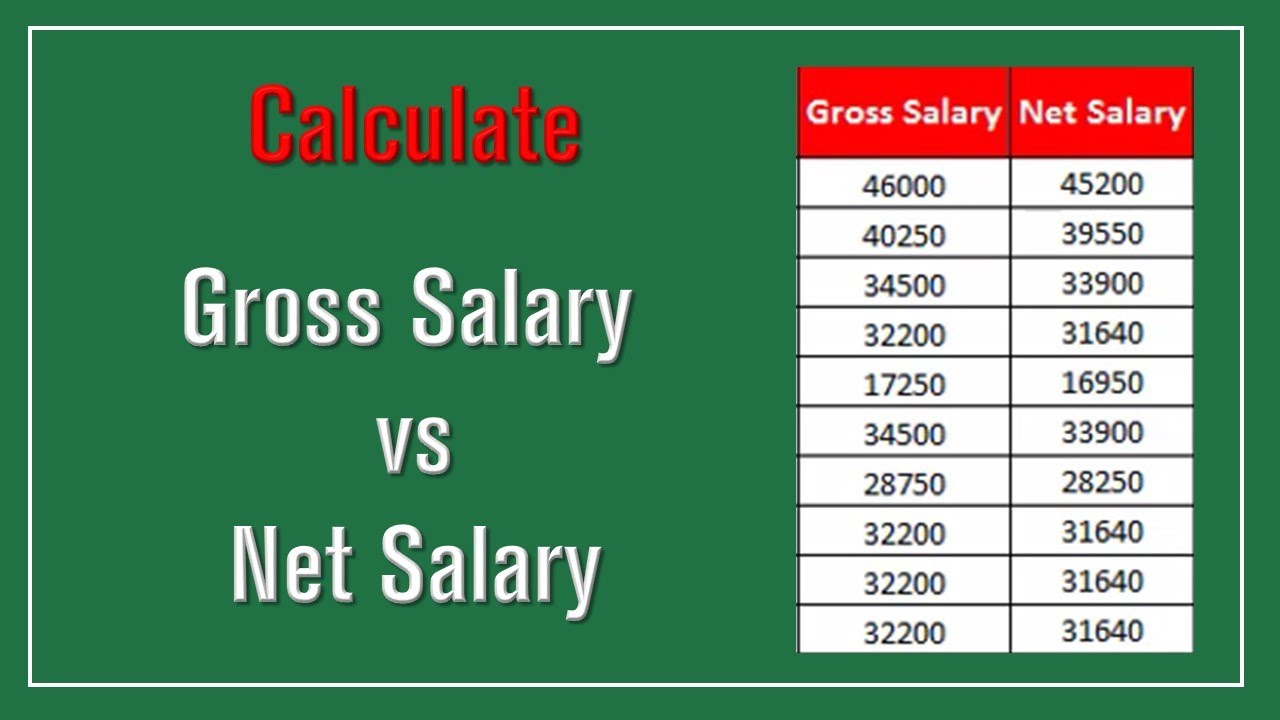

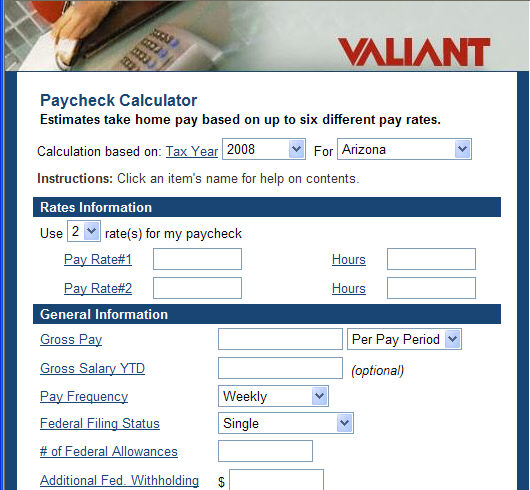

For example if an employee receives 500 in take home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

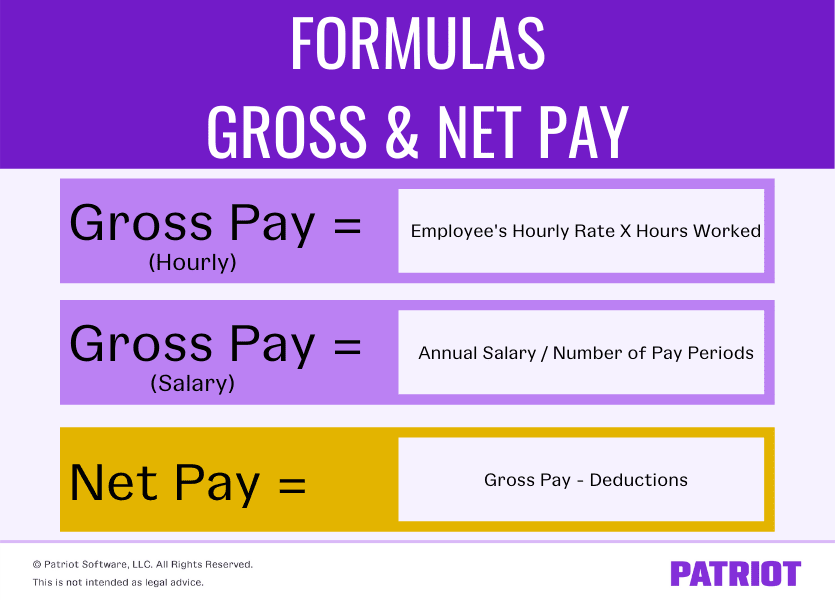

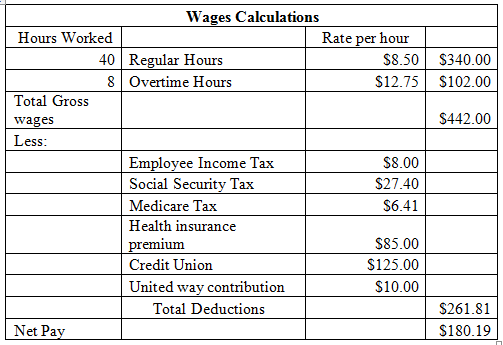

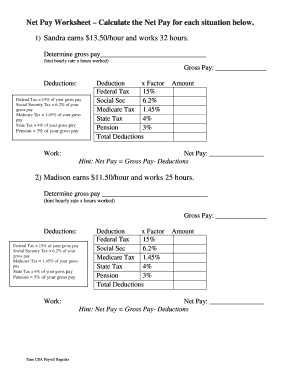

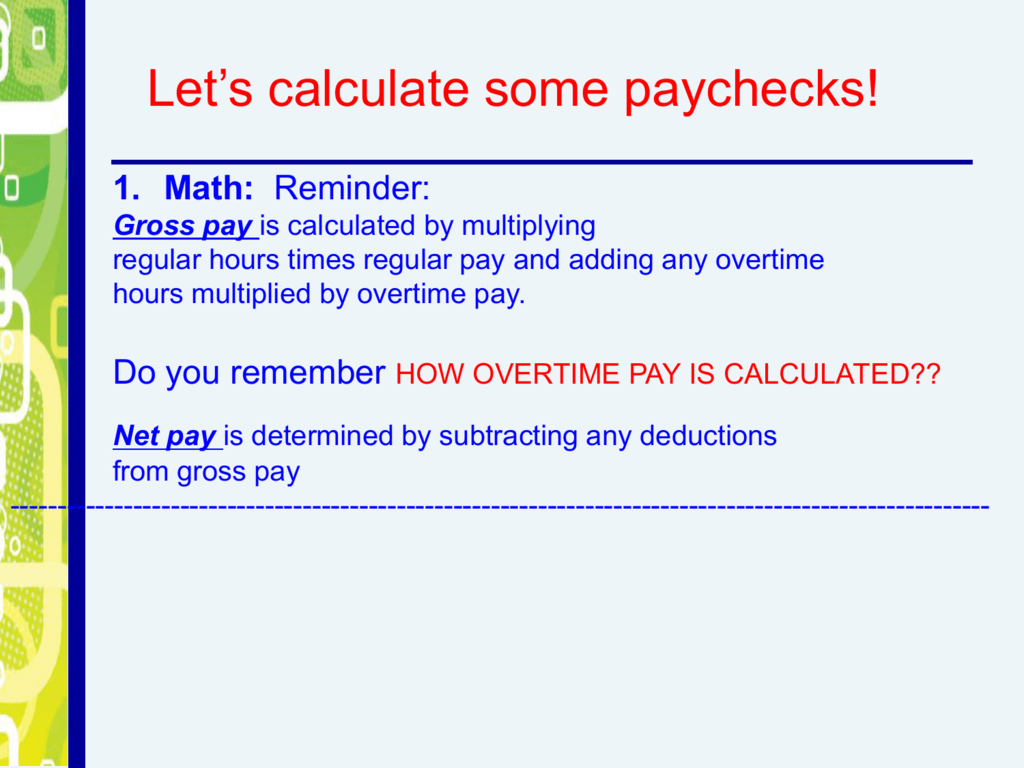

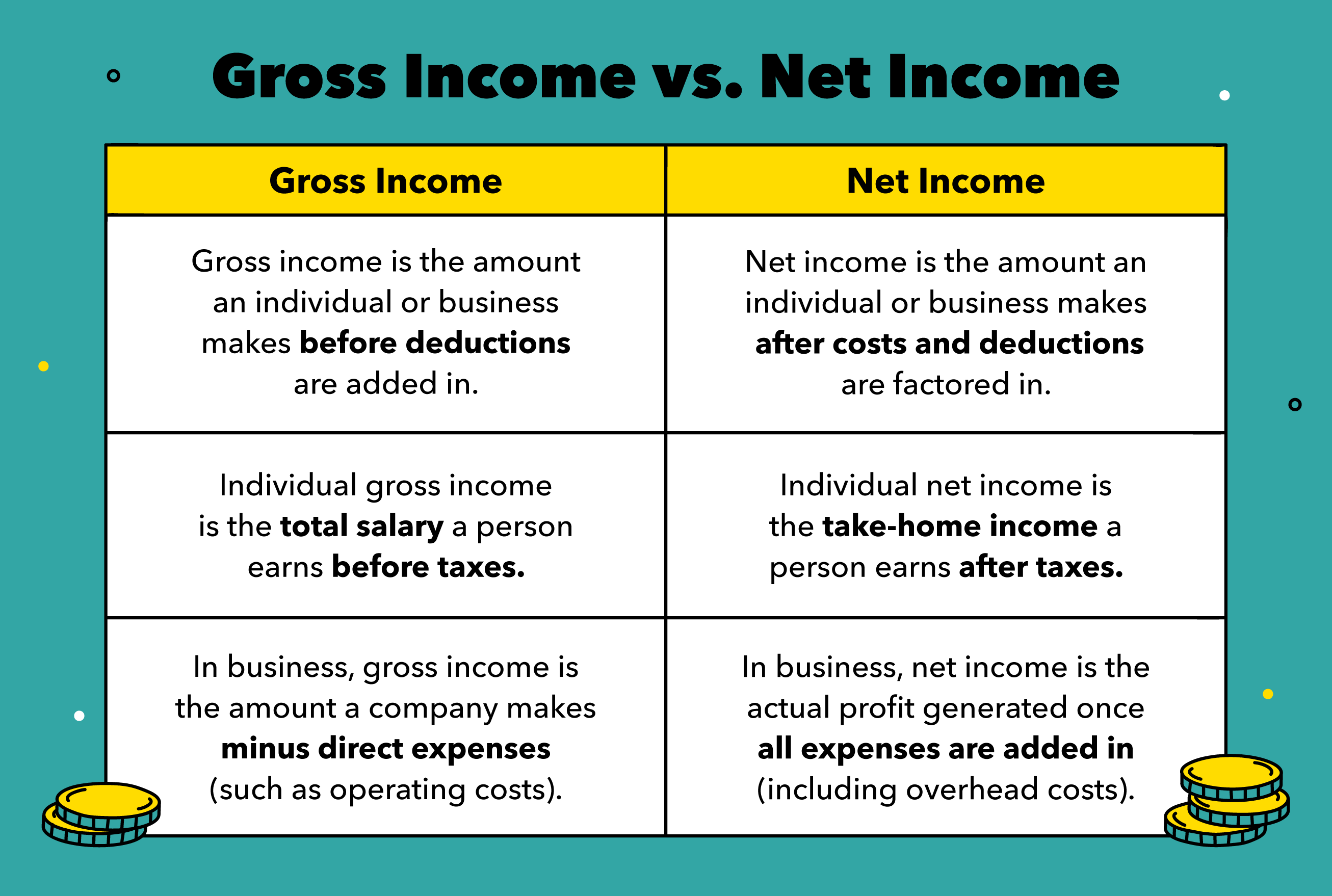

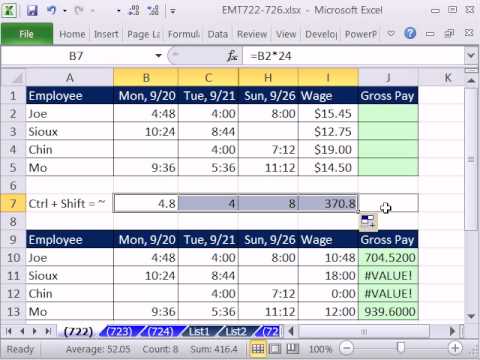

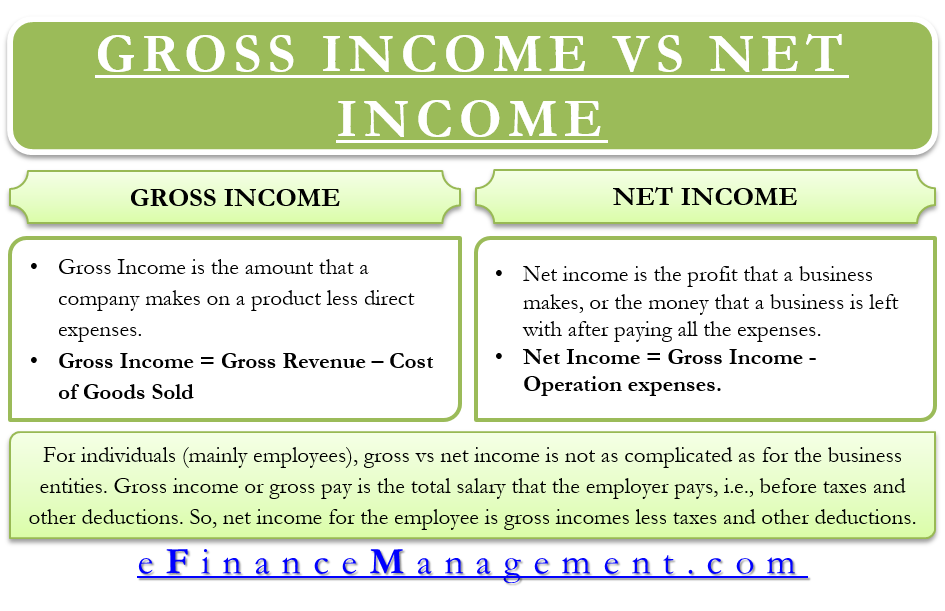

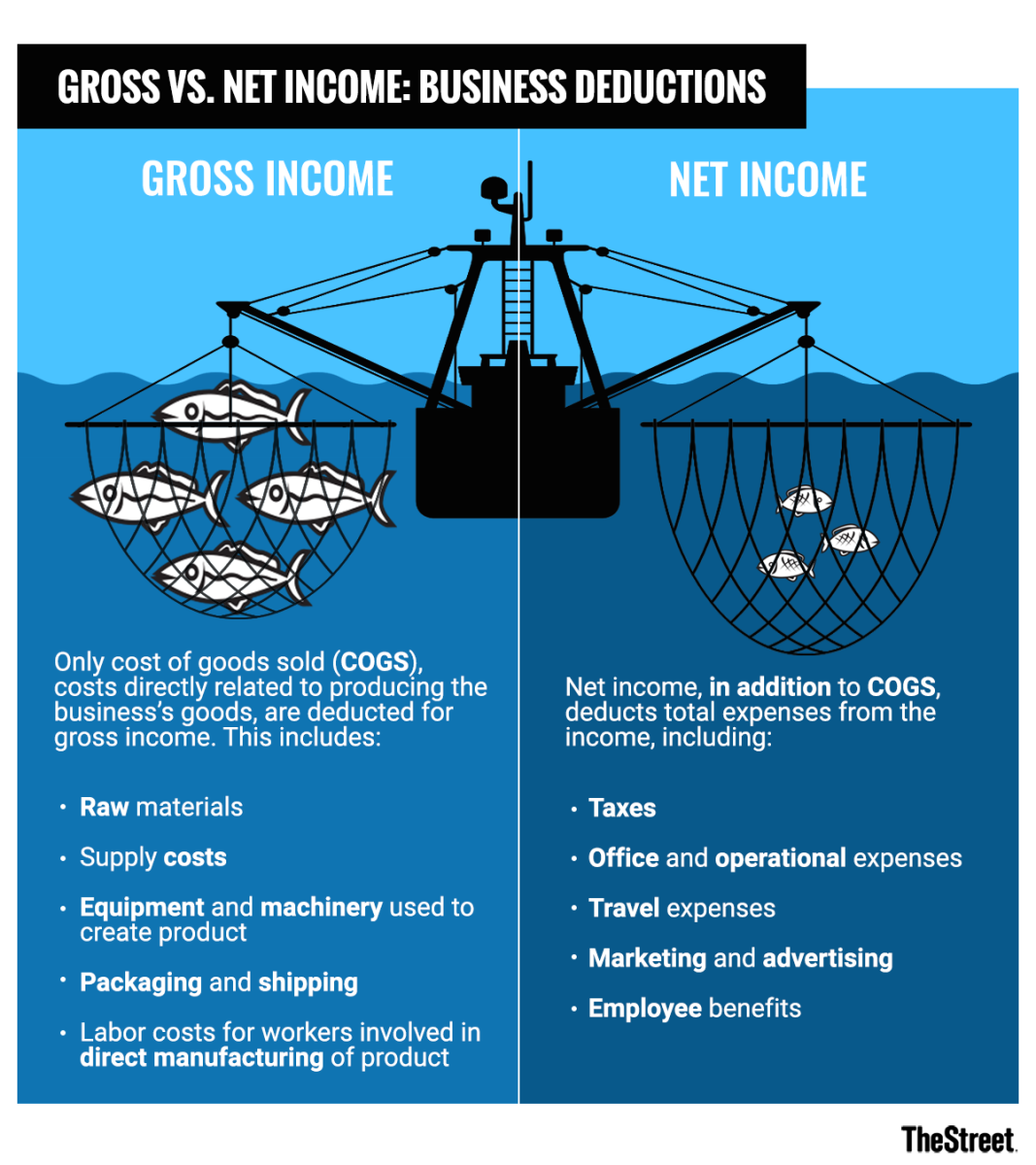

How to figure out gross pay from net pay. Salary employees divide the annual salary by the number of pay periods each year. Then add any additional income the employee has earned that pay period just as you did with the hourly employees. What is net pay.

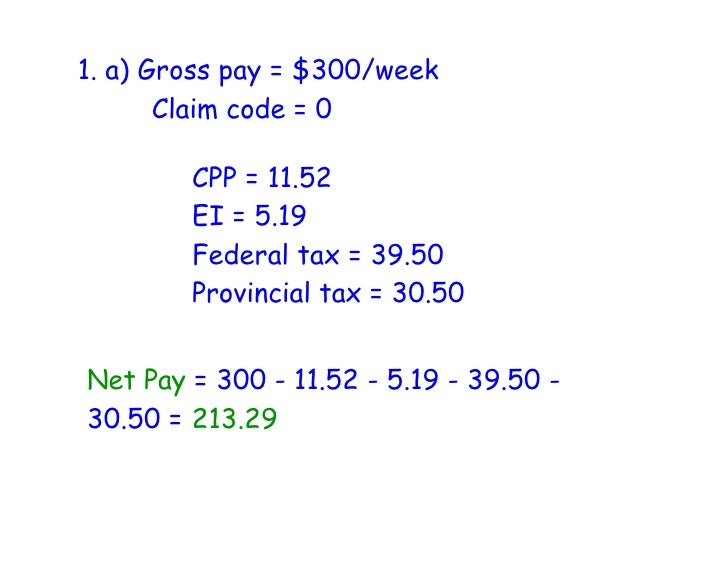

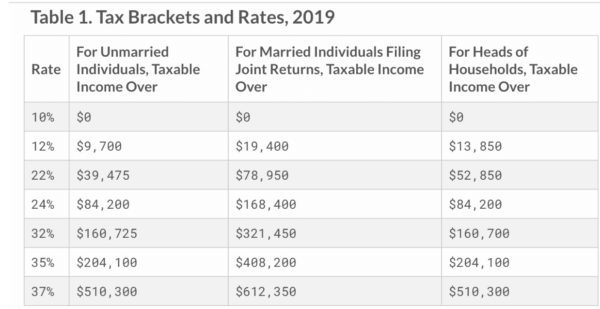

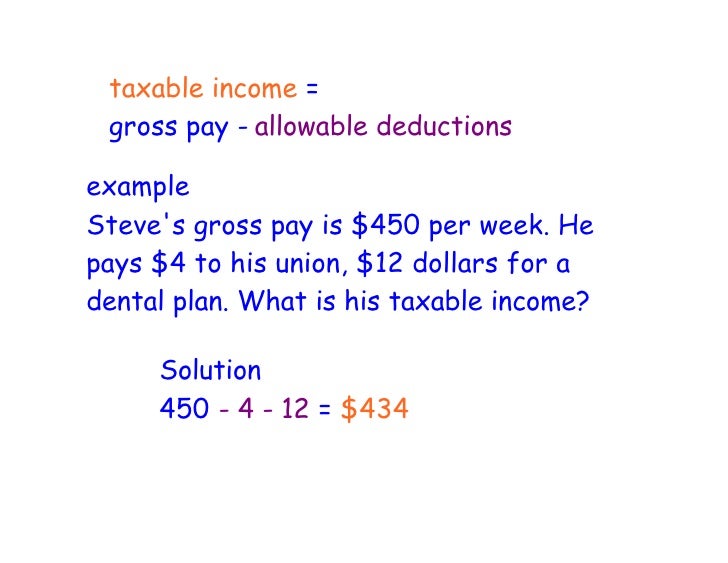

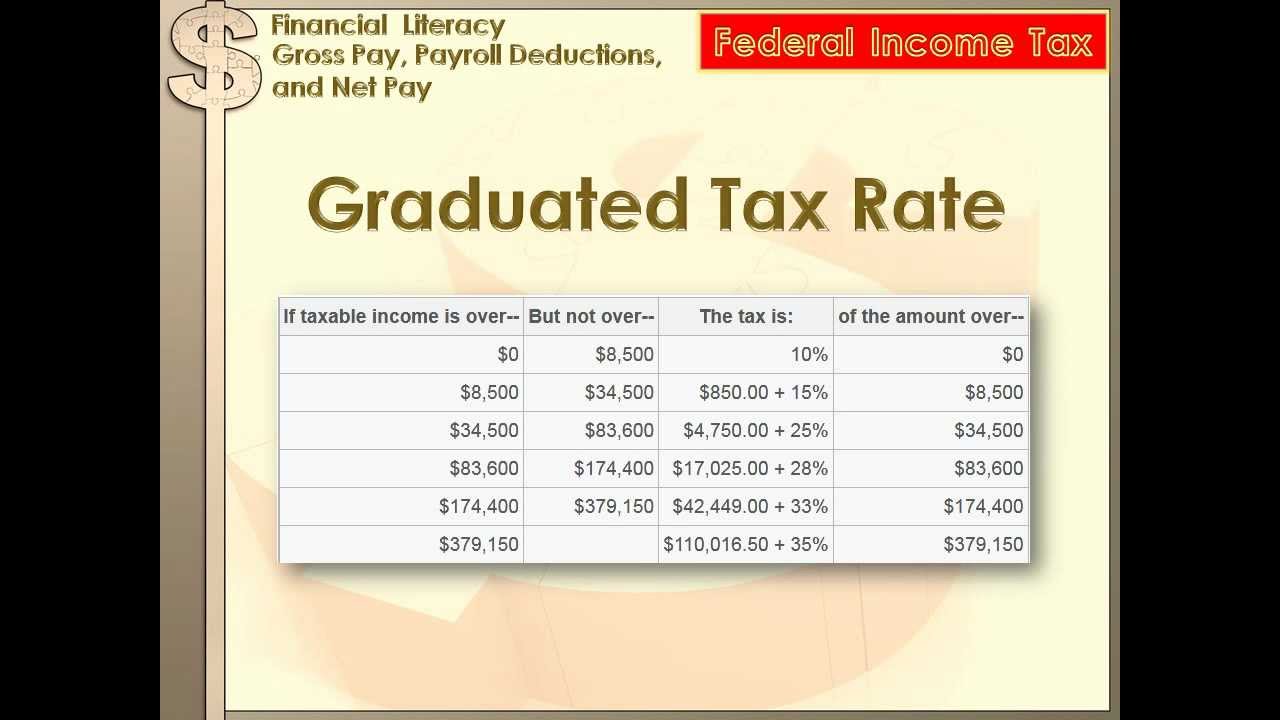

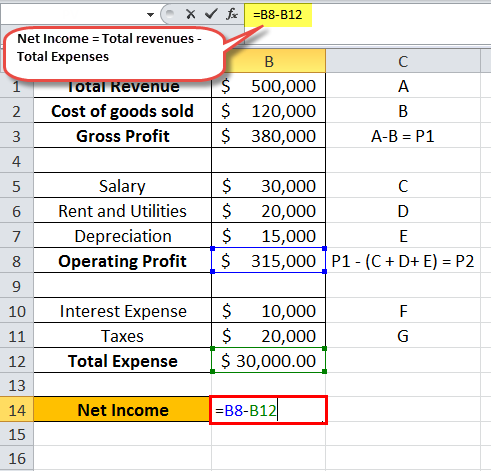

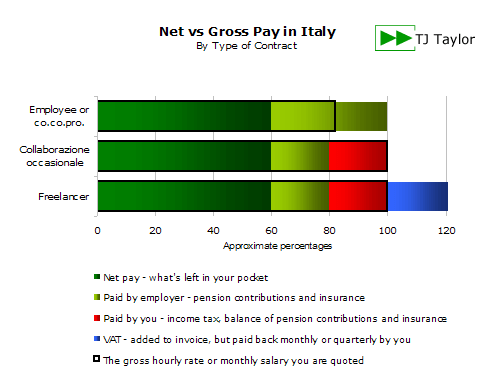

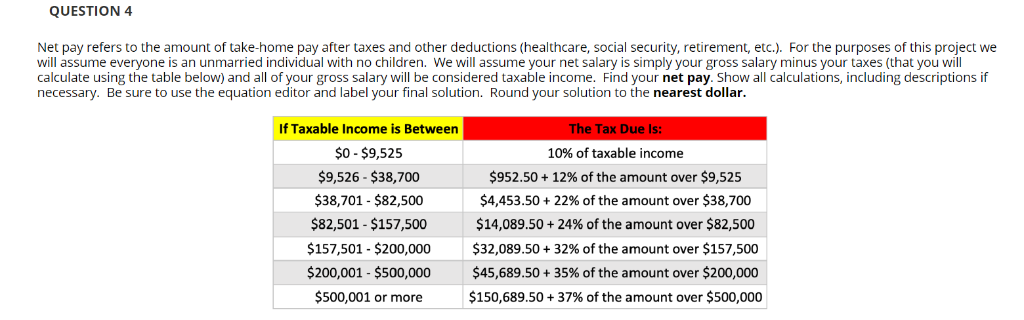

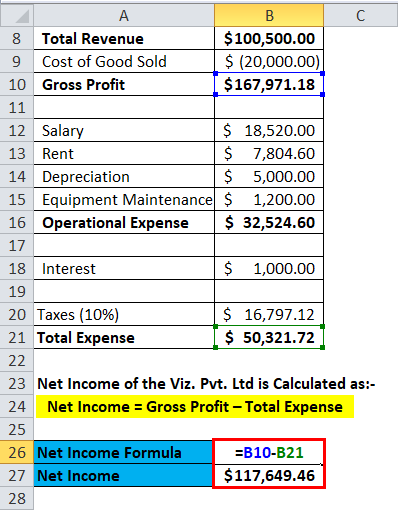

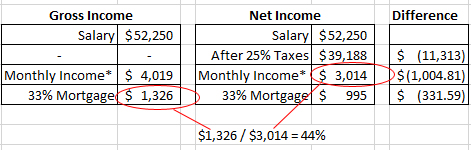

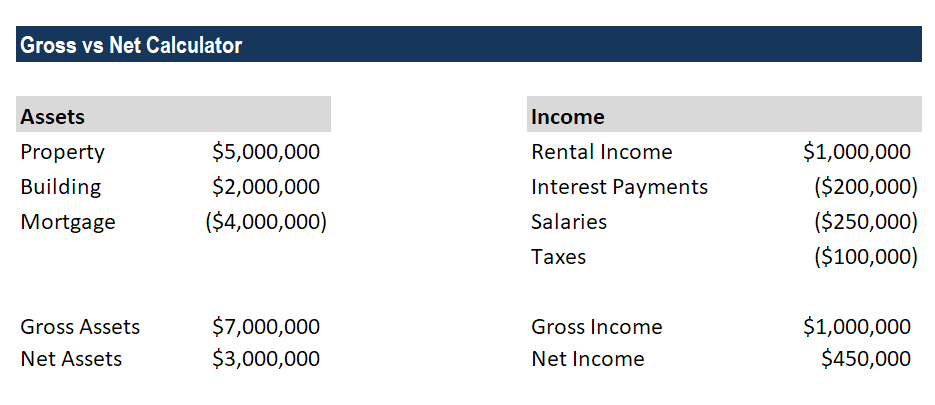

You work backward to come up with the gross to net pay calculation and divide 5000 by 75. Net price is 40 gross price is 50 and the tax is 25. The income tax is 20 so your net income is 50 20 50 10 40.

Unless you gross up an employees wages gross pay is usually the sticker price you offer. To calculate an employees gross pay start by identifying the amount owed each pay period. You can find weekly gross pay for salaried employees by dividing their yearly salary by 52 weeks.

You perform a job and your gross pay is 50. This number is the gross pay. For hourly workers multiply the employees hourly pay by the number of hours worked.

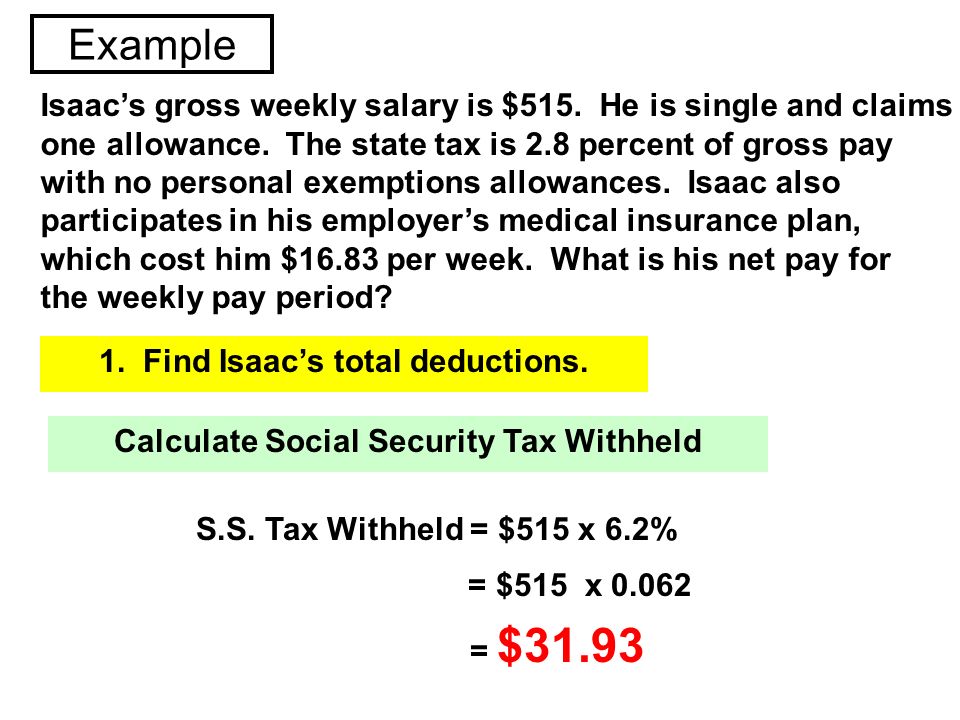

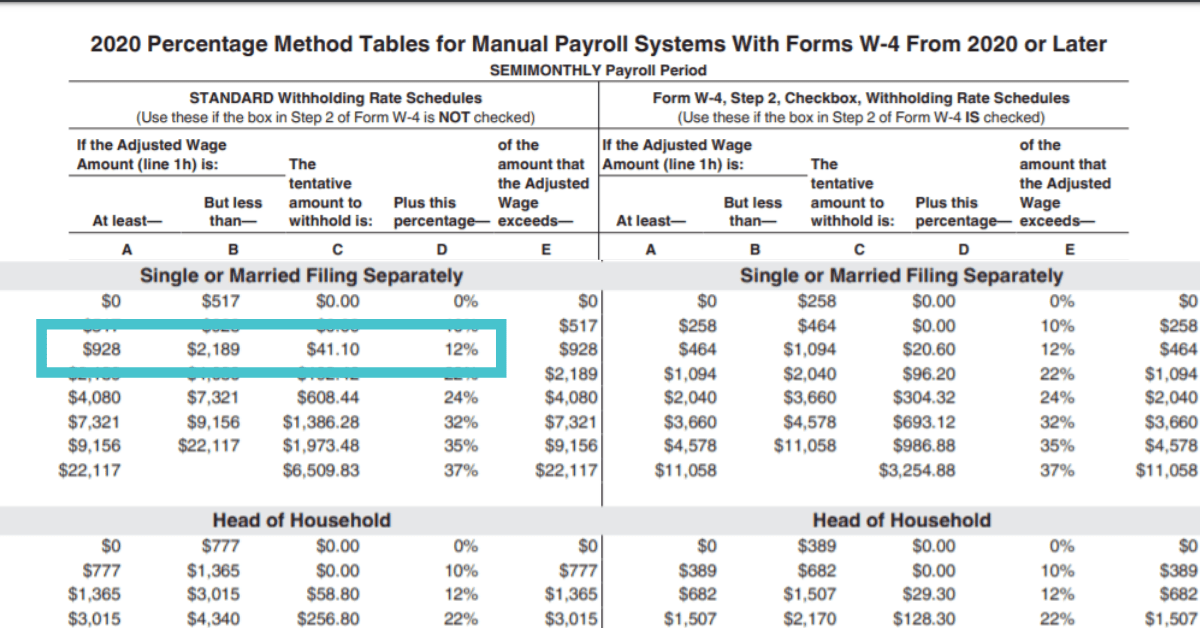

Subtracting the value of allowances allowed for 2017 this is 4050 multiplied by withholding. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed. Jane is happy because she receives the full 5000 to pay her movers.

Youre happy because youve convinced jane the rockstar to join your small business. Use this federal gross pay calculator to gross up wages based on net pay.

.jpg)

/paper-pay-slip-with-tax-and-pension-information-137555952-5bcb8401c9e77c0051c7b3e7.jpg)

:strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-5104896c92544bc6b8bc04fbe310e62c.png)

:max_bytes(150000):strip_icc()/what-is-gross-pay-and-how-is-it-calculated-398696-v1-5bbd1ae146e0fb0026778399.png)